CLRS Presentation 9-8-2003 - Casualty Actuarial Society

advertisement

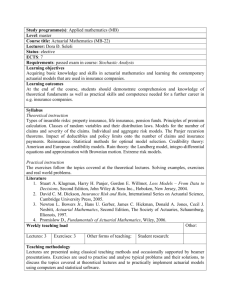

Casualty Loss Reserve Seminar September 2004 Solvency SurveillanceWhat is Working and What is Not Ron Dahlquist, FCAS, MAAA California Dept. of Insurance 1 What isn’t working: The Actuarial Opinion • • • • Actuarial Opinions and supporting reports least reliable when company is in financial difficulty – Multiple insolvencies of CA WC specialty companies – Companies with excessive exposure to construction defect claims – Some multiple lines carriers Great majority of all insolvent or impaired companies (and all of the insolvent CA WC specialty companies) had clean actuarial opinions at previous year end – Only one company I can recall that self-identified an insolvency to CDI – Reserve deficiencies the proximate cause of nearly all recent insolvencies Insurance Department examiners, financial analysts cannot rely on actuarial opinions to identify inadequately reserved companies Actuarial opinions don’t provide comfort that apparently healthy companies are truly healthy 2 Support for Actuarial Opinions • Actuarial Reports supporting Opinions characterized by (overly) optimistic assumptions • Examples: – California Workers Compensation – Bornhuetter-Ferguson application, with new and discontinued programs – Problem areas, e.g. construction defect 3 Support for Actuarial OpinionsCalifornia Workers Compensation (1) • Characteristics of CA WC experience, development statistics: – Severe medical inflation – Marked, long-term slowdown in settlement rates – Marked, long-term upward trend in age-to-age development patterns (both paid and incurred) 4 Support for Actuarial OpinionsCalifornia Workers Compensation(2) • Actuarial Opinion analyses: – Ignore incurred development method, citing apparent reserve strengthening • Do not adequately test reserve strengthening assumption • Do not perform Berquist-Sherman adjustment for change in case reserve adequacy – Rely on paid development method (almost) exclusively • Do not test settlement rate for changes • Do not perform Berquist-Sherman adjustment for change in settlement rate, citing prevalence of partial payments • Do not make alternative adjustments to treat problem – Use three-year averages of age-to-age factors, or longer-term averages, despite strong upward trend in actual age-to-age factors • Cite expectations that development must moderate on its own (it can’t stay high forever) • Ignore causal links to closing rate, high inflation 5 California Workers Compensation (3) WCIRB Pure Premium Rate Analysis Track Record • Analysis more aggressive than Appointed Actuaries rendering opinions on subsequently insolvent companies • Relied exclusively on paid development method • Trended loss development factors – Trending used for last several filings – Seen as aggressive • Past estimates of ultimate loss have proven to be far short of subsequent estimates • Recent estimates show less adverse development 6 CALIFORNIA WORKERS' COMPENSATION WORKERS' COMPENSATION INSURANCE RATING BUREAU ANALYSIS ESTIMATED ULTIMATE LOSS RATIOS Estimated Ultimate Loss Ratios: as of Accident Year 1995 1996 1997 1998 1999 2000 2001 2002 2003 Earned Premium 3,922,429,612 3,832,585,126 4,140,947,275 4,458,921,916 4,724,984,138 6,401,248,003 9,837,605,273 13,282,762,835 18,780,082,806 as of as of as of as of (1) as of 3-31-1999 3-31-2000 3-31-2001 3-31-2002 3-31-2003 3-31-2004 79.7% 88.3% 94.5% 99.3% 81.6% 91.6% 98.3% 106.2% 110.6% 85.1% 96.7% 104.2% 116.8% 121.4% 104.9% 87.9% 100.7% 109.3% 123.8% 131.2% 116.4% 95.6% 89.9% 103.0% 112.2% 126.8% 135.6% 121.9% 105.0% 88.9% 90.3% 102.9% 112.5% 130.2% 139.8% 124.4% 110.2% 90.3% 64.6% 69,381,566,984 (1) prior to consideration of AB 227 / SB 228 7 CALIFORNIA WORKERS' COMPENSATION WORKERS' COMPENSATION INSURANCE RATING BUREAU ANALYSIS CHANGE IN ESTIMATED ULTIMATE LOSS RATIOS Change in Estimated Ultimate Loss Ratios: Accident Year 1995 1996 1997 1998 1999 2000 2001 2002 2003 Earned Premium 3,922,429,612 3,832,585,126 4,140,947,275 4,458,921,916 4,724,984,138 6,401,248,003 9,837,605,273 13,282,762,835 18,780,082,806 3-31-1999 3-31-2000 3-31-2001 3-31-2002 3-31-2003 Total to to to to to Change 3-31-2000 3-31-2001 3-31-2002 3-31-2003 3-31-2004 To Date 1.9% 3.3% 3.8% 6.9% 3.5% 5.1% 5.9% 10.6% 10.8% 2.8% 4.0% 5.1% 7.0% 9.8% 11.5% 2.0% 2.3% 2.9% 3.0% 4.4% 5.5% 9.4% 0.4% -0.1% 0.3% 3.4% 4.2% 2.5% 5.2% 1.4% 10.6% 14.6% 18.0% 30.9% 29.2% 19.5% 14.6% 1.4% 69,381,566,984 8 Characteristics of CA WC Experience WCIRB data as of 3-31-2004 Paid Medical Loss Accident Year 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 15 to 27 1.680 1.538 1.532 1.570 1.592 1.653 1.735 1.786 1.844 1.976 2.080 2.079 Development 27 to 39 39 to 51 51 to 63 1.201 1.177 1.181 1.166 1.188 1.208 1.221 1.243 1.272 1.318 1.353 1.375 1.094 1.084 1.095 1.097 1.086 1.093 1.111 1.129 1.139 1.158 1.180 1.194 1.049 1.052 1.056 1.054 1.056 1.062 1.075 1.089 1.098 1.111 1.124 63 to 75 75 to 87 87 to 99 1.034 1.034 1.037 1.039 1.042 1.045 1.055 1.065 1.075 1.088 1.023 1.024 1.027 1.025 1.030 1.038 1.051 1.057 1.062 1.017 1.018 1.019 1.020 1.024 1.032 1.041 1.048 99 to 111 111 to 123 1.014 1.012 1.013 1.016 1.025 1.028 1.035 1.010 1.010 1.012 1.016 1.021 1.029 9 Characteristics of CA WC Experience WCIRB data as of 3-31-2004 Ultimate Reported Indemnity Closed Claim Ratios Accident Year 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 Evaluated as of months: 15 27 39 45.2% 43.6% 42.5% 41.2% 39.7% 38.1% 36.1% 32.9% 32.5% 32.5% 65.1% 66.0% 63.8% 63.1% 61.8% 59.9% 57.5% 54.5% 50.7% 48.4% 75.1% 78.6% 78.8% 77.9% 77.1% 75.8% 73.3% 70.6% 68.2% 63.2% 51 83.5% 85.5% 87.0% 86.9% 86.1% 85.0% 83.9% 81.2% 79.6% 76.7% 63 90.6% 90.1% 91.1% 91.7% 91.0% 90.2% 89.4% 88.1% 86.5% 84.5% 75 87 99 111 94.0% 94.0% 93.9% 94.5% 94.0% 93.4% 92.7% 91.9% 90.9% 89.3% 95.9% 95.9% 96.2% 96.2% 95.6% 94.8% 94.2% 93.6% 92.6% 97.1% 97.3% 97.3% 97.1% 96.5% 95.9% 95.6% 94.7% 97.8% 98.0% 97.9% 97.8% 97.3% 96.7% 96.2% 10 California Workers Compensation Conclusions • Trending the medical development factors was the right thing to do in last year’s analysis – Paid loss development factors continue to increase – Closing rate continues to decline- with possible exception of AY 2003 • Choice of three-year (or longer) average factors: – Appears to have been overly optimistic last year – Still appears to be overly optimistic for pre-reform analyses • No apparent support for assumption that development will revert to older, lower levels without effects of reforms • Incurred development method should be given weight; paid development can’t seem to catch up 11 Bornhuetter-Ferguson Expected Loss Ratios • We have seen the following: – Credit given to company “improvements” in operations, without solid evidence to back up assumptions – Optimistic trends assumed – Optimistic development assumptions used – Too much weight given to immature years, which may not be appropriately developed – Too little weight given to more mature years – Adverse experience in some years discounted – Adverse experience in similar programs discounted 12 Problem Segments of Business • Failure to identify, isolate, and separately analyze problem segments (i.e. construction defect) has been the apparent cause of several insolvencies • Proper questioning of underwriting and claims personnel can usually identify these • Failure of due diligence • Some companies better than others at this 13 Observations and Conclusions • My personal opinion: – In situations of potential financial difficulty, actuarial opinions and supporting reports usually give impression that Appointed Actuary has taken role of company advocate rather than impartial estimator of company’s reserve adequacy – Emphasis seems to be on presenting reasons why reserves could be reasonable, rather than on what an appropriate reserve level would be – This becomes an obstacle for the regulator to overcome, not an aid to evaluating companies – This has implications for the value of the Actuarial Opinion and the public perception of the profession 14 Signs of Advocacy • Analyses are not conservative – Reasons for fiscal conservatism: • Time needed for results to be known • Surprises tend to be adverse rather than favorable • cost of underestimation not the same as cost of overestimationdelays or prevents corrective action • Analyses don’t make proper use of available methods – Provide rationales why methods that yield higher estimates may be distorted- yet don’t apply standard adjustments to remove distortions – Provide rationales why methods that yield lower estimates, but are clearly distorted, may apply- again, don’t apply standard adjustments or adjust in any way • Analyses don’t seem to react to consistent pattern of underestimation – Methods should be made more responsive to current conditions in this case – We see this responsiveness in ratemaking analyses but not in reserving 15 Successes • Internal financial modeling has provided early identification of some problem companies • Skeptical internal approach has also provided early identification and led to close monitoring • This has reduced the cost of some insolvencies, may have prevented others • Flexible approach to troubled companies has allowed: – Some to obtain outside capital or be acquired – others to transfer books of business and go into orderly runoff – Has avoided some insolvencies, reduced the costs of others 16