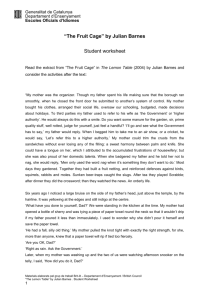

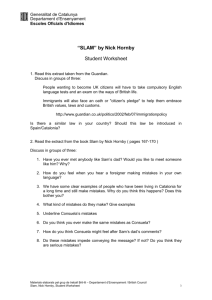

Generalitat de Catalunya Departament d'Ensenyament Direcció

advertisement