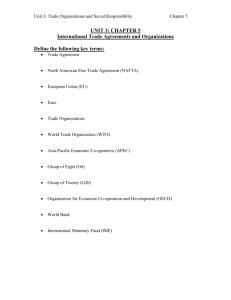

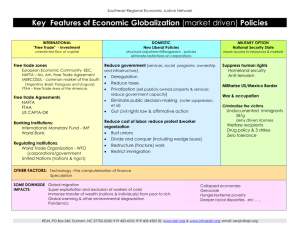

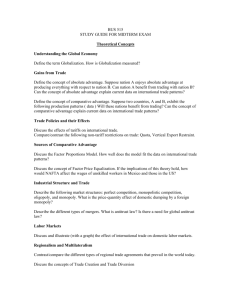

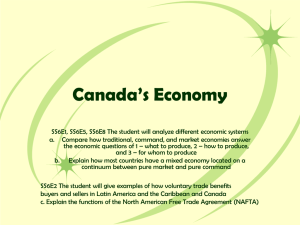

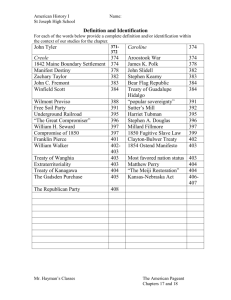

Taxation, Non-Discrimination and International Trade in Services

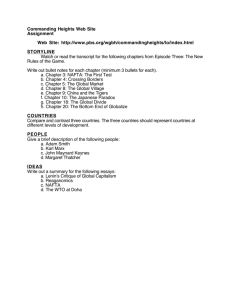

advertisement