Econ EOCT

advertisement

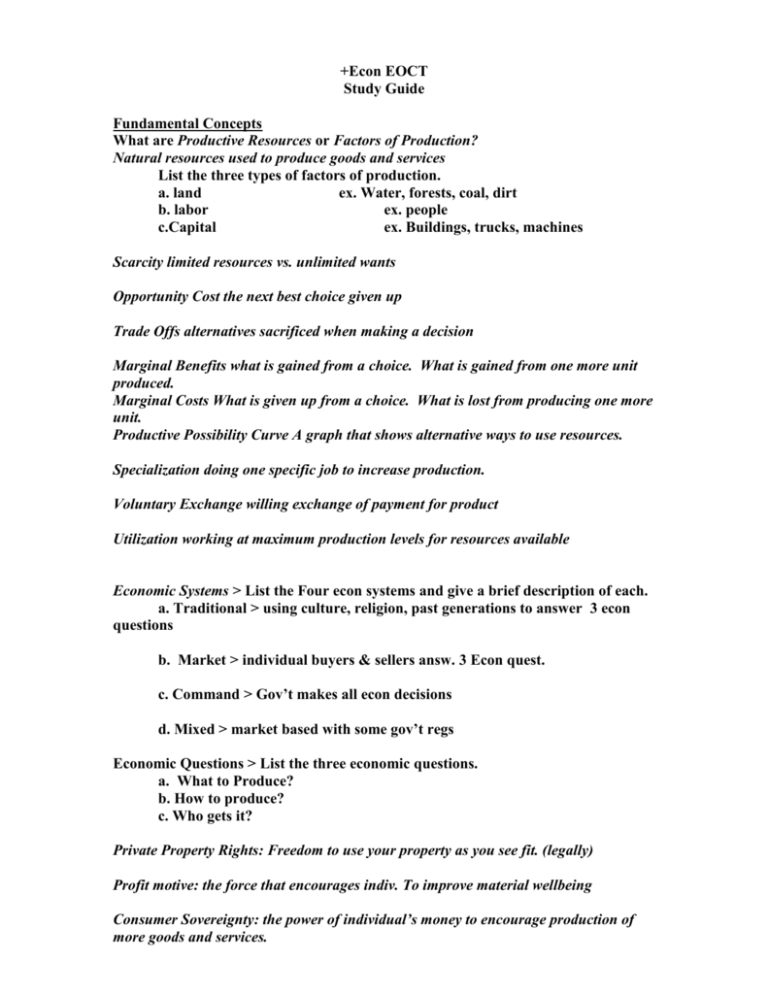

+Econ EOCT Study Guide Fundamental Concepts What are Productive Resources or Factors of Production? Natural resources used to produce goods and services List the three types of factors of production. a. land ex. Water, forests, coal, dirt b. labor ex. people c.Capital ex. Buildings, trucks, machines Scarcity limited resources vs. unlimited wants Opportunity Cost the next best choice given up Trade Offs alternatives sacrificed when making a decision Marginal Benefits what is gained from a choice. What is gained from one more unit produced. Marginal Costs What is given up from a choice. What is lost from producing one more unit. Productive Possibility Curve A graph that shows alternative ways to use resources. Specialization doing one specific job to increase production. Voluntary Exchange willing exchange of payment for product Utilization working at maximum production levels for resources available Economic Systems > List the Four econ systems and give a brief description of each. a. Traditional > using culture, religion, past generations to answer 3 econ questions b. Market > individual buyers & sellers answ. 3 Econ quest. c. Command > Gov’t makes all econ decisions d. Mixed > market based with some gov’t regs Economic Questions > List the three economic questions. a. What to Produce? b. How to produce? c. Who gets it? Private Property Rights: Freedom to use your property as you see fit. (legally) Profit motive: the force that encourages indiv. To improve material wellbeing Consumer Sovereignty: the power of individual’s money to encourage production of more goods and services. Competition: Rivalry among sellers to attract customers What is the role of Government Regulations? To protect property rights, contracts, and other business activities in our free enterprise system List 3 examples of Gov’t regulations. 1. FDA > safe food and drugs 2. OSHA > safety at work place 3. USDA > set standards for ag List 2 examples of Gov’t deregulations. 1. airlines 2. electricity What are the effects of regulations and deregulations on the producers and consumers? Regulations effects Deregulations effects Producers Creates competition Lowers barriers to entry Regulates industry sets price controls Consumers Lower prices Quality control Regulates price levels More choice and variety What are the 6 Economic Goals most economic systems try to address? Give a brief description of each. 1. economic efficiency > max production 2. economic freedom > choices 3. economic security > gov’t protection 4. economic equity > = pay for = work 5. economic growth & innovation > improved standard of living 6. additional goals > environmental protection, national healthcare Role of the Gov’t in a Market Economy 1. What are Public Goods & Services? Give some examples of each. Gov’t provided G&S > items that are too expensive to buy indiv. if provided by the private sector Roads, national parks, national defense, education 2. How does the Gov’t redistribute income in the US? Welfare, social security, TANF, unemployment comp 3. How does the Gov’t protect Private Property Rights in the US? 5th and 14th amendment > eminent domain Court system 4. How does the Gov’t resolve market failures? Fiscal policy> increase spending or tax cuts Define Productivity as the relationship of inputs to outputs. The more resources used to produce one product the fewer resources can be used to produce another. What is Capital Investment? Reinvesting profits to improve production What three areas do firms usually apply capital investment to? 1. human 2. technology 3. physical When firms apply capital investment to these areas, what is the effect on the US? It raises the standard of living Microeconomics Concepts Draw and label the Circular Flow Model. What is the role of Money in the economy? It is used as a means of exchange, unit of account, store of value What is the Law of Demand? As price increases demand decreases, as price decreases demand increases What is the Law of Supply? As price increases amount supplied increases, as price decreases the amount supplied decreases What is the role of Price in the Free Market? It sets a standard of value It helps move land, labor, and capital into the hands of producers, and finished goods into the hands of buyers. Explain how prices serve as incentives in a market economy. Higher prices encourage production by suppliers and attract new firms to the market What is the Equilibrium price? The point where supply and demand meet. Graph the following information and determine the equilibrium price. Price of a slice of pizza $.50 $1.00 $1.50 $2.00 $2.50 $3.00 Quantity Demanded 300 250 200 150 100 50 Quantity Supplied 100 150 200 250 300 350 What are Price Ceilings? The max price that can be legally charged for a good or service What do price ceilings lead to? Shortages What are Price Floors? A minimum price for a good or service What do price floors lead to? Surplus What factors lead to changes in Supply? a. future expectations b. number of suppliers c. technology d. cost of production e. subsidies f. taxes g. regulations What factors lead to changes in Demand? a. income b. consumer expectations c. tastes and advertising d. population What is Elasticity of Supply? The measure of how a change in price affects quantity supplied What is Elasticity of Demand? The measure of how consumers react to a change in price. List and describe the four types of market structures and their characteristics. Types of Market Structures Description Characteristics Pure Competition Large number of firms all produce the same product Monopoly Dominated by a single seller Monopolistic Competition Many companies sell products that are similar but not identical Many buyers and sellers Identical product Well informed buyers & sellers Easy entry and exit for firms One firm No variety of products Complete barrier to entry Complete control of price Many firms Few barriers to entry Slight control of price Differentiated products Oligopoly A few large firms dominate a market Few large firms Some variety of goods High barriers to entry Some control of price List and describe the three types of Business Structures. Give two advantages and disadvantages of each type. Type of Business Structure Sole proprietorship Partnership Corporation Description Advantages Disadvantages One owner 1., make all rules 1. Take all risk 2. get all profits 2. limited life 1. share risk 1. potential for conflict 2. join resources 2. share profit 1. unlimited life 1. difficult to start up 2. shared risk 2. double taxation Two or more owners Owned by stockholders What is the role of Profits for an Entrepreneur? An incentive to invest in a new idea or business to make money Macroeconomics How is economic activity measured? GDP the total value of all final goods and services produced in the US GDP = C + I + G + (X-M) Vocab: Gross Domestic Product (GDP) the total value of all final goods and services produced in the US Economic Growth Growth allows successive generations to have more and better goods and services than their parents. An increase in standard of living Unemployment The percentage of the nation’s labor force that is out of work Consumer Price Index (CPI) A price index determined by measuring the price of a standard group of goods meant to represent the “market basket” of a typical urban consumer Inflation The general rise in price levels Stagflation A decline in real GDP combined with a rise in the price level Aggregate Supply The total amount of goods and services in the economy available at all possible price levels Aggregate Demand The total amount of goods and services in the economy that will be purchased at all price levels. Identify the 4 types of unemployment. Types of Unemployment Frictional Seasonal Structural Cyclical Describe Occurs when people take time out to find a job Occurs when industries slow or shut down for a season or make seasonal shifts in their schedule Occurs when workers’ skills do not match the jobs available Rises during econ downturns and falls when econ improves Label the 4 phases of a business cycle. c a a = expansion b = trough c = peak d = contraction d b What is the difference between a recession and a depression? Recession is a prolonged econ contraction lasting 2 quarters Depression is a recession that is especially long and severe What is the difference between national debt and government deficits? National debt is all the money the gov’t owes to bondholders Gov’t deficits is when the gov’t spends more than it raises in revenues What is role and function of the Federal Reserve? It acts as the gov’ts bank, it sells bonds, issues currency, it serves banks for check clearing, supervises lending practices, and is the lender of last resort. It regulates the bank system and the money supply. What is Monetary Policy? The actions the Fed takes to influence the level of real GDP and the rate of inflation in the economy. (control interest rates) What is Fiscal Policy? The use of gov’t spending and revenue collection to influence the economy How are fiscal and monetary policies similar? How do they differ?(434) Both fiscal and monetary policies affect the nation’s economy. However, fiscal policy is created by Congress while monetary policy is created by the FED. Fiscal and Monetary Policy Tools (434) Fiscal Policy Tools Monetary Policy Tools Expansionary Tools 1.Increase gov’t spending 1.open market opers: Bond purchases 2.cutting taxes 2.decrease the discount rate- rate the FED charges for loans to commercial banks 3.decrease reserve requirements- cash that banks have on hand in vaults or on deposit with the federal reserve- check clearing by depositor of different bank Contractionary Tools 1.decreasing gov’t 1.open market opers: spending bond sales 2.increase discount rate 2.raising taxes 3.increase reserve requirements International Economics What is absolute advantage in regards to trade? The ability to produce more of a given product using a given amount of resources (not best guide for deciding who should do what; comparative advantage is better.) What is comparative advantage in regards to trade? The ability to produce a product most efficiently given all the other products that could be produced- law of comparative state that the worker, firm, region, or country with the lowest opportunity cost of producing an output should specialize in that output Why does most production of goods and services use a comparative advantage? Each nation can use the money it earns selling those goods to buy other goods it cannot produce efficiently. (more efficient and productive due to specialization) What is the difference between a balance of trade and a balance of payments? Balance of trade is the relationship between a nation’s imports and its exports The balance of payments (BOP) is the method countries use to monitor all international monetary transactions at a specific period of time. Theoretically, the BOP should be zero, meaning that assets (credits) and liabilities (debits) should balance. But in practice this is rarely the case and, thus, the BOP can tell the observer if a country has a deficit or a surplus and from which part of the economy the discrepancies are stemming. Define the following trade barriers. Tariffs (ex. custom duty) A Tax on imported goods Quotas A limit on the number of any product entering the country Embargos an embargo is the prohibition of commerce and trade with a certain country. Standards something set up and established by authority as a rule for the measure of quantity, weight, extent, value, or quality Subsidies a gov’t payment that supports a business or market Identify the cost/benefits of trade barriers over time. Costs >increased prices on foreign goods, trade wars, slows introduction of new goods and better technologies Benefits > job protection, protect infant industries, safeguard national security What are trading blocks? Free trade agreements between regions and countries Describe the following Examples of trading blocks. EU = European Union is a regional trade org made up of European nations NAFTA= North American Free Trade Agreement eliminates all tariffs and other trade barriers between Canada, Mexico, and the US ASEAN= The Association of Southeast Asian Nations or ASEAN. The aims and purposes of the Association are to accelerate the economic growth, social progress and cultural development in the region Free trade Pros Free trade cons Lowers price of all goods Less Job protection Improves economic efficiency and consumers of all nations a wide variety of goods Inability to Protect infant industries introduction of new goods and better Less Safeguard for national security technologies Define exchange rates The value of a foreign country’s currency in terms of home country’s currency What is the impact of exchange rates on purchasing power? Depending on the rate of exchange purchasing power can be increased or decreased depending on the other country’s economy Personal Finance Economics Decision making model Alternative Alternative Choice 1- Sleep late Choice 2 –wake up early to study Benefits Enjoy more sleep Have more energy during the day Decision Sleep late Better grade on test Teacher and parental approval Personal satisfaction wake up early to study Opportunity Cost Extra study time Extra sleep time Benefits Forgone Better grade on test Teacher and parental approval Personal satisfaction Enjoy more sleep Have more energy during the day Financial Institutions and Services (510-511) Types Description Commercial banks For indiv. And business Savings & Loan Intended for home owners- long term financing Deposits and low risk investments Savings Banks Credit Unions Non profit owned by their members Services Checking, savings, money market, CD, loans Mortgages, savings Gov’t bonds, and some offer services like commercial banks Checking, savings, low rate loans Saving & Investing (506-509) Options Savings Bonds Common stock Preferred stock Mutual funds Income generated Steady Very steady Variable Less variable than common stock Variable Growth potential Little or none Little or none Good Good Risk level Low Low risk High risk Moderate risk Good moderate Taxes Type of tax Progressive Regressive proportional Describe Increase with income Goes down with income Constant % at all income levels example Income tax Sales tax Flat tax What factors affect credit worthiness? Capacity > ability to repay debt Capital > income plus savings available Character > willingness to repay debt Collateral > property used to secure loan What are the types of interest on credit accounts and give a description. a. fixed >stays the same b. Variable > the rate will rise or fall as the prime rate or other econ indicators change What is the purpose of insurance? To help defray the cost in the event of any personal loss List 3 types of insurance. a. Auto b. health c. property What are the costs and benefits of insurance? Costs > premiums, deductibles- an amount of expenses that you must pay before the insurer will cover any expenses Benefits > company promises to pay compensation in the event of an accident What is the importance of investment in education, training, and skill development in the workforce? To help maximize skills in order to perform a job more effectively