the revised social fund budgeting loan scheme 5 April 1999 a

advertisement

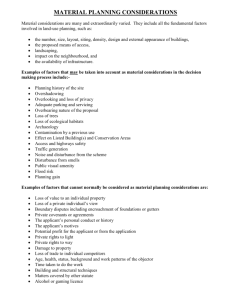

the revised social fund budgeting loan scheme 5 April 1999 a description of the scheme DSS SOCIAL FUND POLICY BRANCH FEBRUARY 1999 Introduction The Social Security Act 1998 contains legislative measures designed to simplify the social fund budgeting loan applications, decision-making and review processes. The scheme will be implemented on 5 April 1999. A simpler, fact-based approach will replace the current discretionary system, making the scheme easier for applicants to understand and apply for, less time-consuming for staff to operate, and more cost-effective to administer. Decisions will be largely automated, and therefore speedier. Why these changes are being made The discretionary social fund was set up in 1988. It is a system of one-off payments, mainly to people receiving income support or income-based JSA. There are three such types of payment, all subject to a national budget which is distributed to, and administered by, each Benefits Agency District: community care grants (CCG), mainly to help people on benefit who are leaving care, or help them stay out of care, or assist families experiencing exceptional pressure; crisis loans (CL), available to anyone in a sudden and unforseen emergency, where such a payment is the only way of preventing a serious risk to health or safety; budgeting loans (BL), designed to help people with the occasional lump-sum expenses which are difficult to budget for after a period on benefit. At present, all three types of social fund applications are decided by staff exercising discretion within set parameters. To ensure the local budget is not breached, applications are prioritised. The priority of BL applications is determined by which items the loan is applied for, and a judgement on why and how badly these items are needed. This system of decision-making has attracted criticism for a number of reasons: - its complexity confuses customers and staff alike, and the time-consuming exercise of discretion is unnecessary to target commonplace needs such as those covered by BLs (unlike the special and more unusual needs for which CCGs and CLs are designed); - it requires the completion of a lengthy (20-page) application form, asking for enough information to enable staff to decide whether the qualifying conditions for a loan or grant (which are very different) are met. This information may not be relevant to the reason for the application, and is asked for irrespective of whether a grant or loan is being applied for; - it is expensive to administer; - questioning applicants about the extent of need is perceived as unnecessarily intrusive in what should be a straightforward loans system for everyday needs; - its focus on items promotes dishonesty, because it encourages applicants to apply for items of a known high priority. Key Changes a separate fact-based decision making for BLs, with awards based on two sets of factual criteria individual maximum possible amounts of BL debt according to rules for treatment of individual circumstances under factual criteria abolition of "application to the fund as a whole" separate and simpler application forms for each type of SF payment, supported by leaflets which should enable applicants to decide which payment is likely to fit their circumstances automated decision-making, with more transparent decisions the scope of the BL scheme is defined by a set of broad categories (direction 2) the scheme is still based on need, but it is need for financial assistance (for intermittent expenses) rather than item(s) no investigation of need, which removes intrusive and paternalistic questioning excluded items no longer applies to BLs (direction 12 is deleted) scheme allows help with expenses for seeking/re-entering work in support of the welfare-to-work initiative repeat application restrictions (direction 7) no longer apply to BLs "linking" breaks of qualifying benefit entitlement are extended the specific item requested no longer has a bearing on the prioritisation of applications any outstanding budgeting loan debt may restrict the amount of an award The above list identifies the key changes to the budgeting loan scheme, due to be implemented on 5.4.99. The table below compares features of the present scheme and the new scheme. Before April 1999 After April 1999 All applications were considered for all three types of payment, and the appropriate award made to the applicant. The legal requirement automatically to consider awarding any of the other types of payment on every application has been removed. A BL application form will lead to a BL decision. There were two application forms: a combined BL/ CCG form and separate CL form. Separate application forms are to be introduced for BLs (SF500), also for CCGs (SF300) and CLs (SF400/401). Priority was based on the item applied for and the applicant's circumstances. SFOs made discretionary assessments on the extent of an applicant's need for every individual item applied for. The priority of a BL application will be based on consideration of specified factual criteria relating to the applicant's personal circumstances, from information on the application form or held on system. There is no SFO discretion. Maximum £1000 loan/minimum £30 single upper and lower limit for all applicants The overriding maximum limit of £1000 and £30 minimum still applies. However, the maximum possible size of budgeting loan debt will be determined by individual circumstances under the initial and wider criteria, and the size of the local budget. This maximum will increase as length of time on benefit and family size increase. The applicant was required to state the The applicant will just be required to item or service which they were applying indicate on the application form which for and justify the need for each one broad category or categories they are applying under. An application to the Social Fund could not be considered if the customer had already asked for the same item or services in the previous 26 weeks (direction 7) The 26-week repeat applications rule (direction 7) will no longer apply to BLs under the revised scheme, because items are not relevant. In the 26 week qualifying period one break of up to 14 days would not break eligibility. This "linking" provision is extended to 28 days and an unlimited number of breaks. The BA social fund manager was Unchanged. responsible for monitoring the District budget, ensuring that awards remain within budgetary constraints, and that as far as possible decisions remain consistent throughout the financial year. A BL application was considered for any item or service the applicant wanted but there were certain needs which could not be met by law (these were called "excluded items" (direction 12)). Excluded items (direction 12) will no longer apply to BLs under the revised scheme. People will apply under a broad range of categories. Only an item/service/expense which falls outside the scope of these categories will be refused (under direction 2). Guidance stated that loans should be repaid within 78 weeks but SFOs had discretion to increase the repayment period up to 104 weeks in exceptional circumstances. Budgeting Loans should be repaid within 78 weeks. However the current post-award "rescheduling" facility will remain where unforseen financial difficulties occur. The applicant received one offer of a loan. Where a loan cannot be repaid within 78 weeks at the standard rate, the applicant may be able to make a choice between 3 offers. Parameters of the new BL scheme the applicant's eligibility whether the application is within the scope of the scheme the priority the application warrants based on: the initial set of factual criteria, and where appropriate the wider set of factual criteria the District budget treatment of existing budgeting loan debt the applicant's/partner’s capital the minimum and maximum to be awarded the applicant's ability to repay Eligibility and other award rules The applicant must be in receipt of a qualifying benefit, IS and JSA (IB) for 26 weeks (within the 26 week period the customer or partner is allowed any number of breaks in entitlement of up to 28 days) The applicant/partner must not be involved in a trade dispute. Savings over and above of the £1000 limit (for those aged 60 and over) must not exceed the amount applied for. Savings over and above the £500 limit (for those aged under 60) must not exceed the amount applied for. Applicant's/partners social fund debt must not exceed £1000 Application or potential award cannot be for less than the £30 minimum. Categories of loan award The scope of the revised BL scheme will be defined by broad categories of allowable expenses in direction 2. They are: furniture and household equipment clothing and footwear rent in advance and/or removal expenses to secure fresh accommodation improvement, maintenance and security of the home travelling expenses expenses associated with seeking or re-entering work HP and other debts (for expenses associated with the above categories) This list will be included on the new BL application form (SF500). Currently, in order to apply for a budgeting loan, the applicant must provide detailed information relating to all the individual items required. Under the new scheme, the applicant will be asked simply to state the amount applied for and tick which category(ies) it belongs to. The SF500 form tells the applicant that a detailed breakdown of items is not needed. An application for an item or expense which does not belong in the broad categories will be refused (under direction 2) as being outside the scope of the scheme. Prioritisation of applications The purpose of the BL scheme is to provide an interest-free credit facility to help people who are receiving income support or income-based JSA spread the cost of routine intermittent expenses over a longer period. Unlike CLs and CCGs, they are not limited to special difficulties arising from unusual circumstances. However, because BLs are still subject to an overall cash limit, applications still need to be prioritised. Relevant facts are of course crucial to the outcome of all three types of application. However, for CLs and CCGs, primary legislation also requires "the nature, extent and urgency of need" to be taken into account. This enables discretion to be focused on CL and CCG decisions, where detailed consideration is appropriate. In contrast, for BLs, the 1998 SS Act provides for the applicant's personal circumstances as specified in Secretary of State's directions to be taken into account (the initial criteria), and where these preclude the award of a BL, for other criteria, also specified in directions, to be considered (the wider criteria). Thus, primary legislation provides for all BL applications to undergo an initial "test", and if this does not lead to a BL award, a wider "test". The main reason for having two sets of criteria is that moving from a discretionary system to a fact-based system could mean that some types of customer may find it difficult to qualify for a BL (eg a single person who has only been on a qualifying benefit for a short time). The purpose of the wider criteria is to enable a more flexible consideration of the applicant's circumstances to be taken into account should any of the wider criteria apply. Effectively, they represent a more liberal interpretation of the initial criteria, intending to safeguard against the risk that a rigid cut-off point might be too harsh in certain cases. In doing so they retain the principle of sensitivity to a wide range of circumstances currently provided by the SFO's discretion. The criteria themselves have been chosen because they enable the cash-limited budget to be targeted at the people whom policy research has confirmed are most likely to need budgeting help. The initial criteria The initial criteria are set out in direction 50. This direction also specifies the linking arrangements which apply to the length of time on benefit criterion (ie any periods of 28 days or less will link). The criteria are: Length of time in receipt of a qualifying benefit (IS or JSA(IB)) subject to a maximum of 3 years periods of 28 days not in receipt of qualifying benefit do not break length of time eligibility Number of people in the IS or JSA(IB) assessment unit Weightings of personal circumstances The above two types of personal circumstances will be taken into account in every budgeting loan application. To determine an application's priority, each applicant's circumstances will receive a set weighting, weightings which apply nationally. These weightings work in such a way that the longer the time on benefit, and the larger the family, the higher the priority. In turn, the level of priority for each application, coupled with the size, and demand placed upon, the local social fund budget, will inform the maximum possible BL debt each applicant in each location can have. The weightings (which apply to both the initial and the wider criteria) are set out in direction 52. They are as follows: for length of time on benefit, the maximum period of 3 years shall have a weighting of 1.5 times the minimum period of 6 months. The base weighting for 26 weeks on qualifying benefit is 1, and for 3 years on benefit it is 1.5. Any point in between will attract a pro rata weighting (eg the halfway stage between 6 months and 36 months - 21 months - would be weighted at 1.25) This means, for example, that a single applicant who has been receiving a qualifying benefit for three years will have a weighting - or priority - of 1.5 times that of a single applicant on benefit for 26 weeks. In turn, this will mean that the former would have a maximum possible BL debt limit of 1.5 times that of the latter. for family size: the applicant shall have a weighting of 1. Weightings which can increase from this base are: for an applicant's partner, where a weighting value of one-third (of the applicant) will apply; for the first child in the family, where a value of two-thirds (of the applicant) will apply; for the second child and any subsequent children, where a value of one-third (of the applicant) will apply for each one. Overall, the provisions of direction 52 are designed to ensure that identical personal circumstances always result in identical weightings (nationally) - and therefore identical priority levels - and that the differential in priority between two different sets of personal circumstances will always remain constant. For example: - an applicant who has a partner and one dependent child will have a priority or maximum loan size of twice that of a single person where both have been on benefit for the same length of time; and - in any District a single person on benefit for three years will always have a priority or maximum loan size of 1.5 times a single person on benefit for six months. Maximum borrowing limit Two factors combine to determine the maximum borrowing limit for each applicant: - the priority of the application, as determined by the weightings of the criteria as set out in direction 52; and - the size of the District budget. Wherever the applicant lives, the differential in priority between two given sets of circumstances will always be the same. However, since the size of local budgets vary from one District to another, it is possible that the maximum size of a budgeting loan will also vary (consistent prioritisation of applications between Districts will be achieved by the new scheme. The way in which budget allocations to Districts are now being calculated is designed to even out, over time, inconsistencies in outcomes between Districts caused by budget distribution). At present, the Area Social Fund Officer (ASFO - who in real terms is the District's social fund manager) issues guidance to SFOs on the level of priority which the loans budget can meet - high, medium, and low. However, this is based on a priority given to different items, while it is circumstances, not items, which will establish priority in the revised scheme. This requires a fresh approach. In the revised scheme, the ASFO guidance required by direction 41 will be in the form of a monetary figure. Aided by a computerised management information system, the ASFO will profile the budget allocation over the year and set sustainable limits on the maximum amount of BL debt permissible for each possible set of applicant circumstances. He/she will then issue guidance to social fund staff on the limit applicable to the "minimum circumstances" of a single person on benefit for six months, from which the corresponding limit for any set of circumstances can then be derived. Calculation of awards The award rules are set out in direction 53. The precise amount of the loan an applicant will be able to borrow will depend on: the maximum size of budgeting loan appropriate to their circumstances, in conjunction with ASFO guidance on what the budget can meet (this is defined in the direction as the "maximum amount") whether they already have budgeting loan debt If the applicant does not have budgeting loan debt he/she will be able to receive: the amount applied for if this is equal to or less than their maximum amount (subject to capital and ability to repay consideration) the maximum amount if the amount applied for exceeds that figure (again subject to capital etc.) If the applicant already has budgeting loan debt the highest amount they can receive will be the difference between their existing and proposed BL debt and their maximum amount. For the purpose of this calculation; existing debt is the applicant's current BL debt outstanding proposed debt is the total of the existing BL debt and the amount applied for Effectively, this means that an applicant with existing BL debt will need to reduce their debt to below half of their maximum amount before being able to obtain a further BL. Thus applicants with existing debt will not be able to obtain a further BL to take him/her up to his/her limit, although they may be able to have a lesser amount. This is to ensure that a broad spectrum of applicants in different circumstances are able to have access to budgeting loans, rather than just those whose circumstances result in large loan limits being encouraged to run up their maximum debt and stay there for their length of time on benefit. The way in which treatment of outstanding BL debt operates in the new scheme will enable applicants to exercise a degree of choice over the timing of their application for a BL, depending on whether they are seeking a large or a smaller loan. The wider criteria Where an applicant does not achieve a sufficient priority to receive an award under the initial criteria (ie the potential award is nil or less than the £30 minimum loan), a set of wider criteria can be used, where such circumstances are declared on the application, to enhance the priority given to the applicant under the initial criteria. This could increase the application's priority to the extent that a loan may be offered. The wider criteria are set out in direction 51, as follows: time in receipt of other income-based benefits, Family Credit, Housing Benefit or Council Tax Benefit (these are defined in the direction as the "secondary benefits", to distinguish them from the qualifying benefits income support and JSA(IB)) non-dependant members of the household (and their families) who are in receipt of IS or JSA (IB) if the applicant or partner is pregnant, and if so the number of children they are expecting in addition, loans taken out as part of a previous relationship can be disregarded if the current application is the direct result of the separation Where wider criteria apply, the effect would be to increase the weighting for length of time on benefit or family size (or both) obtained from the initial criteria. If the application is successful - either partially or fully - following application of the initial criteria, then the wider criteria are not applied. Treatment of debt/ability to repay The applicant's ability to repay is considered following confirmation that the applicant is: • eligible for a BL (direction 8) • the applicant has indicated he is applying for one of the category of items (direction 2) • prioritisation and BL debt consideration, and • any reduction has been taken into account because of excess savings or maximum debt. Offer repayment options Currently, when a loan is awarded an applicant receives one offer with a single repayment option. Guidance says that loans should be repaid within 78 weeks, but the repayment arrangement may be adjusted by negotiation with the SFO in order to meet the applicant's individual need. Under the new scheme, loans should be repaid within 78 weeks (as the great majority of loans are at present). However, if an applicant has requested a loan that is within his maximum amount but cannot be repaid in 78 weeks at standard repayment rates, he may be given alternative offers to maximise the award size and enable him to make a choice according to existing commitments. Up to 5 optional repayment arrangements will be calculated, and a maximum of the 3 most appropriate options will be offered to the applicant, depending on their circumstances. The repayment options are: the appropriate award amount at the standard repayment rate, or the appropriate award amount at a higher than standard repayment rate (not exceeding 25%), or an amount equal to the standard repayment rate x the number of weeks, or an amount equal to the maximum repayment rate x the remaining number of weeks, or the appropriate award amount at a revised repayment rate determined by adding all outstanding debt to the proposed loan and dividing by 78 weeks The examples below, which illustrate optional repayment terms, assume that the applicant's maximum loan amount permits payment of an award. Example 1 Applicant asks for £200, and has no current Social Fund debt His standard repayment rate is £5 He will receive one offer: £200.00 @ £5 per week over 40 weeks Example 2 Applicant asks for £500, and has no current Social Fund debt His standard repayment rate is £5 Applicant will receive two offers: £390.00 @ £5 per week = 78 weeks £500.00 divided by 78 weeks = £6.42 per week Example 3 Applicant asks for £400, and has £300 current Social Fund debt which he is repaying @ £5 per week at a standard repayment rate of 5%. At this rate there are 60 weeks before the loan is cleared, and therefore a further 18 weeks after that before the 78-week limit is reached. Applicant will receive three offers: 1) £90.00 @ £5 per week (ie 18 weeks @ £5 = £90) 2) £400.00 @ £22.22 per week (ie 22% repayment rate. This will repay the debt over 18 further weeks = 78) 3) £400 + £300 (current debt) = £700 divided by 78 = £8.97 per week (ie the applicant would need to agree to increasing repayment rate on current loan to accept this option) No offer will exceed the maximum recovery rate of 25%. Reviews The revised Budgeting Loan scheme has not changed the review process in that: applicants will still have the right of review where they are dissatisfied with the outcome of their application. BL review requests must still be made in writing within 28 days of the decision and contain full reasons for the request: the Social Fund Review Officer will still process BL review decisions there will still be the right of further review to the Independent Review Service In processing BL review applications, the SFRO or SFI will have regard to: the applicant's personal circumstances as they existed at the time of the original decision the material facts confirming the applicant's personal circumstances which existed at the time of the original decision any new evidence, supporting the material facts which confirm the applicant's personal circumstances existing at the time of the original determination was made and has since been produced any new loan debt the applicant has received the relevant District budget at the time of the review decision The revised review directions allow the reviewing officer to conduct telephone reviews in certain circumstances, subject to the applicant's agreement. Review directions There are no completely new directions to SFROs. Review procedures for CL and CCG applications will not change, apart from the new provision to conduct a telephone review if the applicant agrees (which applies to all reviews). Directions 31, 32 & 39 have therefore been revised simply to separate out BL review procedures arising from the new scheme from the CL/CCG review procedures. The only changes to directions 33-36 are their expansion to provide for the telephone review where appropriate. Directions 37-38 are unaltered. Directions to SFIs For social fund inspectors at the Independent Review Service (IRS), in addition to the two current directions 1 & 2, which remain unchanged, there are two new directions 3 & 4, which relate solely to the review of BL determinations. Leaflets Leaflets SB16 and GL18 (previously the SFL2) will be revised to include details relating to the simplified scheme. This follows consultation with various groups and external bodies and will contain information on each aspect of the social fund which will help applicants to decide which payment they may be eligible for. Forms As application to the fund as a whole will no longer apply to budgeting loans, a new application form (SF500) has been developed. This followed an extensive consultation exercise which involved BA staff, Policy Branch, Solicitors Branch, the Independent Review Service and welfare organisations (Age Concern, CPAG, Help the aged, NACAB, Birmingham Settlement Money Advice Service and the Society of St Vincent de Paul NI). The existing forms SF300 (CCG's) and SF401 (CLs) have also been revised. Each form contains a detachable notes page which explains the circumstances when a payment may be made.