Internal Control and Accounting for Cash

advertisement

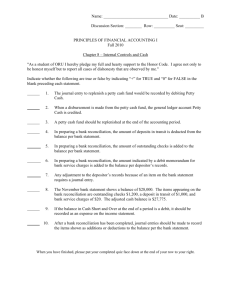

Chapter Seven Internal Control and Accounting for Cash McGraw-Hill/Irwin ©The McGraw-Hill Companies, Inc. 2006 Key Features of Internal Control 1. 2. 3. 4. 5. 6. 7. 8. 9. Separation of Duties Quality of Employees Bonded Employees Required Absences Procedures Manual Authority and Responsibility Prenumbered Documents Physical Control Performance Evaluations Separation of Duties When duties are separated, the work of one employee can act as a check on the work of another employee. The likelihood of fraud or theft is greatly reduced. Quality of Employees The ability of cross-trained employees to substitute for one another prevents disruptions in the workplace. Job rotation may help relieve boredom and increase productivity. Bonded Employees A fidelity bond provides insurance that protects a company from loss caused by employee dishonesty. To become bonded, an employee’s background is investigated. Required Absences An employee may be able to cover up fraudulent activities if they are always present at work. All employees should be required to take regular vacations and their duties should be rotated periodically. Procedures Manual Accounting and other important procedures should be written in a procedures manual. Periodically, management should conduct an investigation to see that required procedures are actually being followed. Authority and Responsibility General authority applies to all member of the organization. For example, all employees are required to fly coach and purchase airline tickets from a specific vendor. Specific authority applies only to a specific position within the organization. For example, all checks must be cosigned by the Controller and Treasurer. Prenumbered Documents. Prenumbered forms are used for all important documents such as checks, purchase orders, receiving reports, and invoices. The use of prenumbered forms helps keep track of all forms issued during a particular period. Physical Control All companies should maintain adequate physical control over valuable assets that may be misappropriated. For example, inventory should be properly stored in a secure location. Serial numbers should be placed on all valuable assets to assist in a physical count of these assets. Performance Evaluation •Internal controls should include independent verification of employee performance. •A physical inventory should be taken at least annually. An independent reconciliation between the general ledger balance and inventory should be compared to the inventory count. •Auditors should evaluate the effectiveness of the control system. Limitations Internal controls can be circumvented by collusion among employees. Two or more employees working together can hide embezzlement by covering for each other. No system can prevent fraud. Accounting for Cash Cash receipts should Up to date signature card should be maintained. A monthly bank reconciliation should be prepared by an independent party. be recorded immediately upon receipt and deposited intact daily. Controlling Cash A deposit ticket should be used for all deposits. Cash disbursements should be made by prenumbered check. Reconciling the Bank Statement The bank reconciliation reports on the differences between the balance on the bank statement and the balance in the general ledger cash account. The reconciliation results in the true cash balance that will appear on the balance sheet. Adjustment to the Bank Balance Unadjusted bank balance + Deposits in transit Deduct - Outstanding checks Equals = True cash balance Add Adjustments to the Book Balance Unadjusted book balance Add + Accounts receivable collections + Deduct Deduct Equals = Add Interest earned Bank service charges Non-sufficient funds (NSF) check True cash balance Reconciling the Bank Statement If an error is found on the bank statement, an adjustment for it is made to the unadjusted bank balance to determine the true cash balance. An error made on our books requires an adjusting journal entry to correct. Bank Reconciliation Matrix, Inc. is preparing the bank reconciliation for the month of June. 1. The June 30th balance on the bank statement is $4,892.56, and the Cash general ledger balance on this date is $4,240.54. 2. There was a deposit in transit in the amount of $475. 3. The bank erroneously deducted a $200 check drawn on the books of Matters, Inc. from our account. 4. At June 30th there were three checks outstanding. Check 1078 dated 6/28, for $372.33; Check 1080 dated 6/29, for $402.41; and Check 1081 dated 6/30, for $66.89. More Information Bank Reconciliation 5. During the month of June the bank collected an account receivable for us in the amount of $875. 6. A check actually written for $146.88 for supplies was erroneously recorded in our records by the bookkeeper as $173.88. 7. Matrix earned interest of $9.25 on its checking account. 8. The bank assessed a service charge of $12.75 for June and we deposited a NSF check in the amount of $413.11. Let’s prepare the bank reconciliation Bank Reconciliation Matrix, Inc. Bank Reconciliation Statement June 30, 2006 Unadjusted bank balance, June 30 Add: Deposits in transit Bank error Less: Outstanding checks Check No. 1078 - June 28 372.33 Check No. 1080 - June 29 402.41 Check No. 1081 - June 30 66.89 True Cash balance, June 30 Unadjusted Book Balance, June 30 Add: Account collected by bank Bookkeeping error Interest earned on checking account Less: Bank service charge NSF Check True Cash balance, June 30 $ 4,892.56 475.00 200.00 (841.63) $ 4,725.93 $ 4,240.54 875.00 27.00 9.25 (12.75) (413.11) $ 4,725.93 Bank Reconciliation Matrix, Inc. Bank Reconciliation Statement June 30, 2006 Unadjusted bank balance, June 30 Add: Deposits in transit Bank error Less: Outstanding checks Check No. 1078 - June 28 372.33 Check No. 1080 - June 29 402.41 Check No. 1081 - June 30 66.89 True Cash balance, June 30 Unadjusted Book Balance, June 30 Add: Account collected by bank Bookkeeping error Interest earned on checking account Less: Bank service charge NSF Check True Cash balance, June 30 $ 4,892.56 475.00 200.00 (841.63) $ 4,725.93 $ 4,240.54 875.00 27.00 9.25 (12.75) (413.11) $ 4,725.93 Bank Reconciliation Matrix, Inc. Bank Reconciliation Statement June 30, 2006 Unadjusted bank balance, June 30 Add: Deposits in transit Bank error Less: Outstanding checks Check No. 1078 - June 28 372.33 Check No. 1080 - June 29 402.41 Check No. 1081 - June 30 66.89 True Cash balance, June 30 Unadjusted Book Balance, June 30 Add: Account collected by bank Bookkeeping error Interest earned on checking account Less: Bank service charge NSF Check True Cash balance, June 30 $ 4,892.56 475.00 200.00 (841.63) $ 4,725.93 $ 4,240.54 875.00 27.00 9.25 (12.75) (413.11) $ 4,725.93 Bank Reconciliation Matrix, Inc. Bank Reconciliation Statement June 30, 2006 Unadjusted bank balance, June 30 Add: Deposits in transit Bank error Less: Outstanding checks Check No. 1078 - June 28 372.33 Check No. 1080 - June 29 402.41 Check No. 1081 - June 30 66.89 True Cash balance, June 30 Unadjusted Book Balance, June 30 Add: Account collected by bank Bookkeeping error Interest earned on checking account Less: Bank service charge NSF Check True Cash balance, June 30 $ 4,892.56 475.00 200.00 (841.63) $ 4,725.93 $ 4,240.54 875.00 27.00 9.25 (12.75) (413.11) $ 4,725.93 Bank Reconciliation Matrix, Inc. Bank Reconciliation Statement June 30, 2006 Unadjusted bank balance, June 30 Add: Deposits in transit Bank error Less: Outstanding checks Check No. 1078 - June 28 372.33 Check No. 1080 - June 29 402.41 Check No. 1081 - June 30 66.89 True Cash balance, June 30 Unadjusted Book Balance, June 30 Add: Account collected by bank Bookkeeping error Interest earned on checking account Less: Bank service charge NSF Check True Cash balance, June 30 $ 4,892.56 475.00 200.00 (841.63) $ 4,725.93 $ 4,240.54 875.00 27.00 9.25 (12.75) (413.11) $ 4,725.93 Bank Reconciliation Matrix, Inc. Bank Reconciliation Statement June 30, 2006 Unadjusted Bank Balance, June 30 Add: Deposits in transit Bank error Less: Outstanding checks Check No. 1078 - June 28 372.33 Check No. 1080 - June 29 402.41 Check No. 1081 - June 30 66.89 True Cash balance, June 30 Unadjusted Book Balance, June 30 Add: Account collected by bank Bookkeeping error Interest earned on checking account Less: Bank service charge NSF Check True Cash balance, June 30 $ 4,892.56 475.00 200.00 (841.63) $ 4,725.93 $ 4,240.54 875.00 27.00 9.25 (12.75) (413.11) $ 4,725.93 Adjusting the Books Every reconciling item that appears on the unadjusted book balance section requires a journal entry to adjust the general ledger cash balance to the true cash balance. Account Title Cash Accounts receivable Supplies expense Interest revenue Bank service charge expense Accounts receivable Cash Debit 911.25 Credit 875.00 27.00 9.25 12.75 413.11 425.86 Cash Short and Over When using a cash register, employees sometimes make mistakes in collecting cash or making change for customers. If the cash register does not reconcile by a small amount at the end of the day, we use an account called cash short and over to force a balance. Assume a cash register was to have a balance of $500, but contained only $499 at the end of the day. Account Title Cash Cash short and over Sales Debit 499.00 1.00 Credit 500.00 Using Petty Cash Funds A petty cash fund is used to make small expenditures that cannot wait for the formal checkwriting process. The fund is operated on an imprest basis. This means that when the fund gets low on cash it is replenished. The petty cashier is always responsible for the cash in the fund. This is an excellent internal control. Using Petty Cash Funds Establishing a $500 petty cash fund. Account Title Petty cash Cash Debit 500.00 Credit 500.00 Petty cashier takes the check to the bank and gets $500 cash for the fund. Treasurer prepares a $500 check payable to the petty cashier. Using Petty Cash Funds During the month the petty cashier paid out $217 for FedEx deliveries, $34.50 for late-working employee meals, $27 for cab fare to the airport for a salesperson, and $187.60 for office postage stamps. The petty cashier asked for and received a receipt for each disbursement made this month. The fund is getting low on cash so the petty cashier requests that the fund be replenished. Using Petty Cash Funds Here is an analysis of the impact of the reimbursement. Assets = Liab. (466.10) = NA + Equity Rev. – Exp. + NA – 466.10 = (466.10) = Net Inc. (466.10) Cash Flow (466.10) OA The journal entry to record the reimbursement would be: Account Title Delivery Expense Employee Meal Expense Taxi Expense Postage Expense Cash Debit 217.00 34.50 27.00 187.60 Credit 466.10 Using Petty Cash Funds Petty cashier takes the check to the bank and gets $466.10 cash for the fund. Treasurer prepares a $466.10 check payable to the petty cashier. The fund is now returned to its $500 balance. Current Versus Noncurrent Current assets are expected to be converted to cash or consumed within one year or an operating cycle, whichever is longer. Current assets include: •Cash •Marketable Securities •Accounts Receivable •Short-Term Notes Receivable •Interest Receivable •Inventory •Supplies •Prepaids Current Versus Noncurrent Current liabilities are due within one year or an operating cycle, whichever is longer. Current liabilities include: •Accounts Payable •Short-Term Notes Payable •Wages Payable •Taxes Payable •Interest Payable Limbaugh Company Classified Balance Sheet As of December 31, 2006 Assets Current Assets Cash Accounts Receivable Inventory Prepaid Rent Total Current Assets Property, Plant, and Equipment Office Equipment $ 80,000 Less: Accumulted Depreciation (25,000) Building 340,000 Less: Accumulted Depreciation (40,000) Land Total Property, Plant, and Equipment Total Assets $ 20,000 35,000 230,000 3,600 $ 288,600 55,000 300,000 120,000 $ 475,000 763,600 $ 193,800 Liabilities and Stockholders' Equity Current Liabilities Accounts Payable Notes Payable Salaries Payable Unearned Revenue Total Current Liabilities Long-Term Liabilities Notes Payable Total Liabilities Stockholders' Equity Common Stock Retained Earnings Total Liabilities and Stockholders' Equity $ 32,000 120,000 32,000 9,800 100,000 293,800 200,000 269,800 $ 469,800 763,600 Classified Balance Sheet Current Ratio Current Asset Current = Current Liabilities Ratio For Limbaugh Company the current ratio is: Current = Ratio $288,600 = 1.49:1 $193,800 End of Chapter Seven