See

advertisement

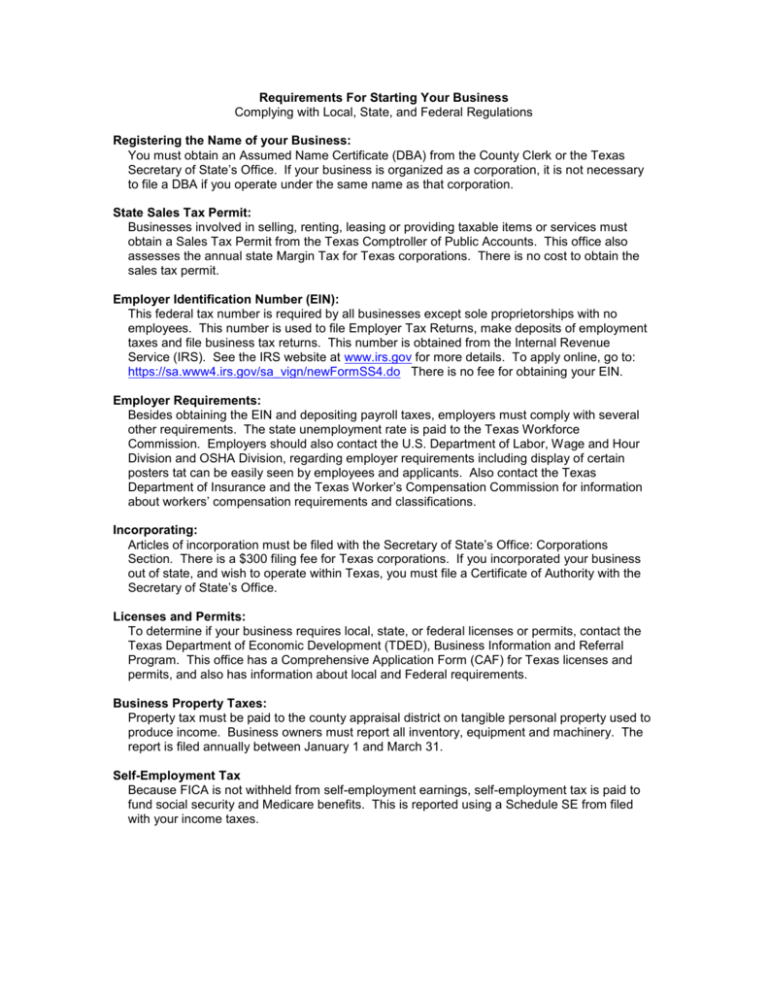

Requirements For Starting Your Business Complying with Local, State, and Federal Regulations Registering the Name of your Business: You must obtain an Assumed Name Certificate (DBA) from the County Clerk or the Texas Secretary of State’s Office. If your business is organized as a corporation, it is not necessary to file a DBA if you operate under the same name as that corporation. State Sales Tax Permit: Businesses involved in selling, renting, leasing or providing taxable items or services must obtain a Sales Tax Permit from the Texas Comptroller of Public Accounts. This office also assesses the annual state Margin Tax for Texas corporations. There is no cost to obtain the sales tax permit. Employer Identification Number (EIN): This federal tax number is required by all businesses except sole proprietorships with no employees. This number is used to file Employer Tax Returns, make deposits of employment taxes and file business tax returns. This number is obtained from the Internal Revenue Service (IRS). See the IRS website at www.irs.gov for more details. To apply online, go to: https://sa.www4.irs.gov/sa_vign/newFormSS4.do There is no fee for obtaining your EIN. Employer Requirements: Besides obtaining the EIN and depositing payroll taxes, employers must comply with several other requirements. The state unemployment rate is paid to the Texas Workforce Commission. Employers should also contact the U.S. Department of Labor, Wage and Hour Division and OSHA Division, regarding employer requirements including display of certain posters tat can be easily seen by employees and applicants. Also contact the Texas Department of Insurance and the Texas Worker’s Compensation Commission for information about workers’ compensation requirements and classifications. Incorporating: Articles of incorporation must be filed with the Secretary of State’s Office: Corporations Section. There is a $300 filing fee for Texas corporations. If you incorporated your business out of state, and wish to operate within Texas, you must file a Certificate of Authority with the Secretary of State’s Office. Licenses and Permits: To determine if your business requires local, state, or federal licenses or permits, contact the Texas Department of Economic Development (TDED), Business Information and Referral Program. This office has a Comprehensive Application Form (CAF) for Texas licenses and permits, and also has information about local and Federal requirements. Business Property Taxes: Property tax must be paid to the county appraisal district on tangible personal property used to produce income. Business owners must report all inventory, equipment and machinery. The report is filed annually between January 1 and March 31. Self-Employment Tax Because FICA is not withheld from self-employment earnings, self-employment tax is paid to fund social security and Medicare benefits. This is reported using a Schedule SE from filed with your income taxes. Important Contact Information: County Offices Hays County Clerk Travis County Clerk Williamson County Clerk State Offices Texas Secretary Of State Texas Dept. of Economic Development State Comptroller’s Field Office Texas Workforce Commission Texas Workers’ Compensation Commission Texas Department of Insurance Address Telephone 137 N. Guadalupe Street, San Marcos, TX 78666 1000 Guadalupe Street, #222, Austin, TX P.O. Box 18, Georgetown, TX 78627 Address James Earl Rudder Bldg.,1019 Brazos, Room 106, Austin, TX 78701 Stephen F. Austin Bldg, 1700 North Congress, Austin, TX 78711 111 West 6th Street, Austin, TX 78701 Tax Department, 9001 N. IH35, Suite 110, Austin, TX 78753 7551 Metro Center Drive, Austin, TX 787441609 333 Guadalupe, Austin, TX 78701 Texas Alcoholic Beverage Commission Texas Dept. of Health 5806 Mesa Drive, Austin, TX 78731 Office of the Governor Federal Offices Taxpayers Assistance Office Internal Revenue Service (IRS) Social Security Administration State Insurance Building, 1100 San Jacinto, Austin, TX 78701 Address 825 East Rundberg Lane, H-4 Austin, TX 78753 903 San Jacinto, Austin, TX 78701 U.S. Department of Labor Wage & Hour Division Department of Labor (OSHA) Northchase 1 Office Building, 10127 Morocco, Suite 140, San Antonio, TX 78216 903 San Jacinto #319, Austin, TX 78701 U.S. Small Business Administration 17319 San Pedro, Bldg 2, #200 San Antonio, TX 78232 1100 W. 49th Street, Austin, TX 78757 512-393-7330 512-854-9188 512-943-1515 Telephone 800-648-9642 www.sos.state.tx.us 512-936-0101 www.tded.state.tx.us 800-252-5555 www.cpa.state.tx.us 512-837-8636 www.twc.state.tx.us 512-804-4100 www.twcc.state.tx.us 512-463-6169 www.tdi.state.tx.us 512-206-3333 www.tabc.state.tx.us 512-719-0232 www.tdh.state.tx.us 512-463-2000 www.governor.state.tx.us Telephone 800-499-5127 www.irs.gov 512-916-5404 www.ssa.gov 210-308-4515 www.dol.gov 512-916-5783 www.osha.gov 512-403-5900 www.sba.gov Business Entity Tax Form Chart Use the chart below to determine what tax forms you need to file Basic Tax Forms and Schedules Estimated Tax Payments Helpful Publications Sole Proprietorship Form 1040 Schedule-C Schedule SE Form 1040-ES Publication 334 Partnership LLC LLP S Corporation C Corporation Form 1065 Sch. K-1 Form 1040 Sch. C Sch. SE -ORForm 1065 Sch. K-1 Form 1040ES -ORForm 1120W Publication 8832 & Inst. Form 1065 Sch. K-1 Form 1120-S Sch. K-1 Form 1120 Form 1040-ES Publication 541 Form 2553 (1st year Only) Form 1040ES Form 1120-W 1120-W Form 1040-ES Form 8832 Inst To Form Inst. To Form 1120-S Inst. to 1065 & K-1 Form 2553 These publications can be found on the IRS website at: www.irs.gov Publication 542 (MORE ARTICLES TO COME) Other possible topics Top Ten Reasons For Business Failures (And How To Avoid Them) Business Plan Basics Analyzing Financial Statements HR and the Law (Ten Things You Need To Know Before You Hire)