Really Wants to be a Millionaire

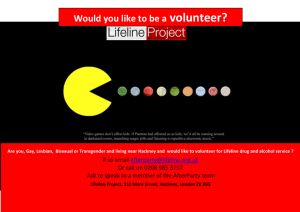

advertisement