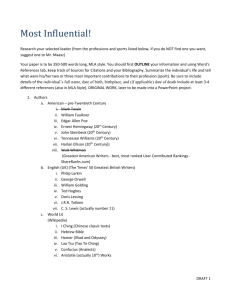

20th

advertisement

Why do nations trade? A simple guide into the history and theory of international trade What will I talk about? Links between the history and the theories of international trade Most important trade theories and their implications You won’t see: Complex math Complex charts Model of Intl. Trade Relations Country B Country A Goods & Services Production Factors Capital, Labour, Technology Trade Policy Tariffs, Non-Tariff Barriers Currency Exchange Rates International Organisations The major theories Absolute advantage Comparative advantage Factor abundance theory Modern explanations Let’s start, then! 3rd-4th Ancient Times First trade: barter exchange between tribes (ca. 5000 B.C.) Trade centres: China, India, Egypt, Phoenicia, Babylon, Persia, Greece, Rome Inventions: money, wheel, weighing and measuring system, commercial law, sails, commodity exchanges First trade routes established 3rd-4th Ancient Times No intensive international trade Lack of safe and low-cost transportation Dispersed trade centres (from global perspective) Long-distance routes mostly for luxurious goods Stability of the commodity structure, practically until the colonial conquest 3rd-4th Silk Road 3rd-4th Amber Road 13th-14th Middle Ages Lower importance of cities Marco Polo at court of as trade centres Kubilai Khan c.1280 Feudal system- lords, vassals and fiefs (land given to a vassal by their lord) Decreasing intensity of international trade Trade centres: Byzantium, Arabia, Italian cities (Venice, Genoa, Firenze, Pisa), Hansa Banking system, bills of exchange, credits for production Trade – big share of products necessary for sailing (sailcloth, wood, tar, salt) 13th-14th Hansean Trade 15th-16th Age of Discovery Bartholomew Diaz – Cape of Good Hope (1487) Vasco da Gama – new sea route to India (1498) Christopher Columbus – the „discovery” of America (1492) Ferdinand Magellan – expedition around the world (1519-21) Colonial conquest Take a look at http://www.ucalgary.ca/applied_history/tutor/eurvoya/ 15th-16th Mercantilism Colonial conquest – the basis Not a theory, rather a set of policy guidelines Positive trade balance Governments as „gold-collectors” High protectionism against import 17th-18th Industrial revolution Significant growth of output Major change in trade volume and commodity structure First trade patterns: (Europe) manufactured goods (Colonies) tropical products 18th Theory of absolute advantage Adam Smith, The Wealth of Nations” 1776 First classical theory Simple analysis of the causes of trade patterns Major assumptions: two countries, two goods, no additional trade costs, labour as the only production factor 18th Theory of absolute advantage Example: Unit costs (hours of labour) HOME FOREIGN 2 4 4 1 How can Home get oil? 18th Theory of absolute advantage Example (cont.): Unit costs (hours of labour) HOME FOREIGN Production Import Production Import 2 4 4 1 4 2 1 4 Countries produce and export goods, which production costs are lower than abroad! 19th Theory of comparative advantage David Ricardo, 1817 The most influencing classical theory Same assumptions: two countries, two goods, no additional trade costs, labour as the only production factor Question: What if a country produces both goods at a lower cost? 19th Theory of comparative advantage Example: Unit costs (hours of labour) HOME FOREIGN 1 4 2 3 How does it work now? 19th Theory of comparative advantage Example (cont.): Unit costs (hours of labour) HOME FOREIGN Production Import Production Import 1 2 4 3 2 1 3 4 Why does it work now, either? Compare the opportunity costs! 19th Theory of comparative advantage Example (cont.): Unit costs (hours of labour) HOME FOREIGN 1 (0,5) 4 (1,33) 2 (2) 3 (0,75) Lower opportunity costs decides about „comparative advantage” 19th Transportation revolution Sea and land steam-powered transportation Goods traded in large volumes Diminishing transportation and communication costs – soaring trade New trade patterns (West – developing countries) 20th Factor abundance theory E. Hecksher, B. Ohlin, 1930s Two countries – two goods Two production factors: labour and capital Same technology of production No transportation costs 20th Factor abundance theory Example: Technology Factor resources HOME FOREIGN 800 400 4 1 100 600 2 6 Compare „factor abundance” and „factor-consumption” 20th Factor abundance theory Example (cont.): Home is labour – abundant Foreign is capital – abundant Oranges are labour – consuming Cars are capital - consuming Home will export oranges – Foreign will export cars. 20th – 50’s Leontief paradox Leontief made an empirical research to verify the H-O theory using data on the U.S. trade He surprisingly found that the U.S. – a capitalabundant country – exported more labourconsuming goods Possible explanation: assumptions underlying the H-O theory no longer reflected fast-changing situation in the post-war world economy This inspired economists to look for new explanations to international trade late 20th New trends in a post-war world Fall of colonial empires led to a growing number of independent states 1935 2010 Source: WTO late 20th New trends in a post-war world Variety of actors in international trade Governments Shape the country’s economic policy and attitudes towards foreign trade. DOMESTIC BUSINESSES Run commercial transactions with foreign companies (export, import, foreign direct investments) HOUSEHOLDS, INDIVIDUALS E.g. tourists, private investors, workers Domestic level INTERNATIONAL ORGANISATIONS Government or Non-Government TRANSNATIONAL CORPORATIONS Run global business operations through foreign subsidiaries REGIONAL INTEGRATION GROUPINGS Groups of neighbouring countries that eliminate trade barriers International level late 20th New trends in a post-war world Intra–industry trade – similar products are imported and exported IIT = | Exporti - Importi | Exporti + Importi Grzegorz Karpiuk Koordynator projektu „Program rozwoju WSIiZ – Uczelnia Jutra” late 20th New trends in a post-war world New actors – international organisations Source: WTO Source: Wikipedia II poł. XXw New trends in a post-war world New actors – multinational corporations 2004 No. Company Country 2009 Market value (USD bln) Company Country Market value (USD bln) 1 ExxonMobil USA 405,2 ExxonMobil USA 335.54 2 General Electric USA 372,1 PetroChina CHN 270.56 3 Microsoft USA 273,7 Wal-Mart Stores USA 193.15 4 Citigroup USA 247,7 China Mobile CHN 175.85 5 BP UK 231,9 ICBC CHN 170.83 6 Royal Dutch/Shell NED/UK 221,5 Microsoft USA 143.58 7 Wal-Mart Stores USA 218,6 Procter & Gamble USA 141.18 8 Pfizer USA 198,0 AT&T USA 140.08 9 Johnson&Johnson USA 194,7 Johnson & Johnson USA 138.29 10 Bank of America USA 188,8 Royal Dutch Shell NED 135.10 Żródło: Forbes, http://www.forbes.com/lists/2009/18/global-09_The-Global-2000_MktVal.html late 20th New trends in a post-war world Trade structure Value 2004 (bn USD) GOODS Value 2008 (bn USD) Value 2009 (bn USD) 8907 15775 12147 783 1342 1169 Fuel and minerals 1281 3530 2263 Manufactures 6570 10458 8355 SERVICES 2125 3730 3312 Transport 500 875 704 Tourism 625 945 854 1000 1910 1754 Agricultural Other Source: World Trade Report 2010, WTO late 20th Source: World Trade Report 2014, WTO late 20th Source: World Trade Report 2014, WTO late 20th Source: World Trade Report 2014, WTO late 20th continued from the previous slide… Source: World Trade Report 2014, WTO late 20th Source: World Trade Report 2014, WTO late 20th continued from the previous slide… Source: World Trade Report 2014, WTO late 20th Leading exporters and importers of goods (bn USD) Source: World Trade Report 2014, WTO late 20th Leading exporters and importers of services (bn USD) Source: World Trade Report 2014, WTO late 20th Leading importers (bn USD) Goods Source: World Trade Report 2010, WTO Services late 20th Statistical Data on Trade late 20th Globalisation Global financial market Institutional development of international trade „McDonaldisation” – global convergence of customer preferences towards certain products Increase of FDI flow Dominating position of MNEs Geographical development of value chains (distribution channels) Knowledge-based economy emerged Lower importance of states in the global trade New sector of economy – knowledge management 20th, 60’s Modern theories Imitation lag theories (Posner, 1961): Technological gap between the Leader and the Rest of World lag in demand lag in reaction TRADE Leader starts production Demand occurs in the Rest of World Rest of World starts production 20th, 60’s Modern theories Theory of overlapping demands (Linder, 1961) Country A high GDP Country B avg. GDP Country C low GDP Explanation of the intra – industry trade 20th, 60’s „New” theories International product life cycle (Vernon, 1966) Uses a marketing concept of product life cycle Explains: international trade; foreign direct investments (FDI) , intra-industry trade (IIT). Three actors: Leader Developed countries (DC) Rest of World (RW) Empirical evidence proves the theory can explain the developments in the post-war international trade flows of teletransmission equipment 20th, 60’s Simulation of the int’l product life cycle - cars Export net Time: T0 Leader starts production of cars. No international trade so far DEVELOPED COUNTRIES LEADER Produce REST OF WORLD 20th, 60’s Simulation of the int’l product life cycle - cars Export net T1 T2 T3 T4 T5 T6 Time: T1 Leader’s domestic market matures. Demand for cars arises in DC Trade is initiated DEVELOPED COUNTRIES LEADER Produce REST OF WORLD 20th, 60’s Simulation of the int’l product life cycle - cars Export net T1 T2 T3 T4 T5 T6 Time: after T1 Leader is the only exporter of cars. Growing demand in DC causes trade growth. DEVELOPED COUNTRIES LEADER Produce REST OF WORLD 20th, 60’s Simulation of the int’l product life cycle - cars Export net T1 T2 T3 T4 T5 T6 Time: T2 Leader is still the only exporter of cars. Demand for cars emerges in RW, which begins import. DEVELOPED COUNTRIES LEADER Produce REST OF WORLD 20th, 60’s Simulation of the int’l product life cycle - cars Export net T1 T2 T3 T4 T5 T6 Time: T2 Technological advancement in DC and Leader’s outward FDIs make it possible to start production in DC. Leader can now import cheaper cars from DC (IIT) DEVELOPED COUNTRIES LEADER Produce Produce REST OF WORLD 20th, 60’s Simulation of the int’l product life cycle - cars Export net T1 T2 T3 T4 T5 T6 Time: after T2 Leader’s exports to DC decreases, RW’s imports Increases as RW starts importing cars from DC. DEVELOPED COUNTRIES LEADER Produce Produce REST OF WORLD 20th, 60’s Simulation of the int’l product life cycle - cars Export net T1 T2 T3 T4 T5 T6 Time: T3 DC become the major exporter of cars. The Leader’s market share decreases. DEVELOPED COUNTRIES LEADER Produce Produce REST OF WORLD 20th, 60’s Simulation of the int’l product life cycle - cars Export net T1 T2 T3 T4 T5 T6 Time: T4 Leader ceases the domestic production of cars. In pursuit of lower costs the Leader starts outward FDIs to the RW, which becomes a car maker. DEVELOPED COUNTRIES LEADER Produce Produce REST OF WORLD 20th, 60’s Simulation of the int’l product life cycle - cars Export net T1 T2 T3 T4 T5 T6 Time: T4 RW starts exports of cars to the Leader and the DCs. The price is competitive due to low labour costs. DEVELOPED COUNTRIES LEADER Produce Produce REST OF WORLD 20th, 60’s Simulation of the int’l product life cycle - cars Export net T1 T2 T3 T4 T5 T6 Time: T4 – T5 DCs start to invest in RW (outward FDIs). RW becomes the major producer and exporter of cars DEVELOPED COUNTRIES LEADER Produce Produce REST OF WORLD 20th, 60’s Simulation of the int’l product life cycle - cars Export net T1 T2 T3 T4 T5 T6 DEVELOPED COUNTRIES LEADER Produce Time: T5 – T6 RW becomes the only producer and exporter of cars. REST OF WORLD