H&R Block Strategic Plan

advertisement

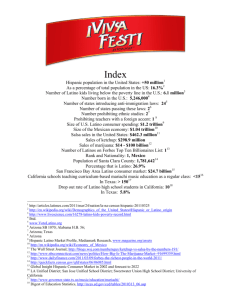

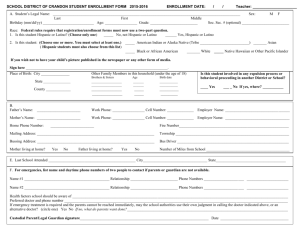

H&R Block Strategic Proposal: The College Block Program Team 4: South Hampton Through the use of existing and potential strategies, this proposal is specifically designed to optimize recognition, retention and recruitment for the H&R Block South Hampton office, located in Benicia. Team 4 Consultants: Brett Lowers Lila Schwarzbach Valerie Potts Timothy Gerritsen EXECUTIVE SUMMARY H&R Block has been a tax service provider since 1955. They have up-to-date knowledge, extensive training and state-of-the-art technology to ensure your taxes get done right. H&R Block currently has a community-based project in place called the “School House Program” and an internet-based program called “Best of Both”. The South Hampton group’s strategic plan focuses on expanding and capitalizing on the current “School House Program” and “Best of Both” by creating a new venture called the “College Block Program”. It is hoped that through the implementation of this strategic plan, H&R Block will be able to gain the customer recognition, retention, and recruitment they strive for. Our mission is to increase H&R Block’s current clientele base 10% by expanding our current tax preparation services to accommodate college students in the Benicia and Vallejo areas. It is our goal to guide them with their tax and financial needs throughout college and into their future careers, by establishing long-term relationships that will last a lifetime. Once the “School House Program” proves successful, we foresee a national implementation of the program within the next 5 years. Through this strategic plan, we are looking to target the younger generation market of college students, hoping to influence them early on and establish long-term relationships. H&R Block can become a staple figure in the tax preparation industry. The implementation of our strategic plan can simply be done by making a presence on college campuses through presentations, demonstrations, and visual aids (i.e. flyers, postcards). By establishing interpersonal relationships and putting a face on H&R Block’s image, we are looking to take the intimidation factor out of filing taxes, since they can be stressful to young people When examining H&R Block’s competitors in the area, we concluded that they outshine H&R Block in regards to having a more personable relationship with your tax consultant. By putting a face on the H&R Block image to college students through our strategic plan, this weakness (in comparison to competitors) can be overcome. The objectives of our strategic plan are as follows: develop a new market for H&R Block focused on college students, and expand the “College Block Program” throughout Northern California within 2 years. We have three main goals we would like to accomplish through our strategic plan: establish and build relationships with high school and college students that will last a lifetime, increase customer base by 10 % within the initial 2-year period, and extend the program nationwide by 2015. 1 CONTENTS Executive Summary .......................................................................................................................................................1 Introduction ...................................................................................................................................................................3 Mission and Vision .........................................................................................................................................................4 External Factors and Analysis ........................................................................................................................................5 Mean Income Level....................................................................................................................................................5 Ethnic groups .............................................................................................................................................................6 Current School Enrollment ........................................................................................................................................7 Competitive Comparison ...........................................................................................................................................8 Internal Factors and Analysis .......................................................................................................................................10 Long-Term Objectives ..................................................................................................................................................11 Implementation of “Latino Blitz” .............................................................................................................................11 Office Improvements ...............................................................................................................................................11 Best of Both .............................................................................................................................................................12 Evaluation and Analysis of “The School House” Program .......................................................................................13 H&R College Block proposal ....................................................................................................................................14 Stratagy Evaluation and Selection ...............................................................................................................................16 “Marketing”/ Implementation Plan .............................................................................................................................18 Strategy –High Order ...............................................................................................................................................18 Strategy-Low order ..................................................................................................................................................19 Evaluation Plan ............................................................................................................................................................20 Potential Issues ............................................................................................................................................................20 Conclusion ...................................................................................................................................................................21 2 INTRODUCTION H&R Block had originally asked the different groups in Dr. Bruce Hartman’s Strategic Management class to prepare a strategic plan in order to implement a “Latino Blitz”. After careful research we found that only 10% of individuals living in Benicia are Hispanic or Latino. With much consideration, the South Hampton office group came to the conclusion that a “Latino Blitz” would not be applicable to the South Hampton office due to low Latino demographics. However, we still believe that it is important for there to be bilingual brochures and tax professionals. After careful deliberation with the H&R Block district manager for Vallejo, Dorothy Lirio-Casa, it was concluded that it would be best if the South Hampton group looked at other alternatives for a relevant project that would tap into underdeveloped markets. Dorothy Lirio-Casa discussed the “School House Program” with us, and encouraged that it be our main focus. Another program mentioned was the “Best of Both”. The South Hampton group decided that a plan inspired by the current district “School House Program” would be the best course of action. Our strategic plan is to expand the “School House Program” to colleges, with different promotions. It is called the “College Block Program”. The current “School House Program” consists of free tax returns for high school students, a 10% discount coupon for parents of high school students, and a flat-fee tax return service for high school teachers. These discounts are only available to students, parents, and teachers at high schools that are official participants of the “School House Program”. This project was compiled to the best of the groups’ capabilities based on the information provided. 3 MISSION AND VISION “Our mission is to increase H&R Block’s current clientele base 10% by expanding our current tax preparation services to accommodate college students in the Benicia and Vallejo areas. It is our goal to guide them with their tax and financial needs throughout college and into their future careers, by establishing long-term relationships that will last a lifetime. Once the “School House Program” proves successful, we foresee a national implementation of the program within the next 5 years.” “Best of Both” Lifetime Involvement Long Term Relationships Guidance Increase Client Retention Community Involvement “School House Program” New Program Expansion College Block 4 EXTERNAL FACTORS AND ANALYSIS When first designing our strategic plan, our team first had to examine and evaluate the potential external factors that could influence which plan would best work for the South Hampton office. After much deliberation, we concluded that there are a few keys issues that could heavily influence our decision process: What is the average income level of families living in Benicia? What is the percentage of Spanish-speaking families/individuals living in Benicia? What is the current school enrollment of students living in Benicia? Who are our largest competitors? Not only in Benicia, but online as well? A search of the US Census bureau gave our team the information needed to successfully address demographic questions, and a competitive investigation gave us the necessary information to address these questions. The conclusions of our findings are presented on the following pages. MEAN INCOME LEVEL For a strategic and marketing plan to succeed, it is imperative that the market you are serving is understood. One way to judge this is to compute the mean income level of families living in Benicia. This important figure can give invaluable insight to the consultation firm. A US Census Survey taken in 2008 shows that the mean income level of families living in Benicia is approximately $87,739. Compare this to the national average $50,233. Please see Figure 1 for a comparison of income. 5 2500 2000 1500 1000 500 0 Figure 1- Comparison of Household Income in $1,000’s What does this mean for the South Hampton office? First, we can easily identify and state that Benicia is an upper income level city. With a mean score of over $30,000 higher than the national average, the South Hampton office resides in a higher-end neighborhood. This can be useful in identifying the clientele that could potentially visit the store. Additionally, this gives us a good basis of what types of tax services may come through the office in the upcoming tax season. Lastly, this snapshot of the income level in Benicia can help us determine what kind of promotional discounts would be appropriate for this office. Often, marketing teams decide whether “flat-rate” or “percentage” discounts (income-based) would be best. In this situation, considering the potential for difficult and more involved tax returns, we have decided that a percentage discount would be the most cost effective plan. Later, we will address the various discount opportunities available and how best they pertain to our strategic plan. ETHNIC GROUPS When presented with the “Latino Blitz” marketing campaign, we decided the first step would be to determine if a Latino campaign would be beneficial in to the South Hampton office in Benicia. We looked at the percentage of families in the area surrounding the South Hampton office who primarily speak Spanish in their homes. Unfortunately, this information is not readily available on any online or offline services. Thus, we decided to analyze the percentage of Hispanic/Latino families currently living in Benicia. The numbers show that only 10% 6 of individuals living in Benicia are Hispanic or Latino. For a graphical representation of Hispanic/Latino ethnicity, please see Figure 2. Hispanic or Latino (of any race) 6% Mexican 3% White alone 41% Not Hispanic or Latino 50% Figure 2- Ethnic divisions This information proved to be a key factor in determining a strategy formulation for the South Hampton office. If we were to design a marketing campaign for this location, would a “Latino Blitz” campaign produce the greatest return on investment? When looking at the numbers, 10% did not seem like a large enough number to constitute a large investment of time, energy, and money to make it a complete strategy. However, we did decided that creating a secondary strategy that would ensure that our final plan included services for Spanish speaking individuals would be important. It is also important to note that these numbers do not necessarily directly show the total number of Spanish speaking persons in the Benicia area, though we feel it does give a decent benchmark. CURRENT SCHOOL ENROLLMENT After realizing that the “Latino Blitz” program may not be the best use of resources for this particular office, our group set out to see where the best market was to create retention, recognition and recruitment. One idea that came to mind was the college student demographic. As students leave home, they must quickly learn how to fend for themselves; this includes learning to file for tax returns. In this situation, the possibility of new client recruitment is huge. Our research shows that 30% of students enrolled in an education program are in college. This relatively untapped market could potentially not only attract college level students, but also attract their parents as well. Figure 3 further reinforces this hypothesis. 7 Nursery school, preschool 4% College or graduate school 31% Kindergarten 3% Elementary school (grades 1-8) 38% High school (grades 9-12) 24% Figure 3- School Enrollment K-College This new piece of information provides an interesting twist to our strategic decision: the potential for the college market is huge, how can this be best attained? A current H&R Block program named “The School House Program” provides an interesting groundwork for a potential expansion into the college demographic. These ideas will be addressed later on. COMPETITIVE COMPARISON Around the Benicia area, there is a surprising amount of tax preparation services available. Below is a list of some local companies that provide similar services as H&R Block: Benicia Tax Services Ats Tax & Financial Solution Strong Tax Services Emerald Professional Service Gaynel Kew EA Tax & Financial Mc Veigh & Associates CPA Barata Sylvia Ea Kaori Mimaki Kay's Financial Services 8 These “boutique” stores provide a personal experience, much like a small home business. The fact of the matter is though, these small stores simply do not have the same financial backing, national recognition, or professional “tax masters” H&R Block does. Since Benicia is a city of community, the argument can be made that a small business environment may be more appealing to people in Benicia. It is in our opinion however, that the majority of professionals in this South Hampton area would rather have the peace of mind knowing that their taxes will be done right the first time. One competitor stands out from the rest however. Jackson Hewitt, located on Columbus Parkway is H&R Block’s biggest competitor in the area. This company provides face-to-face tax services, at a competitive price. In situations such as these, a Competitive Profile Matrix (CPM) would be made to distinguish the strengths and weaknesses of each company. Table 1 (below) shows a CPM between three competitors: Inuit Inc. (INTU), Jackson Hewitt (JTX), JTH Tax (JTH, Privately held), and the industry standard. After viewing this information, it is clear that H&R Block is the market leader. HRB Market Cap: 6.76B Employees: Qtrly Rev Growth (yoy): Net Income (ttm): 9.53B JTH 146.22M N/A INDUSTRY 275.41M 8,300 7,800 355 2801 892 2.50% 17.70% N/A 12.60% 4.06B 3.19B 249.08M 87.60M1 454.37M 38.79% 80.44% 42.60% N/A 34.72% 1.04B 954.73M 68.28M N/A 68.28M 23.38% 20.82% 22.07% N/A 8.98% EBITDA (ttm): Oper Margins (ttm): JTX -7.20% Revenue (ttm): Gross Margin (ttm): INTU 517.55M 431.04M 18.17M N/A N/A EPS (ttm): 1.457 1.308 0.637 N/A 0.02 P/E (ttm): 13.83 23 7.97 N/A 14.85 PEG (5 yr expected): 1.29 1.22 0.82 N/A 1.29 P/S (ttm): 1.71 3 0.56 N/A 0.96 Table 1- Competitive Profile Matrix of Industry Competitors Additionally, H&R Block has something that Jackson Hewitt does not: Tax Professionals. At Jackson Hewitt, it is not necessary to pass an exam to file the public’s taxes, while at H&R Block, a course must be taken to make sure the staff is well-trained and meets set standards. In the end, this proves that H&R Block is the better choice for business professionals and families. 9 INTERNAL FACTORS AND ANALYSIS The internal factors listed below (were chosen for the following reasons: It is clear that while H&R Block is the largest tax preparer in the U.S., a large cut in domestic offices will in many ways affect their already low presence at U.S. colleges. In order for the “College Block Program” strategy to work on a commercial level, these weaknesses will have to be addressed with the available resources. Obviously this is something that will have to be examined on a district-by-district basis. The factors we chose are based on the information at hand regarding H&R Block, and based on the meetings with the district representatives. Strengths are based on the current position of H&R Block in the tax services market place. Furthermore, due to the unique market gap and possibility to enter a new niche spot in collegiate tax preparation. The fact that H&R Block does have an international presence is definitely an added strength that benefits any possible long-term relationships with college clients expanding their future careers abroad. Key Internal Factors Weight Rating Weighted Scores Strengths 1. HRB has high brand recognition in the US 0.1 4 0.4 2. HRB offers do-it-yourself tax prep with HRB 0.15 3 0.45 0.05 3 0.15 0.05 4 0.2 0.05 4 0.2 0.1 4 0.4 0.15 2 0.15 2. Closing 400 regular offices this year 0.15 1 0.15 3. Closing of 1,200 Wal-Mart offices this year 0.1 1 0.2 4. Expects a continued shift to the "do-it-yourself" 0.1 1 0.2 support 3. Experience with educating College students about financial responsibility 4. Strong base for implementation of a new college focused initiative 5. Offices across the United states, Canada and Australia 6. Offers banking services applicable to college students Weaknesses 1. Tax preparation is seasonal – college students work in semesters or quarters model from the assisted preparation model. TOTAL 1 2.5 10 LONG-TERM OBJECTIVES With the internal and external factors documented and analyzed, work can begin by formulating a strategy with long-term objectives. Before our plan is presented, it is important to mention additional secondary plans that can work in congruence with our “College Block Program”. This includes the “Latino Blitz”, the widely successful “School House Program” already put into action by the H&R Block team, and “Best-of-Both”. All of the aforementioned plans can be considered parts of our overarching “College Block Program” strategy. IMPLEMENTATION OF “L ATINO BLITZ” As previously mentioned, in regards to the South Hampton office, the “Latino-Blitz” marketing campaign, though viable in many other markets, may not be as efficient for the Benicia demographic. With a Hispanic/Latino population of only 10%, marketing resources may be put to better use in other areas. This is not to say we should forget our Latino demographic. It is for this reason we feel that creating bilingual promotional material would be an effective implementation of the “Latino Blitz” in the Benicia community. This relatively inexpensive approach can greatly serve this small, but specialized market. Examples of such material include, but are not limited to: brochures, postcards, store-wide posters, discount coupons, etcetera. The implications of the “Latino Blitz” program are not limited. With a successful implementation, we could potentially see an increase in our Latino customer numbers, based on the fact that a wider audience can be reached and informed that bilingual tax professionals are available. Additionally, an “ethnic friendly” positive public relation image can be built. In the end, though the “Latino Blitz” marketing campaign may not pertain exactly to the South Hampton district, small changes in the overall diversity of the office can potentially have an important impact in adding a more diverse client base in our district. OFFICE IMPROVEMENTS In any office environment, it is important to create an open, friendly, and inviting environment. Studies show that the more comfortable a client feels in location the more likely he or she is to return. This is not to say that the current layout of the South Hampton office is uninviting, but improvements can potentially be made to improve the overall appearance of the site. These changes can not only be aesthetic, but in the extra services offered as well. These include, but are not limited to: A less “temporary” look 11 During our analysis of the office, we felt the layout/furniture selection seemed temporary, sterile and cold. Though this may prove to be an expensive investment at first, we feel an updated “look” may be beneficial to the office environment. A “home town” experience In Benicia, it is hard to escape that fact that it is indeed a “small town.” Local businesses thrive all around our location. It may be beneficial to give the office a small-town feeling by including local artists, Benicia Herald articles, and other artifacts specific to Benicia history. These small changes can give a personalized look to the South Hampton office. Refreshment services Since tax preparation services can take some time, a refreshment service may be beneficiary to the incoming clients. Coffee, tea, water, and snacks can greatly increase the comfort of the guests staying at the office for prolonged periods of time. Although H&R Block has a strong online presence, it is still represented by its office and Tax Masters located within. Aesthetic changes, albeit expensive at time, can improve the inviting nature of any office. With Benicia’s tight knit community, a more personalized décor can draw in the “mom and pop” shoppers. For in the end, H&R Block does not only want to be your tax advisor, it wants to be your family’s tax advisor. BEST OF BOTH The “Best of Both” program is a way for customers, who may not be able to physically come into an H&R Block office, to still be able to file their taxes with H&R Block through use of the internet and all its great qualities. The program works by the customer inputting all of their information needed for their taxes into the computer. The Tax Master then takes the given information, and prepares their taxes. Since most information needed to file taxes can be found online, many Tax Masters can be authorized by the customer to view all information needed. This is handy in situations when the customer does not know all of their information. There is a flat fee of $99.00 for the customer to use the “Best of Both” program. The” Best of Both” program can be used by college students who have gone to college away from their original H&R Block office. This program allows the student to be away from home, but still have access to the accommodations of their home office: South Hampton. 12 EVALUATION AND ANALYSIS OF “THE SCHOOL HOUSE” PROGRAM With the creation of the widely successful school house program, we see how though the support of high school graduates and college-bound undergrads H&R Block can make a significant change in the community, while growing their customer base. It is for these reasons we felt that including aspect of the “School House” program into our overall College Block strategy, we could create a successful program that not only helps the local students, but creates a potential revenue source. But, before we can apply “School House” to our proposal, analysis of this home-grown project must be completed. The H&R Block School House Program is designed as a community service project dedicated to helping local High School students with some form of revenue to complete their tax returns efficiently and correctly. This service is invaluable to the student who does not quite understand United States tax code. Additionally, the “School House Program” can potentially add a second or third consumer base. With every student applying to the program, a discount can be applied to their teacher or parent. In this way, H&R Block can add new clients to their database. Table 2 and Figure 1 both show the potentiality of growth. It is important to note that there are three levels of client recruitment. At the South Hampton office, our goal is to reach 10% of the students at Benicia High School. In the projection below, we have aimed at 20% for high recruitment, 10% for expected recruitment, and 5% for low recruitment. In each segmentation, it is necessary to note that income is being received. School House Objectives # of Teachers recruited Revenue from professors All Students (with discount) 20% 358 20% 4 20% $676.00 10% 179 10% 2 10% $338.00 89 5% 1 5% $169.00 20% 175 20% 2 20% $338.00 10% 88 10% 1 10% $169.00 5% 44 5% 1 5% $169.00 5% Junior/Senior Table 2 13 Revenue from Professors $800.00 $700.00 $600.00 $500.00 $400.00 $300.00 $200.00 $100.00 $0.00 20% 10% 5% Table 3 H&R COLLEGE BLOCK PROPOSAL The “College Block Program” was inspired by the “School House Program”. While we understand that the “School House Program” was designed to be a community-based service, we see that it has the potential to have a viable commercial spin-off. By offering free tax services through the “School House Program”, H&R Block is starting a relationship with high school students. What we fear is that the foundation set in place in high school will be lost when those students begin their college career. Also, although it is easier to influence high school students, the majority of them will not be in the phase of their lives where tax preparation is applicable; therefore, we want to build onto the established relationship set forth by the “School House Program” by reinforcing H&R Block’s commitment to their tax needs when they are in college. The “College Block Program” offers a flat fee of $40 to college students for tax filings. There is also a $30 flat fee offered for students with a GPA of 3.5 or higher. A maximum income level will be established, and for students who exceed that limit, discounted (rather than a flat fee) tax filings are available. Through this strategic plan, we believe that H&R Block will build relationships with college students that will make them lifelong clients. The “College Block Program” is similar to the “School House Program” in that discounts are offered to professors. Since college professors generally have higher incomes than high school teachers, the implementation of a $169.00 flat fee could be a financial drain to H&R Block, so a discounted service will be offered instead. The South Hampton team wants to see the “College Block Program” implemented in colleges in the area such as: the California Maritime Academy, Diablo Valley College, St. Mary’s College, Laney College, Touro University, Contra Costa Community College, UC Davis, and Solano Community College. These colleges offer the 14 perfect setting to implement the “College Block Program” on a smaller scale. Our short-term goal through the program at these local colleges is to establish and maintain strong relationships with at least 10% of the students at each college. The long-term goal is to see success in the program, and expand it nationally. To implement the “College Block Program” H&R Block representatives can visit college campuses and deliver presentations in classes or in communal centers to students and professors. Like the “School House Program”, the “College Block Program” can have flyers and coupons ready to be handed out at these presentations. These flyers and coupons can also be distributed into student and professor mailboxes. We, the South Hampton group, feel that the “College Block Program” has great potential for growth, not only in our local district, but as a nationwide strategy. Through this strategic plan, H&R Block will be accomplishing more than just a community-based service. H&R Block can capitalize on the “School House Program” by expanding into the college demographic. We will be acquiring a whole new clientele base, of students and professors alike. By creating relationships with the youngest generation possible, most of whom have a very promising future in the making, H&R Block is tapping into a pristine market. The “College Block Program” can guarantee that H&R Block will gain the recognition, retention, and recruitment they strive for. School House Program Best of Both Latino Blitz College Block Program 15 STRATAGY EVALUATION AND SELECTION The Plus Minus Interesting (PMI) matrix was used to weigh the main influences that were the basis for choosing the “College Block” program in lieu of other strategic ideas that were pitched among the consulting group. As can be seen from the matrix it was felt that the befit of a program that has the option to be implemented on a nationwide scale (and possibly international) if successful would be an investment worthwhile. Plus Minus Interesting Great new service +5 Not community based -3 Niche opportunity +3 Could help students across Possibly a high investment in We are in a decent position the nation + 3 "cost cutting economic times" -4 for a trial in Benicia district. +3 Offers teachers a break +2 How many students file a full tax-return? -3 Long-term relationship with students +3 Potential huge market +3 +16 -7 +3 Total: +12 In addition, when we apply Porter’s five forces model to our strategy it becomes apparent that much of the success of the “College Block” program will rely on the fact that H&R Block is the leading Tax preparer in the U.S and has the added benefit that it is entering a relatively untapped niche market. In order to solidify its position H&R Block will have to successfully implement the Leapfrog strategy as mentioned in the implementation plan. By doing this other offerings by competitors trying to duplicate the new business model will be fended off. The “In-House” capabilities H&R Block currently has will further assist in keeping and further developing the increased competitive advantage the new program will offer if implemented as a long-term strategy. 16 Threat of new entry: All Tax preparers could offer a Competitive Rivalry: similar service Several large Tax Prepares in the US Low barriers of entry High cost of leaving market Schools could offer their own services Competitive Rivalry Supplier power: We are our own supplier of services We train our tax own “Tax Masters” Buyer Power: Supplier power is very limited Many potential substitutes such as free online tax prep. Threat of substitution: Can file your own taxes Some substitution Online software packages (one time buy+ free upgrades) Figure 4- Porters 5 Forces model 17 “MARKETING”/ IMPLEMENTATION PLAN OBJECTIVES Develop a new market for H&R Block focused on college students Expand the “College Block” program throughout Northern California within 2 years GOALS Establish and build relationships with high school and college students that will last a lifetime. Increase customer base by 10 % within the initial 2-year period. Extend the program nationwide by 2015. STRATEGY –HIGH ORDER TARGET MARKET High school graduates College freshmen starting their collegiate career. Existing college students POSITIONING/ UNIQUE SELLING POINT H&R Block will be able to leverage their current market position and their current experience with the ““School House Program” (which is community based). Based on these experiences and economies of scale H&R Block is the ideal college tax professional partner. CORE STRATEGY We will follow a combination Leapfrog strategy/Flanking strategy since we are trying to a build niche market for H&R Block in the existing tax preparation industry thus tapping into a customer base previously untouched. PUSH VS. PULL Initially we will have to push our “new” services onto our target markets in order to situate the H&R Brand into the college students’ mind. In due time this will have to be re-evaluated to determine if a more equal balance between push and pull can be made. 18 LOYALTY VS. TRIAL The services we are entering, although existing, will be new to college students. Based on this fact we will have to engage the students on a trial basis through various promotional activities. STRATEGY-LOW ORDER PRODUCT Our new service should clearly reflect the fact that we are trying to offer a comprehensive and tailored tax service with the backing of the H&R Block brand to college students. PRICE We will start with at a flat fee rate of $40 per filing, with a progressive pricing scale based on annual income and tax needs activating at a certain level of income. Possibility to adjust prices based on student income levels. PLACE An excellent opportunity to gain customer awareness for this amazing initiative is to attend the many career fairs on college campuses. A good spread of program awareness material through financial aid offices will also add well to promotional support. PROMOTION We will add GPA based incentives. Proposed incentive s are to lower the “flat fee” rate from $40 to $30 with a GPA of 3.5 or higher. This will also affect the progressive scale used in our pricing strategy. Flyers and Informational packets distributed by i.e. college financial aid offices 19 EVALUATION PLAN Since we are using the Benicia South Hampton office as a trial location for our strategy this will be the best available option to evaluate the success of the School House Block Strategy. Once implemented we will be able to measure success by evaluating market penetration: (# college students signed up/ # students in district). A similar measure will be possible by evaluating colleges that sign up with the program and agree to distribution of informative materials through their financial aid offices and advisors. Based on the demographic diversity in Solano County and the multiple educational institutions in the area we will be able to gauge the effectiveness of the College Block program in conjunction with the “Latino Blitz” and “Best of Both” elements of the proposed strategic plan. To measure effectiveness of our marketing and promotional efforts we will implement various customer surveys as well as customer follow-ups done on a case-by-case basis when possible by the individual tax masters or an assigned office representative. This will also reflect our efforts to make our customers feel more at home and involved on a personal level, hopefully adding to overall customer satisfaction. POTENTIAL ISSUES Our ideas are solely strategies; thus, making the possibility of arising issues to come about. The main issue of concern is the chance of an unsuccessful venture upon attempting to capitalize on the “School House Program” through the “College Block Program” after investing the time, effort, and money needed. Our goal is to gain recognition through the “School House Program” and seal retention through the “College Block Program” and/or the “Best of Both” program. Our team believes the strategies we have created are flexible enough to work with the ever-changing markets and industry. Also, if issues do arise, we have faith in H&R Block’s skills and knowledge of the industry and their clients, to recover from an unsuccessful venture with this strategic plan. 20 CONCLUSION Learning the ins and outs of a company can be very tedious; however, our group tackled the process by breaking down the company’s wants and needs. Originally, our group was told H&R Block wanted us to create a strategy to implement a “Latino Blitz” program. After a couple of meetings with Dorothy Lirio-Casa, we got a different feeling and decided to venture another way; putting our focus more on the “School House Program.” Our change of course was influenced by a very low percentage of Latinos living in the surrounding areas to our South Hampton office; thus, making too much time spent on the “Latino Blitz” irrelevant. The course we traveled on mainly dealt with the expansion of the “School House Program,” because Benicia is a very tight knit community and we felt the community would respond more to a community service program, than a publicity stunt. We expanded our course by creating the “College Block” program, which has the potential to retain members of the “School House Program” as they embark on their next life adventure: college. The retention comes about with the discounts offered and the easy access with the use of the “Best of Both” program. It is an unavoidable fact that tax season is a stressful time for all, along with the strains we endeavor in these tough economic times. With our proposed “College Block Program”, we hope to create a win-win relationship with both students and professors. The “College Block Program” can guarantee that H&R Block will gain the recognition, retention, and recruitment they strive for. 21