Budgets - Texas Municipal Clerks

advertisement

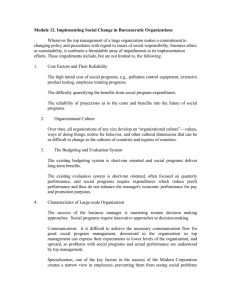

Budgets Texas Local Government Code § 102.001 - § 102.011 Texas Local Government Code § 102.001. BUDGET OFFICER. (a) The mayor of a municipality serves as the budget officer for the governing body of the municipality except as provided by Subsection (b). (b) If the municipality has the city manager form of government, the city manager serves as the budget officer. Acts 1987, 70th Leg., ch. 149, § 1, eff. Sept. 1, 1987. Texas Local Government Code § 102.002. ANNUAL BUDGET REQUIRED. The budget officer shall prepare each year a municipal budget to cover the proposed expenditures of the municipal government for the succeeding year. Acts 1987, 70th Leg., ch. 149, § 1, eff. Sept. 1, 1987. Texas Local Government Code § 102.003. ITEMIZED BUDGET; CONTENTS. (a) The budget officer shall itemize the budget to allow as clear a comparison as practicable between expenditures included in the proposed budget and actual expenditures for the same or similar purposes made for the preceding year. The budget must show as definitely as possible each of the projects for which expenditures are set up in the budget and the estimated amount of money carried in the budget for each project. (b) The budget must contain a complete financial statement of the municipality that shows: (1) the outstanding obligations of the municipality; (2) the cash on hand to the credit of each fund; (3) the funds received from all sources during the preceding year; (4) the funds available from all sources during the ensuing year; (5) the estimated revenue available to cover the proposed budget; and (6) the estimated tax rate required to cover the proposed budget. Acts 1987, 70th Leg., ch. 149, § 1, eff. Sept. 1, 1987. Texas Local Government Code § 102.004. INFORMATION FURNISHED BY MUNICIPAL OFFICERS AND BOARDS. In preparing the budget, the budget officer may require any municipal officer or board to furnish information necessary for the budget officer to properly prepare the budget. Acts 1987, 70th Leg., ch. 149, § 1, eff. Sept. 1, 1987. Texas Local Government Code § 102.005. PROPOSED BUDGET FILED WITH MUNICIPAL CLERK; PUBLIC INSPECTION. (a) The budget officer shall file the proposed budget with the municipal clerk before the 30th day before the date the governing body of the municipality makes its tax levy for the fiscal year. (b) The proposed budget shall be available for inspection by any taxpayer. Acts 1987, 70th Leg., ch. 149, § 1, eff. Sept. 1, 1987. Texas Local Government Code § 102.006. PUBLIC HEARING ON PROPOSED BUDGET. (a) The governing body of a municipality shall hold a public hearing on the proposed budget. Any taxpayer of the municipality may attend and may participate in the hearing. (b) The governing body shall set the hearing for a date occurring after the 15th day after the date the proposed budget is filed with the municipal clerk but before the date the governing body makes its tax levy. (c) The governing body shall provide for public notice of the date, time, and location of the hearing. Acts 1987, 70th Leg., ch. 149, § 1, eff. Sept. 1, 1987. Texas Local Government Code § 102.0065. SPECIAL NOTICE BY PUBLICATION FOR BUDGET HEARING. (a) The governing body of a municipality shall publish notice before a public hearing relating to a budget in at least one newspaper of general circulation in the county in which the municipality is located. (b) Notice published under this section is in addition to notice required by other law, except that if another law requires the governing body to give notice, by publication, of a hearing on a budget this section does not apply. (c) Notice under this section shall be published not earlier than the 30th or later than the 10th day before the date of the hearing. Added by Acts 1993, 73rd Leg., ch. 268, § 24, eff. Sept. 1, 1993. Amended by Acts 2001, 77th Leg., ch. 402, § 9, eff. Sept. 1, 2001. Texas Local Government Code § 102.007. ADOPTION OF BUDGET. (a) At the conclusion of the public hearing, the governing body of the municipality shall take action on the proposed budget. (b) The governing body may make any changes in the budget that it considers warranted by the law or by the best interest of the municipal taxpayers. Acts 1987, 70th Leg., ch. 149, § 1, eff. Sept. 1, 1987. Texas Local Government Code § 102.008. APPROVED BUDGET FILED WITH MUNICIPAL CLERK. On final approval of the budget by the governing body of the municipality, the governing body shall file the budget with the municipal clerk. Acts 1987, 70th Leg., ch. 149, § 1, eff. Sept. 1, 1987. Texas Local Government Code § 102.009. LEVY OF TAXES AND EXPENDITURE OF FUNDS UNDER BUDGET; EMERGENCY EXPENDITURE. (a) The governing body of the municipality may levy taxes only in accordance with the budget. (b) After final approval of the budget, the governing body may spend municipal funds only in strict compliance with the budget, except in an emergency. (c) The governing body may authorize an emergency expenditure as an amendment to the original budget only in a case of grave public necessity to meet an unusual and unforeseen condition that could not have been included in the original budget through the use of reasonably diligent thought and attention. If the governing body amends the original budget to meet an emergency, the governing body shall file a copy of its order or resolution amending the budget with the municipal clerk, and the clerk shall attach the copy to the original budget. (d) After the adoption of the budget or a budget amendment, the budget officer shall provide for the filing of a true copy of the approved budget or amendment in the office of the county clerk of the county in which the municipality is located. Acts 1987, 70th Leg., ch. 149, § 1, eff. Sept. 1, 1987. Texas Local Government Code § 102.010. CHANGES IN BUDGET FOR MUNICIPAL PURPOSES. This chapter does not prevent the governing body of the municipality from making changes in the budget for municipal purposes. Acts 1987, 70th Leg., ch. 149, § 1, eff. Sept. 1, 1987. Texas Local Government Code § 102.011. CIRCUMSTANCES UNDER WHICH CHARTER PROVISIONS CONTROL. If a municipality has already adopted charter provisions that require the preparation of an annual budget covering all municipal expenditures and if the municipality conducts a public hearing on the budget as provided by Section 102.006, the charter provisions control. After the budget has been finally prepared and approved, a copy of the budget and the amendments to the budget shall be filed with the county clerk, as required for other budgets under this chapter. Acts 1987, 70th Leg., ch. 149, § 1, eff. Sept. 1, 1987. Budgets Budget - budg·et [buhj-it] • • • • • A budget (from old French bougette, purse) is a list of all planned expenses and revenues. It is a plan for saving and spending. A budget is an important concept in micro economics, which uses a budget line to illustrate the trade-offs between two or more goods. In other terms, a budget is an organizational plan stated in monetary terms. In summary, the purpose of budgeting is to: – Provide a forecast of revenues and expenditures i.e. construct a model of how our business might perform financially speaking if certain strategies, events and plans are carried out. – Enable the actual financial operation of the business to be measured against the forecast. A budget is a financial document used to project future income and expenses. The budgeting process may be carried out by individuals or by companies to estimate whether the person/company can continue to operate with its projected income and expenses. A budget may be prepared simply using paper and pencil, or on computer using a spreadsheet program like Excel, or with a financial application like Quicken or QuickBooks. The process for preparing a monthly budget includes: – Listing of all sources of monthly income – Listing of all required, fixed expenses, like rent/mortgage, utilities, phone – Listing of other possible and variable expenses. Budget - budg·et [buhj-it] • • • • • A budget (from old French bougette, purse) is a list of all planned expenses and revenues. It is a plan for saving and spending. A budget is an important concept in micro economics, which uses a budget line to illustrate the trade-offs between two or more goods. In other terms, a budget is an organizational plan stated in monetary terms. In summary, the purpose of budgeting is to: – Provide a forecast of revenues and expenditures i.e. construct a model of how our business might perform financially speaking if certain strategies, events and plans are carried out. – Enable the actual financial operation of the business to be measured against the forecast. A budget is a financial document used to project future income and expenses. The budgeting process may be carried out by individuals or by companies to estimate whether the person/company can continue to operate with its projected income and expenses. A budget may be prepared simply using paper and pencil, or on computer using a spreadsheet program like Excel, or with a financial application like Quicken or QuickBooks. The process for preparing a monthly budget includes: – Listing of all sources of monthly income – Listing of all required, fixed expenses, like rent/mortgage, utilities, phone – Listing of other possible and variable expenses. Budget • BUD-GET • BUD – Budweiser (Anheuser-Busch), a global pale lager brand • GET – Retrieve or procure What is a Budget? • A planning and policy document where you record your best estimate / guess / calculation of how to pay for the expenses that you anticipate for a given year. • You have to consider all sources and amounts of available funds. • There are multiple types of budgets that can be developed. Why is the Budget Important? • • • • Shapes local economy Communicates effective leadership Sanctions and limits administrative action In sum: – Budget • process: citizens as market: consumers 20 Budget Concepts • Operating Budget – Reports the spending plan for a government’s ongoing services by department and by line-item – Funded by current revenues – Requires being balanced • CR (Current Rev.) = CE (Current Exp.) • CR + FB (Fund Balance) = CE -> Drawdown FB • CR = CE + FB (Fund Balance) -> Add too FB 21 Budget Concepts • Capital Budget – Spending plan for the acquisition of fixed assets. – Part of a capital Improvement Plan (CIP) • 5 to 8 year rolling plan. – Funding usually from the sale of bonds and grants. 22 Best Practices • The budget process should clearly define: – Roles and responsibilities – The timetable for completion – The type of information to collect and use – The policies that guide financial practices 23 Budget Policies • The budget begins with a budget policy statement that is approved by the governing body. • The budget policy statement includes: – The financial forecast for the year – Description of factors that will influence the revenues and expenditures. – Priorities and goals. – Department preparation guidelines / templates. – Recommendation for the budget officers. – (Look at Example) Budget Policies • Operating – – Establish the scope of the budget. – What constitutes a balanced budget. – What type of reserves should be maintained. – General guideline for preparation and amendment processes. – Who is responsible for budget preparation. 25 Budget Policies • Revenue – – Changes in property tax rate. – Use of one-time revenues. – Frequency of reviewing changes. – Collection of delinquent taxes and charges. 26 Budget Policies • Debt – Maximum term for which debt can be incurred. – The mix of long-term debt and current revenues as a basis for financing capital improvements. – How bond proceeds will be used. – Under what conditions short-term debt will be used. 27 Budget Policies • Budget Implementation – Govern the transfer of funds across accounts. – Interfund borrowing/payments. – Empowerment of chief executive to encumber budget authority. – Standards for government accounting, financial reporting and auditing. What is a Balanced Budget? Preparation Phase 1. Chief executive must submit a balanced budget. Legislative Phase Executive Implementation Accounting and Financial Reporting 4. Budget amendments and supplemental appropriations must include offsetting revenue sources. 5. Must end fiscal year with a balanced budget. 2. Budget approved by council must be balanced 3. Budget signed by elected chief executive, after and vetoes, must be balanced 29 NACSLB - 4 Principles of the Budget Process • Establish Broad Goals to Guide Government Decision Making – A government should have broad goals that provide overall direction for the government and serve as a basis for decision making. • Develop Approaches to Achieve Goals – A government should have specific policies, plans, programs and management strategies to define how it will achieve its long term goals. • Develop a Budget Consistent with Approaches to Achieve Goals – A financial plan and budget that moves towards achievement of goals, within constraints of available resources, should be prepared and adopted. • Evaluate Performance and make Adjustments – Program and financial performance should be continually assessed, and adjustments made, to encourage progress towards achieving goals. NACSLB – National Advisory Council on State and Local Budgeting GFOA – Recommended Budget Practices Steps to Budgeting • Identify the person who will coordinate the budgeting process and will train staff in methods, definitions, document formats, assign responsibilities and communicate deadlines • Analyze yearly operational objectives and service goals with staff recommendations • Align goals and objectives with strategic plans, staffing requirements and budget estimates • Prioritize services and goals in order to construct the budget details Policy Decisions in the Budget Process • Tax rates and revenue sources – Increase or frozen, special taxes, prior year availability or any new taxes? • Transfers of revenue – Taxes replaced with user / service fees? • Earmarked funds – Internal service fees shifted? • Allocations – How is the budgeted money allocated? Budget Process Players • • • • Budget Officer City Council Department Heads The Public Budget Process Players • Who is the Budget Officer? – TLGC 102 specifies that the mayor is the budget officer except those with a CM form of government. – In home rule, the charter may specify that the (finance officer or a finance committee) has the responsibility Budget Process Players • Budget Officer – Prepares the forms and instructions – Distributes them to the department heads – Controls the timeline – Makes the revenue forecasts – Presents the balanced budget to the municipal clerk for distribution to the city council – Monitors departmental compliance – Tracks the performance of the budget Budget Process Players • City Council – Publishes notices for and conducts the public hearing on the proposed budget – Writes the budget policy statement – Hold budget workshop sessions that are open to the public – Adopts the budget in a timely manner Budget Process Players • Department Heads – Request budgetary needs for the coming year – Analyze community needs – Propose service modifications – Provide long range input to capital improvements • Typically include: streets, drainage, buildings and other multiyear projects Budget Process Players • The Public – The budget must be publically available to be reviewed – The public provides input at the budget hearings and is allowed to provide insight, opinions and recommendations to the budget The Beginning Process - CNA • Community Needs Assessment – Services and programs needed and their costs – Programs in demand and not in demand – Revenue anticipation – Community improvements and efficiencies – Community changes and direction – May result in a partnership for a joint-service delivery Budget Cycle Let’s look at 2 processes… Budget Cycle in Brief #1 • Phases Product • • • • Executive’s proposed budget Appropriation act Encumbrance & disbursement of funds Comprehensive annual fin. report Preparation Legislative Approval Executive Implementation Accounting & Fin. Reporting 41 Preparation • Preparation – Engage department heads, link to the strategic plans and performance measures. – A budget calendar and budget manual. – Regular updates of revenue forecasts. – Executive – level hearings. 42 Legislative • Legislative Approval – Council reviews and modifies the proposed spending plan, • invites public comment, public hearings • assesses how proposals meet community needs – Approves plan as appropriation (budget authority) – Tax-supported versus fee-supported activities. 43 Preparation (and Legislation) Phase • Revenue forecasting methods – Informal judgment – Deterministic, or formula based – Time series analysis – Econometric or causal model 44 Legislative Phase • • • • • • • Manager’s budget Council work sessions Public hearings End runs Biennial budget Tax ordinance - EXAMPLE Appropriation (budget) ordinance – EXAMPLE #1 and EXAMPLE #2 • Line-item veto • Failure to adopt budget before start of FY. 45 Executive • Executive Implementation – Communicate budget information to stakeholders. – Maintain budget compliance – Policies and procedures designed to alter budget as circumstances warrant. – Technology platform • Forecasting revenues and expenditures (short term/long term) • Budget preparation • Formulating budget scenarios • Performance measurement. 46 Executive Implementation • • • • • • • Budget authority Estimated Revenues Requisitions, encumbrances Salary savings Apportionment Allotment Lapse in budget authority 47 Accounting • Accounting & Financial Reporting – Provide financial control. – 13 GAAP principles provide the accounting guidelines for local governments – Interim and CAFR reports • Reconciliation of all transactions • Comparison to approved and amended budget. – Interim report -- an early warning system. 48 Budget Cycle #2 Forecasting Adoption Analysis Public Hearing Preparation Presentation Budget Cycle - Best Practice • Duties should be clearly identified. • Policies should be established to guide deliberations. • Timely and accurate revenue forecasts. • Assess the long-term financial impact of proposals. 50 Budget Cycle: Forecasting • Forecasting – Estimation / Calculation and Best Guestimates of anticipated revenues and expenditures • • • • • • Bank Statements General Ledger Prior budget worksheets Accounting reports Price indexing from prior year numbers Publication data, economic data, vendor data Budget Cycle: Analysis • Ensuring all revenues and expenses are identified and organized • Develop budget instructions and targets • Departmental data is compiled and integrated into the budget building worksheets and forms • Departmental review for accuracy and consistency Budget Cycle: Preparation • Publish a calendar identifying deadlines for tasks and individual responsibilities • Ensure worksheets and documents cover all areas of the budget details and process • Confirm accuracy and data flow throughout the budget worksheets Budget Cycle: Presentation • Basic Guidelines: – Easy to understand with basic information. – Explain the budget in terms of priorities. – Be honest and do not exaggerate or mislead. – Be able to justify each item in the budget. – Be able to explain cuts and their ramifications. – Be able to provide proof of service effectiveness. – Know the facts of each department – Be prepared for scenarios on the budget Budget Cycle: Public Hearing • After the tax rate has been proposed, the public may express their opinions. – If a tax rate is proposed, notice must be given at least 7 days before the initial hearing, giving date, time and place of hearing. – The second hearing may not be held earlier than 3 days after the initial hearing • Texas Tax Code §26.06 outlines the specific requirements Budget Cycle: Adoption • The adoption is typically an agenda items after all the required and publicized public meetings. • The budget for the next fiscal year is adopted with an ordinance. • Time to collect the taxes… Estimating Revenues • Based on: – Revenues collected during the fiscal year – Budgeted for collection for the coming fiscal year – Projected for the coming fiscal year – Anticipated changes: • • • • Community retail and industry More or less jobs Demographic issues Housing changes Estimating Expenditures • Based on the known expenditures and other potential issues: – Tax base – Building, staff, benefits – New services and existing services – Grants and alternative income – Laws, contracts – Interest expenses Budgetary Sources • Property tax – No State property Tax – Appraisals based on market value as of Jan. 1 – Assessment used to for the purpose of levying the property taxes • Sales tax – Retail sales of merchandise • Currently Texas has a 6.25% tax. Municipalities can levy up to an additional 2% for a total of 8.25% • Franchise fees – Charged to telecom, cable, gas and electric utilities for the right to solicit customers in the community. – Based as a percentage of the revenue generated and is negotiated with the community • Occupancy tax – Hotels, motels, Inns, Lodges and is used to support tourism in Texas Budgetary Sources • Beer, mixed drink – Taxes on alcoholic beverages and drinks • Amusement tax – Bingo, coin operated (related to amusements) • User Fees – Users of services (bus fees, golf courses, rec. classes) • Special assessment – Owners of benefit from improvements (roads, curbs) • Capital recovery fees or Impact Fees – Sewers, water lines, roads, schools, parks • Licenses and permits – Food service, building permits, daycare permits Budget Types Budget Types • • • • • • • • Lump Sum – Distributed totals (grants) Formula – Calculations based on formulas Line-Item – Categorized by accounting tracks Program – Cost categories by program Performance – Tied to indicators / functions PPBS – Program + Performance Zero-Based – Substantiate into decision packages Responsibility Centered –Dept. centered Budget Types: Lump Sum • Each department receives a certain amount of funds and the department head decided on how to allocate those funds and develops the budget – Advantages: Flexibility to move funds where they are needed. – Disadvantages: Lack of accountability and vision. You want a budget that follows a plan, not a plan that follow a budget. Budget Types: Formula • Formula funds are allocated by numbers ( miles, population) and further allocated by additional formulas. – Advantages: Response to growth in numbers and can be modified easily with formula adjustments. – Disadvantages: Allocations can decrease easily. More difficult to add line items to an existing budget due to the total reallocation of formulas Budget Types: Line-Item • There is a line for each revenue and expenditure item with a percentage for allowable variations from budget. – Advantages: Easy to construct and typically based on prior year funding. – Disadvantages: Across the board cuts may not be realistic to actual expenditures ( i.e.. 10% cuts). Also, the do not show the costs of individual programs or services. Budget Types: Program • Ties all costs to specific programs. Difficult to set up, but easy to maintain. It is important to keep accurate records and statistics documenting usage. – Advantages: Closely tied to the mission, goals and objectives. Total costs are kept together so accounting is easier. – Disadvantages: Everything must be tied to a program, so proration of expenses may be difficult. Budget Types: Performance • Tie a program’s functions to various performance indicators. Provides for easy cost-accounting of municipal services traceable to per unit charges. – Advantages: Easy to track costs of services and their respective efficiencies. – Disadvantages: Emphasizes economy over service. Maintenance of statistics shouldn’t overshadow the reasons for tracking performance. Budget Types: PPBS • Planning, programming, budgeting system is a combination of program and performance based budgeting. Planning and cost benefit analysis plays an important role. – Advantages: Easiest budget format for cost analysis. Individual staff performance can be analyzed. – Disadvantages: Does not assess the quality of service. Only indicated cost of providing service. Budget Types: Zero Based • Based on what is needed for the future. Each program begins with zero and you must justify the related costs. Each program is packaged into decision packages which are ranked. – Advantages: Common goals and limited resources are pooled to accomplish the common goals. – Disadvantages: Very time consuming. The ranking of packages takes time. Budget Types: Responsibility Centered • All operating expenditures and revenue should be assigned to that center. Incentives should exist to reduce costs and promote priorities. Each department is expected to be self-supporting. The centers are: Cost Center, Revenue Center and Profit Center – Advantages: Each Dept. self supports – Disadvantages: Over collaboration of centers Budgets as a Financial Plan • Tax Rate = Millage levied by the taxing entity. The tax rates are combined for the home owner’s tax bill. • Assessed value (x) Multiplier (-) Exemptions (x) Tax rate = Total tax bill Millage • Mill = 1/10of a penny, or $1 for every $1,000 in taxable value. • Each taxing entity (city, school district, county) levies a specific millage against the property taxes. – A 1 mill tax increase is a $100 additional property tax on a $100,000 house. Calculating Effective Tax Rate Prior year’s taxes ( - ) less taxes on property lost this year ----------------------------------------------------------- (DIVIDED BY ) Current AV of property taxed last year x 100 = Effective Tax Rate 73 Rollback Rate • Calculated upon the maintenance and operations portion of the proposed budget. – An 8% increase is allowed by law. – If the entity adopts an amount that exceeds the rollback rate, voters may petition for an election to limit the rate to 8%. Property Tax Calculation • M&O and I&S rates set by council / commissioners • Combined on tax bill • (Assessed Value – Exemptions) x PTR =Tax Liability • For City / County budget: – Total Taxes Receivable – Delinquents = Current Tax Yield 75 Citizen Engagement • People are interested and pay attention. • Judgments tend to be formed by their personal experiences. • Individual interaction with an agency defines the opinion of that agency / dept. • People are clear in what they want / don’t want from an agency. 76 Fostering Citizen Engagement • • • • • • • • • • • • Public hearings Citizen surveys Advisory boards Focus groups Web based budget exercises Open House On line suggestion box Posting information on-line Changing public perceptions of government Sustainability of citizen partnerships Inclusion in the processes of government Citizen feelings of representation, inclusiveness and equity in the process 77 Budget Components Budget Components • • • • Funds Budget Structure Revenue Expenditures Budget Components - Funds Municipal Accounts are called funds. • General Funds – – Operating funds • Special Revenue Funds – – Ear-marked for a special purpose or project • Hotel/motel taxes – Tourism or grant funds • Special assessment funds – Streets, sidewalks, etc. Budget Components - Funds • Capital Project Funds – – Construction, building, acquisition, development – Typically funded through referenda – Carry over from year to year – Not comingled with General Funds – Usually incorporated into a Capital Improvement Program (CIP). • Debt Service Funds – Used to pay off Principle & Interest on debt issues Budget Components - Funds • Enterprise Funds – – Primarily funded by user fees • Golf Courses, airports, utility depts., marinas – Raise their own revenue • Internal Service Funds – – Internal charges between departments ( janitorial services, computer & vehicle maintenance). – Prorated and levied to other department budgets • Fiduciary Funds – – Collected as an agent for another fund • Court fees sent to State, employee pension funds ). Budget Components – Budget Structure • Depends on the size of the entity – (Small) • Public Works may incorporate Utilities, Streets, Sewer and Heavy Equipment • Public Safety might include Emergency Mgmt., Police, Fire, Animal Control – (Large) • Each area might have its own director and separate budget managers Budget Components - Revenue • Listed in the budget by source: – Property taxes – Sales Taxes – Franchise Fees – Fines & Fees – Licenses and permits – Interest – Contracts – User fees Budget Components - Expenditures • Typically grouped by type: – Personnel services – Operating expenses – Contractual expenses – Capital outlays – Debt service City of Chuck Wagon Budge Summary 2010 – 2011 Beg. Bal. (BB) REVENUES Taxes - Property - Sales - Other Franchise Fees Service Charges Licenses & Permits General Fund Water Fund Wastewater Total $ $ $ $ City of Chuck Wagon Budge Summary 2010 – 2011 REVENUES Fines & Forfeitures Agency Contracts Int. income Water Fees Wastewater Fees Waste Tap Fees Other Revenue Total Rev. (TR) TR + BB General Fund Water Fund Wastewater Total $ $ $ $ City of Chuck Wagon Budge Summary 2010 – 2011 General Fund EXPENDITURES $ Salary Supplies Contract Svcs. Cap. Outlays Debt Svc. Benefits Other Revenue Total EXP. (EXP) Contingency Ending Balance Water Fund Wastewater Total $ $ $ Budget Calendar Budget Calendar FY Beginning 10/1 Date Activity 03/01 Review Budget Process and Set Calendar Distribute budget forms and worksheets to depts. 04/01 Dept. budget requests submitted to CM/BO/FD for review Preliminary review of estimates submitted to CM/BO 04/15 Meet with DHs individually to review budget requests Tabulate and analyze budget requests & revenue estimates and prepare budget for the first draft Resp. Party CM / BO CM / BO DHs Fin Dir. CM / BO CM / BO 05/15 City Council Planning Meeting CM / BO 06/15 Proposed budget is presented to City Council in draft format CM / BO 06/20 Budget workshop with Council in public session CM Aug Sep MC Give 72-hour notice for governing body meeting Budget Calendar FY Beginning 10/1 Date Activity Resp. Party Aug Sep Govt. body meeting to discuss proposed tax rate & make arrangements for a public hearing and take a record vote Council Tax Increase – publish a “Notice of Public Hearing on Tax Increase” 7 days prior to the public hearing listing both dates for the 2 required public hearings. Tax Code 26.06 gives specific details on newspaper requirements MC Post 72-hour notice for the public hearing on tax increase MC Hold public hearing on the tax increase Council Post 72-hour notice for the 2nd public hearing MC Hold public hearing Publish a “Notice to Vote on Tax Rate” between notice and vote dates MC Budget Calendar FY Beginning 10/1 Date Activity Resp. Party Aug Sep Post 72-hour notice for public meeting to vote on tax rate MC Hold public meeting to vote on tax rate Council Final draft of budget presented to Council and copy placed with MC and the public library CM Public hearing on budget Council First reading of budget Council Second reading of budget Council Publish summary of budget and announcement where it can be reviewed MC Budget filed with Municipal Clerk and County Clerk CM / BO 9/30 Preparation for Next Year • Keep a folder detailing notices of rate increases from vendors, postage and other recurring charges that might be increasing during the year and that will impact the budget. • Map out the process for the current year and note areas that took additional efforts and time constraints to better prepare for next year. Budget Forms • Information pockets that will be distributed to department heads will contain all the forms to be used in the budget process. Typically prepared by the finance manager. • Typically will include a statement by the City Manager or Chief Executive setting the tone for the coming fiscal year in addition to providing the time-table for completion of the process. Budget: Legal Document Texas Local Gov. Code, Chapter 102 requires: • Budget shows a complete financial statement of the municipality. • Proposed budget be filed with the municipal clerk before the 30th day the date that the tax levy ordinance is passed. • Proposed budget be available for inspection by any taxpayer. Budget: Legal Document Texas Local Gov. Code, Chapter 102 requires: • Public hearing be held after the 15th day following the date the budget was filed with the municipal clerk, but before the date that the tax levy ordinance is passed. • Public notice be given in at least one newspaper of general circulation in the county and on the municipality’s webpage. (26.06) Budget: Legal Document Texas Local Gov. Code, Chapter 102 requires: • Action be taken on the budget at the end of the public hearing. • The final budget be filed with the municipal clerk and the county clerk. (102.008-009(d)) • Taxes be levied and municipal funds spent in strict compliance with the budget, except in emergencies with an amendment to the budget. • Amendments be made at public meetings. Budget Monitoring • Adjustments to revenues and expenditures should be expected. • Department heads and budget officers must ensure the budget is on track and that revenues and expenditures are reported correctly. • Monthly reports to council and the public confirm that the budget is performing as anticipated. Bill Payment • Texas has a prompt payment law which established when payments are due. • (Chapter 2251, Government Code) – “Payment for goods and services are due 30 days after the goods are provided, the service completed, or a correct invoice is received, whichever is later”. Encumbrances • Funds that are committed, but not yet spent. – Example: Salary for the year – Actual costs are tracked verses the encumbrances. • Encumbrances are common to ensure: – No large balances are shown in the planning process initially. – Bills are paid by the end of the fiscal year. Basic Concepts - Funds • Capital Project Funds – – Construction, building, acquisition, development – Funded by debt and current revenues – Carry over from year to year – Not comingled with General Funds – Capital Improvement Program (CIP) provides multi-year timeframe • Debt Service Funds – Used to pay off Principle & Interest on debt issues 101 Basic Concepts - Funds • Enterprise Funds – – Primarily funded by user fees • Golf Courses, airports, utility depts., marinas – Raise their own revenue • Internal Service Funds – – Internal charges between departments ( janitorial services, computer & vehicle maintenance). – Prorated and levied to other department budgets • Fiduciary Funds – – Collected as an agent for another fund • Court fees sent to State, employee pension funds ). 102 Accounting • Typically 2 types: – (Accrual) - records income when it is earned rather than when received and expenses the item when ordered rather than when payment is made. – (Cash) is like checkbook accounting by recording income when it is received and expenses when they are paid. • Municipalities use the modified accrual method. It records supplies and consumables as used during the fiscal year when they are purchased. Accounting Principles • Modified Accrual Basis (Governmental) – Revenues – measurable & available – Expenditures – goods and services received – Change in fund balance – Balance sheet – Statement of Revenues, Expenditures and Changes in Fund Balance 104 Accounting Principles • Accrual Basis (Enterprise Funds) – – – – – – – – Revenues – Earned & measurable Expenses – Goods and services used Depreciation Restricted Assets Payables from restricted assets Changes in net assets Statement of Net Assets Statement of Revenue, Expenses and Changes in Net Assets 105 Fund Accounting • Examples of funds that can not be comingled requiring separate accounting are: – Photocopy revenues – Fine money – State or Federal funds – Endowment or grant funds – Capital funds – General funds Financial Reporting A = L + FB – R + E A: assets L: liabilities FB: fund balance (or net assets) R: revenue E: Expenditures (or expenses) 107 Accounting Automation • Do we need it? – What currently works and what doesn’t? – Will we monitor/track all accounts? – Do we have issues with the current system? – How could we improve the current situation? – Will the costs offset the benefits? – Will it provide additional features we currently do not have? Accounting Automation • Can we implement it? – Are current staff computer savvy enough? – Do we have sufficient hardware to support it? – Do we want it on the network of locally? – Does it provide strong security and backup functions? – What is the cost, is it modular and is there an annual maintenance agreement cost? Accounting Automation • Can we implement it? – Does it provide all the reporting formats we need and can it be customized by us for ad-hoc reporting? – Will our IT department support it or will we need to get support from the vendor? – Can we integrate our current systems and will it support our current account structure? – How is data entered / processed / maintained? Automation Evaluation • • • • • Can we get a demo? Who else used it? How much support? What are the comparable programs? Is it proprietary or can we use the data in other formats? • How does it compare cost wise with other products? Outsourcing • Outsourcing (contracting to external companies) or Privatization (shifting to a private sector) should only be implemented if there is a savings or improved service over internal operations. • Cost benefit analysis studies should be instituted to ensure that taxpayers are getting the best services / benefits for the expense. Outsourcing Pros and Cons • Pros – Save time and money. – Specialized vendors can typically perform the services at a more efficient level. – Salaries and benefits may outweigh vendor contracts in total expense. • Cons – – – – Quality control is more difficult to maintain. Vendors may cut corners and not understand the needs Jobs may be lost and vendors may go out of business. Lowest bid may result in lowest service level. Successful Outsourcing • • • • • • • • • Do your homework Involve key parties Initiate Request for Proposals (RFPs) Ensure a competitive environment Ensure quality work Employ a skilled attorney Keep good records Make progress reports Review your homework again Outsourcing Questions • • • • • • • • • • • Why outsource? What are the costs? What is the current workflow? Who will oversee the process? What is the staff impact? What is essential to the municipality? Which vendors to use? What services to outsource? What are the institutional obligations? Can current staff be absorbed? What can be outsourced? – Custodial, Security, vending, landscape, pet control, repairs, DR, waste management, etc. Protecting Property • Dealing with misappropriated property can be handled by: – Municipal staff – Referral top a collection agency – Referral to a court system – Offsetting debts against payments – Extended use fees – Amnesty days – Skip chases (locating people…) Theft of Public Property • • • • Be willing to prosecute if necessary Document everything Know the law Security measures: – Access management systems – CCTV – RFID – Computer Security Risk Management & Insurance • Municipalities may be self insured or covered by a policy. • Know what is covered • Know what is not covered • Know how to report a claim • Know the deductible • Is the property inventory listing current? • Should employees be bonded? Disaster Management and the Budget Policy Disaster Management and the Budget Policy • • • • Mitigation Preparedness Response Recovery Disaster Management and the Budget Policy • Mitigation – Is the insurance coverage sufficient for a large scale losses of city or county property? – What impact would a disaster or emergency have on the property tax base? Sales tax base? Water & wastewater charges? Other revenue sources? – What level of budget reserves is appropriate given the community’s vulnerability to particular types of disasters or emergencies? – What protection should be available to cover debt service costs in the event of a disaster? Disaster Management and the Budget Policy • Preparedness – For coordination purposes, what role should state government have in ensuring the continuity of operations in disaster prone local governments? – What is the cost and what procedures should be followed to restore revenue administration (collections & enforcement) in the event of a disaster? – Do mutual aid agreements include assistance with revenue-related needs in the event of a disaster? Disaster Management and the Budget Policy • Response – What surcharges to taxes or service charges would be available to cover short-term revenue needs in the event of a major disaster? – Under what conditions can the local government incur short-term debt to cover the operating costs associated with an emergency or disaster? – What loans or grants are available from the state or federal government to ensure continuity in operations for the local government? Disaster Management and the Budget Policy • Recovery – What tax relief options should be considered for households and businesses in the event of a disaster? – What alternatives should be available for taxpayers unable to pay their tax liability? For those unable to pay for locally provided utility services? How should penalties and interest on late payments be treated for victims of a disaster? Disaster Recovery & Emer. Mgmt. • • • • Have a plan Run drills with first responders Establish phone trees and communications Establish a business impact analysis (BIA) on the various departments and establish priorities for continuation of business and ways to minimize service disruptions. – BUSINESS IMPACT ANALYSIS example Budget Crisis Strategies High severity of budget crisis EXPENDITURE RESPONSES Impose Layoffs Reduce Salaries Close Facilities Freeze Hiring Improve Prod. Reduce OT Reduce Hrs. Delay Maintenance Delay Cap. Imp. Seek Approval for Inter-fund Loans Raise Fees Tap Budget Reserves Raise Excise Taxes SHORT TERM Downgrade Bond Rating Increase Rates on Major Taxes Seek State Bailout Declare Bankruptcy Duration REVENUE RESPONSES LONG TERM Low severity of budget crisis Effective Tools • Life cycle of a budget crisis: 127 Effective Tools – Strategies for Restoring a Balanced Budget 128 Public Property Inventory • • • • • • • • Make a plan and time schedule Decide on a partial or full inventory Full scale or selected equipment Automated or manual Keep the information updated and current Dealing with broken or replaced items Analyze the exception reports closely Make a policy… Sale & Disposal of Property • • • • • • Is the property no longer needed? Can it be used by another department? Can it be used by another entity? Could a non-profit entity use it? Can it be sold and the proceeds reapplied? What are the steps for removing it from inventory? • Make a policy… Fine & Fee Collections • Fines and fees are imposed to recover the costs for providing a service. • Multiple examples in your book. • Considered part of the municipalities revenue. • Usually turned into the general operating fund. • Establish strong cash management practices. • Make a policy… Budget Innovations • A century of budget innovations – Line-item budgeting (input) – Zero-base budgeting (inputs – outputs) – Minimum service package – Current service package – Enhancement package – Ranking decision package – Target-base budget (inputs) 132 Budget Innovations - Program Budgeting • Prioritizing by goals and objectives • Weighing the costs and benefits of alternatives • Organizing the entity into programs 133 Budget Innovations – Performance Budgeting • Improving management through monitoring inputs, outputs, and outcomes • The causal linkage conundrum 134 Best Practices - Improving Government Productivity 100% 100% ` Private sector produces and/or finances 0% Privatization Outsourcing Public-private nonprofit partnerships Intergovernmental partnerships Performance measurement and management Public sector produces and/or finances 0% 135 Internal Controls Budgets and Planning Internal Controls - Checklist • Segregation of Duties – Responsibilities segregated for budget preparation, execution and reporting? – Duties and functions of the Budget Control Officer segregated from cashiers, purchasing agents and voucher clerks? – Are actual revenues, encumbrances, and expenditures periodically compared with the accounting records? – Are comparative reports of estimates and actuals submitted to management at least monthly? – Is an encumbrance system actually used effectively? – Is a percent of achievement included in monthly reports? Internal Controls - Checklist • Segregation of Duties – Perpetual balances of estimated resources to be received and unencumbered maintained for line items in the budget? – Are operating results of budgets used as a management tool? – Do internal controls ensure that budget data agrees with the approved budget and correspond to annual financial statements? – Are internal audits reasonably independent of the individuals or departments subject to the audit? – Is the scope of the internal audit work reasonably comprehensive? Internal Controls - Checklist • Segregation of Duties – Does the internal audit work follow a written program? – Are written reports issued by internal audit on all work undertaken and management required to respond to findings? – Are organizational charts established and maintained? – Does the organizational chart set forth the lines of responsibility? – Are the duties of positions and/or employees defined as to responsibility? Internal Controls - Checklist • Segregation of Duties – Are all persons having positions of trust adequately bonded? – Do all personnel in positions of trust take annual vacations? – Is the work of persons in positions of trust performed by others during their absence? – Are all journal entries approved by a responsible employee? – Is a periodic review of insurance coverage made by a responsible employee? – Are key employees customarily free from overtime work except for emergencies? Internal Controls - Checklist • Segregation of Duties – Are key employees free from any detrimental influences by reason of relations with others in position to control over their activities? – Are custodians of cash denied access to records or documents used to determine the amount of cash they should have on hand? Internal Controls - Checklist • Preparation Controls – Does the law require budgets and budgetary procedures? – Does a budget policy exist that outlines the process and procedures used in establishing the budget? – Is there an awareness of budget practices, procedures and policy within the organization? – Are budgets prepared for all significant activities regardless of whether or not mandated by law? – Is a budget calendar used for the orderly submission and approval of the budget? Internal Controls - Checklist • Preparation Controls – Have initial budget submissions been developed and prepared by major departments and activity centers? – Has a finance or budget officer reviewed departmental budgets and have the departments of oversight met the legislative body’s goals and objectives? – Is the type of budget performed compatible with the accounting system? – Is the budget prepared in sufficient detail providing a meaningful tool with which to monitor subsequent performance? Internal Controls - Checklist • Preparation Controls – Is both the original and final amended budget available? – Are interfund and interdepartmental transfers included in the budget? – Are advances included in the budget? Internal Controls - Checklist • Adoption Controls – Is citizen input obtained through budget hearings? – Are all the legal requirements met to levy taxes in accordance with state statute or other requirements? – Has the budget been submitted to the legislative body for approval, and is there clear communication to departments or agencies on the effects of legislatively mandated budget modifications, either increase or decrease? Internal Controls - Checklist • Adoption Controls – Coincident with the adoption of the budget, has there been appropriate legislative action to: • Adopt legislation to implement the raising of budgeted revenues? • Initiate expenditure appropriations? • Document approval action in formal minutes? – Are estimated resources and appropriations recorded in the accounting records for later comparison to actual amounts realized or incurred? Internal Controls - Checklist • Adoption Controls – Are budget estimates supported by detailed worksheets that show how the estimates were calculated and how the assumptions were made? – Are budgets that have been approved by grantors in connection with grant activity recorded in the accounting system? – Are accounting manuals made available for general use? – Are budgets published if required by law? Internal Controls - Checklist • Execution Controls – Have procedures been adopted and communicated establishing authority and responsibility for transfers between budget categories? – Is the flow of expenditures or commitments controlled through the use of an appropriation system? – Does the accounting department submit approval as to availability of funds before the issuance of purchase order or expenditure commitment? Internal Controls - Checklist • Execution Controls – Are requests for supplemental appropriations of budget changes processed and approved in the same manner as the original budget is processed and approved (or as required by law)? – If liabilities and expenditures are recorded on an encumbrance or obligation basis, are there controls to ensure knowledge of outstanding commitments? Internal Controls - Checklist • Reporting Controls – Are actual expenditures compared to budget with reasonable (monthly) frequency and on a timely basis? – Are reports discussed with departmental personnel and are there explanations for significant variations from the budget? – Are executives and legislative branches notified of expenditures in excess of the appropriations or budget? Internal Controls - Checklist • Reporting Controls – Are actual results of operations against the budget published if required by law? – Are the same accounting principles used in the budget preparation the same as those used to prepare the financial statements? – Are budget resources and performance dates appropriately summarized in an annual report to the authoritative body? Recommended Practices of the National Advisory Council on State & Local Budgeting NACSLB Practices Principle 1 – Establish Broad Goals to Guide Government Decision Making Element 1 - Assess Community Needs, Prioritize, Challenges and Opportunities 1. 2. Identify stakeholder concern, needs and priorities Evaluate community condition, external factors, opportunities and challenges Element 2 – Identify Opportunities and Challenges for Government Services 1. 2. 3. Assess services and programs, and identify issues, opportunities, and challenges Assess capital assets, and identify issues, opportunities and challenges Assess governmental management systems, and identify issues, opportunities and challenges NACSLB Practices Principle 1 – Establish Broad Goals to Guide Government Decision Making Element 3 – Develop and Disseminate Broad Goals 1. 2. Identify broad goals Disseminate goals and review with stakeholders Principle 2 – Develop Approaches to Achieve Goals Element 4 - Adopt Financial Policies: 1. 2. 3. 4. 5. 6. 7. Stabilization funds Fees and changes Debt Issuance and management (Debt level and capacity) One-time revenue (Unpredictable revenue) Balancing the operating budget Revenue diversification Contingency planning NACSLB Practices Principle 2 – Develop Approaches to Achieve Goals Element 5 – Develop Programmatic, Operating and Capital Policies and Plans 1. Prepare policies and plans to guide the design of programs and services 2. Prepare policies and plans for capital asset acquisition, maintenance, replacement, and retirement NACSLB Practices Principle 2 – Develop Approaches to Achieve Goals Element 6 – Develop Programs and Services that are Consistent with Policies and Plans 1. Develop programs and evaluate delivery mechanisms 2. Develop options for meeting capital needs and evaluate acquisition alternatives 3. Identify functions, programs, and/or activities of organizational units 4. Develop performance measures 5. Develop performance benchmarks NACSLB Practices Principle 2 – Develop Approaches to Achieve Goals Element 7 – Develop Management Strategies 1. Develop strategies to facilitate attainment of program and financial goals 2. Develop mechanisms for budgetary compliance 3. Develop the type, presentation, and time period of the budget NACSLB Practices Principle 3 – Develop a Budget Consistent with Approaches to Achieve Goals Element 8 – Develop a process for Preparing and Adopting a Budget 1. Develop a budget calendar 2. Develop budget guidelines and instructions 3. Develop mechanisms for coordinating budget preparation and review 4. Develop procedures to facilitate budget review, discussion, modification and adoption 5. Identify opportunities for stakeholder input NACSLB Practices Principle 3 – Develop a Budget Consistent with Approaches to Achieve Goals Element 9 – Develop and Evaluate Financial Options 1. 2. Conduct long range financial planning Prepare revenue projections 1. 2. 3. 4. 3. 4. 5. 6. Analyze major revenues Evaluate the effect of changes to revenue source rates and bases Analyze tax and fee exemptions Achieve consensus on a revenue forecast Document revenue sources in a revenue manual Prepare expenditure projections Evaluate revenue and expenditure options Develop a capital improvement plan NACSLB Practices Principle 3 – Develop a Budget Consistent with Approaches to Achieve Goals Element 10 – Make Choices Necessary to Adopt a Budget 1. 2. 3. 4. 5. 6. 7. 8. Prepare and present a recommended budget Identify Key Issues Provide a financial overview Provide a guide to operations Explain the budgetary basis of accounting Prepare a budgetary summary Present the budget in a clear, easy to use format Adopt the budget NACSLB Practices Principle 4 – Evaluate Performance and Make Adjustments Element 11 – Monitor, Measure, and Evaluate (MME) Performance 1. Program performance 1. 2. 3. 4. 5. Stakeholder satisfaction Budgetary performance Financial condition External factors Capital program implementation NACSLB Practices Principle 4 – Evaluate Performance and Make Adjustments Element 12 – Make Adjustments as Needed 1. Adjust the budget 2. Adjust policies , plans, programs and management strategies 3. Adjust broad goals, if applicable Budgeting A Budgeting Guide for Local Governments Robert L. Bland Context of LG Budgeting • The budget process tends to produce far more information than is used in decision making, resulting in considerable frustration among the department heads and staff members responsible for completing the paperwork if they perceive their input is going unused. • It is the rudder that steers the public organization. Budget Cycle in Brief • Preparation creates the Executive budget. • Legislative approves of the appropriation. • Executive implementation to approve disbursements of funds. • Accounting & financial reporting via a Comprehensive Annual Financial Report (CAFR) that is reviewed by an independent auditor. Budget Cycle in Brief • Preparation – Engage department heads over activities, links to the strategic plans and the measures used to assess progress towards the budget goals. – A budget calendar and budget manual assist in the information gathering process. – Regular updates of revenue forecasts are critical. – The final step in preparation is the high level meetings defending the proposals. Budget Cycle in Brief • Legislative – The council reviews and modifies the proposed spending plan, invites public comment, assesses how the proposals will meet the community needs and finally approves the plan as an appropriation. – Most deliberations are typically centered around the tax-supported as opposed to fee-supported activities. Budget Cycle in Brief • Executive Implementation – Communicate budget information to stakeholders. – It’s a two-sided coin: • On one side are procedures designed to maintain budget compliance; on the other are procedures and policies designed to alter the budget as circumstances warrant. – Technology platform greatly assist in forecasting, collaboration among users and formulating budget scenarios and performance measurement. Budget Cycle in Brief • Accounting & Financial Reporting – Provide financial control. – The 13 GAAP principles provide the accounting guidelines for local government accounting. – Interim and CAFR reports provide a full reconciliation of all transactions and their effects. – Interim report are also an early warning system while CAFRs provide a final reckoning to council. Budget = 2 Documents • Operating Budget – Reports the spending plan for a government’s ongoing services such as police, fire, parks, recreation, water and sewer service. Typically organized info. by department and provides line item detail. – Money comes from current revenues such as property, sales and income taxes, service charges, fees and fines; and grants. Budget = 2 Documents • Capital Budget – Represents a spending plan for the acquisition of fixed assets, such as highway and building construction, water & sewer lines and park development. – Usually part of a capital Improvement Plan (CIP) that projects major construction and acquisition needs for a 5 to 8 year period. – Funding usually comes from the sale of bonds and other long-term obligations. Budget Comparisons Public Sector • Operates as monopolies and therefore tend to be less efficient. • Subject to nature and level of service including mandates. • No profit incentive. • Political ramifications. • Open to outside influence. Private Sector • Targets sales volume and profits. • Strive for continued efficiencies and cost reductions. • A single bottom line versus multiple funds of public goods. • Competition forces continued improvements and effective pricing. Goods Public Goods • Meant to serve the greater level of service. • Include: – – – – Police & Fire protection Mosquito eradication A river dam Water & Sewer services – Can you contract for these services??? Private Goods • Divisible and excludable to the unit level. • Can be traded in the market place. • Include: – – – – Goods Services Items Efficient private operations and services ( i.e. lawn care, trash) Environments of Public Budgeting • Political – Feedback from citizens – Citizen involvement • Economic – Recessions & Expansions – Inflation & Interest rate changes – Competition for business investment & residents • Social – Population change – Age distribution – Personal income • Legal – Requirements for budgetary balance – Mandates The View of Local Governments • People are interested and pay attention. • Judgments tend to be formed by their personal opinions. • Individual interaction with an agency defines the opinion of that agency / dept. • People are clear in what they want / don’t want from an agency. • People acknowledge success and failures in government improvements. • Most feel that better areas get better services. • People want and like information from their government. • People will complain more about services than taxes. • People tend to feel powerless to improving services. Lessons in Budgeting • The fewer resources available to a community, the less room the community has for error in discovering budget issues. • The quality of the data coming into the process is critical to the success of the budget. • Budget comparisons between entities is tough. It’s best to use historical data. • Performance measurement is difficult but worth it in the long run. Build benchmarks. Sources of Conflict 177 Sources of Conflict • Advocates request funding for a program or service from which they benefit, but conservers, taking into consideration revenue constraints, are not able to fill all requests. • Budget officers need information, but department heads are reluctant to share information for fear that they may lose some budgetary control. • The administrator’s concern for budget realities may clash with the politician’s concern for image and expediency. • The goal of democracy – equality and accountability – may conflict with those of bureaucracy – centralization of power and control. Budgets have become an important tool for creating accountability within bureaucracy. Sources of Conflict • Legislators must address special interest or risk losing supporters and votes, but they must also address collective interests to avoid revolts that result when citizens become sufficiently irritated. • The well-being of a community is not always served by what the public desires. The job of a manager is to educate the public while at the same time understanding current public opinion. • All of these conflicts can be managed by effective budget policies that can be written or unwritten, but a formal statement of the budget policies provides a standard of budgetary performance that all have to agree on. • This statement includes policies for operating budget, revenue, budget implementation and debt. 13 GAAP - Principles The thirteen (13) generally accepted accounting principles for governmental units are outlined below: 1. Accounting and Reporting Capabilities 2. Fund Accounting Systems 3. Type of Funds 4. Number of Funds 5. Reporting Fixed Assets 6. Valuation of Fixed Assets 7. Depreciation of Fixed Assets 8. Reporting Long-Term Liabilities 9. Measurement Focus and Basis of Accounting in the Basic Financial Statements 10. Budgeting, Budgetary Control, and Budgetary Reporting 11. Transfer, Revenue, Expenditure, and Expense Account Classification 12. Common Terminology and Classification 13. Interim and Annual Financial Reports Budgeting for Improved Performance • Performance measures 1. Inputs (personnel and money) 2. Outputs 3. Outcomes – Combinations of such as efficiency and cost-effectiveness. • Challenges – – – – Measuring what matters to the citizens. Impact of changes in inputs on outputs and outcomes. Capacity to collect adequate cost data. Fail to reflect the complex interrelatedness of community issues and interaction among departments. Budget Innovations - Entrepreneurial • Responsibility Centered – Operating expenditures and revenue assigned to a revenue center. – Each center expected to be self-supporting. – Central services supported by a “tax” on revenue centers. • Advantages: Makes units much more aware of revenue requirements; encourages cost reduction • Disadvantages: creates winner and losers in organization. 182 Budget Innovations - Entrepreneurial • Budgeting for Outcomes – Articulate community wide goals – Request for results prepared – Bidders both inside and outside government submit proposals • Advantages: introduces competition into service production • Disadvantages: ignores the public nature of public goods (non divisible and non excludable) 183 Expectation-Based Budgeting O>E or O<E Expected performance (E) Optimum performance (O) A>E or A<E A>O or A<O Actual performance (A) E>O>A Performance drag A>O>E Performance legacy E>A>O Performance dividend O>A>E Performance deficit 184 Budgeting for Capital Improvements • Capital improvement plan identifies projects over the next few years • First year of the CIP becomes the capital budget • Municipal bonds typically provide financing for capital improvements • Projects costs typically include engineers, financial advisors, and a strong budget officer • Recommended CIP committee assist in the development and review of the CIP budget and plans. 185 Budgeting for Capital Improvements • Cornerstone is the (CIP) capital improvement plan which identifies the local government wishes/projects over the next few years. • The first year of the CIP becomes the capital budget and each year the CIP is updated. • Municipal bonds typically provide local governments the flexible means to finance capital improvements. • These projects typically include engineers, financial advisors, and a strong budget officer. • It is recommended that a CIP committee assist in the development and review of the CIP budget and plans. Let’s Close it up… What is Good Budgeting? • Qualified and committed budget director and analyst. • Providing technology to support budget preparation and implementation. • A commitment to understand our entity’s unique relationship by monitoring inputs, outputs and outcomes. 188 What is Good Budgeting? • A culture of accuracy in budget estimates – quality of data used in budget deliberations directly affect the quality of decisions. • Have in place budget policies to guide deliberations and manage conflict. • Prepare a long-tem financial plan to assess the impact of current spending and revenue trends into the future. 189 What is Good Budgeting? • Good financial policies and practices are the most effective economic development tool for a city of county. – No amount of tax incentives can compensate for poor budget and financial management. 190