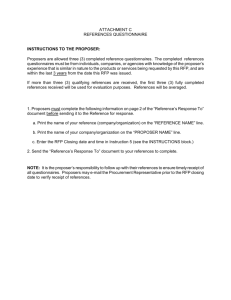

Proposers must describe

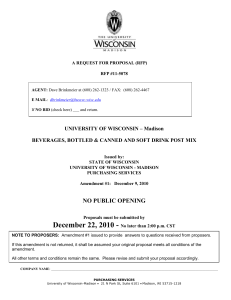

advertisement