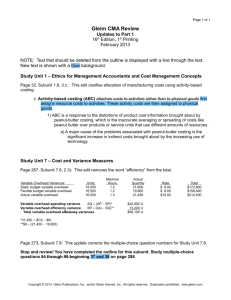

Peer 7-1-2011

advertisement

1. Activity-based costing is a costing method that is designed to provide managers with cost information for strategic and other decisions that potentially affect capacity and therefore "fixed" costs. (Points : 2) True False 2. Direct labor-hours or direct labor cost should not be used as a measure of activity in an activity-based costing system. (Points : 2) True False 3. In activity-based costing, some costs may be broken down and assigned to two activity cost pools. For example, part of a supervisor's salary may be classified as a product-level activity and part of it may be classified as a batch-level activity. (Points : 2) True False 4. An activity-based costing system that is designed for internal decision-making generally will not conform to generally accepted accounting principles. Which of the following is NOT a reason for this happening? (Points : 2) Some manufacturing costs (i.e., the costs of idle capacity and organization-sustaining costs) will not be assigned to products. Some nonmanufacturing costs are assigned to products. Allocation bases other than direct labor-hours, direct labor cost, and machine-hours are used. First-stage allocations may be based on subjective interview data. 5. Parts administration is an example of a: (Points : 2) Unit-level activity. Batch-level activity. Product-level activity. Organization-sustaining. 6. Leaper Corporation uses an activity-based costing system with the following three activity cost pools: The Other activity cost pool is used to accumulate costs of idle capacity and organization-sustaining costs. The company has provided the following data concerning its costs: The distribution of resource consumption across activity cost pools is given below: The activity rate for the Order Processing activity cost pool is closest to: (Points : 2) $1,485 per order $1,540 per order $1,465 per order $1,320 per order 7. Eccles Corporation uses an activity-based costing system with three activity cost pools. The company has provided the following data concerning its costs and its activity-based costing system: Distribution of resource consumption: How much cost, in total, would be allocated in the first-stage allocation to the Assembly activity cost pool? (Points : 2) $144,000 $96,000 $36,000 $105,000 8. Lakatos Corporation uses an activity-based costing system with three activity cost pools. The company has provided the following data concerning its costs: The distribution of resource consumption across the three activity cost pools is given below: How much cost, in total, would be allocated in the first-stage allocation to the Fabricating activity cost pool? (Points : 2) $88,000 $132,000 $264,000 $120,000 9. Houseal Corporation has provided the following data from its activity-based costing system: Data concerning one of the company's products, Product W58B, appear below: According to the activity-based costing system, the product margin for product W58B is: (Points : 2) $3,668.60 $5,975.60 $5,515.40 $19,418.40 10. Data concerning three of the activity cost pools of Salcido LLC, a legal firm, have been provided below: The activity rate for the "meeting with clients" activity cost pool is closest to: (Points : 2) $95 per meeting hour $61 per meeting hour $163 per meeting hour $1,182,239 per meeting hour 11. Which of the following budgets are prepared before the cash budget? (Points : 2) 12. Which of the following benefits could an organization reasonably expect from an effective budget program? (Points : 2) Better control of the organization's costs. Better coordination of an organization's activities. Better communication of the organization's objectives. All of these. 13. When preparing a merchandise purchases budget, the required purchases in units equals: (Points : 2) budgeted unit sales + beginning merchandise inventory + desired merchandise ending inventory. budgeted unit sales beginning merchandise inventory + desired merchandise ending inventory. budgeted unit sales beginning merchandise inventory budgeted unit sales + beginning merchandise inventory desired merchandise ending inventory. desired merchandise ending inventory. 14. Which of the following statements is NOT correct concerning the Manufacturing Overhead Budget? (Points : 2) The Manufacturing Overhead Budget provides a schedule of all costs of production other than direct materials and labor costs. The Manufacturing Overhead Budget shows only the variable portion of manufacturing overhead. The Manufacturing Overhead Budget shows the expected cash disbursements for manufacturing overhead. The Manufacturing Overhead Budget is prepared after the Sales Budget. 15. Sioux Company is estimating the following sales for the first six months of next year: Sales at Sioux are normally collected as 60% in the month of sale, 35% in the month following the sale, and the remaining 5% being uncollectible. Based on this information, how much cash should Sioux expect to collect during the month of April? (Points : 2) $250,800 $264,000 $290,700 $306,000 16. On January 1, Barnes Company has 8,000 units of Product A on hand. During the year, the company plans to sell 30,000 units of Product A, and plans to have 6,500 units on hand at year end. How many units of Product A must be produced during the year? (Points : 2) 28,500 31,500 30,000 36,500 17. Alexis Fabrication, Inc. manufactures and sells box trailers for semi trucks. Each trailer requires two (2) axles. For next quarter, Alexis has scheduled 720 trailers for production and 750 for sale. Alexis is also moving to just-in-time purchasing next quarter and plans on reducing its inventory of trailer axles by 100. How many axles should Alexis budget for purchase for next quarter? (Points : 2) 1,240 axles 1,300 axles 1,340 axles 1,400 axles 18. Pooler Corporation is working on its direct labor budget for the next two months. Each unit of output requires 0.15 direct labor-hours. The direct labor rate is $7.00 per direct labor-hour. The production budget calls for producing 6,500 units in April and 6,200 units in May. The company guarantees its direct labor workers a 40-hour paid work week. With the number of workers currently employed, that means that the company is committed to paying its direct labor work force for at least 1,000 hours in total each month even if there is not enough work to keep them busy. What would be the total combined direct labor cost for the two months? (Points : 2) $13,825.00 $13,335.00 $14,000.00 $13,510.00 19. Haylock Inc. bases its manufacturing overhead budget on budgeted direct labor-hours. The direct labor budget indicates that 5,600 direct labor-hours will be required in August. The variable overhead rate is $5.40 per direct labor-hour. The company's budgeted fixed manufacturing overhead is $69,440 per month, which includes depreciation of $15,680. All other fixed manufacturing overhead costs represent current cash flows. The August cash disbursements for manufacturing overhead on the manufacturing overhead budget should be: (Points : 2) $99,680 $84,000 $53,760 $30,240 20. Francis Manufacturing Company is currently preparing its cash budget for next month and has gathered the following information: The beginning cash balance will be $6,000 and the company requires a minimum cash balance at the end of the month of $5,000. How much will Francis Manufacturing need to borrow to meet its cash needs for the month? (Points : 2) $9,100 $14,100 $20,100 None of these.