ACCTG833_f2007_CHPT03D2

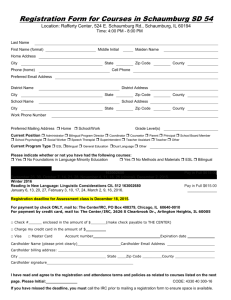

advertisement

Chapter 3 The Corporate Income Tax Tax Accounting Methods: Accrual Method Slide C3-3 Accrual Method [Reg. §1.446-1(c)(ii)] Income is taxable when: (1) All events have occurred that fix the right to receive income and (2) The amount of the income can be determined with reasonable accuracy Slide C3-4 Accrual Method Prepaid income Generally taxable when received under the Claim of Right Doctrine (government has the right to tax income when the taxpayer has unrestricted right to use such income amounts) Prepaid rent and royalty income is taxed when received regardless of accounting method [Reg. §1.61-8] Prepaid service income is taxed as it is earned if it is required to be performed by the end of the tax year following receipt, otherwise, it is taxed when received [Rev. Proc. 71-21] Slide C3-5 Accrual Method [Reg. §1.446-1(c)(ii)] Expenses are deductible when: (1) All events have occurred that establish the fact of the liability (2) The amount of the liability can be determined with reasonable accuracy, and (3) Economic performance has occurred Slide C3-6 Accrual Method A liability (expense) is not incurred before economic performance occurs [IRC §461(h)(2)] Services (when provided) Property (when used) Workers compensation and tort liabilities (when paid) Tort is a wrongful act, injury or damage (not involving a breach of contract) for which a civil action can be brought Taxes other than real property taxes (when paid) [Reg. §1.461-4(g)] Exception for recurring items [IRC §461(h)(3)] Slide C3-7 Accrual Method Bad debt expense [IRC §166] Direct write-off method only is allowed for tax purposes (GAAP requires allowance method) Recognize income if account is repaid in a later year Slide C3-8 Accrual Method Accrued compensation must be paid within 2½ months after year-end or deduction is delayed [Reg. §1.404(b)-1T] Matching of deductions and income for payments to related parties [IRC §267(a)(2)] Slide C3-9 Example 4a: Accrued Compensation At the end of the fiscal year ended December 31, Y1, a corporation had accrued bonus payable of $100,000 to its Chief Executive Officer (a cash basis, calendar year taxpayer). How much does the corporation deduct in Y1 and Y2 assuming the CEO owns 2% of the corporation’s stock and the bonus was paid January 15, Y2? Answer: $100,000 deducted in Y1, $0 in Y2 Slide C3-10 Example 4b: Accrued Compensation At the end of the fiscal year ended December 31, Y1, a corporation had accrued bonus payable of $100,000 to its Chief Executive Officer (a cash basis, calendar year taxpayer). How much does the corporation deduct in Y1 and Y2 assuming the CEO owns 2% of the corporation’s stock and the bonus was paid on March 30, Y2? Answer: $0 in Y1, $100,000 deducted in Y2 Slide C3-11 Example 4c: Accrued Compensation At the end of the fiscal year ended December 31, Y1, a corporation had accrued bonus payable of $100,000 to its Chief Executive Officer (a cash basis, calendar year taxpayer). How much does the corporation deduct in Y1 and Y2 assuming the CEO owns 60% of the corporation’s stock and the bonus was paid on January 15, Y2? Answer: $0 in Y1, $100,000 deducted in Y2 Slide C3-12 Example 4d: Accrued Compensation At the end of the fiscal year ended December 31, Y1, a corporation had accrued bonus payable of $100,000 to its Chief Executive Officer (a cash basis, calendar year taxpayer). How much does the corporation deduct in Y1 and Y2 assuming the CEO owns 60% of the corporation’s stock and the bonus was paid on March 30, Y2? Answer: $0 in Y1, $100,000 deducted in Y2 Nontaxable Income and Nondeductible Expenses Slide C3-14 Nontaxable Income Proceeds from key man life insurance [IRC §101] Interest on state and local bonds [IRC §103] Income from discharge of indebtedness in the case of insolvency or bankruptcy [IRC §108] Slide C3-15 Nondeductible Items Illegal payments [IRC §162(c)] Fines and penalties [IRC §162(f)] Key-man life insurance premiums [IRC §264(a)] Expenses and interest allocable to income that is exempt from tax [IRC §265] Capital expenditures [IRC §263] Losses on sales or exchanges with related parties disallowed [IRC §267(a)(1) and (d)] Slide C3-16 Nondeductible Items Meals & Entertainment [IRC §274] 50% disallowed [IRC §274(n)] Entertainment tickets and skyboxes limits [IRC §274(l)] Other limitations and disallowances Slide C3-17 Nondeductible Items Excess officers compensation [IRC §162(m)] Applies only to publicly held corporations No deduction allowed for compensation in excess of $1,000,000 for “covered employees” Exception for “performance-based” compensation Slide C3-18 Nondeductible Items Start-Up Expenditures Definition [IRC §195(c)] General rule: No deduction allowed [IRC §195(a)] Election to amortize [IRC §195(b)] If the election is not made properly, expenses cannot be deducted until the corporation is liquidated Slide C3-19 Example 5: Start-Up Expenditures New Corporation was formed on March 1, 2006 and began doing business on April 25, 2006. The corporation incurred start-up expenditures (including depreciation, rent expense and employee compensation incurred during the training period before the corporation opened for business) of $52,000. If a proper election is not made in the first year tax return, none of the $52,000 is deductible until the business is liquidated Slide C3-20 Example 5: Start-Up Expenditures If a proper election is made under IRC §195(b) for the first tax year, expenses can be deducted as follows: 2006: 3,000 + (52,000 – 3,000) x 9/180 = $5,540 2007: (52,000 – 3,000) x 12/180 = $3,267 2008 through 2020: $3,267 2021: (52,000 – 3,000) x 3/180 = $812 Slide C3-21 Nondeductible Items Organizational Expenditures Definition [IRC §248(b) and Reg. §1.248-1(b)(2)] General rule: No deduction allowed [IRC §248(a)] Election to amortize [IRC §248(a)] If the election is not made properly, expenses cannot be deducted until the corporation is liquidated Example 6: Organizational Expenditures Slide C3-22 New Corporation was formed on March 1, 2006 and began doing business on April 25, 2006. The corporation incurred organizational expenditures of $25,000. If a proper election is not made in the first year tax return, none of the $25,000 is deductible until the corporation is liquidated Example 6: Organizational Expenditures Slide C3-23 If a proper election is made under IRC §248(a) in the first tax year, expenses can be deducted as follows: 2006: 5,000 + (25,000 – 5,000) x 9/180 = $6,000 2007: (25,000 – 5,000) x 12/180 = $1,333 2008 through 2020: $1,333 2021: (25,000 – 5,000) x 3/180 = $338 Charitable Contributions Slide C3-25 Charitable Contributions Charitable contributions are generally deducted in the year paid [IRC §170(a)(1)] Under IRC §170(a)(2), accrual basis corporation may elect to deduct contributions in the year accrued if Authorized by BOD during the year and Paid by the 15th day of third month after year-end Slide C3-26 Charitable Contributions Deductions for property contributions are generally based on FMV with several exceptions: Deduction for ordinary income or STCG property is generally limited to basis [IRC §170(e)(1)(A)] Deduction for tangible personal property put to an unrelated use is limited to basis [IRC §170(e)(1)(B)(i)] Deduction for patents and other intangibles is limited to basis (new law) [IRC §170(e)(1)(B)(iii)] Special rules for contributions of: Certain inventory and other property [IRC §170(e)(3)] Scientific property used for research [IRC §170(e)(4)] Computers for education [IRC §170(e)(6)] Slide C3-27 Charitable Contributions Limitation: Deduction in any tax year is limited to 10% of taxable income calculated before loss carrybacks, dividends-received deductions, and charitable contributions [IRC §170(b)(2)] and before taking the IRC §199 deduction Excess contributions carry forward for 5 years [IRC §170(d)(2)] Slide C3-28 Example 7: Charitable Contributions The XYZ Corporation has a $55,000 tax net operating loss carryforward from last year. In addition, the corporation reported the following income and expenses in its financial statements for the current year: Operating income Dividend income (15% owned companies) Charitable contributions Net income before taxes per books $1,800,000 175,000 (300,000) $1,675,000 Slide C3-29 Example 7: Charitable Contributions Assuming the operating income and dividend income is the same for tax and book purposes, what is the corporation’s charitable contributions deduction for the current year? Answer: Pre-tax book income $1,675,000 Add back contributions 300,000 Less: NOL carryforward (55,000) Total $1,920,000 Limitation (10%) $192,000 Deduction allowed Carryover to next year is $108,000