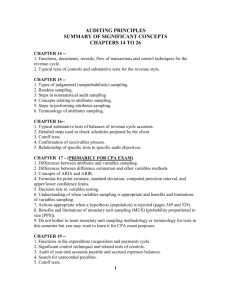

ARENS 17 2128 Audit Sampling for Test of Details of Balances

advertisement

Chapter 17 Audit Sampling for Tests of Details of Balances Accounts Receivable 1 Aaron Tests of Controls What do they measure The operating effectiveness of internal controls 2 The introduction … when all the confirmation replies were received or alternate procedures were completed ….. Bob called Barbara to do some statistical evaluation. 3 Kelly Mc Substantive Tests of Balances What do Substantive Tests measure calculate the dollar misstatements in account balances 4 Sampling Methods Non statistical sampling Statistical sampling monetary unit sampling variables sampling difference estimation ratio estimation Mean-per-Unit 5 Work Paper 2 College Business Computer Sales Collection cycle Sales performed by: date: Tad 1/27/2009 nature of test Substantive tests of transactions objective The objective of this procedure is to determine if the sales account is overstated. assertion(s) Occurrence and Accuracy 1 1 1 1 1 1 1 1 1 1 6523 6526 6532 6537 6542 6545 6552 6560 6562 6565 4973 4975 4981 4985 4990 10153 10155 10161 10165 10170 4998 5006 5008 5011 10178 10186 10188 10191 0.00 0.00 0.00 0.00 0.00 (3,432.00) 0.00 (874.00) 0.00 (16,576.00) Trusco Tank 9,182.00 San Luis Ready Mix 22,546.00 Copeland's Sports Superstoresds 4,188.00 Standard Motor Co. 4,538.00 Airport Auto Center 12,664.00 Flora Design Studio 3,432.00 F. McLintocks 18,908.00 Foothill Cyclery 12,446.00 Sinsheimer, Schiebelhut & Baggett -PC 11,982.00 Hind Inc. 16,576.00 sample average projected value 9,558.00 430,110.00 Book Value projected error 489,029.00 -58,919.00 -2,088.20 -93,969.00 6 Page 413 Test of Details - sampling Objective ---derived from management assertions Define a misstatement “ population “ sampling unit Specify tolerable misstatement ---- a dollar amount risk of incorrect acceptance βeta risk Determine sample size Select the sample Perform the procedure Project the sample results to the population 7 Test of Details – sampling inventory handout Objective all recorded inventory exist as of 12/31 physical quantities on hand agree INV records costs used to value INV are correct Define misstatement population sampling unit incorrect cost or quantity items in parts inventory SKU or part number Specify tolerable misstatement risk of incorrect acceptance Determine sample size $200,000 5% 387 Select the sample Perform the procedure Project the sample results to the population 8 Grace what is the audit risk model ? 9 Audit Risk Model AAR IR CRPDR PDR f (CR) c CR AR RoMM PDR rearrange PDR AAR RoMM if PDR high limited Substantiv e Tests if PDR low extensive Substantiv e Tests 10 Ishrak pretend GAAS requires AAR ≤ .05 Controls are effective, we assess CR as 0.03 Which audit approach will we take ? 11 Mackenzie pretend GAAS requires AAR ≤ .05 Controls are effective, we assess CR as 0.03 We will take the Reduced Level of Control Risk Approach What is the Planned Detection Risk ? 12 Sami pretend GAAS requires AAR ≤ .05 Controls are ineffective, we assess CR as MAX Which audit approach are we going to take ? 13 Catherine pretend GAAS requires AAR ≤ .05 Controls are ineffective, we assess CR as MAX (1.00) We are taking the Primarily Substantive Approach What is the Planned Detection Risk ? 14 Melissa pretend GAAS requires AAR ≤ .05 Controls are effective, not great but Somewhat effective and we assess CR as 0.25 What is the Planned Detection Risk ? 15 Anne pretend GAAS requires AAR ≤ .05 Controls are effective, not great but somewhat effective and we assess CR as 0.25 Which audit approach will we take? 16 Tori is Detection Risk risk of incorrect rejection Type I or risk risk of incorrect acceptance Type II or risk 17 ately 10% of the $1,965,560 balance. Statistical sampling cannot prove t auditing standards do not require balances to be exact. Auditing “obtain reasonable assurance about whether the financial statements are ” Auditing standards require auditors obtain “sufficient, appropriate ments “present fairly, in all material respects.” Auditors are typically , such as inventory, are overstated. If tolerable error is $200,000, we need ce of the parts inventory is greater than $1,765,560. he hypothetical mean $1,036.74 ($1,765,560 / value $1,154.17 ($1,965,560 / 1,703) is This will remain the same regardless of how ha Risk and Beta Risk. The interval is he upper portion of the hypothesis test and the nterval. Together these two elements comprise 18 type II type I 19 20 Test of Details - sampling Project the sample results to the population you must project sample results to the population plus appropriate consideration for sampling risk 21 projected error + allowance for sampling risk must be less than tolerable error 22 Accept cv 23 Also notice that the critical value will change because it now 1.645 standard deviations to the right of the hypothesized mean. Later, during the audit we will select and audit a random sample of 387 inventory line items. If everything goes exactly as planned and the sample mean of the audited values exceeds $1,108.78, we will accept the hypothesis that the parts inventory balance is not materially overstated. The attached work sheet shows the results of our sample. We found two types of errors in our sample. We observed instances where the actual quantity on hand differed from the quantity in the client’s accounting records. We also observed on instance where the cost per the invoice was different than the cost used to determine the inventory balance. The sum of the extended audited balances for the 387 part lines in the sample came to $441,567.00. The sample mean of $1,141.00 lies in the acceptance region. However, the standard deviation of the sample exceeded the standard deviation used to calculate the original critical value. 24 $1,110.32 C V Accept allowance for sampling risk tolerable error $200,000 or $117.44 BV 25 Test of Details - sampling Project the sample results to the population you must project sample results to the population appropriate consideration for sampling risk is the projected error too close to tolerable error How close is too close? 26 Applying what we know about Hypothesis Tests and Confidence Intervals The risk of incorrectly concluding the book value of the inventory is incorrect when it is correct is Alpha risk or a Type I error. This is the risk of incorrect rejection. The risk of incorrectly concluding inventory is fairly presented when the book value is materially overstated is Beta risk or a Type II error. This is the risk of incorrect acceptance. In the previous examples the critical value of the hypothesis test and the lower limit of the interval were arbitrarily set to equal to the midpoint between the hypothetical mean and the book value. This will result in Alpha risk that is twice as large as Beta risk because the hypothesis test is a one-tail test while intervals have two tails. For planning purposes assume that tolerable error for the parts inventory has been set as $200,000, which is approximately 10% of the $1,965,560 balance. Statistical sampling cannot prove that the balance is correct. But auditing standards do not require balances to be exact. Auditing standards require auditors to “obtain reasonable assurance about whether the financial statements are free of material misstatement.” Auditing standards require auditors obtain “sufficient, appropriate evidence” the financial statements “present fairly, in all material respects.” Auditors are typically concerned that asset accounts, such as inventory, are overstated. If tolerable error is $200,000, we need evidence that the actual balance of the parts inventory is greater than $1,765,560. The interval between the hypothetical mean $1,036.74 ($1,765,560 / 1,703) and the average book value $1,154.17 ($1,965,560 / 1,703) is $117.44 ($200,000 / 1,703). This will remain the same regardless of how we allocate risk between Alpha Risk and Beta Risk. The interval is comprised of two elements: the upper portion of the hypothesis test and the lower tail of the confidence interval. Together these two elements comprise the tolerable error. 27 n= Book value Sample total 441,567.00 overstatement Allowance for sampling risk 387 Mean N= Projection 1,154.18 1703 1,965,560.03 1,141.00 1703 1,943,123.00 13.18 22,437.03 Zβ for 0.05 1.645 error plus allowance 73.59 86.77 1703 125,323.77 147,760.80 28 Let’s assume the sample mean was $1,094.09 What if the Sample Mean is less than the Critical Value? Assume the sum of the 387 lines that were audited came to $423,412.83; the standard deviation of the sample was $880.00 and the sample mean was $1,094.09. The sample mean would not lie in the acceptance region. However, the sample mean is larger than the hypothetical mean of $1,036.74. The projected balance would be $1,863,235.27 . The projected discrepancy is $102,324.73 ($1,965,560 - $1,863,235) which is less than tolerable error. The sample does not provide sufficient evidence to state that the parts inventory is not materially overstated with 95% confidence. However, the sample does not provide evidence that the parts inventory is materially overstated. We can modify the equation used to calculate the critical value and determine the level of confidence the sample results do provide. 29 $1,110.32 C V Accept allowance for sampling risk tolerable error $200,000 or $117.44 BV 30 n= Book value Sample total 441,567.00 overstatement Allowance for sampling risk 387 Mean N= Projection 1,154.18 1703 1,965,560.03 1,094.09 1703 1,863,235.27 60.09 102,324.76 Zβ for 0.05 1.645 error plus allowance 73.59 133.68 1703 125,323.77 227,648.53 31 Chris Which assertions relate to Inventory and Accounts Receivable? 32 33 Valuation & allocation 34 Valuation & allocation 35 V&T what we did College Business Computer Sales Collection cycle Sales performed by: date: Tad 2/28/2006 nature of test Test of details of transactions objective The objective of this procedure is to determine if the sales account is overstated. assertion(s) Existence/Occurrence and Valuation 1 1 1 1 1 1 1 1 1 1 6523 6526 6532 6537 6542 6545 6552 6560 6562 6565 4973 4975 4981 4985 4990 10153 10155 10161 10165 10170 4998 5006 5008 5011 10178 10186 10188 10191 0.00 0.00 0.00 0.00 0.00 (3,432.00) 0.00 (874.00) 0.00 (16,576.00) Trusco Tank 9,182.00 San Luis Ready Mix 22,546.00 Copeland's Sports Superstoresds 4,188.00 Standard Motor Co. 4,538.00 Airport Auto Center 12,664.00 Flora Design Studio 3,432.00 F. McLintocks 18,908.00 Foothill Cyclery 12,446.00 Sinsheimer, Schiebelhut & Baggett -PC 11,982.00 Hind Inc. 16,576.00 sample average projected value 9,558.00 430,110.00 36 Page 436-437 Difference Estimation Sales Collection cycle Sales date: 2/28/2011 nature of test Test of details of transactions objective The objective of this procedure is to determine if the sales account is overstated. assertion(s) Existence/Occurrence and Valuation invoice 1 1 1 1 1 1 1 1 1 1 6523 6526 6532 6537 6542 6545 6552 6560 6562 6565 4973 4975 4981 4985 4990 10153 10155 10161 10165 10170 4998 5006 5008 5011 10178 10186 10188 10191 a mount Trusco Tank 9,182.00 San Luis Ready Mix 22,546.00 Copeland's Sports Superstoresds 4,188.00 Standard Motor Co. 4,538.00 Airport Auto Center 12,664.00 Flora Design Studio 3,432.00 F. McLintocks 18,908.00 Foothill Cyclery 12,446.00 Sinsheimer, Schiebelhut & Baggett -PC 11,982.00 Hind Inc. 16,576.00 sample average projected value sample std deviation a udite d a mount diffe re nce 0.00 0.00 0.00 0.00 0.00 (3,432.00) 0.00 (874.00) 0.00 (16,576.00) -2,088.20 -93,969.00 5,203.64 37 customer name invoice 6521 Hind Inc. sales to date 12,376.00 12,376.00 14,314.00 26,690.00 9,182.00 1,344.00 10,020.00 22,546.00 35,872.00 37,216.00 47,236.00 69,782.00 6527 Copeland's Sports Superstoresds32,807.00 102,589.00 6522 Foster's Freeze 6523 6524 6525 6526 T rusco T ank Foothill Cyclery Performing Arts Center San Luis Ready Mix 6528 Madonna Inn 6529 T rusco T ank 7,688.00 8,076.00 110,277.00 118,353.00 6,482.00 124,835.00 Apple Farm Inn 11,020.00 Copeland's Sports Superstoresds 4,188.00 Barbich, Longcrier, Hooper & King Accountancy 10,426.00 Flora Design Studio 4,476.00 First Presbyterian Church 1,344.00 Kimball Motor Co. 4,188.00 Standard Motor Co. 4,538.00 Performing Arts Center 4,834.00 135,855.00 140,043.00 150,469.00 154,945.00 156,289.00 160,477.00 165,015.00 169,849.00 6530 Foster's Freeze 6531 6532 6533 6534 6535 6536 6537 6538 6539 Pacific Conservatory of the Performing 2,594.00 Arts172,443.00 6540 6541 6542 6543 6544 6545 6546 Barbich, Longcrier, Hooper & King Accountancy 1,344.00 Hind Inc. 4,188.00 Airport Auto Center 12,664.00 Foster's Freeze 9,182.00 Madonna Inn 15,976.00 Flora Design Studio 3,432.00 Copeland's Sports Superstoresds 1,344.00 6552 F. McLintocks 336,289.00 8,376.00 18,102.00 344,665.00 362,767.00 5,832.00 368,599.00 1,990.00 28,628.00 3,432.00 370,589.00 399,217.00 402,649.00 19,970.00 422,619.00 6560 Foothill Cyclery 12,446.00 6561 Barbich, Longcrier, Hooper & King Accountancy 1,344.00 6562 Sinsheimer, Schiebelhut & Baggett -PC 11,982.00 435,065.00 436,409.00 448,391.00 6555 Standard Motor Co. 6556 Sinsheimer, Schiebelhut & Baggett -PC 6557 Airport Auto Center 6558 T rusco T ank 6559 San Luis Ready Mix 6563 San Luis Medical Center 6564 Kimball Motor Co. 6565 Hind Inc. sample size = 10 + 48,902.90 122,805.80 + 48,902.90 171,708.70 + 48,902.90 73,902.90 122,805.80 19,370.00 467,761.00 4,692.00 16,576.00 472,453.00 489,029.00 48,902.90 Page 420-29 MUS 171,708.70 220,611.60 269,514.50 + 48,902.90 + 48,902.90 318,417.40 + 48,902.90 367,320.30 + 48,902.90 292,197.00 297,411.00 317,381.00 18,908.00 6553 San Luis Ready Mix 6554 Apple Farm Inn 25,000.00 73,902.90 173,787.00 177,975.00 190,639.00 199,821.00 215,797.00 219,229.00 220,573.00 6547 Apple Farm Inn 39,340.00 259,913.00 6548 Barbich, Longcrier, Hooper & King 12,314.00 Accountancy 272,227.00 6549 Performing Arts Center 19,970.00 6550 Barbich, Longcrier, Hooper & King Accountancy 5,214.00 6551 Neal-T ruesdale Insurance 19,970.00 25,000.00 269,514.50 318,417.40 367,320.30 416,223.20 + 48,902.90 465,126.10 + 48,902.90 416,223.20 38 39 40 41 42 43