Document

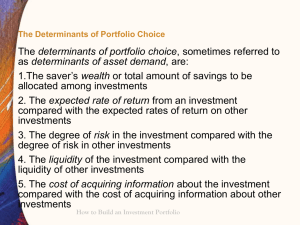

advertisement

Chapter 8 Notes Calculate profits and returns on an investment and convert to holding period returns to annual returns. Profits are the dollars gained on an investment, measured as the difference between the original cost of the investment and its ending value plus any distributions received while holding the asset. A return is the measure of the percentage of change or the ratio of the gain (or loss) to the cost of the investment. Returns are typically stated on an annual basis. To compare different investments held over different periods of time, it is necessary to convert the return that represents the entire holding period into an annualized return. You can do a conversion with a simple interest approach or with a compound interest approach. Define risk and explain how uncertainty relates to risk. Uncertainty is the absence of knowledge of the actual outcome of an event before it happens. Risk is a measure of the uncertainty in a set of potential outcomes for an event in which there is a chance of some loss. Different investments have different levels of risk. We can measure and understand the acceptable level of risk for our investment choices. Appreciate the historical returns of various investment choices. Returns vary across time for the same type of financial assets. U.S. Treasury bills have the lowest average return and the lowest risk, whereas smallcompany stocks have the highest average return with the highest risk. Calculate standard deviations and variance with historical data. The variance of a random variable is a statistical calculation of the sum of the difference between each observation and the average observation squared and then divided by the number of observations (minus 1 to correct for degrees of freedom). The standard deviation is the square root of the variance. Calculate expected return and the variance with conditional returns and probabilities. When determining the expected return and the variance of the expected return, an investor is using an ex-ante view of the world (looking forward). The expected return is calculated by multiplying each potential outcome by its probability and then summing these products. The variance is the sum of the squared differences between the potential outcome and the expected outcome times the probability of the outcome. Interpret the trade-off between risk and return. A higher expected increase in a return generally comes with an increase in risk. This reward-to-reward trade-off is a fundamental concept of finance. When it comes to risk tolerance, there are two rules to follow: (1) if two investments have the same expected return and different levels of risk, the investment with the lower risk is preferred; and (2) if two investments have the same level of risk and different expected returns, the investment with the higher expected return is preferred. Understand when and why diversification works at minimizing risk and understand the difference between systematic and unsystematic risk. Diversification—the spreading of investments over more than one asset— works because the high or low outcome of one asset can often be offset by the outcomes of the other asset. When assets are positively correlated, there is less diversification and less reduction in risk. When assets are negatively correlated, there is more diversification and more reduction in risk. There are two basic kinds of risks for investments: unsystematic or firm-specific risk and systematic or market wide risk. Systematic risk cannot be avoided. Firm-specific risk can be minimized with a well-diversified portfolio of investments. Explain beta as a measure of risk in a well-diversified portfolio. Beta is a measure of the systematic risk of an asset. It is the covariance of the individual returns of an asset with the returns of the markets. Illustrate how the security market line and the capital asset pricing model represent the two-parameter world of risk and return. The security market line is drawn in a two-parameter world of risk and return, with the intercept being the risk-free rate. The line slopes upward as it moves along the x-axis, signifying that as risk increased, expected return on the asset also increases. The line illustrates a constant trade-off between adding more risk and expecting more reward.