Macroeconomic Issues and Policy

advertisement

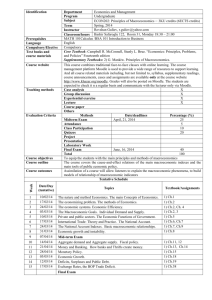

CHAPTER 15 Macroeconomic Issues and Policy Prepared by: Fernando Quijano and Yvonn Quijano © 2004 Prentice Hall Business Publishing Principles of Economics, 7/e Karl Case, Ray Fair C H A P T E R 15: Macroeconomic Issues and Policy Stabilization Policy • Stabilization policy describes both monetary and fiscal policy, the goals of which are to smooth out fluctuations in output and employment and to keep prices as stable as possible. © 2004 Prentice Hall Business Publishing Principles of Economics, 7/e Karl Case, Ray Fair 2 of 40 C H A P T E R 15: Macroeconomic Issues and Policy Time Lags Regarding Monetary and Fiscal Policy • Time lags are delays in the economy’s response to stabilization policies. © 2004 Prentice Hall Business Publishing Principles of Economics, 7/e Karl Case, Ray Fair 3 of 40 C H A P T E R 15: Macroeconomic Issues and Policy Two Possible Time Paths for GDP Path A is less stable—it varies more over time—than path B. Other things being equal, society prefers path B to path A. © 2004 Prentice Hall Business Publishing Principles of Economics, 7/e Karl Case, Ray Fair 4 of 40 C H A P T E R 15: Macroeconomic Issues and Policy Stabilization: “The Fool in the Shower” • Attempts to stabilize the economy can prove destabilizing because of time lags. • Milton Friedman likened these attempts to a “fool in the shower.” The government is constantly stimulating or contracting the economy at the wrong time. © 2004 Prentice Hall Business Publishing Principles of Economics, 7/e Karl Case, Ray Fair 5 of 40 C H A P T E R 15: Macroeconomic Issues and Policy Stabilization: “The Fool in the Shower” An expansionary policy that should have begun to take effect at point A does not actually begin to have an impact until point D, when the economy is already on an upswing. © 2004 Prentice Hall Business Publishing Principles of Economics, 7/e Karl Case, Ray Fair 6 of 40 C H A P T E R 15: Macroeconomic Issues and Policy Stabilization: “The Fool in the Shower” Hence, the policy pushes the economy to points F’ and G’ (instead of F and G). Income varies more widely than it would have if no policy had been implemented. © 2004 Prentice Hall Business Publishing Principles of Economics, 7/e Karl Case, Ray Fair 7 of 40 C H A P T E R 15: Macroeconomic Issues and Policy Recognition Lags • The recognition lag refers to the time it takes for policy makers to recognize the existence of a boom or a slump. © 2004 Prentice Hall Business Publishing Principles of Economics, 7/e Karl Case, Ray Fair 8 of 40 C H A P T E R 15: Macroeconomic Issues and Policy Implementation Lags • The implementation lag is the time it takes to put the desired policy into effect once economists and policy makers recognize that the economy is in a boom or a slump. • The implementation lag for monetary policy is generally much shorter than for fiscal policy. © 2004 Prentice Hall Business Publishing Principles of Economics, 7/e Karl Case, Ray Fair 9 of 40 C H A P T E R 15: Macroeconomic Issues and Policy Response Lags • The response lag is the time it takes for the economy to adjust to the new conditions after a new policy is implemented; the lag that occurs because of the operation of the economy itself. • The delay in the multiplier of government spending occurs because neither individuals nor firms revise their spending plans instantaneously. © 2004 Prentice Hall Business Publishing Principles of Economics, 7/e Karl Case, Ray Fair 10 of 40 C H A P T E R 15: Macroeconomic Issues and Policy Monetary Policy • To make the monetary policy story realistic, two key points must be added: • In practice, the Fed targets the interest rate rather than the money supply. • The interest rate value that the Fed chooses depends on the state of the economy. © 2004 Prentice Hall Business Publishing Principles of Economics, 7/e Karl Case, Ray Fair 11 of 40 C H A P T E R 15: Macroeconomic Issues and Policy Targeting the Interest Rate • The Fed can pick a money supply value and accept the interest rate consequences Or • The Fed can pick an interest rate value and accept the money supply consequences. © 2004 Prentice Hall Business Publishing Principles of Economics, 7/e Karl Case, Ray Fair 12 of 40 C H A P T E R 15: Macroeconomic Issues and Policy The Fed’s Response to the State of the Economy © 2004 Prentice Hall Business Publishing • The Fed is likely to lower the interest rate (and thus increase the money supply) during times of low output and low inflation. Principles of Economics, 7/e Karl Case, Ray Fair 13 of 40 C H A P T E R 15: Macroeconomic Issues and Policy The Fed’s Response to the State of the Economy © 2004 Prentice Hall Business Publishing • When the economy is on the flat portion of the AS curve, an increase in the money supply will lead to an increase in output with very little increase in the price level. Principles of Economics, 7/e Karl Case, Ray Fair 14 of 40 C H A P T E R 15: Macroeconomic Issues and Policy The Fed’s Response to the State of the Economy © 2004 Prentice Hall Business Publishing • The opposite is also true: The Fed is likely to increase the interest rate (and thus decrease the money supply) during times of high output and high inflation. Principles of Economics, 7/e Karl Case, Ray Fair 15 of 40 C H A P T E R 15: Macroeconomic Issues and Policy The Fed’s Response to the State of the Economy © 2004 Prentice Hall Business Publishing • When the economy is on the relatively steep portion of the AS curve, contraction of the money supply will lead to a decrease in the price level, with little decrease in output. Principles of Economics, 7/e Karl Case, Ray Fair 16 of 40 C H A P T E R 15: Macroeconomic Issues and Policy The Fed’s Response to the State of the Economy • Stagflation is a more difficult problem to solve. • If the Fed lowers the interest rate, output will rise, but so will the inflation rate (which is already too high). • If the Fed increases the interest rate, the inflation rate will fall, but so will output (which is already too low). © 2004 Prentice Hall Business Publishing Principles of Economics, 7/e Karl Case, Ray Fair 17 of 40 C H A P T E R 15: Macroeconomic Issues and Policy Data for Selected Variables for the 1989 – 2003 Period Data for Selected Variables for the 1989 – 2003 Period DATE REAL GDP GROWTH RATE (%) UNEMPL. RATE (%) INFL. RATE (%) THREEMONTH T-BILL RATE AAA BOND RATE FED. GOV. SURPLUS SURPLUS/GDP 1989 I II III 5.0 2.2 1.9 5.2 5.2 5.3 4.3 4.0 2.9 8.5 8.4 7.9 9.7 9.5 9.0 - 108.8 - 127.3 - 140.6 - 0.020 - 0.023 - 0.025 IV 1990 I II III IV 1991 I II III IV 1992 I II III IV 1993 I II III IV 1.4 5.1 0.9 - 0.7 - 3.2 - 2.0 2.3 1.0 2.2 3.8 3.8 3.1 5.4 - 0.1 2.5 1.8 6.2 5.4 5.3 5.3 5.7 6.1 6.6 6.8 6.9 7.1 7.4 7.6 7.6 7.4 7.2 7.1 6.8 6.6 3.1 4.5 4.7 3.9 3.5 4.7 2.9 2.5 2.3 3.1 2.2 1.3 2.5 3.4 2.2 1.8 2.3 7.6 7.8 7.8 7.5 7.0 6.1 5.6 5.4 4.6 3.9 3.7 3.1 3.1 3.0 3.0 3.0 3.1 8.9 9.2 9.4 9.4 9.3 8.9 8.9 8.8 8.4 8.3 8.3 8.0 8.0 7.7 7.4 6.9 6.8 - 143.4 - 172.1 - 171.2 - 164.6 - 184.0 - 160.1 - 213.4 - 234.7 - 253.1 - 288.3 - 291.8 - 316.5 - 293.5 - 300.9 - 267.3 - 275.5 - 253.0 - 0.026 - 0.030 - 0.030 - 0.028 - 0.031 - 0.027 - 0.036 - 0.039 - 0.042 - 0.047 - 0.046 - 0.050 - 0.045 - 0.046 - 0.041 - 0.041 - 0.037 © 2004 Prentice Hall Business Publishing Principles of Economics, 7/e Karl Case, Ray Fair 18 of 40 C H A P T E R 15: Macroeconomic Issues and Policy Data for Selected Variables for the 1989 – 2003 Period Data for Selected Variables for the 1989 – 2003 Period DATE 1994 I II III IV 1995 I II III IV 1996 I II III IV 1997 I II III IV 1998 I II III IV REAL GDP GROWTH RATE (%) UNEMPL. RATE (%) 3.4 5.7 2.2 5.0 1.5 0.8 3.1 3.2 2.9 6.8 2.0 4.6 4.4 5.9 4.2 2.8 6.1 2.2 4.1 6.7 © 2004 Prentice Hall Business Publishing 6.6 6.2 6.0 5.6 5.5 5.7 5.7 5.6 5.6 5.5 5.3 5.3 5.3 5.0 4.8 4.7 4.7 4.4 4.5 4.4 INFL. RATE (%) 2.0 1.8 2.4 1.9 3.0 1.7 1.8 2.0 2.5 1.4 1.9 1.6 2.9 1.9 1.2 1.4 1.1 1.0 1.4 1.1 THREEMONTH T-BILL RATE 3.3 4.0 4.5 5.3 5.8 5.6 5.4 5.3 5.0 5.0 5.1 5.0 5.1 5.1 5.1 5.1 5.1 5.0 4.8 4.3 Principles of Economics, 7/e AAA BOND RATE 7.2 7.9 8.2 8.6 8.3 7.7 7.4 7.0 7.0 7.6 7.6 7.2 7.4 7.6 7.2 6.9 6.7 6.6 6.5 6.3 FED. GOV. SURPLUS - 237.5 - 190.6 - 211.8 - 209.2 - 208.2 - 189.0 - 197.5 - 173.1 - 176.4 - 137.0 - 130.1 - 103.9 - 86.5 - 68.2 - 33.8 - 25.0 19.6 33.0 65.7 57.1 SURPLUS/GDP - 0.034 - 0.027 - 0.030 - 0.029 - 0.029 - 0.026 - 0.027 - 0.023 - 0.023 - 0.018 - 0.017 - 0.013 - 0.011 - 0.008 - 0.004 - 0.003 0.002 0.004 0.007 0.006 Karl Case, Ray Fair 19 of 40 C H A P T E R 15: Macroeconomic Issues and Policy Data for Selected Variables for the 1989 – 2003 Period Data for Selected Variables for the 1989 – 2003 Period DATE 1999 I II III IV 2000 I II III IV 2001 I II III IV 2002 I II III IV 2003 I II REAL GDP GROWTH RATE (%) UNEMPL. RATE (%) INFL. RATE (%) 4.3 4.3 4.2 4.1 4.1 4.0 4.0 3.9 4.2 4.4 4.8 5.6 5.6 5.9 5.8 5.9 5.8 1.8 1.4 1.4 1.6 3.8 2.3 1.6 2.1 3.6 2.5 2.2 -0.5 1.4 1.3 1.2 1.8 2.5 3.1 1.7 4.7 8.3 2.3 4.8 0.6 1.1 -0.6 -1.6 -0.3 2.7 5.0 1.3 4.0 1.4 1.9 THREEMONTH T-BILL RATE 4.4 4.5 4.7 5.0 5.5 5.7 6.0 6.0 4.8 3.7 3.2 1.9 1.8 1.7 1.6 1.3 1.2 AAA BOND RATE 6.4 6.9 7.3 7.5 7.7 7.8 7.6 7.4 7.1 7.2 7.1 6.9 6.6 6.7 6.3 6.3 6.0 FED. GOV. SURPLUS 85.1 116.5 132.0 143.2 212.8 197.2 213.1 193.8 173.8 199.6 -51.7 21.3 -145.8 -195.7 -210.5 -247.7 -253.6 SURPLUS/GDP 0.009 0.013 0.014 0.015 0.022 0.021 0.022 0.019 -0.017 0.014 -0.005 0.002 -0.014 -0.019 -0.020 -0.023 -0.024 Note: The inflation rate is the percentage change in the GDP price deflator. © 2004 Prentice Hall Business Publishing Principles of Economics, 7/e Karl Case, Ray Fair 20 of 40 C H A P T E R 15: Macroeconomic Issues and Policy The 1990 – 1991 Recession • After the Fed became convinced that a recession was at hand, it responded by engaging in open market operations to lower interest rates. • Inflation was not a problem, so the Fed could expand the economy without worrying about inflationary pressures. © 2004 Prentice Hall Business Publishing Principles of Economics, 7/e Karl Case, Ray Fair 21 of 40 C H A P T E R 15: Macroeconomic Issues and Policy 1993 – 1994 • During this period, inflation was not a problem, so the Fed had room to stimulate the economy and kept its expansionary policy. • By the end of 1993 the Fed was worried about inflation problems in the future, and decided to begin slowing down the economy. © 2004 Prentice Hall Business Publishing Principles of Economics, 7/e Karl Case, Ray Fair 22 of 40 C H A P T E R 15: Macroeconomic Issues and Policy 1995 – 1997 • Inflation did not become a problem after 1994, and the Fed lowered interest rates. The three-month Treasury bill rate remained at roughly 5.0 percent throughout 1996 and 1997. • During this period, the economy experienced good growth, low unemployment, low inflation, and a balanced government budget! © 2004 Prentice Hall Business Publishing Principles of Economics, 7/e Karl Case, Ray Fair 23 of 40 C H A P T E R 15: Macroeconomic Issues and Policy 1998 – 2000 • Based on concerns about the Asian financial crisis, the Fed lowered the bill rate to 4.3 percent in the fourth quarter of 1998. • The Asian crisis did not affect the U.S. economy very much, and the Fed began raising the bill rate on fears that the economy might be overheating. © 2004 Prentice Hall Business Publishing Principles of Economics, 7/e Karl Case, Ray Fair 24 of 40 C H A P T E R 15: Macroeconomic Issues and Policy 2001 – 2003 • A recession was officially declared in 2001. • The Fed responded by perhaps the most expansionary policy in its history. • Many expected that the attacks on September 11, 2001 would extend the recession, but the growth rate of output was high enough to keep the unemployment rate roughly unchanged. © 2004 Prentice Hall Business Publishing Principles of Economics, 7/e Karl Case, Ray Fair 25 of 40 C H A P T E R 15: Macroeconomic Issues and Policy Fiscal Policy: Deficit Targeting • Many fiscal policy discussions center around the size of the federal government surplus or deficit. • In the last decade, we have seen a substantial deficit turn into a surplus (between 1998 and 2001) and back into a deficit! © 2004 Prentice Hall Business Publishing Principles of Economics, 7/e Karl Case, Ray Fair 26 of 40 C H A P T E R 15: Macroeconomic Issues and Policy Fiscal Policy: Deficit Targeting • The Gramm-RudmanHollings Bill, passed by the U.S. Congress and signed by President Reagan in 1986, is a law that set out to reduce the federal deficit by $36 billion per year, with a deficit of zero slated for 1991. • In practice, these targets never came close to being achieved. © 2004 Prentice Hall Business Publishing Principles of Economics, 7/e Karl Case, Ray Fair 27 of 40 C H A P T E R 15: Macroeconomic Issues and Policy The Effects of Spending Cuts on the Deficit • A cut in government spending causes the economy to contract. Both the taxable income of households and the profits of firms fall. • The deficit tends to rise when GDP falls, and tends to fall when GDP rises. © 2004 Prentice Hall Business Publishing Principles of Economics, 7/e Karl Case, Ray Fair 28 of 40 C H A P T E R 15: Macroeconomic Issues and Policy The Effects of Spending Cuts on the Deficit • The deficit response index (DRI) is the amount by which the deficit changes with a $1 change in GDP. • If the DRI equals -.22, for example, the deficit rises by $0.22 billion for each $1 billion decrease in GDP. © 2004 Prentice Hall Business Publishing Principles of Economics, 7/e Karl Case, Ray Fair 29 of 40 C H A P T E R 15: Macroeconomic Issues and Policy Economic Stability and Deficit Reduction • Spending cuts must be larger than the deficit reduction we wish to achieve. Congress has two options: 1. Choose a target deficit and adjust government spending and taxation to achieve this target, or 2. Decide how much to spend and tax regardless of the consequences on the deficit. © 2004 Prentice Hall Business Publishing Principles of Economics, 7/e Karl Case, Ray Fair 30 of 40 C H A P T E R 15: Macroeconomic Issues and Policy Economic Stability and Deficit Reduction • A negative demand shock is something that causes a negative shift in consumption or investment schedules or that leads to a decrease in U.S. exports. © 2004 Prentice Hall Business Publishing Principles of Economics, 7/e Karl Case, Ray Fair 31 of 40 C H A P T E R 15: Macroeconomic Issues and Policy Economic Stability and Deficit Reduction • Automatic stabilizers refer to revenue and expenditure items in the federal budget that automatically change with the economy in such a way as to stabilize GDP. © 2004 Prentice Hall Business Publishing Principles of Economics, 7/e Karl Case, Ray Fair 32 of 40 C H A P T E R 15: Macroeconomic Issues and Policy Economic Stability and Deficit Reduction • Automatic destabilizers refer to revenue and expenditure items in the federal budget that automatically change with the economy in such a way as to destabilize GDP. © 2004 Prentice Hall Business Publishing Principles of Economics, 7/e Karl Case, Ray Fair 33 of 40 C H A P T E R 15: Macroeconomic Issues and Policy Deficit Targeting as an Automatic Destabilizer © 2004 Prentice Hall Business Publishing Principles of Economics, 7/e Karl Case, Ray Fair 34 of 40 C H A P T E R 15: Macroeconomic Issues and Policy Fiscal Policy Since 1990 • The average tax rate rose sharply under President Clinton and fell sharply under President Bush. • The deficit is a concern when tax rates are falling and spending is rising. © 2004 Prentice Hall Business Publishing Principles of Economics, 7/e Karl Case, Ray Fair 35 of 40 C H A P T E R 15: Macroeconomic Issues and Policy Federal Personal Income Taxes as a Percent of Taxable Income, 1990 I-2003 II © 2004 Prentice Hall Business Publishing Principles of Economics, 7/e Karl Case, Ray Fair 36 of 40 C H A P T E R 15: Macroeconomic Issues and Policy Federal Government Consumption Expenditures as a Percent of GDP, 1990 I-2003 II © 2004 Prentice Hall Business Publishing Principles of Economics, 7/e Karl Case, Ray Fair 37 of 40 C H A P T E R 15: Macroeconomic Issues and Policy Federal Transfer Payments and Grants-inAid as a Percent of GDP, 1990 I-2003 II © 2004 Prentice Hall Business Publishing Principles of Economics, 7/e Karl Case, Ray Fair 38 of 40 C H A P T E R 15: Macroeconomic Issues and Policy Federal Interest Payments as a Percent of GDP, 1990 I-2003 II © 2004 Prentice Hall Business Publishing Principles of Economics, 7/e Karl Case, Ray Fair 39 of 40 C H A P T E R 15: Macroeconomic Issues and Policy Review Terms and Concepts automatic destabilizer negative demand shock automatic stabilizer recognition lag deficit response index (dri) response lag Gramm-Rudman-Hollings Bill stabilization policy implementation lag time lags © 2004 Prentice Hall Business Publishing Principles of Economics, 7/e Karl Case, Ray Fair 40 of 40