Output & the Exchange Rate in the Short Run

advertisement

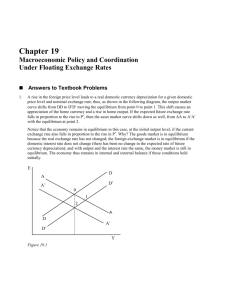

Output & the Exchange Rate in the Short Run • Two kinds of depreciations Britain East Asian countries 92 depreciation 97 depreciation export surged recession+inflation ??? ??? output, exchange rate, and inflation to understand Output & exchange rate in the short run • 1. 2. 3. 4. Aggregate demand for an open economy’s output is the sum of: consumption demand (C) investment demand (I) government demand (G) net export demand / current account (CA) Real exchange rate changes →CA • the effect of a real exchange rate change on the current account CA is ambiguous. • other things equal, a real depreciation of the currency improves the current account. Disposable income changes →CA • an increase in disposable income worsens the current account. The equation of aggregate demand D D( EP * / P, Y T , I , G ) 实际汇率 消费 投资, 政府采购 Y D( EP * / P, Y T , I , G ) Real output (Y) = Aggregate demand (D) 2 elements 1: relationship between output & exchange rate (the DD schedule) that must hold when the output market is in equilibrium 2: relationship between output & exchange rate that must hold when the home money market & the exchange market (the asset market) are in equilibrium Aggregate demand, D D=Y Aggregate demand D( EP * / P, Y T , I , G ) Output↑→demand↑ Output, Y Fig 16-1, Aggregate Demand as a Function of Output Output market equilibrium in the short run: the DD schedule DD = relationship between output & exchange rate Aggregate demand, D D=Y Aggregate demand 贬值 产出增加 Output, Y Fig 16-3, Output effect of a currency depreciation with … Deriving the DD schedule • When P and P* are fixed, a depreciation of the currency leads to the higher output level. • DD: all combinations of output & exchange rate • output market is in short-run equilibrium • aggregate demand = aggregate output D Output market in Equilibrium Exchange Rate E DD Y 贬值 产出增加 Output Y Factors that shift the DD schedule 1. government demand, taxes, & investment 2. domestic & foreign price levels DD 3. variations in domestic consumption behavior 4. foreign demand for home output D( EP * / P, Y T , I , G ) 增加政府开支,国际收支赤字 D ① 政府搞赤字财政 DD Exchange Rate E ② 贬值 DD ③ 产出增加 Y Output Y D( EP * / P, Y T , I , G ) 1. 2. 3. 4. 5. 6. 7. A change in G. A change in T. A change in I d A change in P Y E A change in P* A change in the consumption function A demand shift between foreign & domestic goods. • Any disturbance that raises aggregate demand for domestic output shifts the DD schedule to the right; • Any disturbance that lowers aggregate demand for domestic output shifts the DD to the left. Asset market equilibrium in the short run: the AA schedule • AA: equilibrium in the domestic money market & foreign exchange market. • foreign interest rate is taken as given R R * ( E E ) / E e M / P L( R, Y ) s …The changes in the exchange rate must accompany output changes so that asset markets remain in equilibrium. Exchange market E Ee & R* fixed ● ②本币升值 ● 外汇存款本 币的收益 Asset market equilibrium R L ( R, Y ) ①产出增加 Money market ● Ms P ● Ms P upshot • For asset markets to remain in equilibrium: • a rise in domestic output must be accompanied by an appreciation of the domestic currency, and vice versa. • 本币升值=本币存款利息上升? Deriving the AA Schedule Exchange Rate E 与DD线最大不同:先产出, 后升值 ②本币利率上升 ③本币升值 AA ①产出增加→ Y Output AA schedule • It relates exchange rates and output levels that keep the money and foreign exchange markets in equilibrium. Factors that shift the AA schedule R R * ( E E ) / E M / P L ( R, Y ) e 1. 2. 3. 4. 5. s A change in Ms . (positive correlate) A change in P. (negative correlate) A change in Ee. (positive correlate) A change in R*. (positive correlate) A change in real money demand L(R, Y). (negatively correlate) short-run equilibrium for an open economy: DD + AA • Assumption: output price temporarily fixed foreign interest rate R* fixed expected future exchange Ee fixed. One-short changes→money supplies temporary policy→no effect→Ee Short-run equilibrium: intersections of DD and AA E DD 调整慢 产出市场 调整快 AA 资产市场 Y saddle point DD E ① 预期升值压力 ② 产出市场 贬值打破均衡 ③ AA 增产速度缓慢 资产市场 Y Temporary changes in monetary & fiscal policy government macroeconomic policy output employment inflation counteracting disturbances Monetary Policy ①货币供给增加 ②本币贬值 ③产出增加 ④远期汇率不变 ⑤短期效应 E DD ② ③ AA Y Fiscal Policy ①政府开支增或 减少税收 ②提高总需求 ③产出增加 ④远期汇率不变 ⑤短期效应 E DD 后本币升 值 AA ③先产出增加 Y Policies to maintain full employment 贬值扩大出口带动Output monetary policy 产出增加=就业增加? Fiscal policy 扩大需求刺激产出Output 充 分 就 业 外需突然减少后如何维持充分就业? fall in world demand→② E DD ③ monetary policy The two policies differ in their exchange rate effects: ② ① AA fiscal policy ● Y ●充分就业时的产出水平 Inflation Bias 1. macroeconomic policy→inflation bias: election→temptation→expansion, boom, wage demand↑→spiral →central bank independent. 2. disturbance →output market? or asset market? hard to choose monetary or fiscal policy. 3. fiscal policy →lengthy legislative deliberation; monetary policy →inflation. 4. budget deficit→not to synchronize →business cycle, election cycles. 5. lags of varying length →how much of monetary or fiscal medicine to administrate. Permanent shifts in monetary &fiscal policy Government policy instruments: money supply government spending taxes long-run exchange rates Initial conditions or assumptions: a full employment exchange rate at long-run level domestic interest = foreign interest A permanent increase in the Money Supply upshot: A permanent increase in Money Supply must ultimately lead to a proportional rise in Exchange Rate. Ms = Ee Adjustment to s M↑ • Assumption: full employment, working overtime. • Ms has no lasting effect on output, relative prices, interest rate • overshooting phenomenon will return to its full employment position. E DD AA ● 充分就业水平 Y A permanent fiscal expansion • Government expenditure→aggregate demand for domestic goods and services; • long-run appreciation of currency; • fall of the expected future exchange rate; E DD 本币升值 停留在此 AA ● 充分就业水平 Y Conclusion • If the economy starts at long-run equilibrium, a permanent change in fiscal policy has no net effect on output. Instead, it causes an immediate and permanent exchange rate jump that offsets exactly the fiscal policy’s direct effect on aggregate demand. Macroeconomic policies & current account • Monetary & fiscal policies aimed at domestic objectives > current account. • DD—AA model can be extended to…current account. • DD—AA—XX model: combinations of the exchange rate and output at which the current account balance would be equal to some desired level. XX curve CA( EP * / P, Y T ) X XX is flatter than DD CA balance fall after fiscal expansions. E CA=X DD monetary expansion XX temporary fiscal expansion permanent fiscal expansion CA>X CA<X AA Y monetary expansion causes the current account balance to increase in the short run. temporary fiscal expansion: There is a deterioration in the current account because the currency appreciates and income rises. permanent fiscal expansion: Expansionary fiscal policy reduces the current account balance. DD-AA model: a real depreciation of the home currency immediately improves the current account while a real appreciation causes the current account immediately to worsen. • …the domestic demand for domestic output rises by less than the rise in output itself (since some income is saved and spending falls on imports) • Depreciation of currency along DD to make export demand rise faster than import Gradual trade flow adjustment & current account dynamics The J-Curve (中文展开) If the current account initially worsens after a depreciation, its time path, has an initial segment reminiscent of a J. The primary effect of the depreciation is to raise the value of the pre-contracted level of imports in terms of domestic products. These lags in adjustment …, After the current account exceed its predepreciation level …, Increase in CA tapers off as the adjustments to the real depreciation is completed. If expansionary monetary policy depresses output in the short run, the domestic interest rate will fall farther than it normally would. Exchange rate pass-through & inflation • Assumption: Nominal output prices P & P* can not suddenly jump… • Nominal exchange rate movements affect current account in the short run. • Linkage between the nominal exchange rate and prices of exports and imports. Pass-through The percentage by which import prices rise when the home currency depreciates by one percent is known as the degree of pass-through from the exchange rate to import prices. Percentage??? e.g. DD-AA model: degree is 1. = any exchange rate changes is passed through completely to import prices. Why incomplete? 1. International market segmentation imperfectly competitive firms charge different prices for the same product in different countries. 2. Firms wait to find out the currency movement reflects a definite trend before making price and production commitments 3. Timing of current account adjustment: 4. Currency movements have less-thanproportional effects on the relative price determining trade volumes Korea’s Trade Balance with the U.S. and the Won/Dollar exchange rate depreciation+income cut Skip over Page 474-480 Marshall-Lerner Condition • The validity of the assumption: a real depreciation of a country’s currency improves its current account. • Derive a condition on those responses. • The Marshall-Lerner condition: all else equal, a real depreciation improves the current account if export and import volumes are sufficiently elastic with respect to exchange rate. CA( EP / P, Y d ) EX ( EP / P) IM ( EP / P, Y d ) q EP / P Foreign income is being held constant. IM q EX Imports measured in domestic output Imports measured in foreign output unit CA(q, Y ) EX (q) q EX (q, Y ) d d EX EX q q EX EX q q q q q 2 贬值幅度 1 + the effect of a rise in q (a real depreciation) on export demand – the effect of a rise in q (a real depreciation) on import volume a real exchange rate changes from time 1 to time 2 CA CA CA 2 1 2 1 ( EX q EX ) ( EX q EX ) 2 2 1 1 1 EX (q EX ) (q EX ) 2 Dividing through by △q gives the CA response to a change in q, <0 >0 2 1 q q CA / q EX (q EX ) EX Volume effect value effect volume effect vs. value effect • Volume effect: the effect of change in q on the number of output unit exported and imported. • Value effect: a rise in q worsens the current account to the extent that it raises the domestic output value of the initial volume of imports. Elasticity (q / EX ) EX q 1 1 elasticity of export demand (q / EX ) EX 1 1 elasticity of import demand q q CA / q EX q (q EX ) EX 2 multiply its right-hand side by of trade elasticities. 1 1 (q / EX ) 1 to express it in term CA initially 0 EX q EX 1 CA / q 0; 1 1 (q / q ) 1 0 2 1 If q 0; then, q 2 q1 the condition for an increase in q to improve the current account is 1 1 1 It the current account is initially zero, a real currency depreciation causes a current account surplus if the sum of the relative price elasticities of export and import demand exceeds 1. Complexity & Conclusion • current account initially is non zero; • disposable income is held constant when q changes; • Conclusion of empirical study: • Most countries, 1 • In the long run, a real depreciation improve the current account.