View/Open

advertisement

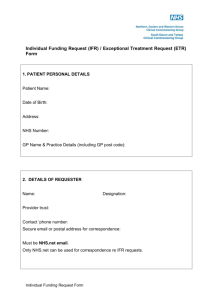

THE IMPACT OF INTERNET FINANCIAL REPORTING ON STOCK PRICES AND ABNORMAL RETURN Lesli Mamaha Ruga Grace T. Pontoh Rahmawati HS ABSTRACT This paper focuses on three examining: the impact of Internet Financial Reporting (IFR), the degree of information disclosure, and the scope of information through internet on stock prices and abnormal return in Indonesian Stock Exchange. This study compares stock prices and abnormal returns between companies with IFR and without IFR, and between companies which disclose more information and those which provide less information on their website. This study also compare abnormal returns between companies that provide a large scope of information disclosure and company that provides a small scope of information disclosure on their website. This study use cross sectional data with event study methodology to investigate all companies listed at the Indonesia Stock Exchange (IDX) until the end of 2010. The result show first, that IFR by using Mann Whitney U test, has significant impact on stock prices and abnormal returns. Second, the degree of information disclosure through the internet, by using the Independent Sample t test, also has significant impact on stock prices and abnormal returns. Finally, the scope of information through the internet, by using Mann Whitney U test, has insignificant impact on abnormal returns. Keywords: Internet Financial Reporting, degree of information disclosure, scope of information disclosure, stock prices, abnormal returns 1. Introduction The rapid development of information technology has an impact in people's lives. Information technology has become a key enabler for a business environment, which means that the business needs information technology to be survived in an increasingly competitive world. In the past few years, internet has become a part of information technology development. Internet has several characteristic and advantages such as pervasiveness, timeliness, low cost, and accessibility (Ashbaugh et al., 1999). In addition, internet can spread the information more quickly, effective and efficient. Internet has been used as a communication tool to provide information about a company. Recently, internet provides a new mode of information dissemination, including the dissemination of financial information that called as IFR (Internet Financial Reporting). IFR refers to the usage of company’s website to disseminate information about the financial performance of the company. IFR is considered as a tool to spread the information more quickly and widely (easily accessible), and to reduce the cost of producing hard copies of financial statements (Barac, 2004). In addition, the publication of financial 1 reporting through the internet is expected to provide significant benefits to corporate reporting, including to facilitate access to potential investors and stakeholders (Ashbaugh et al., 1999) . The disclosures of financial information on the internet offer the same access for all investors (Wagenhover, 2003). However, the internet financial reporting is a voluntary disclosure and unregulated, which means, there is no compulsion to a company to disclose their financial information on the internet eventhough the company has a website. Lai et al., (2010) stated that there’s no international standard that regulate the kind of IFR, which impact the differences in the content of company website. In Indonesia, The Indonesian Capital Market and Financial Institutions Supervisory Agency (Bapepam-LK) has regulated the disclosure of information or matters related to the public companies which may affect the companies’ stock price in the Rule Number X.K.1: Disclosure of Information that must be Made Public Immediately (Decision of The Chairman of Bapepam No: Kep-86/PM/1996 on 24 January 1996). This rule is expected to encourage the public listed companies to immediately announce the information which has significant influence to their stock price, including the financial reporting. Most of the studies about IFR show that firms’ size is the most influence factor to the information disclosure on the internet. Beside that, other factors such as liquidity, leverage, and profitability have positif impact to the information disclosure on the internet. The study of Asbaugh et al., (1999), as one of the pioneer of IFR, found that only firms’ size that influence in IFR practice and IFR is an effective communication tool between firms and stakeholders. Craven and Matson (1999), which researched large firms in England, concluded that firms’ size has significant impact to IFR. There are some studies which have consistent results to Craven and Matson (1999), such as Oyelere et al., (2000) on New Zealand Stock Exchange, Larrán and Giner (2002) on Madrid Stock Exchange, Bonsón and Escobar (2002) on 300 firms from many countries in Eropa, and also Allam dan Lymer (2003) with firms in 5 developed countries. In Indonesia, the study of IFR still has the same focus as the study abroad. There are studies by Chariri and Lestari (2005) and Agustina (2008) which result that firms’ size and type of industry are the most factors that influence information disclosure on the internet. The other studies focus on measurement of quality and content of financial and sustainability reporting on firm’s website by Budi and Almilia (2009) that conclude that firms in Indonesia have not optimize their website to disclose financial information. There are many studies about IFR, but still a few studies that focused on the relation between IFR and stock prices. There was a study by Lai et al., (2010), who compared the firms with IFR and without IFR on Taiwan Stock Exchange. The study concluded that IFR has significant impact on stock prices and abnormal returns. In Indonesia, studies which focused on the relation between IFR and stock prices carried by Hargyantoro (2010) that concluded that IFR has significant impact on stock frequency. Another study by Yulia (2011), that concluded that The Degree of Information Disclosure has significant impact on stock prices. 2 This study replicate the study of Lai et al., (2010). The reason of the replication because there is still a little study about the impact of IFR on stock prices in Indonesia and to re-examine the theory with different samples and location whether the result is similar to previous study. 2. Theoretical Foundation and Hypotheses Development 2.1 The Theory of Efficient Markets The efficient markets hypothesis was first developed by Fama (1970). This theory believes that there is perfect information in the stock market, which means that stock prices reflect all available information. According to Beaver (1968), market efficiency is a relation between information and stock prices. Useful information will be highlighted by many stakeholders such as managements, investors, and policy makers (government and capital market supervisory agency) and auditors. Those information must be on time and relevan, because the decision making by investors depend on how far and how fast those information can influence the market that reflected by the change of stock prices. Haugen (2001) in Gumantri dan Utami, 2004) divided information into 3 groups: (1) information in past stock prices, (2) all public information, (3) all available information including inside or private information. Each group of information reflects the level of market efficiency. 2.2 The Signaling Theory Information is an important element for investors and businesses. The complete, accurate and timely information, are required by investors in capital markets as analysis tool to make investment decisions. The signaling theory explains about how a company should be give the signal to the user of financial reporting. This signal contains information about what the management has been done to accomplish the owner desires. One of the signals is given by the company through the disclosure on the company's website. 2.3 Internet Finacial Reporting Internet Financial Reporting refers to the usage of company website to disseminate information about the financial performance of the corporations (Lai et al., 2010). International Accounting Standards Committee (IASC) in Venter (2002: 213) has identified three stages in the presentation of financial reporting on the Web, namely (1) Duplication of the printed financial statements in “electronic paper” format, (2) Conversion of paper reports into HTML format, (3) Progression beyond the printed paper format by using ornamental that is not possible with paper. According to the study of Allam and Lymer (2002), the most popular format to purposes of reporting financial information is HTML and PDF. The Steering Committee of the Business Reporting Research Project (2000: 1) has identified several motives of companies in presenting information through the internet: 1. Reduction of the cost involved in and the time required for the distribution of information. 3 2. 3. 4. 5. Communication with previously unidentified users of information. Supplementation of traditional disclosure practices. Increase in the extent and types of data disclosure. Improvement of the access that small companies have to potential investors. 2.4 The Impact of Internet Financial Reporting on Stock Prices and Abnormal Return Efficient market hypothesis predicts if markes are efficient, then, in equilibrium, the stock prices will respond to any information that enters the market. On the investment market, useful information usually causes investor to take an action which lead to redistribution on investment return that can be changed the balance of market. Investors react quickly and fully to new information encounter the market, causing the immediate adjustment of shares’ price. This is consistent to Beaver (1968) and Fama (1970) that the stock’s price will move when the useful information enters the market. The literature shows that firms get benefits by doing voluntary disclosure (reducing capital costs, agency fees or contract costs and enhance enterprise value). Voluntary disclosure will reduce the information asymmetry between investors and management regarding the company's financial condition and operations, so that the information disclosed through the IFR as a voluntary disclosure is quickly available to the investors and shorten the delay of information accessibility. Therefore, the response speed of the companies stock price that apply IFR will be different from companies that do not apply IFR. Therefore, the hypothesis is as follows. Hypothesis 1: There are significant differences in stock prices between companies with IFR and those without IFR Hypothesis 2: The abnormal returns of companies with IFR will be higher than those without IFR 2.5 The impact of the degree and scope of information disclosure on stock prices and abnormal return. The important point of signaling theory is that without transparency of information between buyers and sellers, buyers will bid up to the lowest price so the sellers must lower the product quality to maintain profitability. This economy behaviour, will lead to the loss of sellers with high quality goods. This phenomenon is called selective admissions (Spence, 1973). To avoid such situations in the investment market, Beaver (1968) stated that the company will disclose as much information so investors are able to distinguish between good companies and bad companies. Voluntary disclosure of additional information that reveals both financial and non-financial services through the internet will ultimately create greater transparency of information. According to Ashbaugh et al. (1999), an essential element of IFR is the degree or level of disclosure. The higher levels of information disclosure in quantity or transparency will impact to decisions of investor. Easley et al (2004) concluded in their study that investors are given more relevant information to achieve higher return on their investment. This shows how the quantity and quality of information affects stock prices. 4 In addition, the channels of information’ disclosure, can be expanded in scope on the internet by connecting multiple sites into one integrated reporting system. Each website on internet provides information about the performance of subsidiaries, divisions, or strategic business units. Thus, the network not only provides information about the overall performance of the entity, but also the performance of individual business units. Therefore, the hypothesis is as follows. Hypothesis 3: There are significant differences in stock prices between companies that provide more information and those that provide less information on website Hypothesis 4: The abnormal return of companies that provide more information will be higher than those that provide less information on website Hypothesis 5: The abnormal return of companies that provide a large scope of information disclosure will be higher than those that provide a small scope of information disclosure on website. The research model in this study is represented in figure 1. Internet Financial Reporting H1 H2 Degree of Information Disclosure H3 H4 H5 Stock Prices Abnormal Return Scope of Information Disclosure Figure 1 Research Model 3 Research Methodology 3.1 Research Approach This study is conducted to test the hypothesis (hypothesis testing) by performing comparative testing of all the variables studied. This study is an event study and literature research which carried out in cross-sectional that involves a certain time with lots of samples that only can be used once within a period of observation to test the comparative and relationships via the internet publication of financial reporting, the degree of information disclosure on websites and scope of information disclosure on websites on stock prices and abnormal returns. 3.2 Population and Sample Population of this research is all public listed companies on the Indonesian Stock Exchange (IDX) until the end of 2010. The sampling method used in this research is purposive sampling, with the following conditions for the companies: 5 1. 2. 3. 4. 5. Have been listed on the Indonesia Stock Exchange until the end of 2010 Have websites and disclose financial reporting on their websites Have exact dates of IFR publication on the websites; Have complete data from IDX Companies with significantly stable β for the periods before and after the event window 6. Companies with matched companies (non IFR) Of all 419 companies listed on the Indonesian Stock Exchange until the end of 2010, there are 276 companies have websites but only 190 companies that provide financial and non financial information on their websites. Of 190 firms disclosing financial and non-financial information on their websites, only 32 firms are included in the final sample of the IFR companies and 32 samples of non IFR companies as control grup. Non IFR companies are companies without website or with website but did not post financial information. The distribution of sample for each hypothesis is as follows. a) For hypothesis 1 and hypothesis 2, the number of sample used are 64 companies consisting of 32 companies which have implemented IFR and 32 companies which have not applied IFR. b) For hypothesis 3 and hypothesis 4, the number of sample used are 32 companies which have implemented the IFR. They are divided into two groups, namely (1) TPI1: companies which have more information disclosure on the website (> 20) containing of 17 companies and (2) TPI2: companies which have less information disclosure on the website (<20) containing of 15 companies. c) For hypothesis 5, the number of sample used are 32 companies which have implemented the IFR. They are divided into two groups, namely (1) LPI1: the companies which have more scope of information disclosure on the website (> 1) containing of 10 companies and (2) LPI2: the companies which have less scope of information disclosure on the website (<1) containing of 22 companies. This study use 111 trading days consisting of 100 days estimation period and 11-day period covering 5 days before the event day, an event day (the day of financial statements publication) and 5 days after the event day. That period is used to indicate whether or not there is an advantage signal in the short term and in the liquidity of stock trading due to the publication of financial statements. Period 5 days before the event day is used to determine whether there is a information leakage within the company while the period of 5 days after the event day to determine the speed of market reaction, as presented by Ghufron (2006) in Yulia (2011). 3.3 Measurement 1. Stock prices: stock prices are used for hypothesis 1 and 3. Stock prices are calculated by cummulative ratio of stock prices’ returns in 5 days after event window. Here is the formula for calculating the return of stock prices 6 Where, Rit is the return of security I during period t, measured as the change of current stock price (Pt) to the previous closing price (Pt-1 ) and divided by previous closing price. 2. Abnormal returns: abnormal returns are used for hypothesis 2, 4, and 5. An abnormal return is calculated by using market-adjusted model that assumed as the best formula to measure abnormal returns. This hypothesis use “event study” during 11 days, with a 5 days before, 1 event day and 5 days after event date. Here is the formula for calculating abnormal return. Where, ARit is an abnormal return of security I during period t, Rit is the return of security I during period t, and Rmt is the market index return on day t. Rmt is computed by the change of current composite stock price index divided by the previous composite stock price index. Cumulative abnormal return is defined as: 3. Internet Financial Reporting IFR and Non IFR are category scale, then we called dummy variable. Value of a IFR company is “1” and value of a non IFR company is “0”. 4. The Degree of Information Disclosure The method to measure the degree of information’ disclosure is adapted from Ettredge et al. (2001) which is modified by Lai et al. (2010). The assessment use 4-point scale that showed on table 2. 5. The Scope of Internet Reporting. The Scope of Internet Reporting is defined as the extent by which the firm's central website is linked to other websites within or outside of the firm to form an inter- or intra-firm website structure (Lai at al., 2010). The other websites are: (1) the Indonesian Stock Exchange, (2) subsidiary companies or major divisions, (3) strategic business units, and (4) up-stream companies such as suppliers and manufacturers, and down-stream companies such as wholesalers, retailers, and other customers. Each type of linkage is assigned one point and the total possible points for a firm are four points that show on table 3. 4 Results 1. The relationship between IFR and Stock Prices Hypotesis 1 is tested by normality test to determine kind of hypotesis testing. Normality test shows if level of significance < 0,05, that means distribution of data is not normal. Based on this result, we used Mann Whitney U test. The result of Mann Whitney U test is significance (0,041<0,05), shows that hypotesis 1 can be accepted. 2. The Relationship between IFR and Abnormal Return Hypotesis 2 is tested by normality test to determine kind of hypotesis testing. Normality test shows if level of significance < 0,05, that means distribution of data is not normal. Based on this result, we used Mann Whitney 7 U test. The result of Mann Whitney U test is significance (0,003 < 0,05), shows that hypotesis 2 can be accepted. 3. The Relationship between the Degree of information disclosed and Stock Prices Hypotesis 3 is tested by normality test to determine kind of hypotesis testing. Normality test shows if level of significance > 0,05, that means distribution of data is normal. Based on this result, we used Independent sample t-test. The result of Independent sample t-test is significance (0,036 < 0,05), shows that hypotesis 3 can be accepted. 4. The Relationship between the Degree of information disclosed and Abnormal return Hypothesis 4 is tested by normality test to determine kind of hypotesis testing. Normality test shows if level of significance > 0,05, that means distribution of data is normal. Based on this result, we used Independent sample t-test. The result of Independent sample t-test is significance (0,041 < 0,05), shows that hypotesis 4 can be accepted. 5. The Relationship between the Scope of Internet Reporting and Abnormal return. Hypotesis 5 is tested by normality test to determine kind of hypotesis testing. Normality test shows if level of significance < 0,05, that means distribution of data is not normal. Based on this result, we used Mann Whitney U test. The result of Mann Whitney U test is not significance (0,640 > 0,05), shows that hypotesis 5 can not be accepted. Summary of the results are presented in table 1 below. H1 H2 H3 H4 H5 Table 1 Summary of results Hypothesis There are significant differences in stock prices between companies with IFR and those without IFR. The abnormal returns of companies with IFR will be higher than those without IFR. There are significant differences in stock prices between companies that provide more information and those that provide less information on websites. The abnormal returns of companies that provide more information will be higher than those that provide less information on websites The abnormal returns of companies that provide a large scope of information’ disclosure will be higher than those that provide a small scope of information’ disclosure on websites. Accepted Accepted Accepted Accepted Not Accepted 8 6. Discussion The test results will be discussed as follows. 1. The Results of Hypothesis 1 and Hypothesis 2 The test results regarding the influence of Internet Financial Reporting (IFR) on stock prices and abnormal stock return show that there are significant differences between stock prices and abnormal stock returns of companies who applied IFR practices and those which not applied the IFR practices. The results of this study support the results of research performed by Lai et al. (2010)., which stated that the stock prices will move when there is useful information entering the market. In accordance with the efficient market theory that if the market is efficient and balanced, then the useful information would cause investors to react quickly, as reflected in the stock price changes. The test results performed on two groups of companies, companies that have applied and who have not applied IFR, shows that the company's stock price is more responsive after the publication of financial reporting via the Internet, so there are significant differences between stock prices and abnormal stock returns of companies who applied IFR practices and those which not applied the IFR practices. 2. The Results of Hypothesis 3 and Hypothesis 4 The test results regarding the influence of Disclosure Level on stock prices and abnormal returns show that there are significant differences between stock prices and abnormal stock returns of companies that provide more levels of disclosure of information via the Internet those which provide fewer levels of information disclosure through the internet. The results of this study support the results of research conducted by Ashbaugh et al. (1999) and Lai et al. (2010). According to Ashbaugh et al. (1999), an essential element of IFR is the degree or level of disclosure. The higher the level of disclosure of information in quantity or transparency, the greater the impact of disclosure on investor decisions that will be reflected by changes in securities prices. While Lai et al., (2010) concluded that the higher the degree of completeness of the information presented in the company's website will cause an increase in stock prices. So it can be said that the higher level of disclosure in the company's website will benefit the investors in obtaining relevant information in quick time. It will make investors be more quickly in responding or taking action against company’ stocks which will make stock prices move more quickly and automatically enhances abnormal stock returns. 3. The Results of Hypothesis 5 The test results of the fifth hypothesis suggests that the scope of disclosure does not affect significantly positive to abnormal stock returns of the companies which have larger scope of information disclosure on their website with a significance value of 0.640 where the value is greater than 0.05 (α = 5%). The results of this study do not support the results of the study Lai et al. (2010), who found that there is no significant effect between the Scope of 9 Disclosure with the abnormal return. This shows that companies in Indonesia have not considered the scope of the information disclosure on the website as something important. It is characterized by abnormally low returns of the companies which have broader scope of information disclosure than those which have smaller scope of information disclosure. 5 Conclusion and Limitations of Research 5.1 Conclusion This study focuses on examining whether the disclosure information trough internet has impacts on stock prices and whether the degree of information disclosure and scope of information disclosure have significant impacts on stock prices and abnormal returns. The results are shown below. 1. There are significant differences in stock prices between companies with IFR and those without IFR. 2. The abnormal returns of companies with IFR are higher than those without IFR. 3. There are signficant differences in stock prices between companies that provide more information and those with less information on websites. 4. The abnormal returns of companies that provide more information are higher than those with less information on websites. 5. There are no significant differences in abnormal returns between companies that provide a large scope of information disclosure and those with a small scope of information disclosure on websites. 5.2 Limitations of Research This study has limitations as follows. 1) The observation period is limited only for one year, which has less ability to predict long-term results. 2) The method used to find the abnormal return in this study using the market adjusted model. 3) Measurement of the degree of information disclosure used an adaptation of Ettredge (2001) as modified by Lai et al. (2010) for research in Taiwan. Thus not necessarily correspond to the measurement degree of information corporate disclosure in Indonesia. References Agustina, Linda. 2008. Pengaruh Karakteristik Perusahaan terhadap Luas Pengungkapan Informasi Keuangan pada Website Perusahaan. Tesis. Semarang: Program Pascasarjana Universitas Diponegoro. Allam, A. and A. Lymer. 2003. Developments In Internet Financial Reporting:Review And Analysis Across Five Developed Countries. The International Journal Of Digital Accounting Research 3(6). pp. 165-199. Almilia, Luciana Spica. 2009. Analisa Komparasi Indeks Internet Financial Reporting Pada Website Perusahaan Go Publik Di Indonesia. Jurnal disajikan dalam Seminar Nasional Aplikasi Teknologi Informasi 2009 (SNATI 2009). Yogyakarta, 20 Juni 2009 10 Ashbaugh, H. Johnstone, K. and Warfield, T. 1999. Corporate Reporting On The Internet. Accounting Horizons 13(3). pp. 241-257. Bapepam. Keputusan Ketua Bapepam No. Kep-38/PM/1996 tanggal 17 Januari 1996. Tentang Laporan Tahunan. (www.bapepam.go.id). Diakses tanggal 25 April 2011. Barac, K. 2004. Financial reporting on the internet in South Africa. Meditari Accountancy Research Vol. 12 No. 1. pp. 1–20 Beaver, Wiliam. H. 1968. The Information Content Of Annual Earnings Announcement. Journal of Accounting Research 6(3). pp. 67-92. Budi, Sasongko Susetyo dan Almilia, Luciana Spica. 2007. Corporate Internet Reporting of Banking Industry and LQ45 Firms: An Indonesia Example. Chariri, Anis dan Lestari, Hanny Sri. 2005. Analisis Faktor-Faktor yang Mempengaruhi Pelaporan Keuangan di Internet (Internet Financial Reporting) dalam Website Perusahaan. Semarang: Fakultas Ekonomi Universitas Diponegoro. Craven, B. M. and Marston, C.L. 1999. Financial Reporting On The Internet By Leading Uk Companie. The European Accounting Review 8(2). pp. 321333. Ettredge, M., V. J. Richardson, and S. Scholz. 2002. “Dissemination of Information for investors at Corporate Web sites”. Journal of Accounting and Public Policy 21:357- 369. Fama, E. F. 1970: Efficient Capital Markets: A Review of Theory and Empirical Work. Journal of Finance. pp. 383-417. Hargyantoro, Febrian. 2010. Pengaruh Internet Financial Reporting Dan Tingkat Pengungkapan Informasi Website Terhadap Frekuensi Perdagangan Saham. Skripsi. Semarang: Fakultas Ekonomi Universitas Diponegoro. Indonesian Stock Exchange. 2010. I D X Fact Book 2010. Lai, Syou Ching. Cecilia, Lin. Hung, Chih Li. Frederick, H. Wu. 2010. An Empirical Study of the Impact of Internet Financial Reporting on Stock Prices. International Journal of Digital Accounting Research. pp.126. Oyelere, Peter. Fawzi Laswad and Richard Fisher. 2000. Corporate Financial Reporting:Firm Characteristics And The Use Of The Internet As A Medium Of Communication. Commerce Division Discussion Paper No. 81. The Steering Committee of the Business Reporting Research Project. 2000. Electronic Distribution Of Business Reporting Information. Venter, J.M.P. 2002. A Survey Of Current Online Reporting Practices In South. Africa. Meditari Accountancy Research. Vol. 10. pp. 209-225. Yulia, Dina, 2011. Pengaruh Internet Financial Reporting Terhadap Harga Saham, Skripsi.Malang: Fakultas Ekonomi Universitas Brawijaya. 11 Appendix Measurement Items of The Degree of Information Disclosure Information Disclosure Type Basic Profile News Item Operasional Financial Information Stock Information Measurement Items 1 2 3 4 5 6 7 1 2 3 1 2 3 1 2 3 4 5 6 7 8 9 10 11 1 2 3 4 Score Firm profile & history Business cultures, operation policies & strategies Products and services information Firm’s organization and management team Human resources information Investment & conglomerate Contact information Industry information Products and operations information Finance–related news Operation profile 1 Operation objective & outlook Industry analysis & related research report Selected financial information Condensed quarterly financial reports Condensed semi-annual financial reports Condensed annual financial reports Complete set of financial reports (quarterly) Complete set of financial reports (semi-annual) Complete set of financial reports ( annual) Annual board of directors report Monthly operational revenue information Financial analysis Financial forecast Historical stock price and dividend information Dividend policies Current stock price information Stock agent information Total score The Measurement Items of the Scope of Internet Reporting Measurement Items Link firm's website to stock market station of Indonesian Stock Exchange Link firm's website to major divisions or subsidiary companies Link firm's website to strategic business units Link firm's website to up-stream and down-stream companies Total score 1 1 1 1 1 1 1 1 1 1 1 1 1 1 2 2 2 3 3 3 4 1 1 1 1 1 1 1 40 Score 1 1 1 1 4 12