SAMLETopgave

advertisement

[1]

Forfatter: Simon Toft Nielsen

Studienummer: SN70199

Vejleder: Stefan Hirth

A game-theoretic analysis of price bubbles in financial markets

Handelshøjskolen i Århus

2009

[2]

Abstract

Price bubbles have had profound influence on economies in the latest centuries. Studying the

phenomenon has been greatly restricted by the assumption that the efficient market hypothesis

holds. This has incurred a basic lack of understanding investors behavior in price bubbles.

Accepting that the efficient market hypothesis does not hold implies, however, that irrational

investors are directing the market. This raises the issue of how rational investors behavior can be

modeled in an irrational environment.

Game theory is found to be a very efficient tool for handling this issue. First of all, irrational

investors can be modeled quite well. Second, it allows investors to make strategic choices,

depending on their expectations of other investors. The strategic aspect of investing has formerly

been ignored by assuming that rational investors only based decisions on the fundamental value

of stocks.

Furthermore, game theory is in general designed with the purpose of determining players

behavior. Logically, it gives a great framework to analyze investors behavior in price bubbles.

To determine optimal behavior in price bubbles, Abreu & Brunnermeier have presented a

comprehensive model, based on game theory.

This model represents an environment, encompassing both rational and irrational investors.

Additionally, heterogeneity among rational investors leads to a situation, where they become

sequentially aware of the price bubble.

The role of irrational investors is to participate in creating the price bubble, while simultaneously

preventing rational investors from identifying other investors strategies. However, there is a limit

of the amount of selling pressure, irrational investors are able to absorb. When a sufficient

amount of selling pressure is generated, the prices will drop and the bubble burst.

Because of dispersions of opinion, and the absorption capacity of irrational investors, it becomes

rationally optimal to ride the bubble. Until the risk of the bubble bursting exceeds the costs

compared to the benefits of attacking it, investors will stay in the market.

The model additionally presents a broad range of assumptions about the reality.

Violation of these assumptions, logically has major impact on the optimal equilibrium. Discussing

them reveals that they generally are well supported.

Handelshøjskolen i Århus

2009

[3]

Furthermore, presenting a few investigations of actual behavior of rational investors in the

dot.com bubble also supports the results of the model.

Handelshøjskolen i Århus

2009

[4]

Content

1) Introduction

5.

1.1) Method

6.

1.2) Limitations

7.

2) Definition of a price bubble

8.

3) Principles of game theory

10.

4) Game theory in price bubbles

15.

5) Rules of the game

18.

6) The Abreu/Brunnermeier model

19.

6.1) Game theoretical background

25.

6.2) Preliminary analysis

26.

6.3) Identifying the optimal behavior of investors

31.

6.3.1) Exogenous crashes

32.

6.3.2) Endogenous crashes

35.

6.4) Optimal behavior

38.

7) Assumptions

40.

8) Supporting results of the model

49.

8.1) “Hedge funds and the technology bubble”

50.

8.2) “Who drove and burst the tech bubble”

50.

9) Conclusion

51.

10) References

53.

Handelshøjskolen i Århus

2009

[5]

1. Introduction

Analysing modern financial market behavior by game theory is still considered unconventional

compared to traditional asset pricing theories.

However, game theory points out important aspects of investor behavior which contradicts the

fundamental assumptions of traditional theories. Traditional theories are typically founded on the

efficient market hypothesis which constitutes that asset prices are based on every known

information, and that all investors is able to access and benefit from this information1. This implies

that the development of asset prices is unpredictable, since information and news in the future by

nature are unpredictable. As a consequence of unpredictability, the efficient market hypothesis

implies that no investor can consistently outperform the market.

This leads to the idea of the random walk of Wall Street2 where any portfolio of stocks in the long

run will be as good as any other portfolios.

It also leads to the “no-trade theorem”3, where investors cannot benefit from private information.

This means that using private information will have the effect of a signal to other investors. This

will therefore become known information.

Furthermore, if the efficient market hypothesis holds, it implies that a price bubble cannot

develop in the market. The argumentation is, that investors through interpretation of news,

immediately will become aware of the over-valued stocks, and sell them to collect the instant

profit, before other rational investors become aware.

Several papers have proven the weaknesses of the efficient market hypothesis4, and how the

development of asset prices cannot completely be explained by news and information. This shows,

that the asset prices are influenced by other factors, such as historical development, psychology of

investors and other behavioral factors.

1

The Efficient Market Hypothesis: A Survey, 2001

A Random Walk Down Wall Street, Burton Malkiel, 1973

3

Information, trade, and Common Knowledge, Paul Milgrom and Nancy Stokey, 1982

4

On the Possibility of Speculation under Rational Expectations, Jean Tirole, 1982

The limits of price information in market processes, Avraham Beja, 1977

2

Handelshøjskolen i Århus

2009

[6]

The most important contribution of game theory to the analysis of financial markets is, that it can

be extended to cover a market situation which includes both rational and behavioral traders. In a

price bubble situation, which is the focus of this paper, game theory additionally lays a unique

framework to analyze the optimal behavior of rational investors that hold private information.

This paper describes how game theory can be applied to a price bubble situation. Including a

thorough discussion of the assumptions made especially in relation to the roles of rationality and

information.

Following questions will be answered with a game-theoretic approach:

What is a price bubble

How does a price bubble origin and evolve

What is the optimal behavior of investors in a price bubble

The problems above will be explained using a comprehensive model presented by Abreu and

Brunnermeier in their article “bubbles and Crashes”. Finally, the paper aims to show which

behavior rational investors had during the dot.com bubble, compared to the behavior which the

game theoretic model constitutes as optimal.

1.1 Method

As mentioned, the paper is founded on the model presented by Abreu and Brunnermeier. The

assumptions made, however, will be discussed thoroughly and will draw insights from a broad

range of relevant literature.

The presentation of the model is following the same structure which Abreu & Brunnermeier had

used in their paper Bubbles and Crashes (2003). First presenting their model, then develop some

useful propositions in a preliminary analysis, before finally identifying equilibrium. However, trying

Handelshøjskolen i Århus

2009

[7]

to grasp the ideas of the model, did not at first seem straight forward. I have felt it necessary to

clarify some of the issues and interpret the mathematical expressions. Therefore I include a few

more steps in the explanation.

The model explains how a price bubble evolves, and determines the optimal behavior. Each step

of the model will be presented, and assumptions will be discussed, so the implications of the

optimal strategy can be analyzed.

In order to compare the behavior of rational investors during the dot.com, with the optimal

behavior identified in Abreu & Brunnermeiers model, I initially wanted to do an investigation on

Hedge funds.

The action ability and the structural design of a hedge fund means, that it is a good representative

of a rational investor in the model.

Gathering data, however, turned out to be a problem that was not possible to overcome. Access

to databases that hold the necessary information was very expensive.

The investigation of rational investors behavior in the dot.com bubble will, therefore, consist of a

short presentation of 2 papers addressing the issue.

(1) “Hedge funds and the technology bubble” by Brunnermeier and Nagel

(2) “Who drove and burst the tech bubble” by Griffin, Harris and Topaloglu

1.2 Limitations:

Abreu & Brunnermeiers model include some further theories especially about synchronizing

events. This part of the model will not be included in this paper.

Additionally the special case where the price equals the fundamental value at the time 𝑡0 , will be

ignored, since this paper focus its attention on broader aspects of the model.

Handelshøjskolen i Århus

2009

[8]

2. Definition of a price bubble

Price bubbles have had a significant impact in the global economy at numerous times during the

latest centuries. Naming the Tulip mania, the South Sea bubble and the dot.com bubble as a few5.

Kindleberger (1978)6, originally defined price bubbles by the following; “A bubble is an upward

price movement over an extended range that then implodes”. However, this definition seems a

little too simplified, so further explanation is necessary.

A price bubble origins, when a price of an asset rises over its fundamental value. However, it is

complicated to define precisely when this happens.

In the stock market assets are valued as any other goods by the limitations of supply and the

extent of demand. Hence, the price is naturally set by the market, and the price of the asset

reflects its value to the market. The fundamental value of an asset reflects the collected value of

the particular company, including future dividends. Future dividends will naturally depend on an

assessment of how profitable the company will be in the future.

This assessment of the companies profitability in the future is exactly the source of price bubbles

in the financial markets.

Many of the well-known financial bubbles have originated around major technological

innovations7. Companies, that are closely related to or are able to exploit the new technology,

experience exponential increases in stock prices, because investors believe that their future

growth will be higher than the market growth. Under these structural changes unsophisticated

investors tend to believe that the economy has changed as well. They believe that the

technological innovations have created permanently higher growth rates in the particular sector of

the economy.

5

Wikipedia search on; stock market bubble

Maniacs, Panics and Crashes: A History of Financial Crises, 1978

7

Advisors and asset prices: A model of the origins of bubbles

6

Handelshøjskolen i Århus

2009

[9]

The expectations of permanently higher growth rates will make unsophisticated investors overlyoptimistic in relation to a company’s future dividends, and the intensity of demand will increase

and inflate prices significantly higher than the real fundamental value.

Some literature8 also suggests that the amount of unsophisticated investors compared to the

amount of sophisticated investors will increase during a bubble situation. It is argued that the high

growth rates, attracts private investors who have not yet experienced a downturn in the stock

market. They will for this reason behave over-optimistically and hence, support the development

of the bubble.

As time goes by and the investors’ expectations are revealed to be overly-optimistic, the bubble

crashes and leaves the stock prices at very low levels.

The key for a sophisticated investor is to realize when other investors’ expectations of the

companies future profitability is unrealistic. This will inevitably mean that the stock price will rise

over the fundamental value and create the bubble effect.

This definition of a price bubble implies that it, in the situation virtually, is impossible to be certain

whether or not it is a bubble. Only the future will prove whether or not the expectations to the

companies profitability where realistic. However, it is safe to say that all rational investors, during

a period of rapid price increases, will develop a belief from which they act.

The model of Abreu & Brunnermeier corresponds with this perception of a price bubble. Although,

it is not clearly explained, exactly how they define a price bubble, the overall structure of the

model reveals their perspective9.

From their point of view a mispricing is required to be sustained until a certain amount of

investors are aware before it can be regarded as a price bubble.

As the definition above, a price bubble starts to origin, when the price is separating from the

fundamental value. However, a bubble is not established, until a sufficient number of investors are

aware of the mispricing to burst the bubble, but don’t.

8

John Brooks, The go go years, 1973

Michael Brennan, How did it happen, 2004

9

Bubbles and crashes, s. 180

Handelshøjskolen i Århus

2009

[10]

It can be argued that as long as investors actually believe in higher future dividends they also

believe that the fundamental value is represented by the price. If enough investors share this

opinion then the mispricing has not established itself as a bubble. In order for a mispricing to

become a bubble situation at least some investors is required to be aware.

The reasoning behind this is to separate minor mispricing from bubble situations.

Summing up, a price bubble is defined as a situation where the price departs from the

fundamental value, because of overly-optimistic expectations to future dividends. When enough

investors have become aware to correct the mispricing, but don’t, the bubble situation is

established.

3. Principles of Game theory

Game theory will, in this paper, outline the framework of the analysis. The following will give the

basic ideas of how game theory works in order to understand how it can be applied to price

bubbles.

Game theory was created and first published by Von Neumann and Morgenstern in 194410.

Recently their ideas have gained increasing success in analyzing economic problems. Experts

believe that the general methodology of economics has changed, and that the principles of game

theory fit in well with the new paradigm11.

Comparing game theory to traditional economic analysis tools, shows a distinctive characteristic of

game theory. The fundamental assumptions are very primitive. This is because game theories set

of point are the actors which essentially are the most basic units in a given economy. Previously

most economic theories started out with higher-level assumptions about actors’ behavior12.

Macroeconomists were typically assuming different behavioral relationships, like the consumption

10

Theory of games and Economic behavior, 1944

Games and information, p. 2

12

Games and information, p. 2

11

Handelshøjskolen i Århus

2009

[11]

function (the relationship between actors’ income and their consumption). Assuming such

relationships, makes it harder for economists to evaluate results on real-life basis.

The reason is that actors’ behavior is conditioned of these assumptions. This implies, that if the

assumptions do not hold, then results do not hold.

Correspondingly, micro economists often used assumption of sales maximization is problematic.

Sales maximization does not include any cost terms, which indicates that sales maximization can

be viewed as irrational.

Game theory is applying much more simple assumptions. The most important and most general

being that, every actor in a game wishes to maximize his utility function. The actors seek to do

this, given the constraints they are exposed to during the game. Essentially, the assumption

implies, that actors behave rationally13. Traditional economic theories have in recent years

adopted game theories simplicity of assumptions. The paradigms of game theory and traditional

theories have been converging, which is suspected to be the reason of the latest success of game

theory.

The basic idea of game theory is to analyze how players determine their optimal behavior in a

given game.

The first condition that has to be met to use game theory is, that the players strategies must have

an effect on other players strategies. And all players must have an understanding of that relation.

In order to analyze the stock market as a game, this raises a problem, which will be discussed later.

A game consists of players, actions, payoffs and information. All together they form the rules of

the game. The principle of game theory is to take an economic situation and model it, as a game.

The model assigns pay off functions and strategies to each player, and analyzes what happens in

the equilibrium, when every player chooses the strategy, that maximizes his utility pay off.

First of all, the players need to be defined.

13

It can be argued that any goal can behave as an instrument to qualify any behavior as rational. However, it is truly

believed that maximization of utility is the purest form of a goal and accordingly the behavior to reach it is rational.

Handelshøjskolen i Århus

2009

[12]

A player in a game is an individual, who makes decisions in order to maximize his utility. This,

however, has an exception. In order to structure a game, where payoffs are dependent on the

state of the world, it is appropriate to create a pseudo-player, normally called nature. This player

can given specific probabilities, randomly decide the state of the world. The move of nature can be

either before the players move, or after the players move. If nature moves before the players, the

concept of the Harsanyi transformation and Baye’s rule becomes relevant.

Three types of information exist in games. The first two types are information about natures

move, and information about other players’ moves. Both are highly influential to which strategies

the players will follow. The third type of information is common knowledge which also has an

important role in the fundamental construction of the game. Common knowledge is the term used

to describe information that are known to all players, and that all players know that all players

know, and that all players know that all players knows that all players know... (ad infinitum).

Common knowledge is the information which the players share at the beginning of the game.

Including beliefs concerning the state of the world and the probabilities assigned to natures

moves.

Common knowledge is often named as common priors. This expression will be used further on in

this paper, because the game analyzed involves updating these common prior beliefs.

Information about nature are said to be certain, if nature moves before the players. In these cases

the players are able to adapt their actions to the moves of nature. If the nature moves after the

players, information is said to be uncertain. The uncertainty reflects in the pay off functions.

Normally, players select strategies in order to maximize their utility pay off. When natures moves

are uncertain, the pay off becomes uncertain, which makes it difficult for players to chose the

optimal strategy. This problem can be overcome by rationalizing that, when pay off is uncertain,

players will chose the strategies, which maximizes their expected utility. In these cases, players are

said to have Von Neumann-Morgenstern utility functions14.

14

Games and information, p. 48

Handelshøjskolen i Århus

2009

[13]

Information about natures move is, however, found to be even more complicated. When players

move after nature, a situation can arise, where natures move is unobserved by at least one of the

players. These cases are called games of incomplete information. A special type of incomplete

information game, is a game with asymmetrical information. In such games, some players hold

private information, which gives them advantages to other players. Private information can

change players probability distributions of natures moves, and hence change his pay off function

and strategy choice.

The pay off function and actions are very closely related. Any strategy by any player has a certain

pay off linked to it. The pay off function is a term used to describe a players pay off, with every

players strategy choices being an endogenous variable of the function.

An equilibrium of a game is the output of the model. A game has an equilibrium for any

combination of strategies by the players.

The most interesting equilibrium is found, where the players are following optimal behavior.

Determining the equilibrium of optimal behavior can be done in a number of different ways:

-

Best worst-payoff: This type of equilibrium is found by letting players choose strategies

that maximize the worst payoff depending on the actions of other players. This is often

found to be pessimistic, and to risk averse to be representative of rational players in reallife games.

-

Dominated strategies: This technique is rarely used, since many games cannot be solved by

this method. Games solved with this method are typically rather simple. A well known

example is the Prisoners Dilemma15. The method can be used if there exists a dominating

strategy. A dominating strategy is better than any other strategy, no matter what strategy

other players choose. A dominant strategy equilibrium is found, where all players choose a

strategy combination that dominates all other possible strategies.

This implies, that the method cannot be used, if the optimal strategy for a player is

dependent on the strategy of other players

15

Games and information, s 20

Handelshøjskolen i Århus

2009

[14]

-

Iterated dominance: Equilibrium is found by sequentially excluding weakly dominated

strategies, until only one possible strategy is left for each player. Weakly dominant

strategies is characterized by being possible better, but never worse than other possible

strategies. This procedure is also known as backward induction.

-

Nash equilibrium: The idea is, that if all players choose a best response to the choice they

expect other players to take, they will reach a situation, where none of the players can gain

utility from individually altering their strategy. This strategy combination is known as a

Nash equilibrium. This definition implies that any dominant strategy is also a Nash

equilibrium.

The equilibrium found is the solution of the game. Hence, it forecasts the behavior of the players

in the game and the following output.

The certain equilibrium in which all players have chosen the optimal strategy, in order to maximize

their own utility, given the actions of other players, is called a Nash equilibrium.

A Nash equilibrium exists, where none of the players can individually reach higher pay off by

altering their strategy. This implies that a Nash equilibrium can be considered to be quite stable.

Since no players can further maximize their utility by changing strategy, you can expect players to

keep to their strategies. A problem arises, however, if there is more than one Nash Equilibrium in

the game. Therefore, it is important in the analysis of a game’s outcome to evaluate, if the

equilibrium found is unique.

We will later discuss the propositions of a Perfect Bayesian Nash Equilibrium.

A lot of other properties of games, however, need to be explained as well. For instance, it is

important to point out, whether or not coordination is allowed in the game. Logically coordination

will in many cases improve the equilibrium of a game. However, in real life coordination among

players is rare. In many cases, it is the lack of coordination that is the reason why some games

reach such unfortunate equilibriums, even though players have acted rationally with the object of

maximizing utility. Many results of game theoretic analysis are therefore used as a starting point

to solve economic problems by making players in non-cooperative games cooperate.

Handelshøjskolen i Århus

2009

[15]

Another important aspect is the order of plays. It is essential to determine, if the game should be

modeled with simultaneous or sequential moves. If the game includes sequential moves, it means

that players actions are separated in time. This gives an additional implication of information

which has been briefly mentioned previously. Players acting late in the game are able to benefit

from knowing previous actors strategies. In that sense, they have information presented, that the

first movers did not have. Knowing previous moves from other players in the game has a signaling

effect. This effect can be used both by the first mover and the late mover. First movers can expect

late movers to follow the strategy leader, and late movers can exploit the information given by the

first movers, and thereby reconfigure the probabilities assigned to their pay offs.

The principles of game theory can, by a few configurations, be applied very effectively to a price

bubble situation. This enables economists to analyze players behavior.

The configuration of the basic assumptions of game theory, and the definition of the rules of the

game will be specified in the following chapter.

4. Game theory in price bubbles

Applying game theory to the situation of price bubbles can be done in several ways. One of the

earliest, and maybe most interesting applications, were John Maynard Keynes Beauty Contest

Game16.

Keynes compared the challenges of an investor in the stock market to the challenges facing

ordinary people in the 50’s popular beauty contest quizzes. The beauty contest was a popular quiz

concept from the 50’s, where participants would win a prize, if they were able to pick the model

which would be the most popular, and hence get the most votes.

Thinking about this challenge seems at first very straight forward but given it more thought reveals

the complexity of the game. When first facing the models of which one has to be chosen, an

individual would likely prefer one of the models above the others. Picking this model, the

individual hopes that the general population shares his tastes. However, it is more likely that he

picks a model which he believes would suit the general opinion. You can even argue, that the

individual participant would pick the model, which he believes that other believe will suit the

16

General theory of Employment Interest and Money, 1936

Handelshøjskolen i Århus

2009

[16]

general opinion. Keynes claims that the same principles apply to investors in the stock market. The

argumentation becomes clearer when using a numeric example.

Given an interval from [0 ; 100], the participant that comes closest to 2/3 of the average number

guessed will win a prize. Thinking of this game, it becomes clear that there exist weakly dominated

strategies. Picking the number 100 for instance, leaves no chance of a win (unless all other

participants pick the number 100, then it will be a draw). This is because 2/3 of 100 are 66,667 and

the winning number will never be higher than this. So picking any number above 66,667 is a

weakly dominated strategy which should be iterated. To a rational participant this consideration

leaves the interval [0 ; 66,667]. The individual participant can, however, assume that his

opponents behave equally rational and intelligent. They would like himself reduce their interval. If

the individual participant, expect this to be the case, he is once again presented with a range of

weakly dominated strategies. Like before he is able to eliminate strategies higher than 2/3 of

66,667 which is 44,444. The game would continue like this in multiple rounds until all weakly

dominated strategies are eliminated, and the optimal behavior of the participant is found. The

optimal behavior, in this case, is picking the number 0, since all other strategies are weakly

dominated.

The example demonstrates the concept of higher order beliefs. It is a term used to explain the

process of how players think about other players beliefs.

This concept is very important to grasp, because the winner of the game will be the player who is

one step ahead. Hence, one order of belief higher than the general participants. Let’s say, that one

of the participants actually goes through all the steps of eliminating the dominated strategies, and

picks the number zero. Even though he has behaved optimal in the game, his winning chances are

not very likely. This is because the general participants, most likely, only go through a few of these

steps.

Experimental research supports this hypothesis17.

Given that, the prize will be handed to the participant who comes closest to 2/3 of the average

number, the optimal-behaving participant probably won’t win.

This game shows an important feature of games. Even though players behave rationally optimal, it

might not benefit them in a game, where opponents do not behave rationally optimal. The same

17

Behavioral Game Theory: Thinking, Learning, and Teaching, Camerer, Ho, Chong, 2001

Handelshøjskolen i Århus

2009

[17]

goes in an asset price bubble in the stock market. A rational well informed investor might find that

the stock is over-priced and sell. If the general investor is less informed, he will probably stay

invested, and the bubble might even grow further. The rational investor will in this case loose a

profit even though he was right to sell.

The model presented later reveals how the optimal behavior of rational investors, knowing that

the environment includes a considerable amount of irrational investors, is to be one step ahead and win the game.

This feature draws attention to the concept of information which has previously been underscored

as a very important aspect of games. This is because, optimal behavior is dependent on which

information the player has at the time of action. Therefore, asymmetrical information among

players often leads to different actions.

In cases of asymmetrical information, it is possible for all players to act rationally but chose

different strategies. In the case of price bubbles in the stock market, there is asymmetrical

information between well informed investors (knowing of the bubble) and less informed investors

(not knowing of the bubble). This means, that even though everybody behaves rationally

considering their informational level, the well informed player can lose to less informed players.

One of the most important issues of applying game theory to price bubble situations is, how to

handle the number of players. First of all, the number of players in the stock markets are very

high, which makes it impossible to analyze actors behavior with simple tools like game trees.

Second of all, a common idea of the market place, is that there is no monopoly power by any

players. This means, that any individual strategy has no effect in the market, and thereby plays no

role in other players determination of their strategies. This is a major concern, since the

interdependencies of players strategies are the cornerstone of game theory.

Therefore, it must be realized that in a bubble, game players strategies actually will be

interdependent. This is also one of the basic assumptions of the Abreu-Brunnermeier model, that

will be explored later.

It is argued, that the bursting of bubbles is caused by an increasing amount of selling pressure.

Meaning that when the amount of investors, who have sequentially sold the stock, reach a certain

Handelshøjskolen i Århus

2009

[18]

level, it will take on an effect as a price signal, that the stock is overvalued. The bubble will

immediately burst.

The players strategies are interdependent, since the payoff function to an individual are

dependent on, whether other players buy or sell. As long as the selling pressure is below the

critical level, an informed investor can confidently stay invested until he feels the pressure, and

then he must sell before the burst. This is why the bubble game is also known as a timing game.

The selling strategy must be coordinated with the opponents in the market.

5. The rules of the game:

The initial move is made by nature which decides when and if the bubble situation begins.

Additionally, it decides which types of players become aware.

The players in the game consist of all rational investors in the market. Irrational investors are also

important actors, but not active players. They serve as noise traders which mean that the rational

investors are unable to observe which actions previous players have made.

An important issue for modeling games in the stock market is the large number of players.

Normally, an analysis of stock market behavior is grounded on the assumption that no individual

will have strong enough market power to influence the prices and thereby make investors

strategic decision interdependent.

By setting up an absorption limit for selling pressure, of k investors leaving the market, a

dependency among investors is created. This is because each investors payoff depends on the

bubble have bursted or not, and this is in turn depending on how many investors have sold out.

The information structure is quite complex. Natures move is initially unobserved by all players.

However, immediately after nature’s choice players will start to sequentially receive private

information, revealing natures move until all players are informed. The players do not know how

many other players are already informed.

The players can either take maximum long position or maximum short position, both limited by

their individual financial constraints. Furthermore, the game is dynamic which means that actions

Handelshøjskolen i Århus

2009

[19]

are taken simultaneously, in each sequence. The impact of the irrational environment is that

players becoming aware in later sequences is not able to detect the actions taken in prior

sequences.

The players strategic choices only influence each other at the critical point, where enough selling

pressure has been generated to burst the bubble. When this point is reached, the payoff to

investors changes from the pre-crash price (including the bubble effect) to the fundamental value.

6. The Abreu-Brunnermeier Model:

With the object of determining the optimal strategy for investors in the stock market, Abreu and

Brunnermeier have constructed a comprehensive model18. During the following presentation of

the model, several assumptions will be made. These assumptions and their implications on the

results will be discussed later.

The model starts of at a random point, in time where (𝑡 = 0). At this time, the price of the stock

equals the fundamental value. Both have previously developed at a rate equaling the risk free

interest rate denoted (𝑟). The risk free interest rate, symbolizes the rate in which a balanced stock

in the market would grow, if the fundamental value equaled the price. At the time 𝑡 = 0, it is

assumed that both the fundamental value and the price is 1$ per stock. From here, the price

begins to follow a new pattern determined by the function:

𝑃𝑡 = 𝑒 𝑔𝑡

,

Pre-crash price

The price does no longer follow the risk free interest rate, but is now determined by a new growth

rate (𝑔). If the new growth is higher than the risk free rate, the price will increase faster than

before. It is assumed that 𝑔 > 𝑟. The development of the price is now exponential and higher

than before.

18

Bubbles and Crashes, 2003

Handelshøjskolen i Århus

2009

[20]

The higher growth rate is the key to understand the establishment of the bubble. The higher

growth rate is, in the beginning, explained by good news about the new technology, which leads

to higher expectations to the future profit of the company, which leads to a higher stock price.

Until some random point in time, denoted (𝑡0 ), the increasing stock price is explained by an

additional increase in the fundamental value. After 𝑡0 only some part of the stock price is

explained by the fundamental value. This part is given by the function:

𝑃𝑣 = (1 − 𝛽(𝑡 − 𝑡0 ))𝑃𝑡

,

Post-crash price

This means essentially, that the price 𝑃𝑡 includes a fundamental value and a bubble component

which size is described by 𝛽(𝑡 – 𝑡0 ). It is assumed, that the bubble component is a continuous

increasing function of (𝑡 – 𝑡0 ).

It is an important assumption of this model, that the bubble eventually will burst of reasons not

included in the model – exogenous reasons. This means, that the bubble exists in a limited period,

and correspondingly has a maximum size 𝛽̅ . Hence:

𝛽(𝑡 − 𝑡0 ) : [0, 𝜏̅] ↦ [0, 𝛽̅ ]

So,(𝑡 – 𝑡0 ) taking on values between 0 and the maximum life-time of the bubble (𝜏̅) determines

the bubble size 𝛽, which is found in the interval [0, 𝛽]. The maximum size of the bubble is naturally

found, when the bubble reaches its maximum life-time.

The time 𝑡0 is randomly chosen by nature. It follows an exponential distribution with the

cumulative distribution function:

Φ(𝑡0 ) = 1 − 𝑒 −𝜆𝑡0

Handelshøjskolen i Århus

2009

[21]

So, nature picks randomly the time where the price departs from the fundamental value19. After

this time, the price development can only be explained by irrational behavioral traders, who

expect the growth rate of 𝑔 to continue in infinity.

Rational investors are, however, sophisticated enough to become aware of the bubble situation.

This happens sequentially and from 𝑡0 , an amount of 1⁄𝜂 investors will become aware in any

moment 𝑡 until the time 𝑡0 + 𝜂. At this point, all rational investors are aware of the bubble. In

principle the notation 𝜂, represents the heterogeneity of investors. Because of differences of

opinion, they do not interpret the signals of the stock market the same, which is why they become

aware at different points in time. Depending on when they become aware, they represent a type

of investor.

There are an infinite number of investor types.

Given nature’s choice of 𝑡0 , it is only the players, who become aware in the time interval between

[𝑡0 , 𝑡0 + 𝜂] that are active. The investors, that are not included in that interval, have other

perceptions of the stock market. These investors strategies are in general called irrational.

To protect the bubble from unaware investors attacks, the following is assumed:

𝜆

𝑔−𝑟

<

𝛽(𝜂𝑘)

1 − 𝑒 −𝜆𝜂𝑘

This assumption means, that the relationship between the intensity parameter (determines the

strength of the exponential distribution) and the probability that the critical amount of investors

are aware, must be less than the relationship between growth rate minus risk free interest rate,

and the bubble size at time 𝜂𝑘 20.

In short, the left hand side of the expression is a measure of the probability that the bubble will

burst. The right hand side is a measure of the costs compared to the benefits of attacking the

bubble. Hence, the expression says, that if the probability of a burst is smaller than the cost-

19

This is where the mispricing begins. The bubble situation is, however, not established yet. According to Abreu &

Brunnermeier the bubble starts at time 𝑡0 + 𝜂𝑘. Bubbles and Crashes p. 180, quote: “We label any persistent

mispricing beyond 𝑡0 + 𝜂𝑘 a bubble.”

20

The term will be explained later in more detail. In short it represents the amount of selling pressure needed to burst

the bubble.

Handelshøjskolen i Århus

2009

[22]

benefit ratio of attacking the bubble, at the time where the critical mass 𝑘 investors become

aware, they will hold onto their stocks.

From this expression, it is required that the difference between 𝑔 − 𝑟 is high enough, so investors

will have costs leaving the bubble. This will make them stay invested. Furthermore the intensity

parameter 𝜆 is low enough to make it sensible to stay invested.

The assumption makes sure that investors do not have interest in selling until after the critical

amount of investors are aware.

Following the fact, that 𝑡0 is randomly chosen by nature, the investor do not know, if he is the first

to know or the last to know. He can only view the market from his individual perspective. We

denote the investor, who becomes aware of the bubble at time 𝑡𝑖 for 𝑡𝑖 .

In order to estimate when the bubble burst, a rational investor will have to determine the time

where the bubble began; 𝑡0 . For investor 𝑡𝑖 , 𝑡0 must be in the interval given by [𝑡𝑖 − 𝜂, 𝑡𝑖 ]. The

interval begins in time 𝑡𝑖 − 𝜂, where he is the last to become aware, and it finishes in time 𝑡𝑖 ,

where he is the first. The distribution of 𝑡0 for investor 𝑡𝑖 is given by:

Φ(t 0 |t i ) =

eλη −eλ(ti−t0 )

eλη − 1

The investor, who is the last possible to become aware from ti’s perspective, is denoted 𝑡𝑘 = 𝑡𝑖 +

𝜂.

The key in this model is, that it is the accumulated selling pressure, which finally burst the bubble.

The point in time, where enough rational investors have become aware to burst the bubble, is in

𝑡0 + 𝜂𝑘. This means, that when 𝑘 amount of investors know of the bubble, a coordinated attack

on the bubble will generate enough pressure to burst it. The non-coordination feature of the game

means that attacking the bubble at this point is not possible.

The action space for investors is described as the continuum interval [0,1]. 0 reflects the

maximum long position and 1 the maximum short position. Correspondingly, the higher you get in

the interval, the higher the selling pressure will be from the individual investor. The selling

Handelshøjskolen i Århus

2009

[23]

pressure of ti at time t is denoted 𝜎(𝑡, 𝑡𝑖 ). Likewise; [1 − 𝜎(𝑡, 𝑡𝑖 )] is a player’s stock holding. The

strategy profile for an individual investor is:

𝜎 ∶ [0, ∞] × [0, ∞] ↦ [0,1]

This means, that the variables 𝑡 (time) and 𝑡𝑖 (investor type) belong to infinite intervals.

Measurability requirements means, that only strategy profiles, that imply a measureable function

of 𝜎(𝑡,∗) is included in the model21.

The aggregate selling pressure of all investors is given by the following defined integral:

𝑚𝑖𝑛{𝑡,𝑡0 +𝜂}

𝑠(𝑡, 𝑡0 ) = ∫𝑡

0

𝜎(𝑡, 𝑡𝑖 ) 𝑑𝑡𝑖 ,

𝑡 ≥ 𝑡0

The aggregate selling pressure at time 𝑡, is the amount of stocks sold by all individual investors

from t0 until current time (𝑡) or the time 𝑡0 + 𝜂, where all rational investors are informed –

depending on which time comes first. When all rational investors are informed, the selling

pressure is at its maximum.

Knowing that the bubble only will be able to burst, when selling pressure becomes higher than or

equal to 𝑘, the bubbles bursting time can be expressed by:

𝑇 ∗ (𝑡0 ) = inf{𝑡|𝑠(𝑡, 𝑡0 ) ≥ 𝑘

𝑜𝑟

𝑡 = 𝑡0 + 𝜏̅}

This expression says that for a realized 𝑡0 , the bubble will burst either by the aggregate selling

pressure or when the bubble exceeds its maximum lifetime. Whichever comes first. This means

that it is the realization of 𝑡0 and the critical amount of investors 𝑘 that determines the bursting

time. A rational investor, that becomes aware of the bubble at time 𝑡𝑖 , will therefore use his

beliefs about 𝑡0 to determine the bursting time:

Π(𝑡|𝑡𝑖 ) = ∫𝑇 ∗(𝑡

0 )< 𝑡

21

𝑑Φ(t 0 |t i )

𝜎(𝑡,∗) is not always measurable in 𝑡𝑖 .

Handelshøjskolen i Århus

2009

[24]

As described investor 𝑡𝑖 ’s belief about the distribution of 𝑡0 is given by Φ. The bursting time is the

beginning of the integral where; 𝑡 > 𝑇 ∗ (𝑡0 ). Hence, from 𝑡𝑖 ’s perspective, the bubble will burst

when the time reaches his own belief about the bursting time, determined by his own belief about

𝑡0 .

Investors payoffs depend on the stock prices, minus transaction costs. The stock price is either

given by the pre-crash price or the post-crash price, depending on the time of buying and selling22.

Hence, the expected price is:

(1 − 𝛼)𝑃𝑡 + 𝛼(1 − 𝛽(𝑡 − 𝑡0 ))𝑃𝑡

The variable α reflects the selling pressure. If the selling pressure is higher than 𝑘, then 𝛼 > 0.

This means, that the execution price is determined by the post-crash price. The opposite happens,

if selling pressure is below 𝑘, then 𝛼 = 0.

The transaction costs play a role every time an investor makes a trade. The model seeks to

eliminate the influence of the transaction costs on equilibrium by making the following

assumptions. Transaction costs are high enough to restrict the number of trades to a finite amount

and low enough, not to restrict investors from selling on a bubble. Additionally, it is assumed that

the transaction costs are constant through the time period.

A general payoff function for a random investor 𝑡𝑖 , includes many complex relations. But it all

comes down to the expected value of the traders stock holding, given the strategy chosen.

However, the mathematical interpretation23 of the general function is not necessary to grasp the

idea of the model – or equilibrium behavior. Therefore, it makes more sense to describe the

payoff function in a special case:

22

If an investor trades exactly at the bursting time, the order will be generated at the pre-crash price until the

aggregated selling pressure exceeds k. At this point only the first randomly picked order will go with the pre-crash

price and the rest will be executed at post-crash price.

23

Bubbles and Crashes, 2003, appendix A

Handelshøjskolen i Århus

2009

[25]

The payoff of investor 𝑡𝑖 who is fully invested in the market until he sells the entire holding at time

𝑡 is given by:

𝑡

∫𝑡 𝑒 −𝑟𝑠 (1 − 𝛽(𝑠 − 𝑇 ∗−1 (𝑠))) 𝑝(𝑠) 𝑑Π(𝑠|𝑡𝑖 ) + 𝑒 −𝑟𝑡 𝑝(𝑡)(1 − Π(𝑡|𝑡𝑖 )) − 𝑐

𝑖

Furthermore, it is assumed that 𝑡𝑖 stays out of the market until the bubble crashes.

Interpreting this mathematical expression, it comes to show that the payoff is given by the area

between time of awareness (𝑡𝑖 ) and the selling time (𝑡). Hence, the payoff is generated by the

increase in stock prices during the period 𝑡𝑖 rides the bubble.

The length of the period 𝑡𝑖 rides the bubble is furthermore depending on his beliefs about 𝑡0 , the

bursting date and the size of the selling pressure.

6.1 Game theoretical background:

Essentially, the game is one of incomplete information. Investors are not able to define their

payoff, because it depends on whether the stock market is in a bubble or not. Traditional game

theoretic approaches of handling this issue, is to use Harsanyis transformation principles, and

make it a game of complete, but imperfect information.

Additionally, the game can be defined as a dynamic game because of the sequential aspects. It

should be stressed, that private information is not signaled by players moves, because the

environment is irrational.

The Harsanyi transformation24 has been used to restructure this game from a game of incomplete

information to a game of imperfect, but complete information25. The principle of the

transformation is to add a move by nature that decides the state of the world.

24

Games and information, s. 51

25

There exists some confusion about these definitions. Originally games of incomplete information could not be

solved which is why they are transformed to games with complete but imperfect information. Basically this

terminology has been neglected and now people just refer to transformed games, as games with incomplete

information.

Handelshøjskolen i Århus

2009

[26]

The random choice of 𝑡0 , with defined distribution function, should be considered as a move by

nature. It defines the state of the world – if the market is in a bubble or not. This move is initially

unobserved by the players, even though some investors immediately become aware.

The reason why the transformation has to be made is, that players would not be able to define

their payoffs, unless there could be assigned a probability to which state of the world nature has

chosen.

It is essential in the game that the probability distribution of 𝑡0 is shared by all rational investors.

This means, that the probability of being in a bubble is a shared prior belief. This is what is meant

by common priors, and is also called the Harsanyi doctrine, since it is necessary to hold in order to

apply the Harsanyi transformation.

The prior beliefs are, however, allowed to change when investors receive private information by

which they become aware of the price bubble situation. This means, that a situation arises among

investors in which they hold asymmetrical information. The observation of the state of the world is

considered private information, and aware investors correspondingly update their beliefs about

the time 𝑡0 , according to Bayes rule26.

Even though they now know, that they are in a bubble situation, they do not know how many

other investors are aware of this. This means, that their beliefs about how many other investors

know, are included in their payoff function.

The game is viewed from an investor’s individual perspective, assuming that every rational

investor will behave the same way. Therefore, the solution to the game describes the optimal

behavior for any individual investor. The solution is defined as a Perfect Bayesian Nash

Equilibrium. This means, that the optimal behavior is the best response of an individual investor

given that other rational investors follow their optimal behavior.

The definition of the equilibrium is further commented later in the analysis.

6.2 Preliminary analysis:

This section provides some assumptions and propositions that will help define optimal behavior

and thus, equilibrium.

26

Games and information, s. 54

Handelshøjskolen i Århus

2009

[27]

Definition 1: The equilibrium of this game is defined as a Perfect Bayesian Nash Equilibrium.

As previously mentioned, a Nash equilibrium implies that every player chooses the strategy which

is the best response to what other players choose. The reason why it is Bayesian, is because they

have rationally updated their beliefs, following Baye’s rule during the game.

To have a Nash equilibrium therefore means, that any rational investors will choose the strategy

which leads to the highest expected payoff, given other rational investors will do the same. In

equilibrium all rational investors will actually do the same.

At equilibrium in Abreu & Brunnermeiers bubble game, this implies that; an investor whose stock

holding is less than maximum, can expect that all other bubble-knowing investors who became

aware before him, also hold less than their maximum.

Lemma 1:

𝜎(𝑡, 𝑡𝑖 ) ∈ {0,1} ∀ 𝑡, 𝑡𝑖

This assumption means that the action space per period is only allowed to take on values 0 or 1.

The reason for this is to simplify the model. By only allowing investors to be fully invested (1) or

completely out of the market (0), the aggregate selling pressure can be found as the amount of

investors who have left the market.

The elimination of partial buying and selling, means that a rational investor knowing of the bubble

will not be able to gradually sell the stock to reduce risk. This implies that investors in the model

are risk-neutral. This is clearly not realistic, but as explained by Abreu & Brunnermeier it has not

any impact on the results in the model. If partial trading is allowed, it would only make it much

more complicated to determine the aggregate selling pressure. Hence, the implication that this

assumption has on the model is, that the aggregate selling pressure might exceed the critical limit

(𝑘) at another point in time. The general theory of the optimal behavior of investors would be the

same.

Corollary 1:

𝜎(𝑡, 𝑡𝑖 ) = 1 ↦ 𝜎(𝑡, 𝑡𝑗 ) = 1 ∀ 𝑡𝑗 ≤ 𝑡𝑖

Out of the market

𝜎(𝑡, 𝑡𝑖 ) = 0 ↦ 𝜎(𝑡, 𝑡𝑗 ) = 0 ∀ 𝑡𝑗 ≥ 𝑡𝑖

Fully invested

Handelshøjskolen i Århus

2009

[28]

This says that if investor 𝑡𝑖 has become aware of the bubble prior to investor 𝑡𝑖 . And if 𝑡𝑖 is

completely out of the market then 𝑡𝑗 is also out of the market (sold out prior to 𝑡𝑖 ). Likewise, if

𝑡𝑖 became aware prior to 𝑡𝑗 , then 𝑡𝑗 will be fully invested when 𝑡𝑖 is fully invested.

This corollary is put together by definition 1 and lemma 1. Definition 1 states that the investor who

becomes aware first will act first, and lemma 1 states that all investors must be either fully

invested or out of the market.

It is also known as the cut-off property and is a direct implication of the sequential awareness.

Definition 2:

𝑇(𝑡𝑖 ) = inf{𝑡|𝜎(𝑡, 𝑡𝑖 ) > 0}

𝑇(𝑡𝑖 ) expresses the first time investor 𝑡𝑖 sells stocks. It is found, at the greatest lower bound of

time 𝑡27, where the strategic decision 𝜎(𝑡, 𝑡𝑖 ) takes on a value higher than zero. With lemma 1 in

mind, the strategic decision will take on the value 1 and 𝑡𝑖 will leave the market.

Corollary 2:

𝑇 ∗ (𝑡0 ) = min{𝑇(𝑡0 + 𝜂𝑘 , 𝑡0 + 𝜏̅)}

By Corollary 1, we know that when investor 𝑡0 + 𝜂𝑘 sells his stocks all rational investors prior to

him have already sold. This means, that at the time where 𝑡0 + 𝜂𝑘 sells, enough selling pressure

has been generated to burst the bubble. So, the bubble will burst at this moment, unless it has

already bursted for exogenuous reasons at the time 𝑡0 + 𝜏̅.

Definition 3:

𝑡0𝑠𝑢𝑝𝑝 (𝑡𝑖 )

The function expresses the lower bound of support for investor 𝑡𝑖 ’s configurated belief about 𝑡0 at

the time of selling (𝑇(𝑡𝑖 )).

Lemma 2:

𝑡0𝑠𝑢𝑝𝑝 (𝑡𝑖 ) ≥ 𝑡𝑖 − 𝜂𝑘

𝑡0 = 𝑡𝑖 − 𝜂𝑘 expresses the situation where 𝑡𝑖 is the investor who generates the critical amount of

selling pressure to burst the bubble. This lemma states, that the lower bound of investor 𝑡𝑖 ’s

beliefs about t0 in time 𝑇(𝑡𝑖 ) always will be higher or equal to 𝑡𝑖 − 𝜂𝑘. This implies, that at the

time 𝑇(𝑡𝑖 ) where 𝑡𝑖 sells out stocks, a maximum of 𝑘 investors have become aware – and sold –

27

The first possible 𝑡, where 𝜎(𝑡, 𝑡𝑖 ) takes on a value higher than 0.

Handelshøjskolen i Århus

2009

[29]

prior to 𝑡𝑖 . This ensures, that investor 𝑡𝑖 sells out prior to the burst (given his individual belief

about 𝑡0 ). Hence, it is called the preemption lemma.

Lemma 3-4-5:

They are not found to be of significant importance to this paper. However, it should be mentioned

that these lemmas prove that the function for the bursting time 𝑇 ∗ , and the inverse 𝑇 ∗−1 is strictly

increasing and continuous, and that the function of the selling time 𝑇 is also continuous.

This ensures the mathematical liability of the analysis.

Lemma 6:

Pr[𝑇 ∗−1 (𝑇(𝑡𝑖 ))|𝑡𝑖 , 𝐵 𝑐 (𝑇(𝑡𝑖 ))] = 0

,

𝑡𝑖 > 0

This lemma implies, that the probability of the bubble bursting exactly at the time where investor

𝑡𝑖 sells is equal to zero. The probability, that the bubble will burst exactly at the time 𝑡𝑖 sells is

given by 𝑇 ∗−1 (𝑇(𝑡𝑖 )). 𝐵 𝑐 (𝑇(𝑡𝑖 )) expresses the probability that the bubble has not yet bursted at

the time 𝑡𝑖 sells.

Proposition 1:

𝑡 ≥ 𝑇(𝑡𝑖 )

If the previous assumptions hold, rational investors will choose maximum short position at all

times, later than or equal to the first selling time.

This states that in equilibrium investor 𝑡𝑖 , will apply a ‘trigger strategy’ which means that after

leaving the market at time 𝑇(𝑡𝑖 ), he will stay out until the bubble bursts.

The proposition implies that the optimal strategy for investors in the bubble is a trigger strategy.

To prove this, imagine an equilibrium where 𝑡𝑖 re-enters the market after 𝑇(𝑡𝑖 ). Since transaction

costs are high enough to restrict investors from trading constantly, 𝑡𝑖 will stay out of the market in

a certain time period. Lets say, that the time period ends, when investor 𝑡𝑖 + 𝜀 (𝜀 > 0 and

expresses the amount of investors that have left the market, while 𝑡𝑖 was out) leaves the market.

At this point 𝑡𝑖 wishes to re-enter the market. However, given corollary 1, we know that if 𝑡𝑖 is fully

invested all investors that became aware after him will also be fully invested. This means, that 𝑡𝑖

cannot re-enter the market until 𝑡𝑖 + 𝜀 has re-entered. Likewise 𝑡𝑖 + 𝜀 cannot re-enter until 𝑡𝑖 +

Handelshøjskolen i Århus

2009

[30]

2𝜀 has re-entered and so on. This will essentially postpone 𝑡𝑖 ’s reentering until the bubble bursts

by either selling pressure or exogenous reasons. Hence, 𝑡𝑖 is following a trigger strategy.

As a consequence the analysis of equilibrium can be limited to trigger strategies. And it now

becomes clear why the general payoff function was unimportant. Instead we can focus attention

on the payoff function presented on page 15.

The function has been slightly altered; 𝜋(𝑠|𝑡𝑖 ) expresses the conditional density of Π(𝑡|𝑡𝑖 ), which

is 𝑡𝑖 ’s conditional cumulative distribution function)

𝑡

∫𝑡 𝑒 −𝑟𝑠 (1 − 𝛽(𝑠 − 𝑇 ∗−1 (𝑠))) 𝑝(𝑠) 𝜋(𝑠|𝑡𝑖 ) 𝑑𝑠 + 𝑒 −𝑟𝑡 𝑝(𝑡)(1 − Π(𝑡|𝑡𝑖 )) − 𝑐:

𝑖

Lemma 7:

The hazard rate is given by the expression:

ℎ(𝑡|𝑡𝑖 ) =

𝜋(𝑡|𝑡𝑖 )

1 − Π(𝑡|𝑡𝑖 )

This says that the hazard rate of the bubble bursting at the time t for investor 𝑡𝑖 is given by the

ratio of the conditional density function for 𝑡𝑖 ’s belief about the bursting time, and the conditional

probability that it is not bursting. The hazard rate is a measure of the individual investors risk

assignment to the bubble bursting.

Lemma 7 gives the ‘sell out condition’, which is provided by differentiating the above payoff

function with respect to 𝑡:

ℎ(𝑡|𝑡𝑖 ) <

𝑔−𝑟

𝛽(𝑡 − 𝑇 ∗−1 (𝑡))

If 𝑡𝑖 ’s hazard rate is smaller than the cost-benefit ratio of attacking the bubble at time 𝑡, 𝑡𝑖 will

keep holding the stocks. The benefit of attacking the bubble is determined by the bubble size at

the time of attack. The costs of being out of the market, if the bubble does not burst at the time 𝑡

is given by the difference between the bubble growth rate and the risk free interest rate.

Interpreting this means, that if trader 𝑡𝑖 believes that the risk of the bubble bursting at time 𝑡 is

smaller than the cost-benefit ratio of being out of the market at time 𝑡, then he will stay invested.

Handelshøjskolen i Århus

2009

[31]

This can be reversed, meaning that if 𝑡𝑖 ’s hazard rate is higher than the cost-benefits of attacking

the bubble, then he will leave the market.

Hence, this is called the ‘sell out condition’. It determines the investors optimal selling time in both

types of crashes.

6.3 Identifying the optimal behavior of investors:

The model includes 2 types of crashes – by selling pressure or exogenous reasons. To give a

wholesome determination of optimal behavior, this paper describes the reasoning and the

relation behind the behavior in both crash types.

In order to define equilibrium it is assumed that investor 𝑡𝑖 expects the bubble to burst at the time

𝑡0 + 𝜁. Given that 𝑡𝑖 ’s belief about 𝑡0 is distributed by:

Φ(t 0|t i ) =

eλη − eλ(ti −t0 )

eλη − 1

We are able to directly derive his belief about the bursting date. From 𝑡𝑖 ’s perspective his

distribution of the bursting date 𝑡𝑖 + 𝜏 becomes:

Π(𝑡𝑖 + 𝜏|𝑡𝑖 ) =

eλη − eλ(ζ−τ)

eλη − 1

The expression ζ represents the period of time between 𝑡0 and the expected bursting date.

Withdrawing τ from this gives 𝑡𝑖 .

Furthermore, by differentiating the payoff function considering these beliefs, the hazard rate

becomes:

𝜆

ℎ(𝑡𝑖 + 𝜏|𝑡𝑖 ) = 1−𝑒 −𝜆(𝜁−𝜏)

This reflects 𝑡𝑖 ′𝑠 hazard rate that the bubble will burst at 𝑡0 + 𝜁, after he have ridden the bubble 𝜏

period after becoming aware.

This expression of the hazard rate is useable in determining equilibrium since the term 𝜁, is easily

replaced with, whatever expectation investor 𝑡𝑖 has.

Handelshøjskolen i Århus

2009

[32]

6.3.1 Exogenous crashes:

𝜆

1−𝑒 −𝜆𝜂𝑘

≤

(𝑔−𝑟)

̅

𝛽

In this case the bubble will crash before enough selling pressure have been generated.

Interpreting the expression gives the following. 𝑔 – 𝑟 / 𝛽̅ expresses the cost-benefit ratio from

𝜆

attacking the bubble at its maximum size. 1−𝑒 −𝜆𝜂𝑘 represents the hazard rate at the time 𝑡𝑖 beliefs

that the critical amount of investors will sell. 𝑡𝑖 ’s belief about this point in time derived from his

beliefs about 𝑡0 and consequently his beliefs about the bursting date.

If the dispersion of opinion 𝜂 is sufficiently large, the hazard rate at this point in time will be lower

than the cost-benefit ratio. This means that 𝑡𝑖 will delay selling out until the sell-out condition is

met.

This delay effectively means that the bubble will burst for exogenous reasons, since it together

with the large 𝜂 means that 𝑡0 + 𝜏 1 + 𝜂𝑘 > 𝑡0 + 𝜏̅.

Even though enough investors are informed of the bubble to burst it, the condition above makes it

more profitable to ride it further, and let it burst for exogenous reasons.

In equilibrium all investors follow that behavior and endogenous selling pressure will not have

influence.

This means that the optimal behavior is to ride the bubble in a period, and sell prior to the burst.

This explanation is proved by the following section.

Definition 4:

𝜏(𝑡𝑖 ) = 𝑇(𝑡𝑖 ) − 𝑡𝑖

The period of time investor 𝑡𝑖 chooses to ride the bubble (𝜏) is given by the difference between

the time of selling and the point of awareness.

Recapping from earlier, every outcome of 𝑡0 will be exposed of an exogenous crash when the

bubble reaches its maximum size of 𝛽̅ at the time 𝑡0 + 𝜏̅. Every informed investor knows this, and

knows that to sell out before the crash the selling period are limited to the interval [𝑡𝑖 , 𝑡𝑖 + 𝜏̅].

However, there is no reason why the bubble will not crash before 𝑡𝑖 + 𝜏̅. Either by endogenous or

exogenous reasons. It is none the less obvious that the riding time 𝜏(𝑡𝑖 ) < 𝜏̅ in equilibrium.

Proposition 2:

1

𝑔−𝑟

𝜏 1 = 𝜏̅ − 𝜆 ln (𝑔−𝑟−𝜆𝛽̅) < 𝜏̅

Handelshøjskolen i Århus

2009

[33]

Proposition 2 claims that there is a unique symmetric trading equilibrium at 𝜏 1 which is smaller

than 𝜏̅ (see figure 1).

If investor 𝑡𝑖 believe that the bubble will burst at 𝑡0 + 𝜁. This means that for 𝑡𝑖 the distribution of

the bursting date (𝑡𝑖 + 𝜏) is given by:

Π(𝑡𝑖 + 𝜏|𝑡𝑖 ) =

eλη −eλ(ζ−τ)

eλη − 1

This belief is derived from 𝑡𝑖 ’s belief about 𝑡0 .

Differentiating the payoff function including these beliefs gives an expression of the hazard rate:

𝜆

ℎ(𝑡𝑖 + 𝜏|𝑡𝑖 ) = 1−𝑒 −𝜆(𝜁−𝜏)

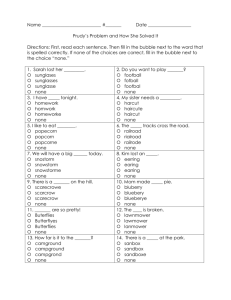

Figure 1: Identifying the optimal strategy in exogenous crashes.

Kilde: Econometrica; Vol. 71 No. 1; Page 188; Bubbles and Crashes; Dilip Abreu & Markus K. Brunnermeier; 2003;

ℎ=

𝜆

1 − 𝑒 −𝜆(𝜏̅−𝜏)

𝑔−𝑟

𝛽̅

𝜆

1 − 𝑒 −𝜆𝜂𝑘

𝜏

𝜏̅ − 𝜂

𝜏̅ − 𝜂𝑘

𝜏1

𝜏̅

The hazard rate and cost-benefit ratio is depicted as a function of 𝜏. The cost-benefit ratio is

independent of 𝜏, because the time of the exogenous crash is independent of 𝜏. This makes the

benefits of attacking the bubble a constant equaling the size at the bubbles maximum lifetime.

This is why the cost-benefit ratio is depicted as a constant. Naturally the hazard rate is strictly

increasing in an exponential development. The longer the investor chooses to ride the bubble the

higher is the risk.

Handelshøjskolen i Århus

2009

[34]

As stated earlier, equilibrium is found where the hazard rate equals the cost-benefit ratio. If 𝑡𝑖

believes that the bubble is bursting for exogenous reasons the term 𝜁 in the hazard rate is

substituted with 𝜏̅.

This gives the final depiction of the hazard rate. It represents the probability from 𝑡𝑖 ’s perspective

that the bubble will burst at each moment in time.

The equilibrium is denoted 𝜏 1 . If 𝜏 is higher than 𝜏 1 the risk of the bubble bursting is higher than

the costs compared to the benefits of attacking – hence it is optimal for investors to be at the

maximal short position. If 𝜏 is lower than 𝜏 1 the reverse is optimal since the risk of the bubble

bursting is lower than the cost-benefit ratio of attacking it. This is given by the sell-out condition.

Therefore the optimal strategy is the trigger strategy of selling at 𝜏 1 . This means, that the bubble

will crash at 𝑡0 + 𝜏̅, since the size of 𝜂 makes 𝑡0 + 𝜏 1 + 𝜂𝑘 > 𝑡0 + 𝜏̅.

This defines the symmetric equilibrium and the optimal behavior of investors. A symmetrical

equilibrium means that all players will apply this strategy.

To prove that the equilibrium 𝜏 1 is unique we look at a possible alternative equilibrium. The

alternative optimal riding time is denoted 𝜏(𝑡𝑗 ). This riding time is smaller than the previous

optimal riding time.

For investor 𝑡𝑗 the smallest possible value of 𝑡0 is still required to be higher than or equal to 𝑡𝑗 −

𝜂𝑘 because of the preemption lemma.

If 𝑡𝑗 ’s belief about the lower support of 𝑡0 is higher than 𝑡𝑗 − 𝜂𝑘, then investor 𝑡𝑗 will not only sell

out because of concerns of an exogenous crash. He will also be concerned of endogenous crashes.

Looking at figure 1, the sell-out condition will in this case be violated unless 𝜏(𝑡𝑗 ) = 𝜏 1 .

If 𝑡𝑗 ’s belief about the lower support of 𝑡0 is equal to 𝑡𝑗 − 𝜂𝑘, the sell-out condition will also be

violated. Since the riding time of 𝑡𝑗 is shorter than 𝑡𝑖 , his hazard rate cannot be higher than 𝑡𝑖 ’s.

Given the initial assumption, we also know that the hazard rate is less than the cost-benefit ratio

at the bubbles maximum lifetime.

This means that selling out prior to 𝜏 1 , is not optimal because the hazard rate is to low compared

to the cost-benefits of attacking it.

Handelshøjskolen i Århus

2009

[35]

To conclude the optimal strategy of investors is to stay with the bubble and sell out after riding the

bubble in the optimal period of r1 which is just prior to the exogenous burst given their beliefs

about 𝑡0 .

𝜆

6.3.2 Endogenous crashes:

1−𝑒 −𝜆𝜂𝑘

>

(𝑔−𝑟)

̅

𝛽

Given this assumption the bubble-crash will be caused by selling pressure. The equilibrium

behavior in this case is found by iteration of non-best response strategies. The principle is much

like ‘the beauty contest games’. Since the bubble burst at the time 𝑡0 + 𝜏̅ if no investors sell,

investor ti will seek to sell just prior to that moment (𝑡𝑖 + 𝜏 1 ). Given the assumption that selling

pressure will burst the bubble, the bubble will burst when the amount of selling pressure reaches

a critical level; 𝑡0 + 𝜏 1 + 𝜂𝑘. Given the initial assumption, the bursting time is now reduced which

means that investors will sell even earlier at time 𝜏 2 , (𝜏 1 > 𝜏 2 ). The backward induction process

will continue to reduce the time in which investors are able to ‘ride the bubble’ until it reaches 𝜏 ∗ .

Traditional analyzes of this bubble behavior logically eliminates the chance of developing a bubble.

However the process loses its effect gradually because the size of the bubble gets smaller as the

riding time is reduced. When the size of the bubble reduces, the benefits of attacking the bubble is

also reduced which means that investors will keep riding it.

Proposition 3:

𝜆

1−𝑒 −𝜆𝜂𝑘

>

(𝑔−𝑟)

̅

𝛽

Assuming that the hazard rate, when the critical amount of investors becomes aware, is higher

than the costs related to the benefits of attacking the bubble when it reaches its maximum lifetime. There will be a trading equilibrium where investors 𝑡𝑖 ≥ 𝜂𝑘 sell out at 𝜏 ∗ , after becoming

aware, and investors 𝑡𝑖 < 𝜂𝑘 sell out at 𝜂𝑘 + 𝜏 ∗ .

This means that in the symmetric equilibrium the bubble will burst at 𝑡0 + 𝜂𝑘+𝜏 ∗ . At this time the

bubble component will be an optimal fraction (𝛽 ∗ ) of the pre-crash price.

The equilibrium time of riding the bubble, 𝜏 ∗ is found by the following.

Handelshøjskolen i Århus

2009

[36]

𝜏 ∗ = 𝛽 −1 (

𝑔−𝑟

𝜆

1 − 𝑒−𝜆𝜂𝑘

)

Investor 𝑡𝑖 ≥ 𝜂𝑘 means that the investor has become aware of the bubble after the critical

amount of rational investors has become aware. However, the equilibrium behavior for this

investor (to maximize utility with the restriction of the hazard rate) is to sell 𝜏 ∗ periods after

becoming aware.

Investor 𝑡𝑖 < 𝜂𝑘 means that the investor has become aware of the bubble prior to the critical

mass which means that his optimal behavior is to sell at 𝜂𝑘 + 𝜏 ∗ in order to ride the bubble as well

as possible.

The time period 𝜏 is bounded by the interval; [0 , 𝜏̅ – 𝜂𝑘]. If 𝜏 is larger than 𝜏̅ – 𝜂𝑘 then the

bubble will burst for exogenous reasons before the investor leaves the market. Given these

considerations the bubble will burst at the time 𝑡0 + 𝜂𝑘 + 𝜏 = 𝑡0 + 𝜁 ; where ζ denotes 𝜂𝑘 + 𝜏.

Substituting this expression into the hazard rate we obtain the following:

𝜆/1– 𝑒 −𝜆(𝜁 – 𝑟)

→

𝜆/1– 𝑒 −𝜆(𝜂𝑘)

This gives the optimal hazard rate.

Equilibrium is presented in figure 2. The hazard rate is independent of the time period of riding the

bubble. This means that the hazard rate is found to be a constant.

The cost benefit ratio of, attacking the bubble are on the other hand dependent on 𝜏. Knowing

that the bubble 𝛽(𝜂𝑘 + 𝜏) is an increasing function, the benefits of attacking it, is also increasing

as 𝜏 increases. Equilibrium will be found when the benefits of attacking the bubble have increased

enough compared to the costs of attacking it, so that it equalizes the investors’ hazard rate.

This is the optimal time for leaving the market. As soon as the investors’ hazard rate is higher than

the costs compared to the benefits of attacking, the investor should sell in order to maximize his

utility. Hence, a rational investor will follow this behavior.

Handelshøjskolen i Århus

2009

[37]

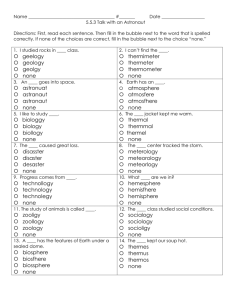

Figure 2: Identifying optimal behavior in endogenous crashes.

Kilde: Econometrica; Vol. 71 No. 1; Page 191; Bubbles and Crashes; Dilip Abreu & Markus K. Brunnermeier; 2003;

𝑔−𝑟

̅

𝛽 (𝜂𝑘 + 𝜏)

ℎ∗ =

𝜆

1 − 𝑒 −𝜆𝜂𝑘

𝜏

𝜏

∗

Shows the hazard rate and the cost benefit ratio of attacking the bubble as a function of the riding

time 𝜏. The hazard rate is constant and the cost-benefit ratio of attack is decreasing as a

consequence of the increasing bubble size. Equilibrium behavior is found where the two

expressions equalize each other.

Since 𝜏 ∗ > 0 when the cost-benefit ratio of attacking is higher than the hazard rate, and 𝜏 ∗ < 𝜏̅ −

𝜂𝑘 when the hazard rate is higher than the cost-benefit ratio, equilibrium can be said to be

symmetric.

To show that equilibrium is also unique is very complicated.

First of all we should remember equilibrium from the exogenous crash 𝑡𝑖 + 𝜏 1 . This equilibrium

will affect the amount of selling pressure if the optimal riding time 𝜏 ∗ (𝑡𝑖 ) > 𝜏 1 for some 𝑡𝑖 .

It is therefore necessary to analyze the behavior of the investor which rides the bubble latest. This

investor is denoted 𝑡𝑗 .

From the preemption lemma we know that at the time 𝑡𝑗 sells ( 𝑇(𝑡𝑗 )), the latest possible time the

bubble originated is 𝑡𝑗 − 𝜂𝑘 where 𝑡𝑗 is the latest investor to become aware. Otherwise the bubble

would already have bursted.

More specifically the preemption lemma says: 𝑡0𝑠𝑢𝑝𝑝 (𝑡𝑗 ) ≥ 𝑡𝑗 − 𝜂𝑘.

Handelshøjskolen i Århus

2009

[38]

If 𝑡0𝑠𝑢𝑝𝑝 (𝑡𝑗 ) > 𝑡𝑗 − 𝜂𝑘, it would mean that 𝑡𝑗 ’s hazard rate at 𝑇(𝑡𝑗 ), is higher than the cost-benefits

of attack at the maximum bubble size. 𝑡𝑗 would therefore sell prior to 𝑇(𝑡𝑗 ).

If 𝑡0𝑠𝑢𝑝𝑝 (𝑡𝑗 ) = 𝑡𝑗 − 𝜂𝑘, the bubble would burst at 𝑡0 + 𝜂𝑘 + 𝜏(𝑡𝑗 ). Since 𝜏(𝑡𝑗 ) > 𝜏(𝑡𝑖 ) the

minimum hazard rate of 𝑡𝑗 is given by ℎ∗ = 𝜆⁄1 − 𝑒 −𝜆𝜂𝑘 . At the same time the benefits of

attacking the bubble will be higher at 𝜂𝑘 + 𝜏(𝑡𝑗 ) than at 𝜂𝑘 + 𝜏 1 . This means that the cost-benefit

of attack is lower than the hazard rate and 𝑡𝑗 should have sold. Therefore is the sellout condition

violated, and the equilibrium is unique since the bubble can only burst of endogenous selling

pressure. 𝜏 ∗ cannot be higher than 𝜏 1 .

Furthermore. For 𝑡𝑖 > 𝜂𝑘 multiple equilibria can arise since the optimal riding time is only

determined by 𝜏(𝑡𝑖 ). It is therefore proved that the minimum and maximum of 𝜏(𝑡𝑖 ) cannot both

comply with the sell-out condition.

For 𝑡𝑖 < 𝜂𝑘 equilibrium is also unique. Their selling time equals the selling time of the last

investors who got aware. Selling out prior to that is clearly not an advantage since they will not

optimize the payoff from the investment.

6.4 Optimal behavior:

What is important to remember in this game is that any active players (aware investors), is looking

at the price bubble from their own perspective. Because of sequential awareness investors will

also sequentially sell.

Looking at the results should be done separately for endogenous and exogenous crashes. The

reason for this is the fundamental assumption behind them.

Beginning with exogenous crashes, the consequences of the previous assumption is that they

delay selling out at the time in which they expect the critical amount of investors to burst the

bubble. Therefore they commit their focus to ride the bubble until the hazard rate of the bubble

bursting from exogenous reasons becomes higher than the costs-benefits of attacking it.

Handelshøjskolen i Århus

2009

[39]

This means that investors becoming aware early will be able to ride the bubble effectively while

investors becoming aware to late will ride the bubble through the crash.

An important issue of this model is to identify which factors determine which kind of crash the

bubble will go through. Recapping from earlier we know that the dispersion of opinion is

significant. Likewise the absorption limit of irrational investors also has influence. If 𝑘 is sufficiently

large then it will have the same effect as 𝜂.

In an endogenous crash the optimal behavior is to ride the bubble for 𝜏 ∗ periods. This means, that

given 𝑡𝑖 ’s belief about the time where the bubble began a bursting date is estimated.

Correspondingly a payoff function based on these beliefs and the strategic possibilities is

formulated. Through iteration of non-best response strategies equilibrium is found. In reality an

investor would therefore ride the bubble for a while until costs of attacking the bubble compared

to the benefit equals the hazard rate of the bubble bursting.

In a larger perspective this means that rational investors that have become aware before the