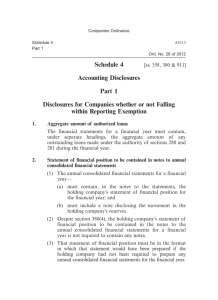

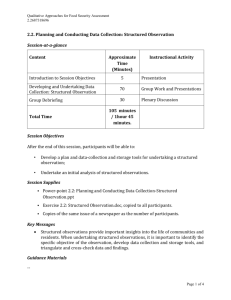

11. Identification of the Financial Statements

advertisement