Gareth Evans

advertisement

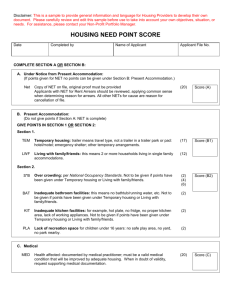

Challenges for social landlords: A business case for providing debt advice and financial inclusion activities CfRC Financial Inclusion and Money Advice Conference Wednesday 20 July 2011 Presentation by Gareth Evans Background to Research: • Currently undertaking 18 month longitudinal analysis. • Researching the effectiveness of a range of debt advice interventions on the rent arrears and behaviour of indebted social housing residents. • First attempt to establish if there is a business case for social landlords to provide debt advice services for its residents. • Partnership of six of the of the country’s leading housing associations – Affinity Sutton / AmicusHorizon / Hyde Group / Circle / MHP / Wandle HA. • Research funded by the Friends Provident Foundation Background to Research: • Attempts to compare effectiveness of different debt advice interventions; – Not providing debt advice services (Control) – Direct external outsourcing of debt advice (Telephone) to free and independent services. – Direct external outsourcing of debt advice (Face to Face) to free and independent services. – In-house delivery of specialist debt advice services with a skilled debt advice specialists delivering services to their own tenants • Looks to make key policy recommendations on best practice in the debt advice field for the social housing sector. Methodological framework 1. Baseline audit that maps current debt advice and financial inclusion activities amongst partner RSLs and the wider social housing sector. Production of an Interim Report in April 2011 that sets out the current scale of the problem, the benefits of addressing financial inclusion/overindebtedness, what the sector is already doing and the resources invested. 2. Qualitative research with residents’ to evaluate the impact and perceived effectiveness of the different debt advice received. Production of summary of findings from telephone surveys. 3. Modelling the effectiveness of different debt advice models in terms of i) the financial return on investment (costs versus savings on arrears/evictions) and ii) the social return on investment (cost versus social benefits to residents). Comprehensive Final Report – findings promoted across the sector. Challenges facing social landlords and residents • The financial circumstances of many social housing residents are expected to be reshaped and deteriorate in the face of: – deficit reduction measures (resulting in major cuts to public sector spending and an increase in certain taxes such as VAT), – forthcoming welfare benefit changes, – adverse economic conditions such as; risk of unemployment and rising inflation, and pay freezes and/or reductions in overtime payments = real term net reduction in household incomes. • Financially excluded households have less room for manoeuvre with low levels of savings and/or insurance to cushion the blow in difficult times. • Disproportionately felt by vulnerable, low income households – many of whom will be social housing residents. • Therefore, levels of overindebtedness, arrears, and ultimately evictions in the social housing sector expected to increase at great personal cost to residents and high financial and reputational cost to social landlords - it is prudent to plan for these changes Challenges facing social landlords and residents • But - Social landlords face a potential financial ‘double whammy’ of rising arrears and eviction related costs and reduced available financial resources (as a result of public spending cuts) to spend on income collections and providing access to debt advice for residents and more general, preventative, financial inclusion work. • Social landlords are already reporting that demand for debt advice is growing amongst their residents - even before the full effects felt. Need for objective debt advice will grow. • However, provision of free independent debt advice services, particularly face-to-face support is expected to diminish as sources of funding from local and national government are significantly curtailed. Challenges facing social landlords and residents Social housing residents are more likely to be financially excluded -killer facts: – Of the poorest 10% of households in the UK, over half live in social rented housing. – 61% of social households have no-one working within the household, compared to 35% nationally – Social housing residents earn on average half as much as private renters with a median annual income of £10,900 – 81% have no savings account and 91% have no insurance cover – Lower income households are more likely to be exposed to unfair practices in the sub-prime lending sector - 20% of people in social housing have used doorstep lenders. – According to Citizen’s Advice, the proportion of social rented residents amongst their debt service users is twice as high as in the general population. – 83% of social housing residents fail to make sufficient plans for their financial future and 94% are making poor product choices. Business benefits to social landlords So how does it cost social landlords money? • Rent arrears are a real drain on RSL resources. Rent collected is on average, 83% of its annual revenue funding. So, rent arrears represents reduced cash flow, lost interest and revenue that could be invested in better homes and services • Continually pursuing rent arrears cost significant funds – huge staffing implications. Early intervention and preventing rent arrear before they escalate, real opportunities can be realised for efficiency savings and direct cost savings. • Court actions are extremely expensive for landlords and are primarily embarked upon on the grounds of rent arrears • When a resident is evicted, the associated costs can be enormous and importantly unknown. • Even when a resident is evicted, landlords still incur costs and charges associated when chasing former resident arrears. There are also negative impacts to their balance sheets of writing off former resident arrears. Business benefits to social landlords Estimating the costs associated with rent arrear interventions: • Limited examples of research studies to establish the direct costs associated with various rent arrear interventions and management. • Our study developed a business model that establishes a lower and an upper unit cost associated with each of the various rent arrear management interventions. • This business model has been developed with income staff and based upon the key procedures for rent arrears management and any specific internal cost analysis • The model allows the calculation of: – the general costs associated with of each different rent arrear intervention, – an estimate of the cost of rent arrears management for an individual resident, and – the overall cost to the business of managing its rent arrears Business benefits to social landlords • Cost of each arrears process to eviction shown: – Lower level - £2,498 – Upper level £7,677 • Costs of evicting residents increasing with an estimated £39M being spent in 2008/09 by the sector removing 7,700 GN residents in rent arrears. – 10% increase = additional £4 million spent on eviction costs. What the sector is already doing and investing? • Social landlords are in a unique position to make a major contribution to promoting financial inclusion and debt management. • Over a quarter of housing associations not to providing any access to debt management advice for resident in rent arrears. • The majority of RSL do help residents access advice on their rent arrears - 56% referral mechanisms to external advice agencies and a similar number having in-house debt advice. – Yet masks the extent of specialist services – most is signposting and and in-house debt advice by rent arrear staff trained in basic money advice. • 75% of TSA respondents stated debt advice provision was via informal referrals or the contact details for external advice agencies. What the sector is already doing and investing? • Report shows the range of Financial Inclusion services and debt advice being offered by sector and 6 RSL partners. • NHF show FI and money advice services a major part of this community investment by RSLs. – £44 million £30 million pounds was from RSL) was invested in providing services to address financial exclusion and debt during 2006/7 – 450 housing association staff were directly employed to deliver these services. – 984 financial inclusion schemes were identified with 368,000 people directly benefiting from these services. • In terms of investment to deliver debt advice for residents, just £1.3 million during 2006/07 (3% of the total in FI). • 6 partners – Significant growth in investment in FI and DA from £90K (£2.29 per HH) in 2008/09 to £500K (£7.90 per HH) in 2010/11. – Growth in DA investment from £1.15 to £4.85 per HH Qualitative residents telephone survey • To help gauge the experiences and thoughts on the debt advice services that residents received and their perceptions of any resulting social and financial benefits. • 10 minute structured interview. • 179 residents from 4 RSLs receiving debt advice during 2010 were surveyed. Telephone Survey Findings: About the resident’s situation: • Over 90% of those accessing the debt advice service had some level of rent arrears at the time of referral. • High number of residents facing serious arrears action at the point of referral - (56%) facing court action and 36% facing eviction. • 82% never accessed debt advice previously. • Rent arrears hugely important indicator of a resident’s wider financial problems – 66% had other debt worries and 38% had more than 4 other creditors. Telephone Survey Findings: About the debt advice service: • 92% of residents being directly recommended from a staff member (61% of these were from arrears staff). • Only 22% of residents thought that it was a problem being referred via landlord - surprisingly low number, given the potential conflicts involved and the often strained relationships. • Vast majority of residents had a positive experience 51% rating it as very good and a further 28% as good - extremely encouraging given the nature of the problem. Telephone Survey Findings: Impact of the debt advice service: • Does debt advice ultimately reduce the levels of rent arrears 71% of cases, resident’s rent arrears had reduced following debt advice, with 36% of these saying the levels are ‘a lot less’. Only 11% of cases has the situation deteriorated • But was this resulting drop in arrear caused by the debt advice. Of those in rent arrears - 62% claim that the debt advice resulted in the reduction of their arrears and 71% believe it helped them prioritise future rent payments. • 48% believe it helped avoid being evicted and 47% from facing court proceedings, representing huge potential cost savings to the associations • Other - 67% stopped them getting further into debt and 65% thought that the impact of the help actually help them reduce their debts. Telephone Survey Findings: • Positive impact resulting from the debt advice appears to be significant, less than 10% saying the service had no effect at all. • 66% claim it had made them feel more in control of their money and 68% claimed they feel more knowledgeable about money matters • 17% of those responding thought that their overall debt problems had been completely sorted and 68% partially sorted. • Argument is that debt advice is offered to residents far too late in the day - 60% of respondents saying that they would have benefited more by earlier access. • 81% would recommend the service to someone else. Next Steps - Quantative analysis of residents • Sample of data from indebted residents who have received debt advice via their landlord and those who have not (control), • Tracking changes to their rent arrears levels and patterns as well number of landlord arrear interventions. • Undertake 12 month retrospective (prior to the debt advice) as well as 12 months following (to current data). • The final report with detailed findings and recommendations will be published towards the end of 2011. Thank you Gareth Evans Financial Inclusion Centre GRE Consulting E: gareth.evans@inclusioncentre.org.uk W: www.inclusioncentre.org.uk E: gareth@greconsulting.co.uk W: www.greconsulting.co.uk MONEY GUIDANCE EVALUATION DRAFT Quantative Analysis Findings: • Impact of Casework MG: £1,200 £800 Average arrears £600 Median arrears £400 £200 Trendline (Median arrears) £0 PR E M PR 9 E M PR 8 E M PR 7 E M PR 6 E M PR 5 E M PR 4 E M PR 3 E M PR 2 E M 1 DO PO R ST PO M1 ST PO M2 ST PO M3 ST PO M4 ST PO M5 ST PO M6 ST PO M7 ST PO M8 ST M 9 Arrears balance £1,000 Months Poly. (Average arrears) MONEY GUIDANCE EVALUATION DRAFT Quantative Analysis Findings: PRE 9 Months Total rent balances adjusted (arrears) • • • • £79,576 POST 9 Months DOR £118,126 £105,379 PRE 9 -DOR Change DOR – POST 9 Change -£38,550 £12,747 Average arrears £730 £1,084 £967 -£532 £117 Median arrears £469 £679 £624 -£252 £98 The average account balance nine months prior to referral was £730 in arrears (and a median average of £469). An evident decline in rent arrears in the months following the receipt of the MGP service. The average rent account balance fell from £1,084 in arrears over the nine months after receiving the service to £967 (or a median average of £624) in arrears. This means that each person receiving the Casework MG, improved rent balance by an average of £117 (or median of £98) over the preceding 9 months compared to the £532 worsening of their account on average in the 9 months before. Impact of CW MG on residents is an average reduction in arrears of 10% over nine month period. MONEY GUIDANCE EVALUATION DRAFT Quantative Analysis Findings: • Model of average arrears (without MGP intervention): £1,800 £1,600 £1,200 £1,000 Average arrears £800 £600 £400 Average arrears (worst case scenario) £200 9 ST M 7 PO ST M 5 PO ST M 3 Months PO ST M 1 PO PO ST M M 1 PR E M 3 PR E M 5 PR E M 7 PR E M 9 £0 PR E Arrears balance £1,400 Average arrears (same scenario) MONEY GUIDANCE EVALUATION DRAFT Quantative Analysis Findings: • Worse case scenario – with same arrears growth would see average arrears increase from £1,084 to £1,609 • Even with same level of arrears after nine months – arrears saving alone would be between £117 and an extra £642 of arrears for each resident. • Equates to between £12,800 and £70,600 MONEY GUIDANCE EVALUATION DRAFT Quantative Analysis Findings: • Impact of Light Touch MG: £180 £160 £140 Arrears Balance £120 £100 £80 Average arrear balance £60 Median arrear balance £40 £20 Trendline (Average arrears) £0 -£20 DOR POST POST M1 M2 POST POST M3 M4 POST POST M5 M6 Months POST POST M7 M8 POST M9 Trendline (Median arrears) MONEY GUIDANCE EVALUATION DRAFT Quantative Analysis Findings: • In fact, the average rent balance was £117 (a median average of £85) with these 69 residents owing £8,100 at the point of accessing the support. Maybe it is not so surprising that new residents have early rent arrears given the relative expense of moving and furnishing a new home. • Average levels of arrears in the immediate months following the referral remain high and appears to peak a couple of months after accessing the service. MONEY GUIDANCE EVALUATION DRAFT Quantative Analysis Findings: • Nevertheless, nine month on from accessing the service, rent balances are shown to have gradually fallen from arrears of £177 (and a median of £85 in arrears) to having an outstanding arrears balance of £94 (or a zero median balance). DOR Total rent arrears POST 9 DOR - POST9 Change £8,100 £6,606 £1,493 Average arrears £117 £94 £23 Median arrears £85 £0 £85 • Impact of LT MG on residents is an average reduction in arrears of 19% over nine month period