ch15xt

advertisement

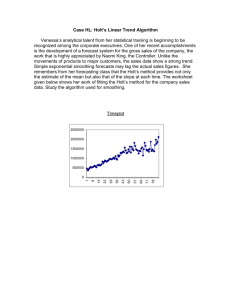

Guide to Using Excel For Basic Statistical Applications To Accompany Business Statistics: A Decision Making Approach, 5th Ed. Chapter 15: Analyzing and Forecasting Time Series Data By Groebner, Shannon, Fry, & Smith Prentice-Hall Publishing Company Copyright, 2005 Chapter 15 Excel Examples Trend Based Forecasting Taft Ice Cream Company Nonlinear Trend Harrison Equipment Company Seasonal Adjustment Big Mountain Ski Resort Single Exponential Smoothing Humboldt Electronics Company More Examples Chapter 15 Excel Examples Double Exponential Smoothing Billingsley Insurance Company Trend Based Forecasting Taft Ice Cream Company Issue: The owners of Taft Ice Cream Company considering expanding their manufacturing facilities. The bank requires a forecast of future sales. Objective: Use Excel to build a forecasting model based on 10 years of data. Data file is Taft.xls Trend Based Forecasting – Taft Ice Cream Company Open File Taft.xls Trend Based Forecasting – Taft Ice Cream Company First click on Chart Wizard, then select Line Chart Trend Based Forecasting – Taft Ice Cream Company Click on Series tab and define range for Data Variables. Click on Next. Trend Based Forecasting – Taft Ice Cream Company Remove unneeded data sets and identify the range for the X Variable. Trend Based Forecasting – Taft Ice Cream Company Label the axes and graph Trend Based Forecasting – Taft Ice Cream Company Size and format the graph as needed. Trend Based Forecasting – Taft Ice Cream Company To develop the linear model, start with the original data. Trend Based Forecasting – Taft Ice Cream Company Click on Tools, then Data Analysis and finally Regression Trend Based Forecasting – Taft Ice Cream Company Define the data range for the X and Y Variables. Use the t column for time. Trend Based Forecasting – Taft Ice Cream Company The regression output determines the slope and intercept of the linear model. Trend Based Forecasting – Taft Ice Cream Company To visually compare the data with a linear model, return to the graph constructed using the chart wizard. Trend Based Forecasting – Taft Ice Cream Company Left click on any data point, then right click and select Add Trendline Trend Based Forecasting – Taft Ice Cream Company Select Linear model then click on Options Tab. Trend Based Forecasting – Taft Ice Cream Company Select Display equation on chart. Trend Based Forecasting – Taft Ice Cream Company Format chart as desired. Trend Based Forecasting – Taft Ice Cream Company To determine both MAD and MSE values, start by selecting the Residuals option in Regression analysis. Trend Based Forecasting – Taft Ice Cream Company The Predicted values and Residuals become part of the regression output. Trend Based Forecasting – Taft Ice Cream Company Write and copy a formula to determine the Squared Residual values. Trend Based Forecasting – Taft Ice Cream Company Also write and copy a formula to find the absolute values of the residuals. Trend Based Forecasting – Taft Ice Cream Company Sum the squared and absolute values of the residuals. Trend Based Forecasting – Taft Ice Cream Company Divide both summed values to find the MSE and MAD values. Nonlinear Trend Harrison Equipment Company Issue: Harrison Equipment is interested in forecasting future repair costs for a crawler tractor it leases to contractors. Objective: Use Excel to develop a nonlinear forecasting model. Data file is Harrison .xls Nonlinear Trend – Harrison Equipment Company Open File Harrison.xls This tutorial will start by finding the trend line. It will also show how to find residuals. Nonlinear Trend – Harrison Equipment Company First click on Chart Wizard, then select Line Chart Nonlinear Trend – Harrison Equipment Company Click on Series tab and define range for both Y and X Variables. Nonlinear Trend – Harrison Equipment Company Format, size and label chart as desired. Nonlinear Trend – Harrison Equipment Company To add trendline, left click on any data point, then right click and select Add Trendline Nonlinear Trend – Harrison Equipment Company Choose Linear Nonlinear Trend – Harrison Equipment Company Trendline appears. Nonlinear Trend – Harrison Equipment Company To build linear model, click on Tools, then Data Analysis and finally Regression Nonlinear Trend – Harrison Equipment Company Define the data range for the X and Y Variables. Use the t column for time. Also ask for residuals. Nonlinear Trend – Harrison Equipment Company The regression output determines the slope and intercept of the linear model. Nonlinear Trend – Harrison Equipment Company Calculate bye MAD value by first finding the absolute value of the residuals using the ABS function. Nonlinear Trend – Harrison Equipment Company Sum the absolute value of the Residuals and divide by the count (number) of residuals to find the MAD. Nonlinear Trend – Harrison Equipment Company To develop nonLinear model define a new variable found by squaring the time values. Nonlinear Trend – Harrison Equipment Company Develop a new regression model with t2 value as the independent variables. The model becomes y = a + bt2. The output gives the new regression coefficients. Nonlinear Trend – Harrison Equipment Company Using the same SUM and COUNT formula find the MAD for the nonlinear model. Nonlinear Trend – Harrison Equipment Company To plot the nonlinear model, define a new column of values determined by plugging the values of t2 into the regression model. Nonlinear Trend – Harrison Equipment Company Use the Chart Wizard, Line options to develop a graph comparing the observed values with the nonlinear model. You will identify two Series. Nonlinear Trend – Harrison Equipment Company Format and place chart as needed. Seasonal Adjustment Big Mountain Ski Resort Issue: The resort wants to build a forecasting model from data that has a definite seasonal component. Objective: Use Excel to develop a forecasting model adjusting for seasonal data. Data file is Big Mountain.xls Seasonal Adjustment – Big Mountain Ski Resort Open File Big Mountain.xls Seasonal Adjustment – Big Mountain Ski Resort To develop the graph first click on Chart Wizard button then select Line. Seasonal Adjustment – Big Mountain Ski Resort Define the range for the Y and X variable values. Seasonal Adjustment – Big Mountain Ski Resort Size and format the graph as desired. Seasonal Adjustment – Big Mountain Ski Resort To find the moving average values use the AVERAGE function. Seasonal Adjustment – Big Mountain Ski Resort Use the AVERAGE function again to find the centered moving average. Seasonal Adjustment – Big Mountain Ski Resort Write a simple formula to find the Ratio to Moving Average values. Seasonal Adjustment – Big Mountain Ski Resort To find the season index values click on PHStat, then Data Preparation and then Unstack. Seasonal Adjustment – Big Mountain Ski Resort To find the seasonal index values start by adding (SUM) the three ratio to moving average values for each season. Seasonal Adjustment – Big Mountain Ski Resort Divide the total values to find the seasonal index numbers. Seasonal Adjustment – Big Mountain Ski Resort Write a formula to select the correct seasonal value to use to deseasonalize the data. Copy the formula into all cells. Seasonal Adjustment – Big Mountain Ski Resort Use the Select Chart Wizard to graph the deseasonalized data. Seasonal Adjustment – Big Mountain Ski Resort Format and place the chart as desired. Seasonal Adjustment – Big Mountain Ski Resort Use the Tools, Data Analysis, Regression option to develop a regression model of the deseasonalized data. Single Exponential Smoothing Humboldt Electronics Issue: The company needs to develop a forecasting model to help make inventory decisions, and wants the model to give more weight to recent values than to regression model do. Objective: Use Excel to develop a single exponential smoothing forecasting model. Data file is Humboldt.xls Single Exponential Smoothing – Humboldt Electronics Open File Humboldt.xls Single Exponential Smoothing – Humboldt Electronics Click on the Chart Wizard button then select Line. Single Exponential Smoothing – Humboldt Electronics Click on the Series tab, then identify ranges for the Y and X variables. Single Exponential Smoothing – Humboldt Electronics Label the axes. Single Exponential Smoothing – Humboldt Electronics Format and place graph as desired. Single Exponential Smoothing – Humboldt Electronics To develop the exponential smoothing model, return to the original data. Set initial forecast to 400 and write formula for following forecasts. Single Exponential Smoothing – Humboldt Electronics Write similar formula to determine Forecast for Period 11. Single Exponential Smoothing – Humboldt Electronics To determine MAD start by writing formula to find the forecast error. Single Exponential Smoothing – Humboldt Electronics Find absolute value of forecast error. Then write a formula to find MAD. Single Exponential Smoothing – Humboldt Electronics Construct a graph of actual and forecast sales by returning to Chart Wizard, Line option. Identify the two Series to graph. Single Exponential Smoothing – Humboldt Electronics Format and place graph as desired. Double Exponential Smoothing Billingsley Insurance Issue: The claims manager has data for 12 months and wants to forecast claims for month 13. But the time series contains a strong upward trend Objective: Use Excel to develop a double exponential smoothing model. Data file is Billingsley.xls Double Exponential Smoothing – Billingsley Insurance Open file Billingsley.xls Double Exponential Smoothing – Billingsley Insurance Click on the Chart Wizard button then select Line. Double Exponential Smoothing – Billingsley Insurance Click on the Series tab, then identify ranges for the Y and X variables. Double Exponential Smoothing – Billingsley Insurance Label the axes. Double Exponential Smoothing – Billingsley Insurance Format the graph as desired. Double Exponential Smoothing – Billingsley Insurance To develop the double exponential smoothing equations, return to the data sheet and determine the initial values for C and T. Double Exponential Smoothing – Billingsley Insurance Use Equations 13-18 and 13-19 to determine the values for the Constant and Trend. Double Exponential Smoothing – Billingsley Insurance Use Equation 13-20 to determine the Forecast values and the Forecast for Period 13. Double Exponential Smoothing – Billingsley Insurance Write equations to find both the Forecast Error and Absolute Forecast Error. Double Exponential Smoothing – Billingsley Insurance Write equations to find both the Total Absolute Error and the MAD.