Chapter 4: Legal Aspects of Professional Engineering in Nepal

advertisement

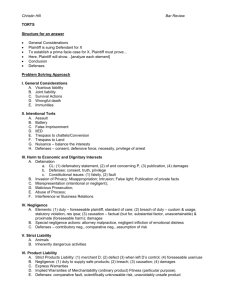

MNG 425.2 Professional Practices Chapter 4: Legal Aspects of Professional Engineering in Nepal (9 hour) 4.1 The Nepalese Legal System as it affects the Practice of Engineering The legal system of a nation includes the acts, rules, regulations, bylaws, treaties, conventions, policies, formation orders, promulgations, access to justice, freedom to choose legal advisor, concepts of “innocent until proven guilty”, and the implementation aspects of the written acts, rules, and regulations. The following are some of the acts related to engineering professional practice.1 The Patent, Design and Trademark Act, 1965 Labor Act, 1992 Insurance Act, 1992 Immigration Act, 1992 Foreign Investment and Technology Transfer Act, 1992 Industrial Enterprises Development Institute Act, 1996 Value Added Tax (VAT) Act, 1997 Environmental Protection Act 1997 Contract Act, 1999 4.2 Nepal Engineering Council Act, 1999 Nepal Arbitration Act 1999 Local Self Governance Act, 1999 Construction Business Act, 1999 Copy Right Act, 2002 Income Tax Act, 2002 & Regulation Company Act, 2006 Public Procurement Act, 2007 (amendment 2012) International laws and conventions, Bilateral agreements (WTO (23 Arp 2004), ILO, BIPPA) Provision for Private Practice and for Employee Engineers Provision for Private Practice Classification of Industries in Nepal Manufacturing Industries Energy-Based Industries Agro and Forest Based Industries Mineral Industries Tourism Industries Service Industries Construction Industries No licensing required to set up energy based industries in Nepal, but registration of the industry is required. Time bound Registration: 21 days. Department of Industries (DOI) for investment on fixed asset > NRs. 30 million. For less than that Registration will be done at the Department of Cottage & Small Industries (DCSI) Apart from the facilities granted by sectoral policies and acts, the ‘Industries’ may enjoy additional facilities as stipulated in Section 15, 16, 22 of the IEA 1992. No nationalisation of privately owned industries enterprises. Provision for Employee Engineers NEC registration of engineers required to be employed in any organization offering and performing engineering services. 1 Refer the link http://www.lawcommission.gov.np/ for a long list of the statutes, acts, rules, regulations, bylaws, treaties, conventions, policies and formation orders of Nepal. 1 4.3 Contract Law The History of law of contract in Nepal is not very long due to belated development of industry and commerce. Some provisions relating to contract could be found in Muluki Ain 1853. However the provisions of said Act were not sufficient There was pressing need to enact new Contract Act to cope with the demand of commercial sector. As a result, a separate Contract Act was enacted in 1966 a fairly detailed enactment on the law relating to contracts 4.3.1 The Contract Act 1966 The Contract Act 1966 had defined contract as an agreement act between two or more parties to do or not to do any act. It had made incompetence of parties to enter in to contract who was under the age of 16 years and person of unsound mind. However it was very short, insufficient and contradictory in some respects in comparison to the principle of law of contract. The Contract Act was enacted in 1999 and came in to force in 2000. 4.3.2 The Contract Act 1999 (for details, refer the Contract Act 2056) The Act has made effort to address the new aspects of contract law developed in the developed countries as the demand of industry and Commerce. The Act contains 90 sections in all. Section 2 has defined ‘contract’ as an agreement concluded between two or more parties for performing or not performing any act which could be executed according to law. 4.3.3 Essentials of a valid contract (RPA 76) To be binding and enforceable, a contract should have the following essential elements: a. Offer and acceptance: An offer is a promise made by a party (or person) to another party (or person) with an intention of getting approval over his/her promise. A tender submitted by a contractor is considered as offer. The client, after due consideration and evaluation of the offer, provides acceptance of the offer. b. Mutual intent to enter into contract: An agreement between two (or more) parties is not automatically considered to be a contract. A contract requires the parties intention to establish a legal relationship. Therefore, the parties’ intention of entering into contract should be clearly reflected in the agreement. c. Consideration: All the concerned parties of the contract should get something of value for fulfilling the terms and conditions of the contract. d. Capacity to contract: A party (or person) entering into a contract should be of legal age and should be under his/her own control. e. Lawful purpose: If the objective of the contract is unlawful, the contract is not considered valid. f. Free consent: The parties in a contract should have consented freely to enter into the contract. A contract signed under coercion, undue influence, fraud, misrepresentation etc are invalid. Hence, all the contract are agreement, but not all the agreements are contracts. 2 4.3.4 Void Contracts: The following contracts shall be void: (a) A Contract preventing anyone from engaging him/herself in any occupation, profession or trade which is not prohibited by prevailing law. Provided that a contract shall not be deemed to have been concluded in preventing profession or trade in the following circumstances: (i) A contract preventing the seller from engaging him/herself in a profession or trade at the time and place as mentioned in the contract concluded between the buyer and the seller on selling and buying of the goodwill of any trade; (ii) A contract concluded among partners in preventing their engagement in any trade or business, other than those of the partnership firm, similar to those of the partnership firm or any other trade or business together with other competitors belonging to the same kind of trade or business as long as the partnership continues. (iii) A contract concluded among the partners in preventing them from engaging in a trade or business under the partnership firm for the specified time or place after being separated from the partnership; (iv) A contract preventing any individual from receiving the service of any such agency, company, firm, individual or competitor of such agency, company, firm, or individual for the specified period of time after the retirement from service or during the service of such agency, company, firm or individual pursuant to contract concluded by any individual with any agency, company, firm or individual. (b) A contract restraining marriages other than those prohibited by the prevailing law. (c) A contract preventing any one from enjoying the facilities already being enjoyed by the general public. (d) A contract seeking to prevent the legal rights of any person from being enforced by any government office or court. (e) A contract concluded in matters, contrary to or prohibited by the prevailing law. (f) A contract concluded for immoral purpose or against Public morality or public interest. (g) A contract which cannot be performed because the parties thereto do not exactly know about the matter in relation to which it has been concluded. (h) A contract which is considered impossible to fulfill even at the time the contract is concluded. (i) A contract which is vague as it does not provide reasonable meaning thereof. (j) A contract concluded by an incompetent person to conclude such contract. (k) A contract concluded with an unlawful consideration or objective. 4.3.5 Voidable Contracts: The following contracts may be made void by the aggrieved party: (a) A contract concluded through coercion: Explanation: A person shall be deemed to have indulged in coercion if he/she, with the objective of compelling any person, to accept any contract against his/her will, withholds or threatens to withhold property belonging to him/her, or threatens to defame him/her, or takes or threatens to take any other action in contravention of prevailing law. (b) A contract concluded through of undue influence: Explanation: (1) Undue influence means influence exercised by a person upon another person who is under his/her influence and is amenable to his/her personal benefit or interest. (2) Without prejudice to the generality of Clause (1), the following persons shall be deemed to be under the influence of any person and amenable to his/her wishes: 3 (i) A person living under his/her guardianship, protection or custody. (ii) a persons who cannot take care of their interest temporarily or permanently by reason of old age, sickness or physical or mental weakness. (iii) A person who can be subjected to under one's economic or ranking influences. (c) A contract concluded through fraud: Explanation: A party to the contract or his/her agent shall be deemed to have committed fraud if he/she, leads the other party or his/her agent to believe or takes any action to believe the particular matter is true, although he/she knows that it is false, or suppresses any information in his/her possession, or indulges in any other fraudulent act punishable under prevailing law, with the intention of deceiving the opposite party or his/her agent. (d) A contract concluded through deceit: Explanation: (1) Any of the following act shall be taken as deceit: (i) Submission of false particulars on any matter without reasonable basis for doing so; (ii) Misleading any party so as to aggrieve him/her; (iii) Causing any wrong deliberately on the matter of contract; (2) In a case of a voidable contract under this section, the following matters shall be dealt with as prescribed below: (i) The party caused to enter into a contract may, instead of making the contract void, demand his/her position to be remained the same, as it was prior to conclusion of the contract. (ii) Burden of proof of innocence of undue influence shall be rest in the party who claims that such contract is not concluded under an undue influence in case a contract is concluded with the person who is under one's influence and amenable to his/her wishes. 4.3.6 Significance of a Contract The following are the significance of a contract. 1. To make agreement legally enforceable 2. To record the terms of agreement 3. To specify the roles and responsibilities of each party of the contract 4. To specify corrective measures in case of breach of contract 5. To specify quantity and quality of work to be done, work schedule and payment schedule and mode 6. To identify parties of the agreement, and the official agents/representatives of the parties, if any. 7. To set out in advance the course of action to be taken in different foreseeable situations 8. To define words and establish common language 9. To define limitations of the contract 10. To define contract termination procedure 11. To define responsibilities of the contracting parties to the third parties like government, community, workers, sub-contractor, material supplier, unions etc. 4.3.7 Factors to be considered in preparing a contract document The contract must be fair to all the parties entering into the contract. The language used in the contract must be clear (unambiguous). 4 The contract language must be consistent. Same word, phrase or abbreviation should not have different meaning in different location. There should be no repetitions, as it tends to create confusion. Contract information must be retrievable by all the parties entering into contract, whenever they need it. So multiple original copies of the contract should be prepared. The terms of the contract should not conflict with existing laws. 4.3.8 Interpretation of a contractual clause (RPA 78) In general, contractual terms are interpreted on the following basis. a. If the language in the contract is clear, the words and terms are interpreted on the basis of the intention of the parties, which is reflected in the contract. b. If the words and terms are not used to give special (or technical) meaning, the words and terms are explained or understood in their ordinary meaning. c. If the words or terms are ambiguous or vague or used to give special (or technical) meaning, them outside help is taken in the interpretation of the words. d. If the contract is ambiguous, with double meaning, or contains conflicting provisions, such words, terms or contractual clauses are interpreted in favor of the party who has not drafted the contract. This rule of interpretation is called contra proferentem rule. Contra proferentem (Latin: "against [the] offeror"),[1] also known as "interpretation against the draftsman", is a doctrine of contractual interpretation providing that, where a promise, agreement or term is ambiguous, the preferred meaning should be the one that works against the interests of the party who provided the wording.[2] The doctrine is often applied to situations involving standardized contracts or where the parties are of unequal bargaining power, but is applicable to other cases.[3] However, the doctrine is not directly applicable to situations where the language at issue is mandated by law, as is often the case with insurance contracts and bills of lading.[4] The reasoning behind this rule is to encourage the drafter of a contract to be as clear and explicit as possible and to take into account as many foreseeable situations as it can. Additionally, the rule reflects the court's inherent dislike of standard-form take-it-orleave-it contracts also known as contracts of adhesion (e.g., standard form insurance contracts for individual consumers, residential leases, etc.). The court perceives such contracts to be the product of bargaining between parties in unfair or uneven positions. To mitigate this perceived unfairness, legal systems apply the doctrine of contra proferentem; giving the benefit of any doubt in favor of the party upon whom the contract was foisted. Some courts when seeking a particular result will use contra proferentem to take a strict approach against insurers and other powerful contracting parties and go so far as to interpret terms of the contract in favor of the other party, even where the meaning of a term would appear clear and unambiguous on its face, although this application is disfavored. Contra proferentem also places the cost of losses on the party who was in the best position to avoid the harm. This is generally the person who drafted the contract. An example of this is the insurance contract mentioned above, which is a good example of an adhesion contract. There, the insurance company is the party completely in control of the terms of the contract and is generally in a better position to, for example, avoid contractual forfeiture. Source: http://en.wikipedia.org/wiki/Contra_proferentem; accessed: June 8, 2014 5 4.4 Liability and Negligence (Nichols 2006) Liability A society can legally impose liability for actions based on a variety of criteria. The following discussion will address three resulting categories of liability: contract liability, criminal liability, and tort liability. 4.4.1 In assigning liability under contracts, society imposes liability based upon an exchange of promises (an agreement). As a result, contract liability imposes responsibility for the protection of a single limited interest of individuals (namely, their interest in what others have promised them). Contract law imposes liability on a party for promises that the first has made to another party. 4.4.2 In assigning liability under criminal law, society can protect the broader interests of the public (as a whole, not as individuals). In criminal law, society claims an interest in certain conduct (criminal conduct) that may bring harm to individuals. The state brings legal actions for criminal acts, such as theft or murder, although an individual member of society may be harmed. In that case, the defendant has a liability to the state. (The defendant may also have liability for the harm to the individual under civil (or tort) law for the same act.) 4.4.3 Liability under tort is a legal mechanism for compensating individuals injured by others. In that case the injured party (the plaintiff) may bring a legal action against the injuring party (who then is the defendant). Tort law is 'directed toward the compensation of individuals, rather than the public, for losses which they have suffered within the scope of their legally recognized interests generally rather than one interest only, where the law considers that compensation is required' 4.4.4 Objectives of tort provision Compensation to the victims of the action or inaction of someone else. Transferring the cost of injury from the victim to the person responsible for the injury. Prevention of repetition of harmful action. Defending the law and rights of victim. 4.4.5 Vicarious Liability: A company is liable for the acts of its own and its employees. Three tests are used to ascertain the degree of vicarious liability. a) Control test: The more control a company has over a person (employee) the more liable the company is. b) Business integration test: The more the work of a person is integrated into the work of a company, the more liable the company is for the acts of the person, even if the person is not a direct employee of the company. c) Multiple test: Control test, business integration test, and other related factors are taken into consideration to determine the degree of liability. 4.4.6 Partnership Liability: Liability of the partners in tort: The partners of a company are liable for the acts of one (or more) of its other partners. 6 4.4.7 Duties and Liabilities of Designers/Professionals i. Fitness for purpose ii. Negligent misstatement iii. Statutes, bylaws and building regulations/codes iv. Examination of site above and below the ground v. Public and private rights vi. Plans, drawings and specifications vii. Materials (quantity, quality and availability) viii. Novel, risky design and employers’ interference in design ix. Revision of design during construction Negligence Negligence is 'conduct which falls below the standard established by law for the protection of others against unreasonable risk of harm'. In order to establish liability for damage, the courts analyze the following four elements, each of which is defined below: 1. duty 2. breach 3. proximate cause 4. damages A defendant may be found liable when that defendant breaches a duty of care to the plaintiff, and the breach of that duty is the proximate cause of loss or harm to the plaintiff (“damages”). In order to be awarded compensation by the courts, a plaintiff must prove all four, namely that the defendant had a duty to the plaintiff, that it was breached, and that that breach was the proximate cause of the loss or harm to the plaintiff. The most general duty under tort law is to exercise 'reasonable care' to avoid harm to others. A person has this obligation (duty) to all other persons at all times. The root of negligence (neglect) is 'imports an absence of care or attention on the doing or omission of a given act'. People have the responsibility to exercise reasonable care toward others. The law of negligence seeks to assign liability for damages to parties due to of the failure of others to be sufficiently careful of their interests. One of the purposes of tort law is to compensate a victim for injuries suffered by the acts (or unreasonable omissions) of others. Legal concepts of negligence and fault are related to moral fault but 'fault' under negligence law is not synonymous with “morally blameworthy”. ''Fault' is a failure to live up to an ideal of conduct'. Although some failure to perform in the ideal way may be blameworthy, a person might be free of moral blame for a failure to live up to some ideal of conduct due to such things as sudden illness over which the person had no control. Concepts of strict product liability, however, are not generally related to moral fault. The breach of duty required for behavior to be negligent in the legal sense is a failure to fulfill the obligation of reasonable care under standards established by society (generally). Liability under negligence requires a sufficient casual connection between plaintiff's conduct and defendant's damages. Causation sounds like an easy concept, but the application of the concept proves troublesome. The connection required is 'proximate cause'. Let us distinguish two notions: 'cause in fact' and 'legal cause'. Cause in fact examines the factual connection between the defendant's conduct and the loss or harm to the plaintiff. The defendant's conduct is not a 'cause in fact' of the event if the event would have occurred in the 7 absence of the defendant's conduct. The defendant's act must have been a necessary condition for the harm done to the plaintiff; 'but for the conduct of the defendant' the damages would not have occurred. Establishing that the defendant’s action was a necessary condition for the occurrence of harm, although it establishes cause in fact, does not establish negligence, however. Proximate cause requires more than cause in fact. It requires 'legal cause' or 'responsible cause'. Proximate cause requires a sufficiently close relationship of the breach of a duty to the harm suffered by a specific victim. This requires that the breach be more than simply a necessary condition for the damages. Proximate cause refers to legal proximity that in fairness allows the defendant to be held financially responsible to the plaintiff for the alleged tortious conduct. A defendant will not be held responsible for all damages which are 'caused in fact' by her conduct. Proximate cause relates to the concept of duty. A defendant has an obligation to exercise 'reasonable care' to all other persons at all times. Proximate cause addresses whether the defendant was under a duty to protect this particular plaintiff against the particular event that injured the victim of that breach of duty. Note that the plaintiff must actually have suffered damages to recover compensation from the plaintiff. That is not to say that the defendant was not negligent, but tort law generally is not intended to punish negligent behavior itself, but to compensate 'innocent' parties for the harm innocent parties suffered from the negligence of others. As a result, it is entirely possible that a negligent party exhibits negligent (or even grossly negligent) behavior, but will not be held liable (under tort law) for his or her negligence Professional Negligence Establishing liability for professional negligence requires the same four elements as negligence in general: duty, breach, proximate cause, and damages. Professional negligence represents a breach of the duty to exercise the degree of care and skill which is exercised by 'reasonably' qualified professionals in a field. Professionals expose themselves to liability under the legal concept of negligence when their conduct represents substandard care as defined by the profession. Note that liability does not necessarily result from below average care, but from substandard care, a distinction that is illuminated by the definition of malpractice in Black's Law Dictionary: Professional misconduct or unreasonable lack of skill...Failure of one rendering professional services to exercise that degree of skill and learning commonly applied under all the circumstances in the community by the average prudent reputable member of the profession with the result of injury, loss or harm to the recipient of those services or to those entitled to rely upon them. It is any professional misconduct, unreasonable lack of skill or fidelity in professional or fiduciary duties, evil practice, or illegal or immoral conduct. 'Professional negligence' represents a special case of negligence in which society holds members of a profession responsible for meeting a standard of care and competence. Members of the profession generally define the standard of care to be provided. For example, courts generally require that a plaintiff must provide testimony from a structural engineer to establish the standard of care used by structural engineers. As stated above, it is possible for an engineer to exhibit professional negligence without being held liable (under concepts of torts) for his or her actions if there was no harm or loss to others. That does not make the behavior less negligent, just less costly. 8 It is also possible in US jurisdictions to be held liable under tort theory for the results of professional activities in the complete absence of negligence. In fact, it is possible to be held liable for the result of professional activities even if the professional exhibits the highest standards of professional conduct. 4.5 Business and Labor Laws 4.5.1 Business Law Laws related to functioning of business are business laws, Human activities that are related to production, sales and/or exchange of goods and services with profit making objective is business. The norms drafted and enforced by a state or local government in order to regulate the activities within that state or locality. Ignorance is law is not an excuse. 4.5.1.1 Sources of Business Law a) English Business Law i) Common Law of England ii) Law of Merchants iii) Principal of Equity iv) State of the Legislature b) Customs and Usages c) Nepali Statutory Acts d) Judicial Decisions e) Writings and Opinions of Scholars f) Commercial Treaties and Agreements 4.5.1.2 Types of Business Enterprises Three types of business concerns exist: (a) Sole Business Concern, (b) Partnership business organization, and (c) Limited Company. a) Sole Business Concern In this type of business concern, single person establishes, manages, organize and control the whole business and also singly liable towards the profit and loss of the business. It is registered under Private Firm Registration Act 2014. i) Characteristics of Sole Business Concern a) Sole ownership, management and control: A single person establishes, owns, manages and controls all aspects of the business. b) No separate existence of business and owner: Owner and business do not have separate identity; the owner represents the business; insolvency of owner dissolves the business. c) Unlimited liability: The sole owner is liable to pay debt not only from business property, but also from personal property, if needed. d) Ownership and risk: The owner bears sole risk and owns total profit. 9 e) Individual capital investment: Capital is invested by owner only from personal property. f) Freedom of Occupation: Easy to form and less capital needed. Can choose occupation best suited to situation. g) Limited area of operation: Due to limitation of financial and human resources, the area of operation is limited. h) Less legal formalities: The requirements to establish and operate sole business concern are much less compared to other forms of business. i) Voluntary origin and end: The owner can start and end business, by fulfilling certain legal formalities. ii) a) b) c) d) e) f) g) h) i) j) k) l) Advantages of Sole Business Concern Easy to form or establish Effective management and control Easy to dissolve High flexibility Quick decision Sole claim on profit Secrecy Benefit of inherited goodwill Credit Standing Direct relationship with customer Social and National advantage Stability and Continuity iii) a) b) c) d) e) f) g) h) i) Disadvantages/Limitations of Sole Business Concern Unlimited liability Limited capital Limited management Limited expansion Absence of legal status Chances of wrong decisions Lack of specialization Loss in the absence of a key person Uncertain future b) Partnership Business Organization (PBO) In this type of business organization, more than one person contract to start a business to earn and share profit by investing and managing collectively. This type of business organization is registered under the Partnership Act 2020 BS (1964). Characteristics of Partnership Business Organization 1. Plurality or association of persons 2. Joint ownership 3. Unlimited liability 10 4. 5. 6. 7. 8. 9. Sharing of profit and loss Established on the basis of agreements and between the persons Members do not have separate existence Joint management and control Joint agentship Partnership right cannot be transferred/ No transfer of interest Advantages of Partnership Business Organization 1. Easy to form: relatively easy to form and register 2. Capital and credit: better than Sole Business Concern 3. Advantages of Division of Labour: each partner can lead in his/her specialization 4. Integration of Ability and Skill: Knowledge, ability and skill of multiple investors/partners can be utilized. 5. Quick Decision Making: Relatively quicker decision making process compared to limited company 6. Incentive to work hard: Since profit is to be shared only among partners, there is incentive to work hard. 7. Flexible: Can change mode of business based on changes in market situation, without much difficulty. 8. Safeguard of the interests of minorities: Decisions are normally taken with consent of all, hence smaller partners also have equal say in decision making. 9. Reduced risk: Risk is reduced, compared to Sole Business Concern, because risk is distributed among partners. 10. Possibility of Expansion: Partners can be added, which increases possibility of more fund for expansion of works. Limitations/Disadvantages of Partnership Business Organization 1. Unlimited liability: Partners are individually and jointly liable for the full amount of loss. 2. Uncertain existence: Partnership business can suddenly collapse due to conflict among partners or due to sudden demise of a partner or due to certain action of a partner. 3. Limited resources (financial and human): Compared to a joint stock company, the resources are limited in partnership business. 4. Possibility of misunderstanding/disagreement and friction among the partners: Due to different interests of each partner, there is possibility of misunderstanding/disagreement and conflict/friction among partners, which can negatively impact PBO. 5. Difficulty in transferring ownership: Consent of other partners is required for transfer of ownership, so one partner cannot sell his/her ownership to anyone whom he/she likes. 6. Slow decision making compared to Sole Business Concern: Decisions are made by consent, so the decision making can be slow. 7. Less of public faith: Financial status statements are not made public, hence there is less public faith in PBO. 11 c) Limited Company (Joint Stock Company) Limited company is established under the act of the country and has limited liability. Finance is collected through issuance of shares. Company is considered as an artificial legal person. Company Act 2053 regulates the incorporation of a company in Nepal. Company can be further divided into two as private limited company and public limited company. As per Company Act 2053, private limited company shall have less than 50 share holders and public limit company shall have minimum of 7 (no upper limit) share holders. Characteristics of Limited Company 1. Voluntary association of persons: Company is an association of persons for business. 2. Legal artificial person: Company is an artificial legal entity (person). It can purchase and sale properties in its own name. It can sue and can be sued. 3. Perpetual existence: Action of one particular shareholder does not affect its continuity. 4. Limited liability: Shareholders are owners of the company, but their liability is limited only up to the amount of their share. 5. Common seal: Company uses a specific seal for all its official business/transactions. 6. Capital collected by distributing shares: capital needed for expansion of business is raised by issuing shares 7. Transferability of shares: ownership shares can be sold to anyone interested to purchase. 8. Management by representatives: management board formed by election of shareholders’ representatives, and managed as per stated rules rather than by whims of owners 9. Publication of financial statements: Regular publication of audited financial statements, normally made public during Annual General Meeting Advantages of Limited Company 1. Limited liability 2. Perpetual existence 3. Transfer of shares 4. Effective management 5. Unlimited capital 6. Public faith 7. Unlimited business capability Disadvantages of Limited Company 1. Difficulty in formation, lengthy legal and format process 2. Lack of personal interest 3. Lack of secrecy 4. Possibility of fraud 5. Exploitation of share holders 6. Groupism for power (Office politics) 7. Conflict of interest 8. Absence of prompt decision 9. Lack of closeness 12 4.5.2 Labor Laws Labor Act 2048 has some special provisions related with construction industry. Before the promulgation of the Labor Act 2048, the act related to labor was Factory and Factory Workers Act 2019 in Nepal. Productive Work: The following works are defined as productive work. 1. The process of using the goods with the purpose 2. of manufacturing of goods, alterations, repair and maintenance, fabrication, packaging, oiling, washing, cleaning, dismantling, breaking into pieces, or use of goods, sales, and distribution, transportation or taking to the destination 3. Pumping of oil, water and wastes 4. Energy storage, alteration, and transmission work 5. Printing press, lithography, photography and the works like … Enterprise Enterprise is defined as any factory, organization, institution, firm, or their group established for the operation of industry, business, or services under the stature and having minimum of 10 or more staff or workers. This also covers: Tea estates established for commercial purpose following the stature Enterprises established in the industrial area, even if having less than 10 staff of workers Staff and Workers In general all the persons involved in administrative tasks of the enterprise are called staff and the persons involved in production or services are called workers. Children: All the persons under the age of 14 years are called children. Minor: All the persons between the age of 14 and 18 are called minor. Seasonal enterprise: The enterprise that cannot be operated all the season, except in a certain season. It also covers the seasonal enterprise that cannot be operated more than 180 days in a year. Sugar factories are examples of seasonal enterprise. Working Hours: Maximum 8 hours a day or 48 hours a week has been fixed as working hour. Workers are provided one-day leave in a week. Workers shall be provided with 30 minutes of break for tiffin and rest. No workers shall be kept working continuously for more than 5 hours. This break shall be also counted in regular working hour. Workers of staff shall be provided extra remuneration for the overtime work that is for working more than 8 hours a day or 48 hours a week. However, no worker or staff shall be forced to work overtime. In general, no worker or staff shall be allowed to work overtime for more than 4 hours a day or 20 hours a week. 13 Health and Safety Manager of an enterprise is responsible: 1. In keeping clean the workplace 2. In managing sufficient air, light, and temperature 3. In managing waste disposal 4. For clearing all the foul dust, air, vapor, and any other foul substance that may cause hazard to health 5. For preventing workers from loud noise 6. A worker shall be provided 15 cu. m. space. In calculating this volume, only 4 m height measured form floor level is considered. 7. For arranging water (drinking and sanitation) 8. For arranging toilets separate for ladies and gents 9. Considering the nature of the work, the working area shall be made non-smoking area 10. Arranging for medical checkup for staff and workers at least once in a year in the enterprises having probability of health hazard 11. For other protective measures such as prevention of eye, prevention from chemicals, prevention from fire etc. Welfare Activity 1. Establishment of welfare fund, compensation, housing for workers, and staff, and leave are also dealt in the law 2. A rest room shall be provided in an enterprise having 50 or more workers or staff 3. There shall be a canteen in an enterprise having 50 or more workers or staff Provision for children and women In the enterprise having more than 50 or more women workers, a room shall be provided for the children of the women workers or staff. Children shall be provided with toys and a trained person to look after them. Also, the mothers of the children shall be given break to feed the babies. Special provision for special enterprises The Act has considered construction as one of the special enterprises. The special provisions, besides the general provisions discussed above, are dealt under this chapter. According to the Act, construction workers covers – building, road, bridge, tunnel, canal, railway construction, electricity or telephone or telegraph assembling works. The following are the special provisions for construction industry. 1. Tools shall be provided by the management 2. Management shall manage for shelter, food, drinking water etc. 3. All construction workers shall be insured against the construction risk. 4. Construction site shall be kept safe. 5. Management shall arrange necessary personal protective equipment (PPE) 14 4.6 Relationship to Foreign Firms working in Nepal (TBG 58) WTO (established. Jan 1 1995): It is a new version of the General Agreement on Trade and Tariffs which was established in 1947 with the objectives of reducing tariffs, removing the trade barriers and facilitating trade. Nepal became WTO member on April 23, 2004. The objectives of WTO: a) To raise standards of living b) To ensure full employment c) To promote sustainable development and environment protection d) To ensure the developing countries share in the growth of international trade The major functions of WTO: a) To administer the WTO agreements b) To handle trade disputes c) To monitor national trade policies d) To serve as a forum for trade negotiations e) To cooperate with other international organizations FDI: Foreign Investment and Technology Transfer Act 1992 Salient features of FITTA 1992: 1. Foreign investors are permitted to own up to 100% equity shares in Energy based industries. 2. Foreign Investment means following investment made by a foreign investor in any industry: a) Investment in share, (Equity), b) Reinvestment of the earnings derived from the clause (a) above, c) Investment made in the form of loan or loan facilities. 3. Technology Transfer means any transfer of technology to be made under an agreement between an industry and a foreign investor on the following matters: a) Use of any technological right, specialisation, formula, process, patent or technical know-how of foreign origin, b) Use of any trademark of foreign ownership, c) Acquiring any foreign technical Consultancy, management and marketing service 4. Technology transfer is possible even in areas where foreign investment is not allowed. 5. Permission of the DOI is required to get approval for foreign investment, technology transfer, loan investment and other related agreements 6. For projects with fixed asset of over NRs. 2 billion, Director General of DOI can approve the FDI. Proposal with investment above that, Investment Promotion Board (IPB) grants approval. 7. 100% repatriation possible on the proceeds obtained from the sale of shares, profit or dividend earned on investment on shares, loan principal and interest, fees/royalties in lieu of Technology Transfer 8. Provision Related to Visa: On recommendation of the DOI, following types of visa can be granted by the Department of Immigration i. Non-tourist Visa for up to 6 months, to conduct study or research for making investment ii. Business Visa (to foreign investor, dependent family, authorised representative) up to 5 years at a time till the foreign investment is retained. This visa can also be granted to experts deputed under TTA. iii. Residential Visa: Investment > USD 100,000 at a time 15 9. Provision Related to Dispute Settlement: Parties to settle the dispute in the presence of DOI Arbitration, in accordance with the prevailing arbitration rules of the UNCITRAL at Kathmandu However, in case of projects with fixed asset investment of over NRs. 500 million, disputes may be settled as mentioned in the JVA. In DOI, clear procedures for FDI approval have been laid out for different forms of foreign investment Establishing a new industry either with 100% equity or in Joint Venture (JV) with Nepalese investor/s. Making an equity investment in an existing Nepalese industry by Share Transfer Making a loan investment in an existing Nepalese industry (foreign or local) Engage in Technology Transfer in an existing Nepalese industry Additional Procedures for new proposals (after getting approval for FDI) before commencing the project implementation Incorporate the company at the Company Registrar’s Office Register the industry at DOI (Conditional when the project has to conduct IEE/EIA) Registration at Inland Revenue Office to get Permanent Account Number (PAN) Some of the key institutional arrangements that have been made to promote foreign investment in Nepal are: Nepal is a member of the Multilateral Investment Guarantee Agency (MIGA) and the World Intellectual Property Organisation (WIPO) Nepal has entered into Bilateral Investment Treaties (BITs) with countries such as France, Germany, Mauritius, and United Kingdom. Nepal has also entered into Double Taxation Treaties (DTTs) with 9 countries, namely, India, Norway, China, Pakistan, Sri Lanka, Austria, Thailand, Mauritius, and Republic of South Korea Nepal is also a signatory to the Convention on the Settlement of Investment Disputes between States and Nationals of Other States and a member of the International Centre for the Settlement of Investment Disputes (ICSID), associated with the World Bank. Laws related to FI in Nepal Sector Specific Laws (Civil Aviation, Hydropower, Food Control, Drugs, Telecommunication etc) Foreign Investment and Technology Transfer Act, 1992 Industrial Enterprise Act, 1992 Built Own Operate and Transfer (BOOT) Act and Regulation Financial Transaction Act & Regulation (Nepal Rastra Bank) Company Act Immigration Act & Regulation Income Tax Act & Regulation Value Added Tax (VAT) Act & Regulation Environmental Protection Act & Regulation Labor Act Insurance Act & Regulation 16 4.7 Conflict and Dispute Management (RPA 165) 4.7.1 Approaches to Conflict Traditional: Conflict is harmful; avoid conflict. Behavioral: Conflict is inevitable outcome of behavioral interactions. Conflict cannot be avoided, accept conflict. Interactionist: Conflict is necessary. Conflicts within a manageable limit are beneficial. Functional (constructive): The conflicts supporting goals of the group that helps in performance improvement. Dysfunctional (destructive): The conflicts hindering group performance. 4.7.2 Levels of Conflict a) Intrapersonal conflict: conflict within self due to differences in goal, role, and personal values b) Interpersonal conflict: between two or more persons; can be due to differences in goal, role, values, culture, communication gap c) Intergroup conflict: between two or more groups of people d) Inter-organizational conflict: between two or more organizations 4.7.3 a) b) c) d) e) f) Sources of Conflict Personal differences/Personality clash Goal and role incompatibility Organizational climate and change Gender and other social differences Availability and access to resources, and Communication gap 4.7.4 Conflict Resolution Methods a) Avoidance: avoid conflict, ignore conflict, “time will heal” b) Defuse (resolve): distraction and defuse into multiple sectors c) Containment: conflict contained within certain people, and resolved through discussion and bargaining d) Confrontation: conflict brought in front of all concerned, conflict resolution through open dialogue, face-to-face meeting, open bargaining, and resorting to legal process, if needed. e) Conciliation: Mutually agreed terms and conditions, “give and take” approach, without direct involvement of outsiders (mediator), even though the mediator assists in bringing the parties together. f) Mediation: similar to conciliation, but with direct involvement of outsiders (mediator). 4.7.5 Dispute Disputes, claims and variation are inevitable in construction projects and in engineering professional works. Minor disputes can evolve into something more serious with a significant risk of loss for one or both parties. Disputes may lead to delays, disruptions or a complete halt to the progression of a project. In many cases the personal aspect of the dispute makes the situation worse potentially manifesting into the loss of a prospective long-term business relationship. Dispute resolution procedures are normally mentioned in the conditions of contract. The Public Procurement Act 2063 (PPA 2063) and Public Procurement Rules 2064 (PPR 2064) 17 have provisions for dispute resolution. If the parties in dispute cannot resolve the dispute through mutual consensus (amicable settlement), then: a) For works of value up to Rs. 100 million, disputes can be settled by sole adjudicator. b) For works of value above Rs. 100 million, disputes shall be settled by a Dispute Resolution Board (DRB) consisting of three members. c) If the parties cannot settle dispute through adjudicator or DRB, then the dispute can be resolved through arbitration or litigation (court). 4.7.6 Adjudication The adjudication is “a quick and relatively inexpensive way of resolving a dispute, whereby an impartial third party adjudicator decides the issues between the parties”. The following are the characteristics of adjudication. a) It is a mechanism of dispute resolution. b) An independent third party, called adjudicator, awards the decision c) Quicker and inexpensive mechanism of dispute resolution, compared to arbitration and litigation, normally taking less than 30 days The Public Works Directive (PPD) and the Public Procurement Act (PPA 2063) have provisions for dispute resolution through adjudication. 4.7.7 Arbitration The arbitration is a formal mechanism of dispute resolution conducted outside a court. The following are the advantages of arbitration over litigation. a) It is a private alternative to formal court procedure. b) The arbitrators are normally technical experts c) Less time consuming d) Less expensive e) No public hearing, so low publicity (which is normally preferred by the parties) f) Less formal, hence more convenient to the parties of dispute The PPA 2063 has recognized arbitration as a means of dispute resolution. The Arbitration Act 2038 governs the arbitration process in Nepal. The Nepal Arbitration Council 1991 has been providing arbitration services in Nepal. However, in Nepal, most of the disputes go to court, or settled out of court through mutual consent, even after arbitration, by ignoring the arbitrators’ decisions. 4.8 Intellectual Property Right, Patent Right, Copy Right, Trademark (RPA 156) The creations of human mind are considered as intellectual property. It covers patents, designs, trademarks and copy right, and the legal rights given to the creators of such properties are called intellectual property rights. The World Intellectual Property Organization has listed the following as intellectual property. a) Literary, artistic and scientific works b) Performances of performing artists, phonograms, and broadcasts c) Inventions in all fields of human endeavor d) Scientific discoveries e) Industrial designs f) Trademarks, service marks, and commercial names and designations g) Protection against unfair competition, and 18 h) All other rights resulting from intellectual activities in industrial, scientific, literary or artistic fields The laws related to intellectual property rights in Nepal are: (a) Patent, Design and Trademark Act 2022 (1965), amended in 1987 and (b) Copyright Act 2059 (2002). 4.8.1 Patent: As per the PDT Act 2022, the patent can be issued to any useful invention based on new principle or formula, or any new way or method of construction, operation or transmission related to substance or a body of substance. A patent should be duly registered, by submitting all the required documents, to have the patent right. Once registered, the right over the patent is protected for 7 years (plus two extensions, each of 7 years). The patent right is transferrable. The registered patent should not be used or copied without obtaining specific written permission from the patent holder, until the patent duration expires, within the jurisdiction of the patent provider. The law breaker can be fined up to Rs. 500000 and confiscation of the related items, and up to Rs. 250000 for committing an attempt of an offence. A patent right cannot be granted if: a) The patent is already registered in another person’s name b) The patent was not invented by the applicant and the right to patent has also not been received from the inventor c) The patent is likely to produce adverse effects on health, conduct and morality of the citizen or on national interest d) The patent is against the existing law Design The PDT Act 2022 has defined design as a feature, pattern or shape of a substance made by following any means. The design should be registered to have design right. A registered design should be used by someone else only with specific written permission of the design right holder, until the design right duration expires (5 years plus two extensions each of 5 years). The design right cannot be issued if (a) the design was already registered by someone else, and (b) the design is likely to have adverse impact on the conduct or morality of a person or institution or on national interest. The breach of the design right constitutes a fine of up to Rs. 50000 and confiscation of the related items. Trademark The PDT Act 2022 has defined trademark as the use of any word, sign or picture or a combination of them by a firm, company or person to distinguish the product or services from those of others. The trademark should be registered to have trademark right. A registered trademark, or its close imitation, should not be used by someone else. The right over a trademark can be protected forever subject to renewal (7 years in each renewal). The trademark will not be registered if (a) the trademark has already been registered by someone else and (b) the registration will have adverse impact on the conduct or morality of a person or institution or on national interest. The breach of the trademark right constitutes a fine of up to Rs. 100000 and confiscation of the related items. The PDT should be registered in Nepal, to be effective in Nepal. 4.8.2 Copyright (RPA 160) 19 As per the Copy Right Act 2059, the copy right can be provided to the author of the works that are related to the following. a) Book, pamphlet, article, and research paper b) Drama, opera, dumb-show and similar works prepared for show c) Musical works with or without words d) Audiovisual works e) Architectural design f) Painting, sculpture, wood carving, lithography and architecture related other works g) Photographic works h) Works related to applied art i) Excerpt, maps, plan, three dimensional works related to geography, topography, and scientific writing and articles j) Computer program. The description or the explanations of the ideas, religion, news, concept, formula, law, court decisions, administrative decisions, folk songs, folk stories, proverbs and general statistics, even if they are included in any works, cannot be copy righted. Specific registration is not required to have copy right. There are two types of rights granted under the Copy Right Act: Economic and Moral. Moreover, the Act has granted rights to performers, producers of phonograms and to broadcasting institutions. The copy right is effective up to 50 years after the death of the author (or creator) of the copy righted materials. The copy righted materials can be used without permission in the following circumstances. a) A portion of the work for personal use, as long as it does not hamper the economic right of the copy right holder. b) For public cause or academic purpose, portion of a published materials may be used with proper citation of the source, provided that the use does not directly benefit (economically) the user of the copy righted materials. c) Libraries and archives can reproduce the works for general purpose. Depending on the degree of infringement of the copy righted material, the penalty can range from Rs. 10,000 to Rs. 100000 or imprisonment up to six months or both for the first offense. The penalty doubles for the second offense. Besides, the offender shall be liable for compensation of the damages caused by his/her act. http://imagekhabar.com/samachar/detail/42464/65/.shtml 4.9 Tendering The tender is an offer in writing by the person (or organization) to execute some specified work or to supply specific goods at certain rate/amount within a fixed time-frame under certain conditions of agreement. This is the first step in the formulation of a contract. Bidding, in general, is classified into two types – International competitive Bidding (ICB) and National/Local Competitive Bidding (N/LCB). In National Competitive Bidding process all the eligible bidders are invited to participate. The process is adopted if the amount of job is greater than Rs. 10 lakh. For NCB, the tender 20 notice is published in national newspapers for two consecutive days. The tender notice is also posted in project office, DDC, DAO, Land Revenue Office, Treasury Controller and CAN Office. International competitive Bidding: If the amount of work is big and national/domestic contractors cannot perform the job, eligible bidders are invited from all over the world. The following four considerations guide for the selection of the ICB method as per the World Bank and International Development Association loan or grant. 1. The need for economy and efficiency in the implementation of the project, including the procurement of goods and works involved, 2. The Bank’s interest, as a cooperative institution, in giving all eligible bidders from developed and developing countries an opportunity to compete in providing goods and works financed by the Bank. 3. The Bank’s interest, as a development institution, in encouraging the development of domestic contracting and manufacturing industries in the borrowing country, and 4. The importance of transparency in the procurement process. In ICB, the notice shall also be sent to the embassies in Nepal. While submitting tender, a foreign party shall reveal the following information: Name and address of the bidder’s agent or representative in Nepal, if any, Types of services being provided by the local agent Currency and procedure of payment to the agent, and Any other agreement made with the agent. Purpose of Bidding: The following principles shall be observed in bidding. 1. Funds provided for the project implementation shall be used only for intended purpose. 2. Economy and efficiency shall be observed – best value for its money. 3. All eligible bidders shall be given equal opportunity to compete. 4. Development of domestic contracting and manufacturing industries shall be encouraged. 5. There shall be transparency in all stages of the procurement process. Preparation before inviting Tender (before tender notice publication) 1. Project preparation: The scheme of the project is prepared with the detailed feasibility study. 2. Estimating of Quantities: The quantities of all items involved in the project are to be estimated. 3. Cost Estimate: The tentative cost is derived with the prevailing rates involved in the work. 4. Approval of Estimate: Estimated cost should be approved by the concerned authority. 5. Resource Planning: The owner should allocate the necessary resources. Basically, the budget should be arranged for the construction at different stages. 6. Tender document preparation: All the documents required during the tender should be prepared and should be approved by the authority. 7. Tender Invitation: A notice is publicly published for inviting tenders. Tender Notice: It is the information inviting bids from competent and capable contractors and forms a part of contract document. It should be widely published in important newspapers. 21 Tender notice should contain the following: Name and authority publishing the notice First date of publication Brief description of the job Date, time and place (where and when) the tender document are available. Cost of the tender document Cost estimate (optional) for works up to 1 caror rupees Procedure of submitting tender Name of the officials and office where the tender has to be submitted. Duration of submitting the document Date, time and place where the tender has to be submitted Date, time and place of opening bid. Earnest money and Security deposit amount Expected date of acceptance of successful bids Other relevant information Earnest Money: It is the amount of money deposited while bidding a tender as a guarantee of the party’s willingness of carrying out the work awarded to the party. The amount of the earnest money generally ranges from 1% to 3% of the project cost. In Nepal, 2.5% of the cost is demanded as earnest money for a Nepalese firm and 5% of the cost to a foreign party. This money is returned to unsuccessful bidder. If a successful bidder fails to carry out the contract, the bidder forfeits the earnest money. Security Deposit: It is the amount of money deposited by a successful bidder as a security for satisfactory performance. In Nepal the security deposit is equal to 5% of the contract amount for a Nepalese firm and 10% for a foreign firm. The security deposit is refunded after completion of the defect liability period (maintenance period). If the work is unsatisfactory or contractor fails to perform the duty, the security deposit is forfeited. Tendering Procedure in NCB in Nepal The concerned party first notified for the probable bidders for the execution of the works through a notice. The following are the points to be remembered in publishing a tender notice. a) For the works having estimated amount Rs. 10,00,000 or less, notice shall be published two times in local newspapers. b) For the works having estimated amount Rs. 10,00,000 or more, notice shall be published two times in national newspapers. c) Tender notice are also to be kept on notice board of the concerned office that have invited the tender and also to be sent to local offices like VDC, DDC, Municipality and the office of the local contractors’ association. However, in the Kathmandu Valley, all the tenders shall be published in national newspapers. Pre-qualification: It is a kind of short listing of eligible bidders and avoids crowding of bidders. It ensures that the invitation to bid is extended only to those perspective bidders who have adequate capability and resources to perform the particular contract satisfactorily taking into account their: Experience and part performance on similar contracts 22 Capabilities with respect to personnel, equipment, and construction and manufacturing facilities Financial positions Litigation history PQ is done when amount of work is greater than 10 million rupees. Post qualification: Under this process no pre-qualification process is adopted. All the eligible bidders participate in the bidding process. It may include single envelop system (financial proposal only) or double envelop system (financial and technical proposal in separate envelop). In the double envelop system the successful bidder is selected by adopting one of the following methods. Shortlist from technical proposal and select the lowest bidder to award the contract. Select the lowest bidder and check the technical proposal. If technical proposal is OK, select the party else select the second lowest bidder and check the technical proposal. Give weightage to both the technical and financial proposal. Select the bidder with highest mark. 23 Contract Document The documents that lead towards a contract, are referred to as contract documents and are to be taken mutually explanatory of one another, but in case of ambiguities or discrepancies the same shall be explained and adjusted by the engineer who shall thereupon issue to the contractor instructions thereon and in the event, unless otherwise provided in the contract, the priority of the document, shall be as follows: a) The contract agreement b) The letter of acceptance c) The tender d) Conditions of contract e) The specifications f) The drawings g) The priced bill of quantities h) Addenda- addenda clarifies, corrects, or provides additional information Role of Contract documents Contract documents are most important documents in a contractual relationship. The role of contract documents provides the importance of such documents: a) Define duties and responsibilities of the parties involved in a contract b) Contract document defines payment procedure such as lump sum, cost plus, unit price etc. c) It also deals with the changes in the works during implementation. It guides for the procedure, pricing and payment of the works, alteration, addition, and omission. d) Value and duration of the contractual work e) Contract termination process f) It also assigns risk – soil condition, weather, delays, changes, performance etc. Contractual exclusion clauses: The clauses that take away or limit the rights of a party that may normally be expected to have under a contract. 24 Old Exam Questions from Chapter 4 Legal Aspects, Acts and Regulations 1. Why are legal aspects very important in professional practice? Are they integral parts of contract documents? Why and how? (15) 2. There are many acts related to engineering profession such as Nepal Engineering Council Act, Industrial Act, Company Act, Business Act, Trademark Act, Copyright Act and Contract Act. Throw light on each. (15) 3. Describe the disciplinary action process in detail. (12) Bidding, Tender and Contract 4. What is contract? Describe the essential aspects of a valid contract. 5. Briefly discuss the essential requirements of a valid contract. 6. Define contract and explain the essential of a valid contract. (RPA-C p52) 7. Define contract law. What is the importance of contract documents in the execution of project? 8. What are the essentials of a valid contract? Briefly explain valid, void and voidable contract.[15] 9. All contracts are agreement but all agreements are not contract. Explain. 10. What are the main features of bidding and contract documents? Elaborate systematically (15) 11. List the information to be provided in a tender notice. 12. Write the detailed information to be included on the tender notice. 13. Define conflict and explain the causes of conflict. 14. Explain what is prequalification of contractor and why it is necessary. Liability, Tort, Negligence 15. What do you mean by tort, liability and negligence? How they affect the quality of professional work? 16. Define the tort, liability and negligence and how they affect the quality of professional work 17. Explain in brief the term liability, tort, negligence and ethics. 18. Define liability, negligence and duty. Explain the detailed duties and liabilities of designers. Business Law, company, firms, Labor Law 19. What is business law? Briefly discuss the characteristics and limitations of partnership business organization [15] 20. Discuss the characteristic of a limited company 21. What are the characteristics of a public limited company? 22. Discuss about the partnership firm. 23. What is business? Explain the characteristics of Private Limited Company and Public Limited Company? 24. What are the types of business enterprises? Explain characteristics of company business organization. 25. Labor law works to protect the right of labor force in the construction industry. Explain. Intellectual Property Right, Patent Right, Copy Right, Trademark 26. What do you mean by intellectual property right? Differentiate between the copy right and patent right. 27. What do you mean by copy right? Describe briefly. 28. Explain the provisions of patent design and trademarks. 25