Absolutely for all kinds of investors. Putnam Absolute Return Funds

advertisement

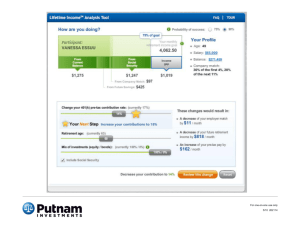

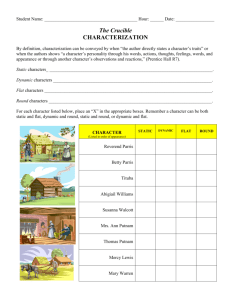

Not FDIC Insured May Lose Value No Bank Guarantee EO093 281219 5/13 |1 A BALANCED APPROACH A WORLD OF INVESTING A COMMITMENT TO EXCELLENCE 281219 1/13 5/13 EO093 276989 |2 Markets demand new ways of thinking • Stock market volatility has increased since 2007 • Bonds and cash offer low yields and limited upside • Better portfolio diversification may be possible with Putnam Absolute Return Funds Diversification does not assure a profit or protect against loss. It is possible to lose money in a diversified portfolio. EO093 281219 5/13 |3 Frequent market volatility argues for reducing equity risk • Stock market volatility has worsened in recent years Higher Stock volatility index 9/11 Iraq War Lehman Brothers bankruptcy Hurricane Katrina S&P cuts U.S. credit rating European debt crisis 90 80 70 60 50 40 30 20 10 Lower September March 2001 2003 August 2005 September 2008 0 December 2012 Source: CBOE Market Volatility Index, June 2000–December 2012. EO093 281219 5/13 |4 Bonds may offer limited upside • Bond yields are at low levels, and vulnerable to inflation (%) 5.0 Bond yields and inflation as of March 2013 4.0 3.0 2.0 1.0 0.0 Aaa-rated bond 10-year Treasury Inflation Sources: U.S. Federal Reserve (Moody’s Aaa-rated corporate bond, 10-year Treasury constant maturity); U.S. Bureau of Labor Statistics Consumer Price Index 12-month change. EO093 281219 5/13 |5 Cash is safe, but lacks growth • The Fed is holding down short-term interest rates “This exceptionally low range for the federal funds rate will be appropriate at least as long as the unemployment rate remains above 6.5%.” Source: Federal Reserve’s Open Market Committee, March 20, 2013. EO093 281219 5/13 |6 Are there mutual funds that seek more consistent returns with less volatility? EO093 281219 5/13 |7 Putnam Absolute Return 100 Fund® Putnam Absolute Return 300 Fund® Putnam Absolute Return 500 Fund® Putnam Absolute Return 700 Fund® EO093 276989 1/13 |8 What is absolute return investing? A strategy that targets positive returns above inflation with less volatility than markets. EO093 281219 5/13 |9 Absolute return versus traditional relative return strategies Absolute return Relative return Defines success as achieving positive returns Defines success as beating a benchmark, even if negative Seeks low volatility and limited market risk Sets no absolute volatility targets Independent of traditional benchmarks Tied to a benchmark index EO093 281219 5/13 | 10 Putnam was the first to offer a suite of absolute return funds Seeks to outperform T-bills by Invests in Alternative to Putnam Absolute Return 100 Fund 1% Global fixed-income sectors Short-term securities Putnam Absolute Return 300 Fund 3% Global fixed-income sectors Bond funds Putnam Absolute Return 500 Fund 5% Global fixed-income sectors, stocks, and alternative assets Balanced funds Putnam Absolute Return 700 Fund 7% Global fixed-income sectors, stocks, and alternative assets Stock funds Each fund seeks to earn a positive total return that exceeds the rate of inflation by a targeted amount over a reasonable period of time (typically 3 years) regardless of market conditions. There can be no assurance that a fund will meet its objective. The funds are not intended to outperform stocks and bonds during strong market rallies. EO093 281219 5/13 | 11 How Putnam manages absolute return 1 2 3 4 Wide range of global securities Progressive risk management Ultimate flexibility Experienced management EO093 281219 5/13 | 12 The funds have delivered positive returns in turbulent markets As of 3/31/13 Inception: 12/23/08 1 year before sales charge 1 year after sales charge 3 years before sales charge 3 years after sales charge Life before sales charge Life after sales charge Absolute Return 100 Fund® 1.74% 0.72% 0.82% 0.48% 1.56% 1.33% 0.65% 0.65% Absolute Return 300 Fund® 4.53 3.48 1.97 1.63 3.39 3.15 0.82 0.82 Absolute Return 500 Fund® 4.70 -1.32 4.11 2.08 5.40 3.95 1.17 1.15 Absolute Return 700 Fund® 5.92 -0.17 4.95 2.90 7.05 5.58 1.31 1.31 BofA Merrill Lynch U.S. Treasury Bill Index 0.14 — 0.15 — 0.19 — — — Class A shares before sales charge Expense What ratio you pay Current performance may be lower or higher than the quoted past performance, which cannot guarantee future results. Share price, principal value, and return will vary, and you may have a gain or a loss when you sell your shares. The class A share performance shown assumes reinvestment of distributions and does not account for taxes. Before-sales-charge returns do not reflect a maximum load of 5.75% for Putnam Absolute Return 500 and 700 Funds, and 1.00% for Putnam Absolute Return 100 and 300 Funds. Had the sales charges been reflected, returns would have been lower. “What you pay” reflects Putnam Management’s decision to contractually limit expenses through 6/30/14. For a portion of the periods, the funds had expense limitations, without which returns would have been lower. A short-term trading fee of 1% may apply to redemptions or exchanges from certain funds within the time period specified in the funds’ prospectus. To obtain the most recent month-end performance, visit putnam.com. The BofA Merrill Lynch U.S. Treasury Bill Index is an unmanaged index that tracks the performance of U.S. dollar-denominated U.S. Treasury bills publicly issued in the U.S. domestic market. Qualifying securities must have a remaining term of at least one month to final maturity and a minimum amount outstanding of $1 billion. It is not possible to invest directly in an index. EO093 281219 5/13 | 13 Conditions favor risk strategies • Solid corporate earnings and Fed’s quantitative easing policy provide supportive conditions • Economic uncertainty may resurface • Potential policy missteps remain a risk • The funds continue to underweight interest-rate risk EO093 281219 5/13 | 14 Absolutely for all kind of investors • Talk with your financial advisor to set your goals • Review your portfolio and risk profile • Add Putnam Absolute Return Funds to diversify a portfolio of traditional funds • The funds have provided low-volatility performance in the up and down markets since 2008 EO093 281219 5/13 | 15 Putnam Absolute Return 100 Fund® Putnam Absolute Return 300 Fund® Putnam Absolute Return 500 Fund® Putnam Absolute Return 700 Fund® An alternative to short-term securities An alternative to bond funds An alternative to balanced funds An alternative to stock funds EO093 281219 5/13 | 16 Consider these risks before investing: Our allocation of assets among permitted asset categories may hurt performance. The prices of stocks and bonds in the fund’s portfolio may fall or fail to rise over extended periods of time for a variety of reasons, including both general financial market conditions and factors related to a specific issuer or industry. You can lose money by investing in the fund. Our active trading strategy may lose money or not earn a return sufficient to cover associated trading and other costs. Our use of leverage obtained through derivatives increases these risks by increasing investment exposure. Bond investments are subject to interest-rate risk, which means the prices of the fund’s bond investments are likely to fall if interest rates rise. Bond investments also are subject to credit risk, which is the risk that the issuer of the bond may default on payment of interest or principal. Interest-rate risk is generally greater for longer-term bonds, and credit risk is generally greater for below-investment-grade bonds, which may be considered speculative. Unlike bonds, funds that invest in bonds have ongoing fees and expenses. Lower-rated bonds may offer higher yields in return for more risk. Funds that invest in government securities are not guaranteed. Mortgage-backed securities are subject to prepayment risk. International investing involves certain risks, such as currency fluctuations, economic instability, and political developments. Additional risks may be associated with emerging-market securities, including illiquidity and volatility. Our use of derivatives may increase these risks by increasing investment exposure (which may be considered leverage) or, in the case of many over-the-counter instruments, because of the potential inability to terminate or sell derivatives positions and the potential failure of the other party to the instrument to meet its obligations. The funds may not achieve their goal, and they are not intended to be a complete investment program. The funds’ effort to produce lower volatility returns may not be successful and may make it more difficult at times for the funds to achieve their targeted return. In addition, under certain market conditions, the funds may accept greater volatility than would typically be the case, in order to seek their targeted return. For the 500 Fund and 700 Fund, these risks also apply: REITs involve the risks of real estate investing, including declining property values. Commodities involve the risks of changes in market, political, regulatory, and natural conditions. Additional risks are listed in the funds’ prospectus. The views and opinions expressed are those of the speaker, are subject to change with market conditions, and are not meant as investment advice. Investors should carefully consider the investment objectives, risks, charges, and expenses of a fund before investing. For a prospectus, or a summary prospectus if available, containing this and other information for any Putnam fund or product, call your financial advisor or contact Putnam at 1-800-225-1581. Investors should read the prospectus carefully before investing. Putnam Retail Management putnam.com EO093 281219 5/13 | 17 EO093 281219 5/13 | 18