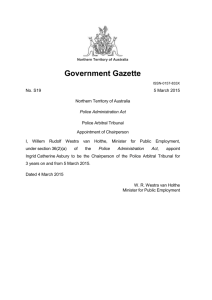

details - ThaiFTA

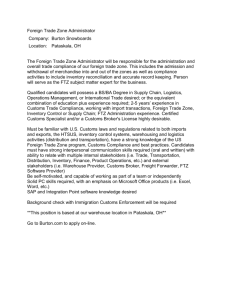

advertisement