P5.3 Consolidation Eliminating Entries, Date of Acquisition

advertisement

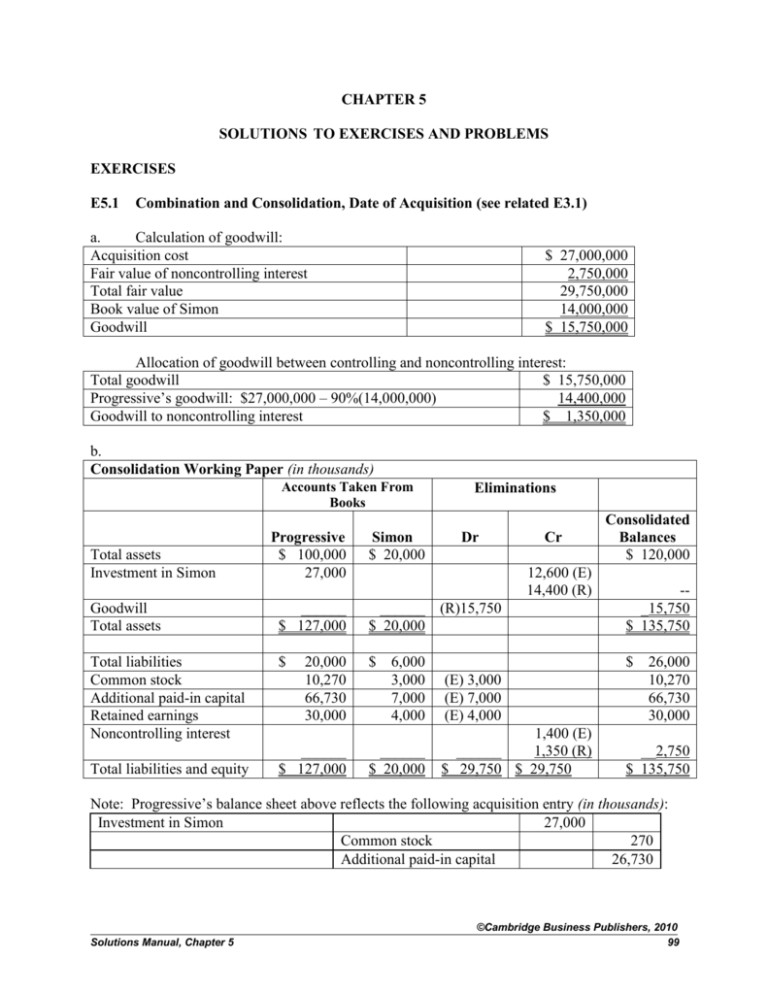

CHAPTER 5 SOLUTIONS TO EXERCISES AND PROBLEMS EXERCISES E5.1 Combination and Consolidation, Date of Acquisition (see related E3.1) a. Calculation of goodwill: Acquisition cost Fair value of noncontrolling interest Total fair value Book value of Simon Goodwill $ 27,000,000 2,750,000 29,750,000 14,000,000 $ 15,750,000 Allocation of goodwill between controlling and noncontrolling interest: Total goodwill $ 15,750,000 Progressive’s goodwill: $27,000,000 – 90%(14,000,000) 14,400,000 Goodwill to noncontrolling interest $ 1,350,000 b. Consolidation Working Paper (in thousands) Accounts Taken From Books Total assets Investment in Simon Progressive $ 100,000 27,000 Simon $ 20,000 Eliminations Dr Cr 12,600 (E) 14,400 (R) Consolidated Balances $ 120,000 Goodwill Total assets ______ $ 127,000 ______ (R)15,750 $ 20,000 -_15,750 $ 135,750 Total liabilities Common stock Additional paid-in capital Retained earnings Noncontrolling interest $ $ $ Total liabilities and equity 20,000 10,270 66,730 30,000 ______ $ 127,000 6,000 3,000 7,000 4,000 ______ $ 20,000 (E) 3,000 (E) 7,000 (E) 4,000 1,400 (E) ______ 1,350 (R) $ 29,750 $ 29,750 26,000 10,270 66,730 30,000 __2,750 $ 135,750 Note: Progressive’s balance sheet above reflects the following acquisition entry (in thousands): Investment in Simon 27,000 Common stock 270 Additional paid-in capital 26,730 Solutions Manual, Chapter 5 ©Cambridge Business Publishers, 2010 99 c. Consolidated Balance Sheet, January 1, 2011 (in thousands) Assets Total assets Goodwill Total assets Liabilities and stockholders’ equity Total liabilities Stockholders’ equity Progressive’s stockholders’ equity: Common stock Additional paid-in capital Retained earnings Total Progressive’s stockholders’ equity Noncontrolling interest Total stockholders’ equity Total liabilities and stockholders’ equity E5.2 $ 120,000 15,750 $ 135,750 $ 26,000 10,270 66,730 30,000 107,000 2,750 109,750 $ 135,750 Date of Acquisition Consolidation with In-Process R&D a. Calculation of goodwill: Acquisition cost Fair value of noncontrolling interest Total fair value Book value of Saylor Fair value – book value: Land IPR&D Goodwill $ 10,000,000 2,000,000 12,000,000 $ 6,000,000 500,000 1,000,000 $ 7,500,000 4,500,000 Allocation of goodwill between controlling and noncontrolling interest: Total goodwill $ 4,500,000 Pennant’s goodwill: $10,000,000 – 80%(7,500,000) 4,000,000 Goodwill to noncontrolling interest $ 500,000 b. Consolidated Financial Statement Working Paper (E) Stockholders’ equity – Saylor 6,000,000 Investment in Saylor (80%) Noncontrolling interest in Saylor (20%) ©Cambridge Business Publishers, 2010 100 4,800,000 1,200,000 Advanced Accounting, 1st Edition (R) Land IPR&D Goodwill 500,000 1,000,000 4,500,000 Investment in Saylor (1) Noncontrolling interest in Saylor (2) (1) 80% x (500,000 + 1,000,000) + 4,000,000 (2) 20% x (500,000 + 1,000,000) + 500,000 E5.3 5,200,000 800,000 Date of Acquisition Consolidation, Bargain Purchase a. Acquisition cost Fair value of noncontrolling interest Total Book value of Sparrow Fair value – book value: Land Other plant assets Investments Long-term debt Fair value of identifiable net assets Gain on acquisition $ 22,000,000 4,000,000 26,000,000 $ 25,000,000 (800,000) 2,000,000 1,500,000 (700,000) 27,000,000 $ (1,000,000) Peregrine’s acquisition entry: Investment in Sparrow Merger expenses 23,000,000 3,000,000 Cash Gain on acquisition b. 25,000,000 1,000,000 Consolidated Financial Statement Working Paper (E) Stockholders’ equity – Sparrow 25,000,000 Investment in Sparrow (80%) Noncontrolling interest in Sparrow (20%) Solutions Manual, Chapter 5 20,000,000 5,000,000 ©Cambridge Business Publishers, 2010 101 (R) Other plant assets, net Investments Noncontrolling interest in Sparrow (1) 2,000,000 1,500,000 1,000,000 Land Long-term debt Investment in Sparrow (2) 800,000 700,000 3,000,000 (1) $5,000,000 – 4,000,000 (2) $23,000,000 – 20,000,000 E5.4 Consolidated Balance Sheet, Date of Acquisition, with Goodwill: U.S. GAAP and IFRS a. Calculation of goodwill: Acquisition cost [($3,000,000 + (200,000 x $80)) Fair value of noncontrolling interest Total fair value Book value of Powerline Fair value – book value: Current assets Plant and equipment Brand names Goodwill $ 19,000,000 1,800,000 20,800,000 $ 4,500,000 500,000 6,000,000 2,000,000 $ 13,000,000 7,800,000 Allocation of goodwill between controlling and noncontrolling interest: Total goodwill $ 7,800,000 Microsoft’s goodwill: $19,000,000 – 90%(13,000,000) 7,300,000 Goodwill to noncontrolling interest $ 500,000 ©Cambridge Business Publishers, 2010 102 Advanced Accounting, 1st Edition b. Consolidation Working Paper (in thousands) Accounts Taken From Books Current assets Plant and equipment, net Investment in Powerline Brand names Goodwill Total assets Current liabilities Long-term liabilities Common stock, par value Additional paid-in capital Retained earnings Noncontrolling interest Total liabilities and equity Eliminations Microsoft Powerline Dr $ 7,000 $ 2,000 (R) 500 35,000 7,000 (R) 6,000 19,000 $ $ ______ 61,000 5,000 20,000 5,000 20,000 11,000 ______ $ 61,000 $ $ $ ______ 9,000 1,500 3,000 100 1,400 3,000 ______ 9,000 Cr 4,050 (E) 14,950 (R) (R) 2,000 (R) 7,800 Consolidated Balances $ 9,500 48,000 -2,000 __7,800 $ 67,300 $ (E) 100 (E) 1,400 (E) 3,000 450 (E) ______ 1,350 (R) $ 20,800 $ 20,800 6,500 23,000 5,000 20,000 11,000 __1,800 $ 67,300 Note 1: Microsoft’s balance sheet above reflects the following acquisition entry (in thousands): Investment in Powerline 19,000 Cash 3,000 Common stock 2,000 Additional paid-in capital 14,000 Note 2: The $14,950,000 credit to investment in entry (R) = 90% (500,000 + 6,000,000 + 2,000,000) + 7,300,000 (goodwill). The $1,350,000 credit to noncontrolling interest in entry (R) = 10% (500,000 + 6,000,000 + 2,000,000) + 500,000 (goodwill). c. Calculation of goodwill: Acquisition cost 90% x fair value of identifiable net assets Goodwill Solutions Manual, Chapter 5 90% x $13,000,000 $ 19,000,000 11,700,000 $ 7,300,000 ©Cambridge Business Publishers, 2010 103 Consolidation Working Paper (in thousands) Accounts Taken From Books Current assets Plant and equipment, net Investment in Powerline Brand names Goodwill Total assets Eliminations Microsoft Powerline Dr $ 7,000 $ 2,000 (R) 500 35,000 7,000 (R) 6,000 19,000 $ Current liabilities Long-term liabilities Common stock, par value Additional paid-in capital Retained earnings Noncontrolling interest $ Total liabilities and equity $ ______ 61,000 5,000 20,000 5,000 20,000 11,000 _____ 61,000 $ $ ______ 9,000 1,500 3,000 100 1,400 3,000 _____ $ 9,000 Cr 4,050 (E) 14,950 (R) (R) 2,000 (R) 7,300 Consolidated Balances $ 9,500 48,000 -2,000 __7,300 $ 66,800 $ (E) 100 (E) 1,400 (E) 3,000 450 (E) ______ __850 (R) $ 20,300 $ 20,300 6,500 23,000 5,000 20,000 11,000 __1,300 $ 66,800 Note: The IFRS alternative valuation method attributes no goodwill to the noncontrolling interest. E5.5 Consolidation Eliminating Entries, Date of Acquisition: U.S. GAAP and IFRS (amounts in thousands) a. Perma’s acquisition entry: Investment in Seismic Merger expenses 14,000 400 Cash Common stock, par value Additional paid-in capital ©Cambridge Business Publishers, 2010 104 400 2,000 12,000 Advanced Accounting, 1st Edition Consolidation eliminating entries: (E) Common stock Additional paid-in capital Retained earnings 200 4,000 6,000 Accumulated OCI Treasury stock Investment in Seismic Noncontrolling interest in Seismic (R) Plant assets, net Trademarks Customer lists Long-term debt Goodwill (1) (1) (2) (3) 3,000 1,000 800 100 1,700 Investment in Seismic (2) 5,900 Noncontrolling interest in Seismic (3) 700 ($14,000 + $1,600) – ($9,000 + $3,000 + $1,000 + $800 + $100) = $15,600 – $13,900 90% x ($3,000 + $1,000 + $800 + $100) + ($14,000 – 90% x $13,900) 10% x $4,900 + [$1,700 – ($14,000 – 90% x $13,900)] b. Consolidation eliminating entries: (E) Common stock Additional paid-in capital Retained earnings Accumulated OCI Treasury stock Investment in Seismic Noncontrolling interest in Seismic (R) Plant assets, net Trademarks Customer lists Long-term debt Goodwill (4) 200 4,000 6,000 500 700 8,100 900 3,000 1,000 800 100 1,490 Investment in Seismic Noncontrolling interest in Seismic (5) (4) 500 700 8,100 900 5,900 490 $14,000 – 90% x $13,900 Solutions Manual, Chapter 5 ©Cambridge Business Publishers, 2010 105 (5) 10% x ($3,000 + $1,000 + $800 + $100) Note: The IFRS alternative valuation method attributes no goodwill to the noncontrolling interest. E5.6 Consolidation at End of First Year (see related E4.3) a. Calculation of goodwill is as follows: Acquisition cost ($10,000,000 + $300,000) Fair value of noncontrolling interest Total Book value of Saddlestone Identifiable intangibles Goodwill $ 10,300,000 6,500,000 16,800,000 $ 7,200,000 2,000,000 Allocation of goodwill between controlling and noncontrolling interest: Total goodwill Peak’s goodwill: $10,300,000 – 60%($9,200,000) Goodwill to noncontrolling interest b. 9,200,000 $ 7,600,000 $ 7,600,000 4,780,000 $ 2,820,000 2011 equity in net income and noncontrolling interest in net income: Saddlestone’s reported net income Revaluation writeoff: Identifiable intangibles $2,000,000/5 Total $ 3,000,000 Equity in NI $ 1,800,000 Noncontrolling interest in NI $ 1,200,000 (400,000) $ 2,600,000 (240,000) $ 1,560,000 (160,000) $ 1,040,000 c. Consolidation working paper eliminating entries for 2011: (C) Equity in net income of S 1,560,000 Dividends – Saddlestone Investment in Saddlestone (E) Stockholders’ equity— Saddlestone, 1/1 600,000 960,000 7,200,000 Investment in Saddlestone Noncontrolling interest in Saddlestone ©Cambridge Business Publishers, 2010 106 4,320,000 2,880,000 Advanced Accounting, 1st Edition (R) Identifiable intangibles Goodwill (1) (2) 2,000,000 7,600,000 Investment in Saddlestone (1) Noncontrolling interest in Saddlestone (2) 60% x $2,000,000 + $4,780,000 40% x $2,000,000 + $2,820,000 (O) Amortization expense 5,980,000 3,620,000 400,000 Identifiable intangibles (N) Noncontrolling interest in income of Saddlestone 1,040,000 Dividends – Saddlestone Noncontrolling interest in Saddlestone E5.7 400,000 400,000 640,000 Consolidation Two Years after Acquisition (all numbers in thousands) a. Calculation of 2012 equity in net income and noncontrolling interest in net income: Noncontrolling Total Equity in NI interest in NI Silver Nugget’s reported NI for 2012 ($100,000 – $80,000 – $14,000 = $6,000) $ 6,000 $ 4,800 $ 1,200 Revaluation write-off: Identifiable intangibles ($20,000/5) (4,000) (3,200) (800) $ 2,000 $ 1,600 $ 400 Solutions Manual, Chapter 5 ©Cambridge Business Publishers, 2010 107 b. Consolidation Working Paper, December 31, 2012 Trial Balances Taken From Books Dr (Cr) Current assets Plant and equipment, net Intangibles Investment in Silver Nugget Goodwill Current liabilities Long-term debt Common stock Additional paid-in capital Retained earnings, Jan. 1 Treasury stock Noncontrolling interest Dividends Sales revenue Equity in income of Silver Nugget Cost of goods sold Operating expenses Noncontrolling interest in NI Mirror Resorts Silver Nugget $ 35,000 215,700 350,000 86,400 $ 5,000 140,000 51,000 -- Eliminations Consolidated Dr Cr $ (R) 16,000 4,000 (O) 400 (C) 17,200 (E) 68,800 (R) (R) 68,000 (50,000) (600,000) (500) (6,000) (25,000) 4,000 (20,000) (150,000) (100) (5,500) (17,500) 1,600 2,000 1,500 (800,000) (100,000) (1,600) 650,000 140,000 -$ -0- -80,000 14,000 --0- ©Cambridge Business Publishers, 2010 108 $ Balances (E) 100 (E) 5,500 (E) 17,500 1,600 (E) 4,300 (E) 15,200 (R) 100 (N) 1,200 (C) 300 (N) 40,000 355,700 413,000 -68,000 (70,000) (750,000) (500) (6,000) (25,000) 4,000 (19,600) 2,000 (900,000) (C) 1,600 (O) 4,000 (N) 400 $ 113,100 $ _______ 113,100 -730,000 158,000 400 $ -0- Advanced Accounting, 1st Edition E5.8 Consolidation after Several Years a. Paulin’s acquisition cost Fair value of noncontrolling interest Total Fair value of identifiable net assets: 1,850,000 – 10,000 + 20,000 + 100,000 + 40,000 Goodwill $ 1,800,000 600,000 2,400,000 $ 2,000,000 400,000 Paulin’s share of goodwill = $1,800,000 – 75%($2,000,000) = $300,000 Noncontrolling interest’s share of goodwill = $100,000 b. January 2007 balance Change in Stevan’s retained earnings, 2007-2012: (1,550,000 – 1,000,000), divided 75:25 Writeoff of Stevan’s identifiable net asset revaluations, 2007-2012: (-10,000 + 20,000 + 60,000 + 40,000), divided 75:25 Goodwill impairment, 2007-2012: (400,000 – 250,000), divided 75:25 Balance, end of 2012 Noncontrolling Investment interest $ 1,800,000 $ 600,000 412,500 137,500 (82,500) (27,500) (112,500) $ 2,017,500 $ (37,500) 672,500 c. (E) Stockholders’ equity-Stevan 2,400,000 Investment in Stevan Noncontrolling interest in Stevan (R) Equipment, net (1) Goodwill Investment in Stevan (2) Noncontrolling interest in Stevan (3) (1) $100,000 – (6/10) x $100,000 (2) 75% x ($40,000 + $250,000) (3) 25% x ($40,000 + $250,000) Solutions Manual, Chapter 5 1,800,000 600,000 40,000 250,000 217,500 72,500 ©Cambridge Business Publishers, 2010 109 E5.9 Consolidated Cash Flow from Operations Consolidated net income ($15,000,000 + $5,000,000) + Consolidated depreciation expense + Amortization of previously unrecognized identifiable intangibles - Amortization of premium created when revaluing LT debt - 40% of undistributed equity method income (.4 x $1,700,000) + Decrease in noncash current operating assets - Decrease in current operating liabilities Cash flow from operating activities $20,000,000 3,000,000 1,400,000 (80,000) (680,000) 2,800,000 (2,100,000) $24,340,000 Note: The $8,000,000 net income reported by the 75%-owned subsidiary is already included in consolidated income, and is therefore not separately reported. E5.10 Consolidated Cash Flow from Operations Consolidated net income (1) + Consolidated depreciation expense (2) + Consolidated amortization expense (3) + Goodwill impairment loss - Undistributed equity investment income (4) Cash flow from operating activities (1) Calculation of equity in net income: P’s share of reported income 80% x $200,000 P’s share of revaluation write-offs: Depreciation Amortization Goodwill impairment loss Equity in net income Calculation of consolidated net income: Parent’s reported income Subsidiary’s reported income Less equity in net income of subsidiary Less revaluation writeoffs: Depreciation Amortization Goodwill impairment loss Consolidated net income (2) (3) (4) $ 981,600 180,000 25,000 30,000 (18,000) $ 1,198,600 $ 160,000 $ (1,600) (8,000) (24,000) 126,400 $ $ 950,000 200,000 (126,400) (2,000) (10,000) (30,000) 981,600 $150,000 + $28,000 + $2,000 $15,000 + $10,000 $45,000 - $27,000 ©Cambridge Business Publishers, 2010 110 Advanced Accounting, 1st Edition E5.11 Consolidation at Date of Acquisition, IFRS (in millions) a. Calculation of goodwill: Acquisition cost Less 49% fair value of identifiable net assets Goodwill € 67 (11) € 78 49% x (22.5) Noncontrolling interests = 51% x €(22.5) = €(11.5) b. (E) Investment in ASTAR Noncontrolling interest 10 10.5 Stockholders’ equity-ASTAR 20.5 (R) Noncurrent financial assets Goodwill Noncontrolling interests 2 78 1 Intangible assets Investment in ASTAR 4 77 E5.12 Consolidation Worksheet, Date of Acquisition and One Year Later, IFRS (in millions) a. Calculation of goodwill: Acquisition cost Fair value of identifiable net assets: Book value Revaluations: Customer lists Trade name Assumed liabilities Deferred tax assets, net Total fair value of identifiable net assets Vivendi’s share Goodwill € 787 € (118) 150 25 (484) 123 (304) x 85% (258) € 1,045 Noncontrolling interests = 15% x (304) = €(46) Solutions Manual, Chapter 5 ©Cambridge Business Publishers, 2010 111 b. (E) Investment in TPS Noncontrolling interest 100 18 Stockholders’ equity-TPS (R) Goodwill Customer lists Trade name Deferred tax assets, net Noncontrolling interest 118 1,045 150 25 123 28 Assumed liabilities Investment in TPS 484 887 c. Calculation of equity in net loss of TPS and noncontrolling interest in TPS income is as follows: Noncontrolling Equity in NL interest in NI TPS’ reported income for 2007 € 68.00 €12.00 Revaluation write-offs: Customer lists (€150/5) (25.50) (4.50) Goodwill impairment (100.00) -Trade name impairment (4.25) (0.75) € (61.75) € 6.75 (C) Investment in TPS 61.75 Equity in net loss of TPS (E) Investment in TPS Noncontrolling interest 61.75 100 18 Stockholders’ equity-TPS (R) Goodwill Customer lists Trade name Deferred tax assets, net Noncontrolling interest 1,045 150 25 123 28 Assumed liabilities Investment in TPS ©Cambridge Business Publishers, 2010 112 118 484 887 Advanced Accounting, 1st Edition (O) Amortization expense Impairment losses 30 105 Customer lists Goodwill Trade name (N) Noncontrolling interest in NI 6.75 Noncontrolling interest Solutions Manual, Chapter 5 30 100 5 6.75 ©Cambridge Business Publishers, 2010 113 PROBLEMS P5.1 Consolidation Working Paper, Date of Acquisition (all numbers in millions) a. Calculation of goodwill: Acquisition cost Fair value of noncontrolling interest Total fair value Book value of Bagota Fair value – book value: Property, plant and equipment Patents and trademarks Customer-related intangibles Long-term liabilities Goodwill $ 1,200 _375 1,575 $ 500 (200) 45 30 __25 _400 $ 1,175 Allocation of goodwill between controlling and noncontrolling interest: Total goodwill $ 1,175 Hershey’s goodwill: $1,200 – 75%(400) 900 Goodwill to noncontrolling interest $ 275 b. Consolidation Working Paper (in millions) Accounts Taken From Eliminations Books Current assets PP&E, net Investment in Bagota Hershey $ 1,500 1,600 1,200 Bagota $ 325 600 -- 1,300 -_____ $ 5,600 $ 1,600 1,900 300 1,950 3,900 (4,000) (50) 75 _____ $ 1,000 $ 100 400 10 200 300 -(10) _____ $ 5,600 _____ $ 1,000 Patents and trademarks Customer-related intangs Goodwill Total assets Current liabilities Long-term liabilities Common stock, par value Additional paid-in capital Retained earnings Treasury stock Accumulated OCI Noncontrolling interest Total liabilities and equity ©Cambridge Business Publishers, 2010 114 Dr (R) 45 (R) 30 (R) 1,175 (R) 25 (E) 10 (E) 200 (E) 300 _____ $ 1,785 Consolidated Cr Balances $ 1,825 200 (R) 2,000 375 (E) 825 (R) -1,420 30 1,175 $ 6,450 $ 1,700 2,275 300 1,950 3,900 (4,000) 10 (E) (50) 125 (E) 250 (R) 375 $ 1,785 $ 6,450 Advanced Accounting, 1st Edition c. Consolidated Balance Sheet, July 1, 2011 Assets Current assets Property, plant and equipment, net Goodwill Other intangibles Total assets Liabilities and stockholders’ equity Current liabilities Long-term liabilities Total liabilities Stockholders’ equity Hershey’s stockholders’ equity: Common stock Additional paid-in capital Retained earnings Treasury stock Accumulated other comprehensive loss Total Hershey stockholders’ equity Noncontrolling interest Total stockholders’ equity Total liabilities and stockholders’ equity P5.2 $ $ $ 1,825 2,000 1,175 1,450 6,450 1,700 2,275 3,975 300 1,950 3,900 (4,000) (50) 2,100 375 2,475 $ 6,450 Consolidated Balance Sheet Working Paper, Date of Acquisition, Bargain Purchase (see related P3.4) a. (amounts in millions) Acquisition cost Fair value of noncontrolling interest Total Book value of Saxon Fair value – book value: Inventory Long-term marketable securities Land Buildings and equipment, net Long-term debt Fair value of identifiable net assets Gain on acquisition Solutions Manual, Chapter 5 $ 1,000 200 $ 1,200 $ 1,295 100 (50) 245 300 110 2,000 $ (800) ©Cambridge Business Publishers, 2010 115 Paxon’s acquisition entry: Investment in Saxon 1,800 Cash Gain on acquisition 1,000 800 b. Consolidation Working Paper (in millions) Accounts Taken From Books Cash and receivables Inventory Marketable securities Investment in Saxon Paxon $ 1,860 1,700 -1,800 Saxon $ 720 900 300 Land Buildings and equipment Accumulated depreciation Total assets Current liabilities Long-term debt Common stock, par value Additional paid-in capital Retained earnings Noncontrolling interest Total liabilities and equity 650 3,400 (1,000) $ 8,410 $ 1,500 2,000 500 1,200 3,210 -$ 8,410 175 600 -$ 2,695 $ 1,000 400 100 350 845 -$ 2,695 Note: In journal entry form, the eliminating entries are: (E) Common stock, par value Additional paid-in capital Retained earnings Investment in Saxon Noncontrolling interest (R) Inventory Land Buildings and equipment Long-term debt Noncontrolling interest Eliminations Dr (R) 100 (R) 245 (R) 300 (R) 110 (E) 100 (E) 350 (E) 845 (R) 59 $ 2,109 Consolidated Balances $ 2,580 2,700 50 (R) 250 1,036 (E) -764 (R) 1,070 4,300 (1,000) $ 9,900 $ 2,500 2,290 500 1,200 3,210 259 (E) 200 $ 2,109 $ 9,900 Cr 100 350 845 1,036 259 100 245 300 110 59 Marketable securities Investment in Saxon ©Cambridge Business Publishers, 2010 116 50 764 Advanced Accounting, 1st Edition The adjustment to noncontrolling interest brings its balance to fair value at the acquisition date. The adjustment to the investment eliminates the remaining balance. c. Consolidated Balance Sheet, December 31, 2012 (amounts in millions) Assets Cash and receivables Inventory Current assets Long-term marketable securities Land Buildings and equipment, net of $1,000 accumulated depreciation Total assets Liabilities and stockholders’ equity Current liabilities Long-term debt Total liabilities Stockholders’ equity Paxon stockholders’ equity: Common stock Additional paid-in capital Retained earnings Total Paxon stockholders’ equity Noncontrolling interest Total stockholders’ equity Total liabilities and stockholders’ equity P5.3 $ $ $ $ 2,500 2,290 4,790 500 1,200 3,210 4,910 200 5,110 9,900 Consolidation Eliminating Entries, Date of Acquisition (all amounts in thousands) a. Investment in Stark Merger expenses 7,600 250 Cash Earnings contingency liability b. 2,580 2,700 5,280 250 1,070 3,300 9,900 7,250 600 Consolidation working paper eliminating entries: (E) Common stock Retained earnings 1,000 4,000 Investment in Stark Noncontrolling interest Solutions Manual, Chapter 5 3,750 1,250 ©Cambridge Business Publishers, 2010 117 (R) Inventories Intangibles In-process research and development Goodwill (1) Noncurrent liabilities 500 200 1,000 3,730 300 Cash and receivables Plant assets, net Lawsuit liability Investment in Stark (2) Noncontrolling interest (3) (1) Calculation of goodwill: Acquisition cost Fair value of noncontrolling interest Total fair value Book value of Stark Fair value – book value: Cash and receivables Inventories Plant assets, net Intangibles Noncurrent liabilities IPR&D Lawsuit liability Goodwill 100 200 380 3,850 1,200 $ 7,600 2,450 10,050 $ 5,000 (100) 500 (200) 200 300 1,000 (380) 6,320 $ 3,730 Allocation of goodwill between controlling and noncontrolling interest: Total goodwill $ 3,730 Penn’s goodwill: $7,600 – 75%(6,320) 2,860 Goodwill to noncontrolling interest $ 870 (2) (3) $7,600 – 3,750, or 75% x (6,320 – 5,000) + 2,860. $2,450 – 1,250, or 25% x (6,320 – 5,000) + 870. ©Cambridge Business Publishers, 2010 118 Advanced Accounting, 1st Edition P5.4 Consolidated Working Paper One Year after Acquisition, Bargain Purchase (see related P4.4) (all amounts in millions) a. Calculation of gain on acquisition: Acquisition cost Fair value of noncontrolling interest $ 1,620 180 1,800 Book value ($100 + 350 + 845) Excess of fair value over book value: Inventory Marketable securities Land Buildings and equipment Long-term debt (discount) Gain on acquisition $ 1,295 100 (50) 245 300 110 2,000 $ (200) b. Equity in NI Noncontrolling interest in NI $ 345 $ 310.5 $ 34.5 (100) 50 (15) (22) $ 258 (90) 45 (13.5) (19.8) $ 232.2 (10) 5 (1.5) (2.2) $ 25.8 Total Saxon’s reported net income for 2013 ($10,000 + 10 – 8,000 – 40 – 25 – 1,600 = $345) Revaluation writeoffs: Inventory Marketable securities Buildings and equipment ($300/20) Long-term debt ($110/5) Solutions Manual, Chapter 5 ©Cambridge Business Publishers, 2010 119 c. Consolidation Working Paper, December 31, 2013 Trial Balances Taken From Books Dr (Cr) Eliminations Consolidated Paxon Cash and receivables Inventory Marketable securities Investment in Saxon Land Buildings and equipment, net Current liabilities Long-term debt Common stock Additional paid-in capital Retained earnings, Jan. 1 Noncontrolling interest Dividends Sales revenue Equity in income of Saxon Gain on sale of securities Gain on acquisition Cost of goods sold Depreciation expense Interest expense Other operating expenses Noncontrolling interest in NI $ 3,270 2,260 -1,962.2 Saxon $ 800 940 --- 650 3,600 (2,020) (5,000) (500) (1,200) (2,410) -- 300 1,150 (1,200) (450) (100) (350) (845) -- 500 100 (30,000) (232.2) -(200) 26,000 300 250 2,770 ____-$ -0- (10,000) -(10) -8,000 40 25 1,600 ____-$ -0- ©Cambridge Business Publishers, 2010 120 Dr (R) 100 (O-2) 50 Cr 100 (O-1) 50 (R) 142.2 (C) 1,165.5 (E) 654.5 (R) (R) 245 (R) 300 15 (O-3) (R) 110 (E) 100 (E) 350 (E) 845 22 (O-4) 129.5 (E) 50.5 (R) 15.8 (N) 90 (C) 10 (N) (C) 232.2 50 (O-2) (O-1) 100 (O-3) 15 (O-4) 22 $ (N) 25.8 2,495 _______ 2,495 $ Balances $ 4,070 3,200 --- 1,195 5,035 (3,220) (5,362) (500) (1,200) (2,410) (195.8) 500 (40,000) -(60) (200) 34,100 355 297 4,370 __25.8 $ -0- Advanced Accounting, 1st Edition P5.5 Consolidated Working Paper Two Years after Acquisition, Bargain Purchase (see related P5.4) (all amounts in millions) a. Total Saxon’s reported net income for 2014 ($12,000 – 9,500 – 60 – 40 – 2,200 = $200) Revaluation writeoffs: Buildings and equipment ($300/20) Long-term debt ($110/5) Equity in NI $ 200 $ Noncontrolling interest in NI 180 $ 20 (15) (13.5) (1.5) (22) (19.8) (2.2) $ 163 $ 146.7 $ 16.3 Note: Inventory (FIFO) and marketable securities revaluations were realized through sale in 2013. b. Consolidation Working Paper, December 31, 2014 Trial Balances Eliminations Taken From Books Dr (Cr) Consolidated Paxon Saxon Cash and receivables Inventory Investment in Saxon $ 3,000 2,500 2,063.9 $ Land Buildings and equipment, net Current liabilities Long-term debt Common stock Additional paid-in capital Retained earnings, Jan. 1 Noncontrolling interest 650 5,905 (2,500) (6,000) (500) (1,200) (3,022.2) -- 250 1,440 (1,000) (800) (100) (350) (1,090) -- 500 50 (35,000) (146.7) 30,000 450 300 3,000 ___-$ -0- (12,000) -9,500 60 40 2,200 ___-$ -0- Dividends Sales revenue Equity in income of Saxon Cost of goods sold Depreciation expense Interest expense Other operating expenses Noncontrolling interest in NI Solutions Manual, Chapter 5 Dr 850 950 -- Cr Balances $ 101.7 (C) 1,386 (E) 576.2 (R) (R) 245 (R) 285 15 (O-1) (R) 88 (E) 100 (E) 350 (E) 1,090 22 (O-2) 154 (E) 41.8 (R) 11.3 (N) 45 (C) 5 (N) (C) 146.7 (O-1) 15 (O-2) 22 $ (N) 16.3 2,358 _______ 2,358 $ 3,850 3,450 -- 1,145 7,615 (3,500) (6,734) (500) (1,200) (3,022.2) (207.1) 500 (47,000) -39,500 525 362 5,200 ___16.3 $ -0- ©Cambridge Business Publishers, 2010 121 P5.6 Consolidation Working Paper, Second Year Following Acquisition (amounts in millions) a. Calculation of goodwill is as follows: Acquisition cost Fair value of noncontrolling interest Total Book value of S Identifiable intangibles Goodwill $ 600 225 825 $ 580 100 Allocation of goodwill between controlling and noncontrolling interest: Total goodwill Harrah’s goodwill: $600 – 70% x $680 Goodwill to noncontrolling interest 680 $ 145 $ 145 124 $ 21 b. Calculation of 2008 equity in net loss and noncontrolling interest in net loss: Equity in Noncontrolling Total NL interest in NL Emerald Safari Resort reported income ($2,200 + 300 + 200 – 1,670 – 1,000 = $30) $ 30 $ 21 $ 9 Revaluation writeoffs: Identifiable intangibles ( 8) (5.6) (2.4) Goodwill (145) (124) (21) $ (123) $ (108.6) $ (14.4) ©Cambridge Business Publishers, 2010 122 Advanced Accounting, 1st Edition c. Consolidation Working Paper, December 31, 2008 Trial Balances Taken From Books Dr (Cr) Harrah’s Current assets Land, buildings, riverboats and equipment, net Intangible assets Investment in Emerald $ 1,400 17,696.2 Emerald Safari Resort $ 800 -- -(1,500) (14,000) (20) (5,500) (900) -- -(300) (2,600) (4) (320) (300) -- 100 5 (6,600) (1,400) (1,000) 108.6 7,200 (2,200) (300) (200) -1,670 1,400 1,000 Dividends Casino revenues Food and beverage revenues Rooms revenues Equity in net loss of Emerald Direct casino, food and beverage, rooms expenses General and administrative expenses Amortization expense Goodwill impairment loss Noncontrolling interest in net loss $ --0- $ Consolidated Dr Cr 200 2,549 2,500 515.2 Goodwill Current liabilities Long-term liabilities Common stock Capital surplus Retained earnings, Jan. 1 Noncontrolling interest Solutions Manual, Chapter 5 Eliminations --0- Balances $ (R) 95 (C) 112.1 (R) 145 (E) 4 (E) 320 (E) 300 (N) 15.9 8 (O) 436.8 (E) 190.5 (R) 145 (O) 3,387 --(1,800) (16,600) (20) (5,500) (900) (220.8) 187.2 (E) 49.5 (R) 3.5 (C) 1.5 (N) 100 (8,800) (1,700) (1,200) -8,870 108.6 (C) (O) 8 (O) 145 _____ 14.4 (N) $ 1,145 $ 1,145 1,600 20,245.2 $ 2,400 8 145 (14.4) -0- ©Cambridge Business Publishers, 2010 123 P5.7 Equity Method and Eliminating Entries Three Years after Acquisition (see related P4.2) a. Calculation of equity in net income and noncontrolling interest in net income for 2012: Equity in Noncontrolling Total NI interest in NI Sea Coast’s reported net income for 2012 $ 130,000 $ 117,000 $ 13,000 Revaluation writeoffs: Plant assets ($100,000)/10 10,000 9,000 1,000 Identifiable intangibles $300,000/20 (1) (15,000) (13,500) (1,500) $ 125,000 $ 112,500 $ 12,500 (1) $300,000 = $1,800,000 + 200,000 – (1,400,000 + 400,000 – 100,000) b. Calculation of investment balance at December 31, 2012: Investment in Sea Coast, December 31, 2009 90% x Sea Coast’s reported income, 2010-2012 90% x Sea Coast’s reported dividends, 2010-2012 (60% of reported income) Revaluation writeoffs, 2010-2012: Plant assets [($100,000)/10] x 3 x 90% Identifiable intangibles ($300,000/20) x 3 x 90% Investment in Sea Coast, December 31, 2012 $1,800,000 360,000 (216,000) 27,000 (40,500) $1,930,500 Note: Under LIFO and increasing inventory, the revalued inventory is assumed to still be on hand. c. Calculation of noncontrolling interest balance at December 31, 2012: Fair value of noncontrolling interest, December 31, 2009 $200,000 10% x Sea Coast’s reported income, 2010-2012 40,000 10% x Sea Coast’s reported dividends, 2010-2012 (60% of reported (24,000) income) Revaluation writeoffs, 2010-2012: Plant assets [($100,000)/10] x 3 x 10% 3,000 Identifiable intangibles ($300,000/20) x 3 x 10% (4,500) Noncontrolling interest in Sea Coast, December 31, 2012 $214,500 ©Cambridge Business Publishers, 2010 124 Advanced Accounting, 1st Edition d. Consolidation working paper eliminating entries for 2012: (C) Equity in net income of Sea Coast 112,500 Dividends – Sea Coast (.6 x $130,000 x 90%) Investment in Sea Coast (E) Stockholders’ equity—Sea Coast, 1/1 70,200 42,300 1,508,000 Investment in Sea Coast 1,357,200 Noncontrolling interest in Sea Coast 150,800 Sea Coast’s stockholders’ equity, January 1, 2012 = $1,400,000 + (1 - .6)(400,000 – 130,000) = $1,508,000. (R) Inventory Identifiable intangibles 400,000 270,000 Plant assets, net 80,000 Investment in Sea Coast 531,000 Noncontrolling interest in Sea Coast 59,000 Revaluations at January 1, 2012 = original revaluations less writeoffs for 2010 and 2011. (O) Plant assets, net Amortization expense 10,000 15,000 Depreciation expense Identifiable intangibles (N) Noncontrolling interest in NI of Sea Coast 12,500 Dividends – Sea Coast (.6 x $130,000 x 10%) Noncontrolling interest in Sea Coast Solutions Manual, Chapter 5 10,000 15,000 7,800 4,700 ©Cambridge Business Publishers, 2010 125 P5.8 Consolidation Working Paper after Several Years (amounts in thousands) a. Calculation of goodwill: Acquisition cost Fair value of noncontrolling interest Total fair value Book value of Piedmont Fair value – book value of franchise rights Goodwill $ 50,000 10,000 60,000 $ 23,000 15,000 38,000 $ 22,000 Allocation of goodwill between controlling and noncontrolling interest: Total goodwill $ 22,000 Coca-Cola Consolidated’s goodwill: $50,000 – 75%(38,000) 21,500 Goodwill to noncontrolling interest $ 500 b. Calculation of equity in net loss and noncontrolling interest in net loss for 2010: Equity in Noncontrolling Total NL interest in NL Piedmont’s reported net income for 2010 (1) $ 3,000 $ 2,250 $ 750 Revaluation write-offs: Franchise rights impairment (3,000) (2,250) (750) Goodwill impairment ($4,000 in the 21.5:.5 ratio from a. above) (4,000) (3,909) __(91) $ (4,000) $ (3,909) $ (91) (1) $3,000 = $300,000 – (175,000 + 114,000 + 8,000) c. Calculation of investment balance at December 31, 2010: Investment in Piedmont, January 1, 2003 75% x Piedmont reported income less dividends, 2003-2009 (1) 75% x Revaluation write-offs for franchise rights, 2003-2009 Equity in net loss, 2010 Investment in Piedmont, December 31, 2010 (1) $ 50,000 5,850 (1,500) (3,909) $ 50,441 Change in book value 2003-2009 of $7,800 (= $30,800 – $23,000) is attributed to accumulated income less dividends, since the stock accounts did not change; $30,800 = $1,000 + $12,000 + $18,000 – $200. ©Cambridge Business Publishers, 2010 126 Advanced Accounting, 1st Edition d. Consolidation Working Paper, December 31, 2010 Trial Balances Taken From Books Dr (Cr) Current assets Property, plant & equipment, net Franchise rights, net Investment in Piedmont Goodwill Current liabilities Long-term debt Common stock Additional paid-in capital Retained earnings, Jan. 1 Accumulated other comprehensive loss Treasury stock Noncontrolling interest Dividends Net sales Equity in loss of Piedmont Cost of sales Selling, delivery and administrative expenses Amortization expense Interest expense Goodwill impairment loss Noncontrolling interest in NI Consolidated Coca-Cola Consolidated Piedmont $ 160,000 250,000 485,650 50,441 $ 30,000 233,800 --- -(120,000) (700,000) (12,000) (100,000) (50,500) 12,000 -(20,000) (210,000) (1,000) (12,000) (18,000) -- 30,000 -- 200 -- 2,000 (1,200,000) 3,909 760,000 400,000 -(300,000) -175,000 114,000 500 28,000 -___ --0- -8,000 -___--0- $ Solutions Manual, Chapter 5 Eliminations $ Dr Cr Balances $ (R) 13,000 (C) 3,909 (R) 22,000 3,000 (O) 23,100 (E) 31,250 (R) 4,000 (O) (E) 1,000 (E) 12,000 (E) 18,000 (N) 91 190,000 483,800 495,650 -18,000 (140,000) (910,000) (12,000) (100,000) (50,500) 12,000 200 (E) 7,700 (E) 3,750 (R) 3,909 (C) 30,000 (11,359) 2,000 (1,500,000) -935,000 514,000 (O) 3,000 (O) 4,000 _____ __91 (N) $ 77,000 $77,000 $ 3,500 36,000 4,000 (91) -0- ©Cambridge Business Publishers, 2010 127 e. Consolidated Income Statement and Statement of Retained Earnings, Year Ended December 31, 2010 Net sales Cost of sales Gross profit Selling, delivery and administrative expenses Amortization expense Interest expense Goodwill impairment loss Consolidated net income Plus: Net loss attributable to noncontrolling interest Net income attributable to Coca-Cola Consolidated Plus retained earnings, January 1 Less dividends Retained earnings, December 31 Consolidated Balance Sheet, December 31, 2010 Assets Current assets Property, plant and equipment, net Franchise rights, net Goodwill Total assets Liabilities and stockholders’ equity Current liabilities Long-term liabilities Total liabilities Stockholders’ equity Coca-Cola Consolidated stockholders’ equity: Common stock Additional paid-in capital Retained earnings Treasury stock Accumulated other comprehensive loss Total Coca-Cola Consolidated stockholders’ equity Noncontrolling interest Total stockholders’ equity Total liabilities and stockholders’ equity ©Cambridge Business Publishers, 2010 128 $ 1,500,000 (935,000) 565,000 (514,000) (3,500) (36,000) (4,000) 7,500 ____91 7,591 50,500 _(2,000) $ 56,091 $ 190,000 483,800 495,650 18,000 $ 1,187,450 $ 140,000 910,000 1,050,000 12,000 100,000 56,091 (30,000) (12,000) 126,091 11,359 137,450 $ 1,187,450 Advanced Accounting, 1st Edition P5.9 Consolidated Statement of Cash Flows Sunny Valley Resort and Subsidiary Consolidated Statement of Cash Flows For the year 2012 Cash from operating activities Consolidated net income ($400,000 + $24,000) (1) Add (subtract) items not affecting cash: Depreciation expense $ 350,000 Goodwill impairment loss 30,000 Loss on retirement of plant assets (2) 50,000 Changes in current assets and liabilities: Increase in other current assets (400,000) Decrease in current liabilities (268,000) Net cash from operating activities Cash from investing activities Acquisition of plant assets (3) Cash from financing activities Increase in noncurrent liabilities 100,000 Dividends paid to controlling stockholders (70,000) Dividends paid to noncontrolling stockholders (16,000) Net decrease in cash Plus cash balance, January 1 Cash balance, December 31 (1) (2) (3) $ 424,000 430,000 (668,000) 186,000 (300,000) 14,000 (100,000) 700,000 $ 600,000 Noncontrolling interest in net income = $120,000 x 20% $1,600,000 + 350,000 – 1,500,000 = $450,000 accumulated depreciation on plant assets scrapped; $500,000 – 450,000 = $50,000 loss on retirement of plant assets. X = cost of plant assets acquired; $4,200,000 + X – 500,000 = $4,000,000; X = $300,000. Solutions Manual, Chapter 5 ©Cambridge Business Publishers, 2010 129 P5.10 Consolidated Statement of Cash Flows Prime Casinos and Saratoga International Hotels Consolidated Statement of Cash Flows For the Year ended December 31, 2013 (in millions) Cash from operating activities: Consolidated net income Add (subtract) items not affecting cash from operations: Depreciation expense Goodwill impairment loss Loss on sale of plant assets Changes in current assets and liabilities: Increase in other current assets Increase in current liabilities Net cash from operating activities Cash from investing activities: Sale of plant assets (1) Acquisition of plant assets Cash from financing activities: Increase in long-term liabilities Issuance of capital stock Dividends paid to majority stockholders Dividends paid to noncontrolling interest (2) Net increase in cash Plus cash balance, January 1, 2013 Cash balance, December 31, 2013 (1) (2) $ 612 $ 250 25 10 285 (100) 250 150 1,047 15 (675) 150 200 (435) (2) (660) (87) 300 200 $ 500 Cost of plant assets sold = $2,500 + $675 - $3,100 = $75 Accumulated depreciation on plant assets sold = $800 + $250 - $1,000 = $50 Cash received from sale of plant assets = $75 - $50 - $10 = $15 $150 + 12 – 160 = $2 ©Cambridge Business Publishers, 2010 130 Advanced Accounting, 1st Edition P5.11 Consolidation Two Years after Acquisition, IFRS (all dollar amounts in millions) a. Calculation of goodwill is as follows: Acquisition cost Book value of Monaco Revaluations: Inventory Property, plant and equipment Identifiable intangibles Fair value of identifiable net assets Goodwill € 4,000 € 1,000 (100) 400 300 1,600 x 80% 1,280 € 2,720 b. Calculation of equity in net income and noncontrolling interest in net income for 2010: Noncontrolling Total Equity in NI interest in NI Monaco’s reported net income for 2010 (1) € 600 € 480 € 120 Revaluation writeoffs: Property, plant and equipment $400/10 (40) (32) (8) Identifiable intangibles $300/3 (100) (80) (20) Goodwill (200) (200) __-€ 260 € 168 € 92 (1) $600 = $3,500 – (2,500 + 400) Solutions Manual, Chapter 5 ©Cambridge Business Publishers, 2010 131 c. Consolidation Working Paper, December 31, 2010 Trial Balances Taken From Books Dr (Cr) Rendezvous Current assets Property, plant and equipment, net Investment in Monaco € Identifiable intangibles Goodwill Liabilities Capital stock Retained earnings, Jan. 1 Noncontrolling interest Dividends € ©Cambridge Business Publishers, 2010 132 500 3,000 4,316 Monaco € 900 2,000 -- --(4,648) (1,500) (1,000) -- 200 -(1,150) (800) (600) -- -- Sales revenue Equity in net income of Monaco Cost of sales Goodwill impairment loss Administrative and other operating expenses Noncontrolling interest in NI Eliminations Dr Cr (R) 360 (R) 200 (R) 2,620 (E) (E) 800 600 280 (E) 112 (R) 82 (N) 40 (C) 10 (N) 50 (5,000) (168) 4,200 -- (3,500) -2,500 -- 300 --0- 400 --0- € 40 (O) 128 (C) 1,120 (E) 3,068 (R) 100 (O) 200 (O) (C) 168 (O) 200 (O) 40 (O) 100 (N) __92 ____ € 5,180 € 5,180 Consolidated Balances € 1,400 5,320 -300 2,420 (5,798) (1,500) (1,000) (474) -(8,500) -6,700 200 € Advanced Accounting, 1st Edition 840 92 -0- P5.12 Consolidation Several Years after Acquisition, IFRS (dollar amounts in thousands) a. Calculation of goodwill is as follows: Acquisition cost Book value of Wholesome Revaluations: Plant and equipment Identifiable intangibles Long-term debt Fair value of identifiable net assets Goodwill € 120,000 € 74,000 (15,000) 25,000 (4,000) 80,000 x 75% 60,000 € 60,000 b. Calculation of equity in net income and noncontrolling interest in net income for 2010: Noncontrolling Total Equity in NI interest in NI Wholesome’s reported net income for 2010 (1) € 5,000 € 3,750 € 1,250 Revaluation writeoffs: Property, plant and equipment (€15,000/10) 1,500 1,125 375 Identifiable intangibles (€25,000/10) (2,500) (1,875) (625) Goodwill (1,000) (1,000) -€ 3,000 € 2,000 € 1,000 (1) €5,000 = €140,000 – (65,000 + 70,000) Solutions Manual, Chapter 5 ©Cambridge Business Publishers, 2010 133 c. Consolidation Working Paper, December 31, 2010 Trial Balances Taken From Books Dr (Cr) Current assets Property, plant and equipment, net Investment in Wholesome Orchid € 35,000 260,500 133,500 Wholesome € 20,000 192,000 -- Identifiable intangibles Goodwill Current liabilities Long-term debt Capital stock Retained earnings, Jan. 1 Noncontrolling interest 100,000 -(30,000) (350,000) (80,000) (60,000) -- 10,000 -(25,000) (100,000) (54,000) (38,000) -- Sales revenue (400,000) (2,000) 250,000 -143,000 -€ -0- (140,000) -65,000 -70,000 -€ -0- Equity in net income of Wholesome Cost of goods sold Goodwill impairment loss Other operating expenses Noncontrolling interest in NI ©Cambridge Business Publishers, 2010 134 Eliminations Dr Cr Consolidated Balances (O) 1,500 € 55,000 445,000 (E) 54,000 (E) 38,000 -122,500 57,000 (55,000) (450,000) (80,000) (60,000) 9,000 (R) 2,000 (C) 69,000 (E) 62,500 (R) (R) 15,000 2,500 (O) (R) 58,000 1,000 (O) 23,000 (E) 1,500 (R) 1,000 (N) (C) 2,000 (O) 1,000 (O) 2,500 1,500 (O) (N) 1,000 ______ € 173,000 €173,000 (25,500) (540,000) -315,000 1,000 214,000 1,000 € -0- Advanced Accounting, 1st Edition