prepared remarks - Automotive News

advertisement

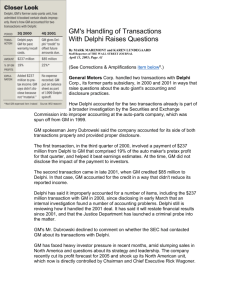

PREPARED REMARKS KEYNOTE ADDRESS by ROBERT S MILLER AUTOMOTIVE NEWS WORLD CONGRESS JANUARY 16, 2005 Thank you for that kind introduction … I promised Rick Wagoner and Ron Gettelfinger that I would avoid saying anything tonight that is related to Delphi’s ongoing confidential discussions with GM and the UAW. So that concludes my remarks. Good night … Actually, it’s a great honor to speak here, but it does seem a stretch to fit Delphi within this year’s overall theme: “The Road to Prosperity.” So I will instead focus on “A Shifting Landscape”, before getting to the prosperity part. Delphi is essentially a “Tale of Two Cities”. A bi-modal company that represents all that is great, and at the same time, all that is troublesome, in our automotive industry. Half our company is global, growing, and profitable. And half our company is shrinking and struggling. We’re in the national spotlight because we’re at the confluence all the many uncomfortable economic and social trends affecting our industry and our society. At Delphi’s birth at the spin-off in 1999, General Motors had created the world’s largest auto supplier, with the incredible blessing of sophisticated automotive technologies, but with Tier I automotive labor contracts that are substantially higher than the prevailing contracts throughout the supplier industry. Simply put, we are uncompetitive in our US operations cost structure. The spin-off of Delphi was the right concept for GM. The basic idea was for Delphi to outrun these labor costs by growing and diversifying its customer base and global footprint. My predecessor did a commendable job on that score. So what went wrong? Two things. First, the spread between Delphi’s costs and competitive supplier costs has widened sharply over the past decade, driven by the globalization of our industry and by rising retiree costs. And second, the decline in GM North American production volumes has been devastating. When the money ran out, we had no choice but to file bankruptcy. And just like the Delphi of ancient mythology, there are numerous myths that surround the contemporary Delphi. There are so many fantasies in the press reports about Delphi and our industry that I can hardly recognize the real world place where I go to work. Here’s my take on eight of these myths. Myth One. Delphi blames its workers for ending up in bankruptcy. False. 1 Delphi’s workers are loyal, dedicated, and skilled at their craft. Our production records and quality gains, even in the tough year of 2005, could not have been possible without them. They help us invent the future by focusing on the technology that wins new business and diversifies our customer base. We have not sought any emergency relief from our labor contracts in the courts, and our workers are continuing to receive their contractual pay and benefits. We are in good faith discussions with our unions, as is required under the bankruptcy law. GM has indicated a willingness to provide some financial assistance, which allows us to discuss so-called ‘soft landings’ to protect our people from undue hardship. It’s very complex, and will take awhile to finish. Our committed objective is to arrive at a consensual resolution to our problem without having to unilaterally impose changes to the labor contract. We have a long history of working things out with our union leadership, and we will continue to do so even under these stressful circumstances. Behind all this financial drama are the lives and livelihoods of thousands of Delphi workers. They played by the rules, and cannot be blamed for having taken a high-paying job at GM or Delphi. They expected us to live up to our promises, but have been caught by that shifting global landscape. They are at risk of being severely impacted and disappointed. I don’t blame them for being angry. I don’t blame them, period. But together, we have to face marketplace realities. Myth Two. Delphi went broke because management cooked the books. Malarkey! It is true that Delphi has had to restate its earnings going back to the time of the spin-off, and that is a matter of profound corporate embarrassment. But the major adjustments were related to the years 1999-2001, which is ancient history in this business. More importantly, none of the adjustments affected cash balances, and as you know, you end up in bankruptcy when you run out of cash, irrespective of reported earnings. Flawless accounting would not have changed the outcome. One final point. The board did a thorough investigation, and made personnel changes affecting those involved in the errors. There are new hires in key positions. The Delphi managers now in charge are part of the solution, not the problem. Myth Three. companies. Bankruptcy is the end of the road for once-great Hogwash! Done right, a successful Chapter 11 process can give a new lease on life to a deeply troubled business. I’ve been associated with a number of bankruptcy situations (Nobody ever calls me when things are going well!) – and the consistent record is that companies that go through it come out stronger than before. 2 I went through my first such restructuring a decade ago as Chairman of Boise-based Morrison Knudsen Construction, in the aftermath of a disastrous leadership by those Detroit legends, Bill Agee and Mary Cunningham. Now known as Washington Group, the company has tripled in size, and is thriving and profitable. Bethlehem Steel was comprised of six domestic steel mills when I joined as CEO in 2001, all of them in imminent danger of extinction. The six mills now are operating in the black and providing good jobs as part of the Mittal Group, the world’s largest steel company. Federal Mogul, where I served as interim CEO, is poised to emerge from a dreadful asbestos-related bankruptcy process that has gone on for four long years, but its operations and underlying profitability have been steadily improving throughout. And United Airlines, where I sit as a board member, just two years ago was predicted by all the pundits to join Pan Am, TWA, and Eastern Airlines in that Great Hangar in the Sky. To everyone’s astonishment, it is flying higher and better today than when it entered Chapter 11, and will soon be out. Remember, Delphi’s heritage is that we “invent the future.” That didn’t change on October 8th. Delphi is committed to providing the highest-quality, lowest-cost technology – including innovations such as satellite radio, navigation systems, stability control, safety systems, common rail diesel injection systems, advanced steering, sophisticated electrical connection systems, and of course, the lifeblood of today’s industry – advanced electronics. We’re working with Ford on hybrids. Beyond autos, we are gaining in other markets such as medical, commercial vehicles, computers, and consumer electronics. Our vision at Delphi is to take the necessary bitter pill of a restructuring, but come out the other side as an even stronger, more vibrant competitor than ever. Just you watch! Anybody can cut costs – but returning a company to prosperity requires continued focus on all the business fundamentals. That means sustained motivation of our employees, careful nurturing of the supply chain, and a relentless pursuit of new technological advances. You literally need to keep draining the swamp even though you’re up to your rear-end in alligators. Myth Four. Bankruptcy is an easy and unfair way to dump legacy obligations. Baloney. Nobody who has ever had to struggle through a bankruptcy process can possibly have made such a statement, but I have seen it loosely tossed about by politicians and disappointed creditors. First, consider the shareholders. They own the company. For them, bankruptcy is only a ‘remedy of last resort’ since they know that Chapter 11 quite often ends up with zero shareholder value. 3 But what about the managers? Don’t they love the benefits of Chapter 11? Hardly! The work is more demanding, the rewards harder to come by, and the future very uncertain. And when you are out in public, you are Rodney Dangerfield – you don’t get no respect! OK. But what about those pension promises and so forth? Don’t companies get a free ride by stripping off pension liabilities in a bankruptcy? Not really. First, a little philosophy about the bankruptcy process in the United States. In many other countries, bankruptcy automatically means a liquidation – close the factories and auction off the equipment. The whole idea of Chapter 11 in the US is that all the creditors will be better off if the business enterprise survives intact, rather than being broken up and sold off in pieces. In some cases, that means that pension obligations have to be terminated and handed off to the PBGC, but that is allowed only in cases where the reorganization could not succeed but for the termination. There is obviously little point in maintaining an obligation that would crush any chance for the business to survive. Such was the case at Bethlehem Steel. And it was the case at United Airlines. But the jury is still out at Delphi. We hope to create a reorganization plan sufficiently robust that we can support our accumulated past pension obligations out of future profits. And by the way, pension plan termination does not mean you’re off Scot free. The PBGC becomes a major creditor of the company, and takes its fair share of the resulting value of the company alongside other creditors as the Chapter 11 case is resolved. Myth Five. GM, and maybe Ford, will follow Delphi into bankruptcy. I sure wouldn’t bet on it! No question, the legacy costs and fierce competition that have pushed Delphi over the edge, have become very problematic for GM, Ford, and Chrysler as well. At Delphi, we ran out of money last fall, and we have to deal with these issues now. The Big Three have their date with destiny next year – September 2007, when their labor contracts expire. I am confident solutions will be found, since all sides recognize that the status quo is not an option. The three companies and the unions have capable, experienced, and realistic leadership that will find a way through this mess. Myth Six. Globalization is inevitably a bad thing for Michigan. I disagree. To begin with, whether we like it or not, globalization is a fact of life these days. At the same time that General Motors’ hottest market is in China, we have Hyundai opening a fabulous new tech center just down the road in Ann Arbor. Governor Granholm is doing the right thing in trying to woo other companies here as well. We’d better accept the 4 fact that no one can guarantee a safe and growing home market any more. The competition is truly global, and unrelenting. But Michigan has highly educated and experienced people to offer. There is no reason our state can’t adapt to the evolving environment, exploit our advantages, and prosper from it. We tend to blame globalization for all our problems. I think there is a deeper issue. What is at stake here is the basic social contract in our traditional industries: steel, airlines, and autos. What these three industries had in common was a longstanding social contract, funded by employers, and worked out over the past half century. The unions in these industries were able to win major economic gains for their members, while their employers passed along the costs to customers. Elaborate defined benefit retirement programs were included in the mix. Back in the days when you worked for one employer till age 65 and then died at age 70, and when health care was unsophisticated and inexpensive, the social contract inherent in these programs seemed affordable. Today, defined benefit retirement programs are undergoing major revision and replacement as industrial compensation policy. First off, the lack of portability of defined benefits forces people to stay with one employer, even though we have a much more mobile and flexible population these days. Second, the notion of having all your retirement eggs in one basket – your employer – is a concentration of risk that is proving to be inadvisable for many people in today’s fast moving economy. Finally, these programs have a way of toppling traditional large employers, and disrupting employees and retirees with limited flexibility to cope. You have to ask whether companies should be making open-ended promises to its workers for fifty years down the road. The great positive of today’s health technology advancements is that people are living longer these days. And medical science is rapidly expanding the capability to spend vast amounts of money keeping each of us alive for decades. We have an affordability dilemma, and it is getting more difficult every year. When I visit our factories and talk to our workers, they tell me that their most cherished benefit is the hard-won right to retire with a full pension and health care after thirty years. In theory, thirty-andout creates new jobs, or at least facilitates downsizing the workforce when necessary. For a number of our employees, it means enjoying the fruits of your labor for more years than you were at labor. As a society, somebody has to pay. The traditional manufacturers who offer this benefit are now struggling financially, since their customers won’t pay for it when they have choices. A lot has been written about how globalization is the villain in this story. That is only part of the story. At Bethlehem Steel, we whined about imports, but in truth we were being run off the road by domestic competitors such as Nucor and Steel Dynamics. They paid good wages, but needed half the labor hours per ton of steel to do the job. In the airline industry, United, Delta, and Northwest have been clobbered by Jet Blue and Southwest, not Air India or Air China. And in the auto industry, Toyota, Nissan, and others are competing from assembly plants in our back yard, with good pay and benefits and flexible work rules. 5 I just don’t buy the argument that globalization has to be a race to the bottom in terms of income opportunity. Given a competitive cost structure and modern operating agreements, companies like Delphi should be able to sustain substantial ongoing businesses with good jobs here in Michigan and throughout America well into the future. Myth Seven. The pension crisis will go away if Congress would simply give companies more time to fund. Wrong Answer! We do have a looming crisis at the PBGC with all the recent and threatened defaults. The numbers are staggering. On one hand, the pension problem is slowly being resolved as more and more of our private sector moves to ‘defined contribution’, 401(k) type of programs. Recently, in fact, bellwether companies like IBM and Verizon have announced freezing their pension plans and replacing them with 401(k) plans instead. We can still do something, however, to avoid further devastating train wrecks with remaining traditional defined benefit programs. Congress has been wrestling with this issue for years. The big question surrounds the dilemma: do you tighten the funding rules and risk tipping over more pension plans into the arms of the PBGC? Or do you loosen the rules, only to find more companies getting into trouble later? There are two reasons we’ve ended up with a pension crisis. Point one, our accounting system permits broad latitude in the assumptions about the earning power of plan assets versus the present value of the plan liabilities. Anyone who is allowed to play with the interest rates, can always show you how a one dollar investment can cover a two dollar problem. Thus Corporate America chronically underestimates the real economic shortfall in the funding of most plans. The SEC is looking into this, and I expect some stiffening of the disclosure requirements. You can’t solve a problem until you are willing to recognize it. Point Two is that there is incredible lag time in the IRS rules for addressing any pension funding shortfall. By the time the rules catch up with you, you may be hopelessly behind. Sure, there are other things companies would rather spend money on than shoring up the pension plan. But it was not the intent of the system to provide easy credit at the expense of the PBGC. Where I fundamentally disagree with the direction Congress is headed, however, is the notion that one-size-fits-all solutions are appropriate. In a nutshell, I would significantly tighten, rather than loosen, the rules, but at the same time give the PBGC the flexibility, with approval authority vested in its board, to cut tailor-made repayment plans that reflect the needs companies that have fallen behind. And I would give the PBGC what I call conventional weapons, including the right to negotiate covenants, collateral, benefit freezes, and other mechanisms to protect the interests of the PBGC from catastrophic failures. Right now, the PBGC has only the nuclear option 6 of plan termination, which they use sparingly and only when all is lost. What I am suggesting will not make our current problems disappear. But we can deal with them constructively without creating more problems down the road. To repeat my suggestion: Tighten the rules. Empower the PBGC to deal with individual situations. One final myth. Myth Eight. health care woes. There’s no silver bullet to fix our Sorry, but this one is true! Health care is a serious issue for our industry, and for all Americans. There is no simple fix. Unlike pension promises, which are pre-funded to some extent, health care promises made to retirees by and large are completely unfunded and without any Federal backstop except the partial coverage of Medicare for those over 65. GM had been sagging under the weight of unfunded health care obligations to retirees. Working together with the UAW, they got some relief in exchange for putting substantial cash into a VEBA. Although the remaining obligation may still be daunting, this was a painful, courageous and positive step. We are reaping the harvest of years of putting more and more of our country’s social costs onto the backs of employers. We lament the loss of jobs to foreign entities that sell goods to our consumers without those burdens. The impact of health care costs is a big part of the problem. How long can we afford this approach? We could spend a month here talking about all the things that could be done to reduce the cost of health care. It’s an important debate. Tort reform and information technology need to be part of the mix. But when it comes to who pays, loading so much of the cost of our nation’s health care on employers and workers is destroying jobs at an alarming rate. Broader based health care programs financed by consumption taxes, ugly as they are politically, may be one way we can slow down the job losses. It won’t be easy. My worries go beyond the auto industry. The economic and demographic factors I am describing are also embedded in our political debates over Social Security and Medicare. The overwhelming voltage in the political third rail of touching these entitlements may forestall corrective action for years, but the problem will only grow. I fear something like inter-generational warfare, as young people increasingly resent having their wages reduced and taxed away to support social programs for their grandparents’ income and health care concerns. We can’t ignore this much longer. To conclude, what’s going to happen to Delphi? If we do this right, Delphi will remain one of the world’s premier global automotive suppliers with flexible and profitable operations in America, all the while continuing to expand our global technical prowess, and working with customers of all kinds to “invent the future.” 7 If we do it badly, Delphi may be broken up into small pieces, and America will have lost some of its precious industrial treasures. impact of a collapse could seriously injure many of the world’s automakers. The We didn’t plan it this way, but Delphi has become a metaphor for nearly every economic and social issue gripping America. It is a huge problem, but also a huge opportunity to address our issues straight on and resolve them, doing everything possible to mitigate the impact on our people. Thank you 8