What is Strategy

advertisement

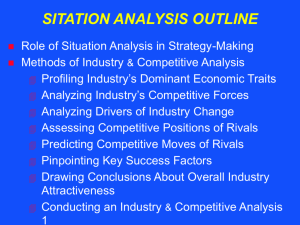

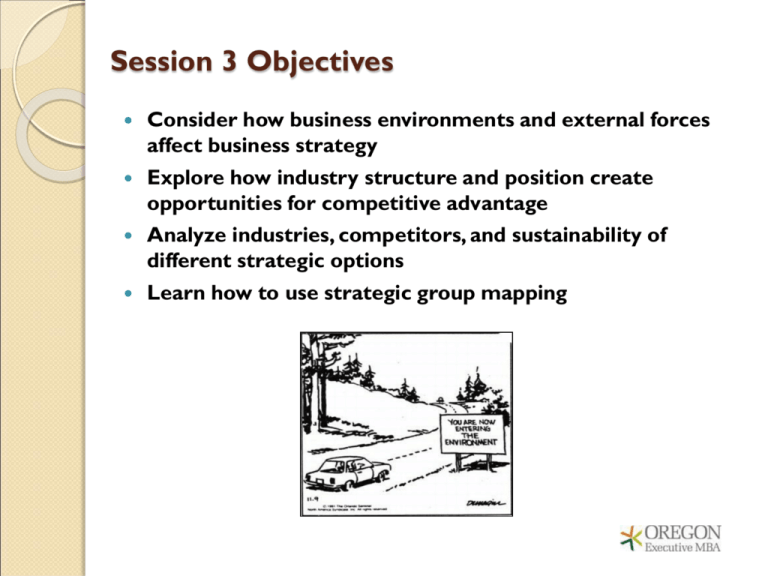

Session 3 Objectives Consider how business environments and external forces affect business strategy Explore how industry structure and position create opportunities for competitive advantage Analyze industries, competitors, and sustainability of different strategic options Learn how to use strategic group mapping The Strategy Design Process Strategic Analysis Strategy Implementation and Evaluation Strategic Choice Identify Sustainable Competitive Advantage Understand Industry Context and Competition Create Sustainable Competitive Advantage Select Sustainable Competitive Advantage Craft and Communicate Vision and Mission Develop Action Plans, Programs, and Processes Develop Strategic Goals and Specific Long Term Objectives Analyze Industry and External Environment Evaluate The Current Situation Analyze Resources and Internal Capabilities Evaluate and Select Strategy Craft Changes in Structure and Processes Implement the Strategy Establish the Basis for Sustainable Competitive Advantage Develop a Strategic Control System Understand and Critique Current Strategy Generate Feasible Alternative Strategies Feedback and Rethinking Evaluate the Strategies Results Environmental Analysis to Industry Analysis MACROENVIRONMENT The Economy at Large Suppliers Rival Firms Substitutes COMPANY Buyers New Entrants IMMEDIATE INDUSTRY AND COMPETITIVE ENVIRONMENT Situation Analysis Assess Industry & Competitive Conditions 1. Industry’s dominant economic traits 2. Nature of competition & strength of competitive forces 3. Drivers of industry change 4. Competitive position of rivals 5. Strategic moves of rivals 6. Key success factors 7. Conclusions about industry attractiveness Assess Company Situation 1. Assessment of company’s present strategy 2. Resource strengths and weaknesses, market opportunities, and external threats 3. Company’s costs compared to rivals 4. Strength of company’s competitive position 5. Strategic issues that need to be addressed Identify Strategic Options for the Company Select the Best Strategy for the Company Question 1: What are the Industry’s Dominant Economic Traits? Market size and growth rate Scope of competitive rivalry Number of competitors and their relative sizes Prevalence of backward/forward integration Entry/exit barriers Nature and pace of technological change Product and customer characteristics Scale economies and experience curve effects Capacity utilization and resource requirements Industry profitability Relevance of Key Economic Features Economic Feature Strategic Importance Market growth rate Small markets don’t tend to attract new firms; large markets attract firms looking to acquire rivals with established positions in attractive industries Fast growth breeds new entry; slow growth spawns increased rivalry & shakeout of weak rivals Capacity surpluses/shortages Surpluses push prices & profit margins down; shortages pull them up Industry profitability High-profit industries attract new entrants; depressed conditions lead to exit Entry/exit barriers High barriers protect positions and profits of existing firms; low barriers make existing firms vulnerable to entry Product is big-ticket item for buyers More buyers will shop for lowest price Standard products Buyers have more power because it’s easier to switch from seller to seller Rapid technological change Vertical integration Raises risk; investments in technology facilities/equipment may become obsolete before they wear out Big requirements make investment decisions critical; timing becomes important; creates a barrier to entry and exit Raises capital requirements; often creates competitive & cost differences among fully vs. partially vs. non-integrated firms Economies of scale Increases volume & market share needed to be cost competitive Rapid product innovation Shortens product life cycle; increases risk because of opportunities for leapfrogging Market Size Capital requirements Question 2: What is Competition Like and How Strong Are the Competitive Forces? Objective is to identify ◦ Main sources of competitive forces ◦ Strength of these forces Key analytical tool ◦ Five (Six) Forces Model of Competition Porter’s Five Forces of Competition SUPPLIERS Bargaining power of suppliers INDUSTRY COMPETITORS POTENTIAL ENTRANTS Threat of Threat of SUBSTITUTES new entrants Rivalry among existing firms Bargaining power of buyers BUYERS substitutes Rivalry Between Established Competitors The extent to which industry profitability is depressed by aggressive price competition depends upon: ◦ Concentration (number and size distribution of firms) ◦ Diversity of competitors (differences in goals, cost structure, etc.) ◦ Product differentiation ◦ Excess capacity and exit barriers ◦ Cost conditions Extent of scale economies Ratio of fixed to variable costs The Threat of Entry The extent to which entrants threaten industry profitability depends upon the height of barriers to entry. The principal sources of barriers to entry are: Capital requirements Economies of scale Absolute cost advantage Product differentiation Access to channels of distribution Legal and regulatory barriers Retaliation Threat of Substitutes Extent of competitive pressure from producers of substitutes depends upon: ◦ Buyers’ propensity to substitute ◦ The price-performance characteristics of substitutes. ◦ Profitability of the substitute industry Five Forces or Six? Introducing Complements SUPPLIERS Bargaining power of suppliers The suppliers of complements create value for the industry and can exercise bargaining power INDUSTRY COMPETITORS POTENTIAL ENTRANTS COMPLEMENTS Threat of new entrants Threat of Rivalry among existing firms Bargaining power of buyers BUYERS SUBSTITUTES substitutes Competitive Force of Buyers Buyers are a strong competitive force when: ◦ They are large and purchase a sizable percentage of industry’s product ◦ They buy in large quantities ◦ They can integrate backward ◦ Industry’s product is standardized ◦ Their costs in switching to substitutes or other brands are low ◦ They can purchase from several sellers ◦ Product purchased does not save buyer money Competitive Force of Suppliers Suppliers are a strong competitive force when: ◦ Item makes up large portion of product costs,is crucial to production process, and/or significantly affects product quality ◦ It is costly for buyers to switch suppliers ◦ They have good reputations and growing demand ◦ They can supply a component cheaper than industry members can make it themselves ◦ They do not have to contend with substitutes ◦ Buying firms are not important customers Dynamic Competition Porter framework assumes industry structure drives competitive behavior Industry structure is largely stable But---competition also changes industry structure Schumpeterian Competition: A “perennial gale of creative destruction” where innovation overthrows established market leaders Hypercompetition: “intense and rapid competitive moves….creating disequilibrium through continuously creating new competitive advantages and destroying, obsoleting, or neutralizing opponents’ competitive advantages Question 3: What Forces Are at Work to Change Industry Conditions? Industries change because forces are driving industry participants to alter their actions Driving forces are the major underlying causes of changing industry and competitive conditions 1. Identify those forces likely to exert greatest influence over next 1 - 3 years – Usually no more than 3 - 4 factors qualify as real drivers of change 2. Assess impact – What difference will the forces make - favorable? unfavorable? Common Types of Driving Forces Entry or exit of major firms Diffusion of technical knowledge and innovations Changes in cost and efficiency Shift from standardized to differentiated products Regulatory policies / government legislation Changing societal concerns, attitudes, and lifestyles Changes in degree of uncertainty and risk Internet and e-commerce opportunities Increasing globalization of industry Changes in long-term industry growth rate Changes in nature of product usage Product innovation/technological change Question 5: What Strategic Moves Are Rivals Likely to Make Next? A firm’s own best strategic moves are affected by ◦ Current strategies of competitors ◦ Future actions of competitors Profiling key rivals involves gathering competitive intelligence about their: ◦ Current strategies ◦ Most recent moves ◦ Resource strengths and weaknesses ◦ Announced plans Competitor Analysis Competitive Scope Strategic Intent • Local • Be dominant leader • Regional • Overtake industry leader • National • Be among industry leaders • Move into top • Multicountry 10 • Global • Move up a notch in rankings • Maintain current position • Just survive Market Share Objective Competitive Position Strategic Posture Competitive Strategy • Aggressive expansion via acquisition & internal growth • Getting stronger; on the move • Mostly offensive • Striving for low-cost leadership • Wellentrenched • Mostly defensive • Focusing on market niche • Expansion via internal growth • Stuck in the middle of the pack • Expansion via acquisition • Going after a different position • Hold on to present share • Struggling; losing ground • Combination • Pursuing of offensive differentiation & defensive based on Quality • Aggressive Service risk-taker Technology superiority • Conservative Breadth of product line follower Image & reputation More value for the money Other attributes • Give up present share to achieve short-term profits • Retrenching to a position that can be defended Predicting Moves of Rivals Predicting rivals’ next moves involves ◦ Analyzing their current competitive positions ◦ Examining public pronouncements about what it will take to be successful in industry ◦ Gathering information from grapevine or industry intelligence about current activities and potential changes ◦ Studying past actions and leadership ◦ Determining who has flexibility to make major strategic changes and who is locked into pursuing the same basic strategy The Contributions of Game Theory to Competitive Analysis Framing strategic decisions as interactions between competitors Predicting outcomes of competitive situations involving a few players Some key concepts: 1. Competition and Cooperation—Game theory can show conditions where cooperation more advantageous than competition 2. Deterrence—changing the payoffs in the game in order to deter a competitor from certain actions 3. Commitment—irrevocable deployments of resources that give creditability to threats 4. Signaling—communication to influence a competitor's decision Problems of game theory: 1. Useful in explaining past competitive behavior—weak in predicting future competitive behavior. 2. What’s the problem? — Multitude of models, outcomes highly sensitive to small changes in assumptions Question 6: What are the Key Factors for Competitive Success? Competitive elements most affecting every industry member’s ability to prosper ◦ Specific strategy elements ◦ Product attributes ◦ Resources ◦ Competencies ◦ Competitive capabilities KSFs spell the difference between ◦ Profit and loss ◦ Competitive success or failure Identifying Key Success Factors Prerequisites for success What do customers want? How does the firm survive competition Analysis of competition Analysis of demand • What drives competition? • Who are our customers? • What are the main dimensions of competition? • What do they want? •How intense is competition? •How can we obtain a superior competitive position? KEY SUCCESS FACTORS Segmentation Analysis: Principal Stages Identify key variables and categories. Construct a segmentation matrix Analyze segment attractiveness Identify KSFs in each segment Analyze benefits of broad vs. narrow scope. Identify segmentation variables Reduce to 2 or 3 variables Identify discrete categories for each variable Potential for economies of scope across segments Similarity of KSFs Product differentiation benefits of segment focus The Basis for Segmentation: Customer and Product Characteristics Characteristics of the Buyers Industrial buyers *Size *Technical sophistication *OEM/replacement Household buyers *Demographics *Lifestyle *Purchase occasion Distribution channel Opportunities for Differentiation Characteristics of the Product Geographical location *Size *Distributor/broker *Exclusive/ nonexclusive *General/special list *Physical size *Price level *Product features *Technology design *Inputs used (e.g. raw materials) *Performance characteristics *Pre-sales & post-sales services Segmentation and Key Success Factors in the U.S. Bicycle Industry SEGMENT Low price bicycles sold primarily through department and discount stores, mainly under the retailer’s own brand (e.g. Sears’ “Free Spirit”); Medium-priced bicycles sold primarily under manufacturer’s brand name and distributed mainly through specialist bicycles stores; KEY SUCCESS FACTORS * Low-costs through global sourcing of components & low-wage assembly. * Supply contract with major retailer. Leading competitors: Taiwanese & Chinese assemblers, some U.S manufacturers, e.g. Murray Ohio, Huffy *Cost efficiency through large scale operation and either low wages or automated manufacturing. *Reputation for quality (durability, reliability) through effective marketing to dealers and/or consumers. * International marketing & distribution. Leading competitors: Raleigh, Giant, Peugeot, Fuji (Japan). High-priced bicycles for enthusiasts. Children’s bicycles (and tricycles) sold primarily through toy retailers (discount toy stores, department stores, and specialist toy stores). *Quality of components and assembly, Innovation in design (e.g. minimizing weight and wind resistance). *Reputation (e.g. through success in racing, through effective brand management). *Strong dealer relations. Leading competitors: K2, Specialized, Trek Similar to low-price bicycle segment. Question 7: Is the Industry Attractive or Unattractive and Why? Develop conclusions about whether the industry and competitive environment is attractive or unattractive, both near- and long-term, for earning good profits A firm uniquely well-suited in an otherwise unattractive industry can, under certain circumstances, still earn unusually good profits Issues to Consider in Assessing Industry Attractiveness Industry’s market size and growth potential Whether competitive conditions are conducive to rising/falling industry profitability Will competitive forces become stronger or weaker Whether industry will be favorably or unfavorably impacted by driving forces Potential for entry/exit of major firms Stability/dependability of demand Severity of problems facing industry Degree of risk and uncertainty in industry’s future Nov 1984 July 2000 Feb 1996 Feb 2004 Apple Computer Historically, what were Apple’s major competitive advantages? Have they changed over time? Why? How has the structure of the PC industry changed over the last 20 years? What new opportunities for competitive advantage have these changes created? Evaluate Apple’s strategies since 1990. Have they developed a sustainable competitive advantage? Has Steve Jobs finally solved Apple’s long-standing problems with the Mac business and Apple’s broader strategic position? What should Apple do today? Question 4: Which Companies are in Strongest / Weakest Positions? A strategic group is a group of firms in an industry following the same or similar strategy. Identifying strategic groups: • Identify principal strategic variables that distinguish firms. • Position each firm in relation to these variables. • Identify clusters. Steps in the construction of strategic group maps: 1. Identify two important competitive characteristics that strategically differentiate firms in an industry from one another. 2. Plot the firms on the two-variable map. 3. Draw circles around the firms that are clustered together. 4. Indicate potential movement of firms with arrows. Strategic Groups in the World Automobile Industry Broad GLOBAL, BROAD-LINE PRODUCERS e.g., GM, Ford, Toyota, Nissan, Honda, VW REGIONALLY FOCUSED BROAD-LINE PRODUCERS e.g. Fiat, PSA, Renault, Rover, Chrysler PRODUCT RANGE GLOBAL SUPPLIERS OF NARROW MODEL RANGE e.g., Volvo, Subaru, Isuzu, Suzuki, Saab, Hyundai NATIONALLY FOCUSED, INTERMEDIATE LINE PRODUCERS e.g. Tofas, Kia, VAZ, Maruti NATIONALLY- FOCUSED, SMALL, SPECIALIST PRODUCERS e.g., Bristol (U.K.), Classic Roadsters (U.S.), Morgan (U.K.) Narrow National LUXURY CAR MANUFACTURERS e.g., Jaguar, Rolls Royce, Daimler-Benz, BMW PERFORMANCE CAR PRODUCERS e.g., Porsche, Maserati, Lotus GEOGRAPHICAL SCOPE Global 2.0 Strategic Groups Within the World Petroleum Industry INTEGRATED DOMESTIC OIL COMPANIES 1.5 PRODUCTION COMPANIES 1.0 PDVSA INTEGRATED INTERNATIONAL MAJORS DIVERSIFIED MAJORS Kuwait Exxon Amoco Arco Phillips Unocal Indian Oil Petrobras Elf Elf Repsol 0.5 Vertical Balance Statoil EN ENI I Neste Nippon 0 Sun 0 10 NATIONALLY-FOCUSED DOWNSTREAM COMPANIES 20 30 BP Chevron Total Texaco Shell Mobil INTERNATIONAL DOWNSTREAM Petrofina OIL COMPANIES 40 50 Geographical Scope 60 70 80 Hamel, “Strategy as Revolution” Strategic planning is often not strategic Strategy making should be subversive The bottleneck is at the top of the bottle Revolutionaries exist in every company Change is not the problem, engagement is Strategy making must be democratic Anyone can be a strategy activist Perspective is worth 50 IQ points Top-down and bottom up are not the only alternatives You cannot see the end from the beginning How to Start a Revolution Re-conceive your product or service ◦ ◦ ◦ Re-define the market space ◦ ◦ ◦ Radically improve the value equation Separate form and function Achieve joy of use Push the bounds of universality Strive for individuality Increase accessibility to your products Re-draw industry boundaries ◦ ◦ ◦ Rescale the industry Compress the supply chain Drive convergence between industries