Help Where They Need It - The exercises in the Study Plan offer

advertisement

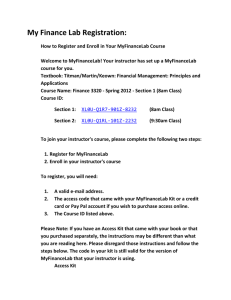

Fall 2012 FIN 3403 Financial Management Online Sections: RVF/RVH Instructor: Joel R. Barber Office: RB 206A, MM Campus Office Phone: 305-348-2027 or 305-348-2680 Office Fax: 305-348-4245 E-mail: barberj@fiu.edu Class Time: Fully Online Class Location: Fully Online Office Hours: Monday 2:00 - 4:00 pm Main Page URL: http://www2.fiu.edu/~barberj Class Numbers: 85241/85338 This is a fully-online section of FIN 3403. All Exams are Online. I will schedule an on-campus review sessions for interested students. Success in this class requires strong self-discipline and time management skills. Carefully read the syllabus as well as all communications from the instructor including email and Discussion Board postings. Students are required to complete various assessments for each chapter on their own time schedule during the week subject to the submission deadlines. Personal issues or technology problems do not excuse you, so please plan accordingly. Blackboard Learn 9 is the Course Management System: Blackboard login instructions Blackboard login Technical requirements We will be using MyFinanceLab, a fully integrated homework and tutorial system with the following features: Textbook problems online Algorithmically generated values for more practice Personalized study plans Extra help for students Online Gradebook It is each student's responsibility to become familiar with both Blackboard and MyFinanceLab Required Materials MyFinanceLab: You are required to purchase access to MyFinanceLab. Textbook: Financial Management: Principles and Applications, 11/E, Sheridan Titman º Arthur J. Keown º John D. Martin, Prentice Hall, 2011, Hardcover Text ISBN: 9780132340359 Three Options: 1. Purchase access and electronic version of textbook from MyFinanceLab. 2. Purchase textbook from bookstore that includes access code to MyFinanceLab (you do not need to buy access code). 3. Purchase access to MyfinanceLab and purchase textbook from some other source. Recommended Financial Calculator: I use and will work examples using TA BA Plus (or TI BA Plus Professional). Allowed Calculators: TI BA II Plus, TI BA II Plus Professional, TI-83 Plus / TI-84 Plus, HP 10bII, HP 12c, HP 17bII+ Bottom Line: You must purchase access to MyFinanceLab, own financial calculator (consider TI BA II if you do not already own a financial calculator), and purchase either a hard copy or electronic version of the textbook. How to Access and Login to MyFinanceLab 1. Go to pearsonmylabandmastering.com. 2. Under Register, click Student. 3. Enter your instructor’s course ID: barber82395, and click Continue. 4. Sign in with an existing Pearson account or create an account: · If you have used a Pearson website (for example, MyITLab, Mastering, MyMathLab, or MyPsychLab), enter your Pearson username and password. Click Sign In. · If you do not have a Pearson account, click Create. Write down your new Pearson username and password to help you remember them. 5. Select an option to access your instructor’s online course: · Use the access code that came with your textbook or that you purchased separately from the bookstore. · Buy access using a credit card or PayPal. · If available, get 17 days of temporary access. (Look for a link near the bottom of the page.) 6. Click Go To Your Course on the Confirmation page. Under MyLab / Mastering New Design on the left, click FIN 3403 - Financial Management - Fall 2012 Dr. Barber to start your work. To sign in later: 1. Go to pearsonmylabandmastering.com. 2. Click Sign In. 3. Enter your Pearson account username and password. Click Sign In. 4. Under MyLab / Mastering New Design on the left, click FIN 3403 – Financial Management - Fall 2012 - Dr. Barber to start your work. Prerequisites Prerequisites: College Algebra (MAC 1105) or Calculus for Business (MAC 2233), Statistics for Business and Economics (STA 2023), Principles of Macroeconomics (ECO 2013), Principles of Microeconomics (ECO 2023) and Accounting for Decisions (ACG 2021). NOTE: Students will be dropped from business courses by the CBA Undergraduate Advising Office if they do not meet the prerequisites. In addition, they will be notified via email of the administrative drop. The email will be sent to the students FIU email account. All students are required to activate and monitor their FIU email accounts. The CBA Undergraduate Advising Office will continue checking enrollment throughout the first week of class and will drop students accordingly. Course Objectives & Course Competencies FIN 3403 is the core finance course required of all business majors. The course integrates practical and theoretical aspects of finance and includes concepts and techniques essential for success in all business disciplines. Emphasis is placed upon the underlying principles and practices and how they relate to the decision making process faced by a financial manager charged with the objective of shareholder wealth maximization. Although this course emphasizes corporate decision making, the skills obtained will also aid the student in personal finance and small business decision making. After completing this course, the student should be able to: Explain and evaluate the concept of shareholder wealth maximization and how it relates to other possible objectives of the firm's management as well as the nature of the agency relationship inherent in the corporate structure. Describe how interest rates are determined and the role played by financial markets and institutions in the global financial system. Explain the concepts of compounding and discounting and utilize these tools to calculate the future value and present value of lump sums, annuities, and uneven cash flow streams and in addition calculate the value of other variables such as the interest rate, time period, and periodic payment. Determine the expected rate of return and risk of an individual investment as well as a portfolio of assets, including concepts such as standard deviation, correlation, diversification, and the CAPM (Capital Asset Pricing Model). Explain the determinants of intrinsic value and utilize these concepts to determine the value and yields of bonds and preferred and common stocks. Calculate various measures of project profitability using traditional capital budgeting techniques including Payback Period, Net Present Value, Internal Rate of Return, and Modified Internal Rate of Return. Explain the concept of the cost of capital and how it is affected by the firms capital structure and the application of these concepts to capital budgeting decision making and dividend policy. Understand the significance of information included in the income statement and balance sheet, discuss the importance of the cash flow statement and explain the difference between accounting net income for the firm and cash flow; analyze a firm's financial performance using financial ratio analysis. Describe the risk-return tradeoff involved in working capital management and explain how firms’ choose appropriate levels of working capital and sources of short term financing. Identify the goals of financial planning and the tools available to forecast the firm's financing requirements. Major & Curriculum Objectives Targeted • Apply critical thinking skills to complex business problems including: Identifying and evaluating relevant issues and information; Generating and evaluating possible solutions to problems. • Use quantitative analytical skills to: Identify and analyze material factors that are involved in business problems; Determine and apply appropriate problem solving techniques to business problems. • Use information technology as a tool to perform essential business tasks. Teaching Methodology The structure of this class makes your individual study and preparation extremely important. You should read and be familiar with the material in the assigned chapter and attempt to solve some problems during the assignment week. There are additional resources available in MyFinanceLab that many students will find helpful. Suggested study procedures: Read the assigned chapter and answer all of the end-of-chapter Study Questions. Utilize the additional resources in MyFinanceLab and Blackboard (Study Plan, PowerPoints) to deepen your understanding of the material. Complete the Homework Assignment for each chapter in MyFinanceLab prior to the deadline; extensions will not be granted. Homework assignments submitted after the posted deadline will incur a 10% score reduction. The Homework Assignments correspond to the end-of-chapter Study Problems in the text. Track your progress for the homework Assignments in the Results section of MyFinanceLab. Post your questions on the Discussion Forum in Blackboard and review the Forum for previously answered questions. Utilize the services of the Student Learning Center in CBC 106A. To learn more, stop by the center and pick up a detailed schedule, call 305-348-1591. Use Course Mail in Blackboard or visit during office hours to communicate privately. Please use Discussion Forum in Blackboard for questions concerning course content. Class and Undergraduate Policies and Procedures Courses follow the University calendar for the term in which they are offered. You are expected to begin your studies in the first week of class and work continually and regularly throughout the term. Students must adhere to University policies and procedures relating to adding, dropping, withdrawing, and canceling courses. Please refer to the Schedule for deadlines. Absolutely no incomplete grades or make-up examinations will be given. In cases of medical or catastrophic emergencies, the student should contact the Registrar's Office to apply for a Late Drop or Refund. Undergraduate Policies & Procedures: The Undergraduate Policies and Procedures Manual outlines and explains the policies and procedures governing undergraduate study at FIU. The policies include those concerning: the Undergraduate Program, University and Department Admission Criteria, College Level Academic Skills (CLAST), Academic Advising, General Academic Policies, Award of Degrees and Commencement Exercises, Educational Support Services and Undergraduate Administration. A keyword index links the Undergraduate, Graduate and Academic Affairs Policies and Procedures Manuals. The Standards of Student Conduct summarizes the position of the University concerning ethics and honesty. Statement of Understanding between Professor and Student: Student Code of Academic Integrity Every student must respect the right of all to have an equitable opportunity to learn and honestly demonstrate the quality of their learning. Therefore, all students must adhere to a standard of academic conduct, demonstrating respect for themselves, their fellow students, and the educational mission of the University. As a student in the College of Business taking this class: I will not represent someone else's work as my own. I will not cheat, nor will I aid in another's cheating. I will be honest in my academic endeavors. I understand that if I am found responsible for academic misconduct, I will be subject to the academic misconduct procedures and sanctions as outlined in the Student Handbook. Failure to adhere to the guidelines stated above may result in one of the following: Expulsion: Permanent separation of the student from the University, preventing readmission to the institution. This sanction shall be recorded on the student's transcript. Suspension: Temporary separation of the student from the University for a specific period of time. By taking this course I promise to adhere to FIU's Student Code of Academic Integrity. For details on the policy and procedure go to the Academic Misconduct section of the Policies and Procedures manual. Exams and MyFinanceLab Assignments - Instructions How to Use MyFinanceLab Take a Sample Test - Sample tests enable students to test their understanding and identify the areas in which they need to do further work. Students can retake the sample tests until they have mastered the material. Review the Study Plan - Taking a practice test automatically generates a personalized study plan showing which topics students have mastered and which they need to practice more. Help Where They Need It - The exercises in the Study Plan offer students a variety of learning aids to help them study concepts on their own, including interactive tutorials, examples, and spreadsheets. Students receive tailored feedback and hyperlinks to the eText. Results Page - Students can click to review an assignment directly from the Results page to see what questions they got right and where they made errors. Reminders for Homework and Tests - Students can see instructor-created announcements on the Course Home page, and the My Assignments dashboard shows what assignments are due today and what assignments are coming up next. Homework Assignment and Exams Please read the Standards of Student Conduct and use it as your guide throughout the course. I take each and every instance of academic misconduct very seriously and hope that this is not an issue with any student who takes the course. Exams: The Exams are multiple choice and are not comprehensive, although some material will carry through. There will be three online exams given throughout the term. Further instructions will be provided before each exam. MyFinanceLab Homework Assignments: A portion of your grade will be based upon homework assignments in MyFinanceLab. The assignments are drawn from the problems at the end of each textbook chapter. You will be given unlimited attempts to correctly answer each question prior to the posted due date. Homework problems that are attempted and submitted beyond the due date will receive a 10% reduction in credit. The number one reason students fail the course is poor performance on Homework Assignments. The number two reason is below-average performance on both the Exams and Homework. Make sure you perform well as possible on the Homework. Also, working the homework is the best preparation for the exams. Prior to attempting any graded assessment, you may wish to use the Study Plan and Sample Tests in MyFinanceLab to receive a personalized study plan which will diagnose areas you need to practice. If you are having trouble with a particular question, while you are in the Assignment, you may want to click Help Me Solve This, View an Example, or Textbook Pages. If you still need help, please post a question on the Discussion Forum for the assigned Chapter. Grade Access, Grade Determination, and Grading Scale Course Grading: The final grade is based upon your performance on the Exams, and Homework Assignments in MyFinanceLab. Assessment Exam #1 (online) Exam #2 (online) Exam #3 (online) Homework Assignments (MyFinanceLab) Total Weight 25% 25% 25% 25% 100% Grading Scale: The letter grade for the course is based upon the scale below. 90 87 84 80 - 100 89 86 83 A AB+ B 77 74 70 60 - 79 76 73 69 BC+ C D 00 - 54 F Scores: All scores will be accessible through Gradebook in MyFinanceLab. Disability Resource Center If a student has a disability and needs assistance, please notify the Instructor and/or contact the Disability Resource Center to make arrangements for the appropriate modification and/or assistance. Extended-time exams will be administered at the Disability Resource Center. Religious Holidays Any student may request to be excused from a scheduled exam to observe a religious holy day of their faith. The student must notify the Instructor and arrange to take the exam in advance of the regularly scheduled exam date. Class Schedule LEGEND Coverage Dates Exam Dates Other Important Dates Date or Chapter/Coverage (Week Of) August 20 1, 2 August 27 3 September 3 4 September 10 5 September 17 and 24 6 1, 2, 3, 4, 5, 6 Topic Due Dates for Corporate Powerpoint MyFinanceLab Finance Slides Homework Live Getting Started --Principles of Finance Chapter September 30 Firms and the Chapter Financial Market Understanding Financial Statements, September 30 Chapter Taxes, and Cash Flows Financial Analysis --Sizing Up Firm September 30 Chapter Performance 1 2 3 4 Time Value of Money September 30 Chapter 5 -- The Basics The Time Value of Money --- Annuities September 30 Chapter 6 and Other Topics EXAM #1 Online Online - two September 30 hours to complete from 8:00 am to Ratio Analysis Time Value of Money October 1 7 October 8 8 October 15 9 October 22 10 7, 8, 9, 10 October 29 11 Drop Date November 5 November 12 November 19 and 26 12 13 14 11, 12, 13, 14 11:55 pm An Introduction to Risk and Return --History of Financial Market Returns Risk and Return --Capital Market Theory Debt Valuation and Interest Rates Stock Valuation October 28 October 28 October 28 October 28 Chapter 7 Risk and Return Bond Chapter 9 Valuation Stock Chapter 10 Valuation Chapter 8 EXAM #2 - Online two hours to complete October 28 from 8:00 am to 11:55 pm Investment Decision Capital December 8 Chapter 11 Criteria Budgeting October 29 Analyzing Project December 8 Chapter 12 Cash Flows Risk Analysis and December 8 Chapter 13 Project Evaluation The Cost of Capital December 8 Chapter 13 EXAM #3 - Online two hours to complete December 8 from 8:00 am to 11:55 pm