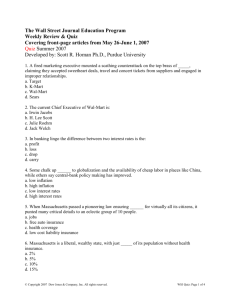

The Wall Street Journal Education Program

Weekly Review & Quiz

Covering front-page articles from May 26-June 1, 2007

Professor Guide with Summaries Summer 2007

Developed by: Scott R. Homan Ph.D., Purdue University

Questions from The First Section, Section A

Roehm Accuses Wal-Mart Brass Of Ethics Lapses

By GARY MCWILLIAMS and JAMES COVERT

May 26, 2007; Page A1

http://online.wsj.com/article/SB118010833916614784.html

A fired marketing executive accused by Wal-Mart Stores Inc. of violating company

ethics rules mounted a scathing counterattack on Chief Executive H. Lee Scott Jr. and

other top brass, claiming they accepted sweetheart deals, travel and concert tickets from

suppliers and engaged in improper relationships.

Claiming in a court filing that Wal-Mart applies its conduct rules arbitrarily, Julie Roehm

accuses Mr. Scott of, among other things, accepting "preferential prices" on boats and

jewelry from financier Irwin Jacobs, whose companies do everything from sell boats to

Wal-Mart to buy unsold goods from the retailer. She contends that Mr. Scott's

relationship with Mr. Jacobs goes "beyond a business relationship" and violates the

corporation's conflicts-of-interest guidelines.

Wal-Mart dismissed the assertions, made in a filing in U.S. District Court in Michigan, as

did Mr. Jacobs.

While it remains to be seen whether any of Ms. Roehm's accusations will stick, they

represent yet another distraction for the world's biggest retailer and its CEO, Mr. Scott.

Wal-Mart has seen sales growth at its U.S. stores bog down amid increasing competition

from other retailers and growing resistance to locating stores in urban areas. Wal-Mart

also has stumbled in its efforts to attract upscale shoppers like those flocking to

competitor Target Corp. at a time when Wal-Mart's traditional blue-collar customers are

being hurt by high gasoline prices and other economic pressures.

The filing is the latest sally in a nasty battle that began after Wal-Mart fired Ms. Roehm

in December. In its own court filing in March, Wal-Mart accused Ms. Roehm of having

an improper romantic relationship with a subordinate, accepting gifts from suppliers and

misusing her company expense account. Now, Ms. Roehm is turning the tables.

It isn't clear how Wal-Mart's ethics rules might apply to the activities alleged by Ms.

Roehm. Its policy says its employees "must avoid conflicts of interest in supplier

selection, such as directing business to a supplier owned or managed by a relative or a

friend." It also warns executives aren't allowed to "have social or other relationships with

suppliers, if such relationship would create the appearance of impropriety or give the

perception that business influence is being exerted." The policy also bars employees from

soliciting jobs for relatives or friends.

In a telephone interview, Mr. Jacobs called the accusations of preferential treatment

"totally outrageous" and without any substance. He acknowledged a long friendship with

© Copyright 2005 Dow Jones & Company, Inc. All rights reserved.

WSJ Professor Guide: Page 1 of 21

Mr. Scott. The two are close enough that their families have vacationed together, and Mr.

Jacobs attended the wedding of Mr. Scott's daughter. But he said there is no favoritism.

"They pay their way; we pay our way," he said. "I've frequently told Mr. Scott, it's very

difficult for me to go with him because he always picks up the check....I'd like at some

point to level up. He won't allow that to happen."

A Wal-Mart spokesman said, "This lawsuit is about Julie Roehm and her misconduct.

Her [court filing] shows how weak her case is." He also said: "The allegations of

impropriety involving our CEO Lee Scott are untrue."

Ms. Roehm and former Wal-Mart Vice President Sean Womack were fired in December

after the company accused them of violating its policies against fraternization and later

claimed they had carried on an affair. She sued Wal-Mart, arguing there was no valid

reason for her dismissal and asking the court to award her unspecified damages, lost pay,

stock options, severance and bonus.

In March, the Bentonville, Ark., company countersued and released details of what it said

were a "series of messages" obtained by Mr. Womack's wife and reports from unnamed

co-workers who described a torrid affair between him and Ms. Roehm.

Ms. Roehm's salvo includes a fierce defense of her short tenure as senior vice president

of marketing communications and challenges the company's portrayals of her in its

counter-suit. She denied accepting gifts, insisted suppliers were told to bill the company

for any meals and, while insisting she acted appropriately, neither admitted nor denied

some of the most salacious descriptions of her relationship with Mr. Womack.

In addition, Ms. Roehm cited an excerpt from an affidavit by Mr. Womack's wife,

Shelley, attesting that she had provided just one email to Wal-Mart and that another

ostensibly damning email didn't name Ms. Roehm.

Ms. Roehm's filing alleges that Mr. Scott personally benefited from his relationship with

Mr. Jacobs, the chairman of boat supplier Genmar Holdings Inc. and owner of Jacobs

Trading and FLW Tour, two private companies with Wal-Mart business relationships.

The two men's relationship began years before Mr. Scott became CEO.

Without identifying any specific instances, Ms. Roehm alleged the CEO obtained travel,

"a number of yachts" and "a large pink diamond" at preferential prices due to the

relationship. The Wal-Mart spokesman declined to comment on specifics of the

allegations.

Mr. Jacobs said he has never sold Mr. Scott a diamond or provided air travel. He said he

has suggested boat dealers to Mr. Scott but was never involved in any sales.

Ms. Roehm also alleged that Wal-Mart looked the other way when senior executives

conducted affairs with subordinates and allowed executives who owned retail stores to

negotiate with subordinates on leases for those properties.

"Many Wal-Mart executives do not abide by Wal-Mart's alleged 'firm' policy forbidding

conflicts of interest," she said in the filing. Despite policies prohibiting conflicts of

interest and the misuse of company assets, "actions apparently speak louder than words at

Wal-Mart," her court filing says.

She cited the role of Mr. Scott's son Eric at Jacobs Trading, the Wal-Mart salvage

supplier. Eric Scott has worked for various companies owned by Mr. Jacobs for several

years. Several years ago, he worked full-time for a boat-manufacturing unit of Genmar

and now works part-time for a salvage company owned by Mr. Jacobs. He shares an

office with Jacobs Trading near Wal-Mart's headquarters. Wal-Mart's attorneys reviewed

© Copyright 2005 Dow Jones & Company, Inc. All rights reserved.

WSJ Professor Guide: Page 2 of 21

and approved the son's business dealings with Jacobs Trading, Mr. Jacobs said. A WalMart spokesman said he was unfamiliar with the decision.

In an interview earlier this year, Mr. Jacobs insisted there never were any discussions

between him and Mr. Scott about hiring Eric Scott at Genmar's Wellcraft unit. "I swear to

God Lee never called me about it," he said in that interview. Mr. Jacobs said he saw an

opportunity for "putting Eric to work," noting his past experience as a Wal-Mart

employee buying merchandise from overseas manufacturers.

Eric Scott said in an earlier interview that he inquired about a job with Mr. Jacobs, who

in turn put him in touch with a manager at Genmar. He also said he doesn't recall

discussing the matter with his father. "I don't remember there ever being a conversation

or an issue," Eric Scott said of his initial hire at Wellcraft. He said that his jobs with Mr.

Jacobs didn't involve any dealings with Wal-Mart.

1. A fired marketing executive mounted a scathing counterattack on the top brass of

_____, claiming they accepted sweetheart deals, travel and concert tickets from suppliers

and engaged in improper relationships.

a. Target

b. K-Mart

c. Wal-Mart Correct

d. Sears

2. The current Chief Executive of Wal-Mart is:

a. Irwin Jacobs

b. H. Lee Scott Correct

c. Julie Roehm

d. Jack Welch

Homeowners Abroad Take Currency Gamble in Loans

By CRAIG KARMIN and JOELLEN PERRY

May 29, 2007; Page A1

http://online.wsj.com/article/SB118040375753116750.html

BUDAPEST -- Tamas Bencze got a rude surprise when he ripped open his mortgage

statement last summer. In just two months, the payment on his three-bedroom home here

had jumped 10%.

"My wife looked at our mortgage and asked me, 'What's happening?'" he says.

Mr. Bencze got burned playing a risky game: He had taken out a mortgage in a foreign

currency, lured by lower interest rates abroad. Everything was fine until exchange rates

suddenly shifted, causing his monthly payment to rise.

Financial strategies like these -- borrowing cheaply in one country to invest in a higheryielding asset somewhere else -- are usually a game for big-money speculators like hedge

funds and Wall Street traders. The maneuver is known as the "carry trade," because in

banking lingo the difference between two interest rates is the "carry."

The carry trade has surged as relatively low interest rates in many parts of the world have

forced investors to look for new ways to boost yield. At the same time, volatility among

currencies is also near historic lows, reducing the apparent risk.

© Copyright 2005 Dow Jones & Company, Inc. All rights reserved.

WSJ Professor Guide: Page 3 of 21

Now, across Eastern Europe, millions of people like Mr. Bencze are literally betting the

house in their own version of the carry trade. They're taking advantage of low interest

rates for loans in euros or Swiss francs.

But they may be in for a wilder ride than they expected. If exchange rates swing sharply,

borrowers could be hard-pressed to pay back their loans. Mr. Bencze's loan is

denominated in Swiss francs, while he makes monthly payments in his own currency,

Hungarian forints. When the Swiss franc rises, he must pay more forints to cover the

difference. While large investors and institutions can buy derivatives to offset currency

risk on large international transactions, that option isn't available to most individual

homeowners with their much smaller loans.

In Poland, a third of all mortgages are in foreign currencies, up from almost none a few

years ago. The Swedish bank SEB says that up to 70% of its lending in Latvia is in euros

instead of the local currency, the lats. In Hungary, half of mortgages are foreign-currency

denominated, according to the central bank, as well as a big chunk of car and smallbusiness loans.

"Everyone's a bit of a gambler," says Mr. Bencze, a financial analyst at a leasing

company, who also has had a Swiss-franc car loan. His mortgage charges 5.75% -- well

below the 14% an equivalent Hungarian forint mortgage would cost.

The sort of surprise that hit Mr. Bencze last summer can also shake the world economy.

On Feb. 27, the unraveling of carry trades by big investors, many involving bets made

with borrowed money, contributed to the U.S. stock market's biggest one-day decline in

four years.

Governments worry that investors, big and small, may have become heedless of the

potential for wide currency swings. In Hungary, the scenario drawing concern involves a

sudden drop in the forint, which could unleash housing-market mayhem and spill over to

the broader economy.

Hungary's central bank last year issued a report stating that foreign borrowing "poses

substantial risk to financial stability." In January, the bank followed up with a survey of

more than 1,000 foreign-currency mortgage holders to measure their awareness of the

risks. Its conclusion: "Quite a huge number didn't have a clue what would happen," says

Tamas Kalman, the Hungarian central-bank official who oversaw the research.

Poland has gone a step further, issuing a directive last July intended to curb foreign loans.

Poland is one of several countries, including Hungary and Latvia, where the foreigncurrency debt coming due exceeds the government's foreign reserves. If foreign investors

for some reason decided to pull their money out of these countries en masse, their

currencies could be vulnerable.

Recently, Latvians got a taste of what a currency scare can look like. On Feb. 16, rumors

spread rapidly that Latvia's currency was about to be devalued. (The lats is pegged to the

euro.) Foreign-exchange booths across Riga, the capital, ran out of euros before

lunchtime as Latvians rushed to convert their savings from lati into euros. The

government denied the rumors but since then, the central bank has had to spend more

than €300 million, or about $403 million -- roughly 10% of currency reserves -defending the lats.

Credit-rating agencies are raising concerns as well. In March, Fitch Ratings examined the

high levels of foreign-currency borrowing in Latvia, as well as neighboring Estonia and

© Copyright 2005 Dow Jones & Company, Inc. All rights reserved.

WSJ Professor Guide: Page 4 of 21

Lithuania, and made a direct comparison with the economies of Mexico and Asia in the

1990s before their financial crises.

The carry trade played a part in the Asian crisis that got rolling in Thailand in 1997. Thai

corporations and banks had borrowed heavily in U.S. dollars to take advantage of lower

interest rates. Then foreign lenders suddenly withdrew their credit, the Thai currency

plunged, and Thais had trouble paying back the loans.

Despite the risks, people keep trying carry trades because they can be highly profitable.

Goldman Sachs says one basic version -- selling the six currencies with the lowest

interest rates, buying the six with the highest, and resetting the mix once a month -- has

returned 19% annually since 1998.

Taking advantage of differences in interest rates is a foundation of finance. It's what

banks do every day, "borrowing" money from depositors at low savings-account rates

and lending it back out at higher rates. Today, the globalization of finance has made it

easier for investors to exploit cross-border interest-rate differences using the carry trade.

In much of the developed world, interest rates are comparatively low. This is largely

because countries such as the U.S. have been able to post solid growth while keeping

inflation low. Some chalk up low inflation to globalization and the availability of cheap

labor in places like China, while others say central-bank policy making has improved. In

Japan and Switzerland, central banks have kept interest rates at rock-bottom levels to

stimulate sluggish economies and keep prices from falling.

3. In banking lingo the difference between two interest rates is the:

a. profit

b. loss

c. drop

d. carry Correct

4. Some chalk up ______ to globalization and the availability of cheap labor in places

like China, while others say central-bank policy making has improved.

a. low inflation Correct

b. high inflation

c. low interest rates

d. high interest rates

How 10 People Reshaped Massachusetts Health Care

By LAURA MECKLER

May 30, 2007; Page A1

http://online.wsj.com/article/SB118047300807417578.html

BOSTON -- When Massachusetts passed a pioneering law ensuring health coverage for

virtually all its citizens, it punted many critical details to an eclectic group of 10 people.

Over the past year, the group, known as the Connector board, had to wrestle with the

tough questions that have stymied efforts at national health-care reform. How much in

premiums can low-income people afford? What about middle-class families? Should

plans be required to include prescription-drug coverage?

© Copyright 2005 Dow Jones & Company, Inc. All rights reserved.

WSJ Professor Guide: Page 5 of 21

Finding a consensus fell to a motley panel drawn from business, labor, academia and

state government. On the liberal end was Celia Wcislo, a 55-year-old organizer with the

Service Employees International Union who half-jokingly refers to insurers as

"sleazeballs and bloodsuckers." Her frequent adversary was Jonathan Gruber, a 41-yearold Massachusetts Institute of Technology economist who had helped then-Gov. Mitt

Romney develop the plan. A Democrat, Dr. Gruber was surprised to find himself on the

conservative wing of the board.

The Connector board offered, in microcosm, a look at the collision of interests -business, labor, medical professionals and needy patients -- that has derailed decades of

efforts to reform the U.S. health-care system. When it comes to health-care reform,

everyone's second choice, after their own plan, has been the status quo.

In Massachusetts, board members did something unusual, finding ways to compromise

on some of their most cherished positions and reach common ground. As a result,

Massachusetts is poised to become the first state to achieve near-universal coverage.

Registration for the new insurance plans began May 1.

Unlike Washington, the Connector compromised successfully because it was expected to,

stepping in after a long struggle by state lawmakers to create a plan supported by all

major parties. Says Joseph Antos, a health-policy expert at the conservative American

Enterprise Institute: "They have a responsibility. They have to produce."

Reaction from the business community is mixed. Many large employers say they're

comfortable with the compromises, but representatives of smaller businesses argue the

Connector's standards for coverage are too strict and say it should offer more choices of

health plans.

In some ways, Massachusetts is an exceptional case. It is a liberal, wealthy state, with just

10% of its population uninsured, compared with 15% nationwide.

And the plan could fail: Skeptics say it isn't tough enough on curbing costs and could

ultimately be unraveled by an escalating price tag. No one knows whether the law's

combination of carrots and sticks will persuade the uninsured to actually buy coverage.

From the start, Connector board members knew that success wasn't guaranteed. In the

early 1990s, the universal-coverage plan spearheaded by Gov. Michael Dukakis collapsed

after he left office, amid intense opposition from business interests.

5. When Massachusetts passed a pioneering law ensuring ______ for virtually all its

citizens, it punted many critical details to an eclectic group of 10 people.

a. jobs

b. free auto insurance

c. health coverage Correct

d. low cost liability insurance

6. Massachusetts is a liberal, wealthy state, with just _____ of its population without

health insurance.

a. 2%

b. 5%

c. 10% Correct

d. 15%

© Copyright 2005 Dow Jones & Company, Inc. All rights reserved.

WSJ Professor Guide: Page 6 of 21

Webbed Bliss: Brides and Grooms Tell All Online

By RACHEL DODES

May 31, 2007; Page A1

http://online.wsj.com/article/SB118057207757919398.html

Jogging in Atlanta a year ago, Chris Tuff tripped and fell. As his girlfriend, Julie

Augustyniak, tried to help him up, Mr. Tuff, already on bended knee, pulled a diamond

ring from his gym shorts.

"Julie, I love you more than anything in the world," he said. Unbeknownst to Ms.

Augustyniak, a cameraman lurking in a parked car nearby zoomed in and recorded her

running into the street, screaming. She eventually calmed down enough to say yes -- on

camera.

In case you missed this scene, you can now watch it on the couple's wedding Web site

www.doublemintwedding.com2. At the bottom of their home page is a poll asking guests

whether posting the engagement video online is a) very cute, b) cheesy, c) classic, or d)

Chris's idea.

Wedding Web sites -- also known as "Wed sites" -- were originally conceived as a

convenient way for couples to notify guests of wedding events, provide directions and

link to gift registries. Now they are turning into elaborate hubs of matrimonial

exhibitionism, with confessional stories, courtship videos, and blow-by-blow accounts of

the preparations.

In the "News and Updates" section on her Web site, bride-to-be Monika Razpotnik griped

that making her own centerpieces was "a disaster," finding a band was "a nightmare," and

looking for a dress was "a total disappointment."

"I am usually not in the best mood, so I tell everybody to look at the Web site to see

why," says Ms. Razpotnik, a singer in a wedding band, who is inviting 600 people to her

October nuptials in Oakville, Ontario. One voyeur wrote Ms. Razpotnik an email saying

that after reading the bridal blog, she's too scared to get married.

Marisa Stones, manager at a financial-services company in Bermuda, used her wedding

blog to keep friends and family members up to date on her engagement ring: "The ring

has a three-stone setting. The middle stone is a princess-cut diamond, .74 carats, clarity of

VS1, and color E," wrote Mrs. Stones. "The side stones are amazing sapphires that weigh

about half a carat altogether."

Also included on the site: video clips of a theatrical performance of the song "One" from

"A Chorus Line" in which the bride and groom perform, and a tune performed by a

traditional Scottish pipe band. The bride, in her wedding dress, dances the Highland Fling

with several young dancers in kilts.

Wedding sites "used to be very 'Just the facts, ma'am,' " says David Liu, chief executive

of TheKnot.com3, an online purveyor of wedding products that started offering free

wedding Web pages in 1999. These days, couples are opting for fancier "premium" Web

sites, where they can pay around $70 a year for features like vanity URLs, music, video

footage and blogs to track couples' thoughts and feelings leading up to the big day.

Etiquette writer Peggy Post, the great-granddaughter-in-law of Emily Post, says that, for

better or for worse, revealing personal information on Web pages is now part of our

culture. But when it comes to wedding sites, she draws the line at long-winded

© Copyright 2005 Dow Jones & Company, Inc. All rights reserved.

WSJ Professor Guide: Page 7 of 21

descriptions of dates leading up to the proposal: "It is similar to sending an e-blast on the

process of giving birth," she says. "Show me the child, not the process."

Couples are particularly keen to record and publicize marriage proposals: About 1,800

such videos are now on YouTube. They range from 10-minute how-we-met montages

culminating in a series of exhortations to "say yes!" from family and friends, to short

clips of actual proposals. In one, following a five-minute photo montage -- including

several shots of the bride-to-be pictured with a string of ex-boyfriends -- Chestin

Salisbury asks his girlfriend, Sharon, to marry him. In another video, cage fighter Steve

Balisky proposes in the middle of the ring after winning a match.

Others post video clips of the ceremony itself. Chris and Anna Saccheri chose to tie the

knot at a chapel in Las Vegas largely because the place offered streaming video. On April

15, at 4 p.m. Pacific time, friends and family could tune in on

www.vivalasvegasweddings.com4, where they got to see the couple drive down the aisle

in a pink Cadillac, get serenaded by an Elvis impersonator wearing gold lamé, and see a

dozen guests in a conga line.

"We told anybody who would listen about our Webcast," says Mr. Saccheri, a Web

developer in Palo Alto, Calif., who later posted the video on YouTube and onto his

wedding Web site www.hoobalicious.com/wedding5.

"The quality was very good," says Matt Schnuck, a former co-worker of Mr. Saccheri's,

who watched the wedding on his computer several days afterward.

Mrs. Augustyniak Tuff admits she was embarrassed when she learned that her proposal

had been taped and posted on YouTube. But she had a change of heart upon receiving

hundreds of congratulatory emails from friends, family -- and unknown supporters in

South Korea, Hawaii and other locations. One such email: "congrats from helsingborg =)

you look really cute together."

"Some people laugh, some people cry, some do both," says Mrs. Augustyniak Tuff.

The video was such a hit with the couple's family that her brother-in-law decided to direct

and star in a spoof sequel. It was shown at the couple's rehearsal dinner before their May

5 wedding. Playing the role of Chris primping before popping the question, Alex Tuff

goes to the gym, puts lots of gel in his hair, strips down to his bikini briefs and shaves a

heart into his chest hair as Diana Ross sings "I'm Coming Out." (See the spoof video8.)

Chris Tuff recently posted his brother's nine-minute video on his wedding Web site, right

above a link to photos from the actual wedding. The couple will pull the plug on their site

in a year, they say.

"By then, it will have served its purpose," Mr. Tuff says. "Enough people have seen our

engagement video." At last count, more than 1,900 people had seen it on YouTube.

7. Many persons planning _____ are developing extensive web sites to help convey

information to participants and interested parties.

a. car purchases

b. home purchases

c. weddings Correct

d. 4th grade classroom birthday parties

© Copyright 2005 Dow Jones & Company, Inc. All rights reserved.

WSJ Professor Guide: Page 8 of 21

8. About _____ marriage proposal videos are now on YouTube.

a. 18

b. 180

c. 1,800 Correct

d. 1,800,000

Bancrofts Open Door To a Sale Of Dow Jones

By SARAH ELLISON, DENNIS K. BERMAN and SUSAN PULLIAM

June 1, 2007; Page A1

http://online.wsj.com/article/SB118065073136620632.html

Dow Jones & Co.'s 125-year history as an independent media company could be nearing

an end.

The Bancroft family, which controls 64% of the company's voting power, said in a

statement late yesterday that it would meet with Rupert Murdoch's News Corp. to

discuss its $5 billion bid for Dow Jones, publisher of The Wall Street Journal. The family

also said it would consider other bidders and options for the company.

In a statement after a meeting of Dow Jones's board, Michael B. Elefante, a Dow Jones

director and representative of the Bancroft family, told directors: "After a detailed review

of the business of Dow Jones and the evolving competitive environment in which it

operates, the family has reached consensus that the mission of Dow Jones may be better

accomplished in combination or collaboration with another organization, which may

include News Corp."

The move, coming a month after Mr. Murdoch's offer was publicly disclosed, opens the

door to him as well as other possible suitors. Though the Bancrofts maintained the option

not to sell, their new willingness to entertain a deal makes one far more likely.

Indeed, investors pushed Dow Jones stock up 12% in after-hours trading, suggesting they

believe a deal is imminent, possibly at a price higher than the $60-a-share offer from

News Corp. Dow Jones stock, which had risen 46 cents to $53.31 in 4 p.m. trading on the

New York Stock Exchange, later surged $6.48 a share to $59.79.

The Bancroft family will meet News Corp. and Mr. Murdoch, its chairman and CEO, "to

determine whether, in the context of the current or any modified News Corp. proposal, it

will be possible to ensure the level of commitment to editorial independence, integrity

and journalistic freedom that is the hallmark of Dow Jones," according to Mr. Elefante.

He said the family also was receptive "to other options that might achieve the same

overarching objectives."

A representative of the company's board will be present at those discussions. That paves

the way for Dow Jones directors to play a more active role in shaping the future of the

company -- and to determine which bidder, if any, the company would sell to. Yesterday,

Dow Jones said its board, which previously has not taken a position on News Corp.'s bid,

"has determined to consider strategic alternatives available to the company, including the

News Corp. proposal."

© Copyright 2005 Dow Jones & Company, Inc. All rights reserved.

WSJ Professor Guide: Page 9 of 21

9. Dow Jones & Co has been an independent media company for ____ years.

a. 15

b. 25

c. 55

d. 125 Correct

10. The ______ wants to buy Dow Jones & Co the publisher of the Wall Street Journal.

a. Newspaper Corp

b. News Outlet Corp

c. IBM Corp

d. News Corp Correct

Questions from Marketplace

Wal-Mart Sneezes, China Catches Cold

By GORDON FAIRCLOUGH

May 29, 2007; Page B1

http://online.wsj.com/article/SB118040251770416752.html

SHANGHAI -- Several months ago, Chinese clothing executive Shao Zhuliang got bad

news from his U.S. agent: Wal-Mart Stores Inc., his biggest customer, wouldn't be

placing any orders for the spring 2008 season.

Now, Mr. Shao says, he is scrambling to line up other buyers from Europe, Japan and

South Korea to keep production lines running this summer at Boshan Linar Garments Co.

in eastern China's Shandong province.

Wal-Mart "said they had inventory piled up over there," says Mr. Shao, who heads

Boshan's sales department. "It's always hard to make money from Wal-Mart orders, but

without them, we are finished."

A softer U.S. economy, rising gasoline prices and business miscues have left the world's

largest retailer with a growing amount of unsold goods in its stores, including about $2

billion worth of clothes and home-décor products. With about 10% of Wal-Mart's

revenue coming from apparel, the excess has several analysts trimming profit estimates

for this year by as much as five cents a share.

And as Wal-Mart struggles to pare down stocks and get sales growth back on track at its

4,000 U.S. stores, some of the company's suppliers in China are feeling the pinch.

11. Several months ago, Chinese clothing executive Shao Zhuliang got bad news from his

U.S. agent: ______, his biggest customer, wouldn't be placing any orders for the spring

2008 season.

a. Target

b. K-Mart

c. Wal-Mart Correct

d. Sears

Could This Be 2007? 'Solid-State' Makes Rare Tech Comeback

By LEE GOMES

© Copyright 2005 Dow Jones & Company, Inc. All rights reserved.

WSJ Professor Guide: Page 10 of 21

May 30, 2007; Page B1

http://online.wsj.com/article/SB118047586006317660.html

Technology terms that have been used and then discarded usually don't get a second go at

things. "Solid-state" is an exception. Several decades back, the phrase became

synonymous with "modern," as solid-state television sets and radios dispensed with

bulky, hot and unreliable vacuum tubes in favor of transistors. Very Space Age.

Now, "solid-state" is making a comeback, this time in the world of computer storage. The

term is being resurrected to describe "disk" drives that dispense with spinning disks and

instead store information on flash memory.

Flash has been around for ages. It's a computer chip like the one used for your computer's

internal memory, but it doesn't forget everything when you turn the power off. Flash has

long been used to make those thumb-size USB drives popular for transferring data

between home and office. It's also inside Apple's iPod Nano music players.

What's new in flash is that it is just now becoming cheap enough that flash chips can be

used as the innards of solid-state drives to replace traditional disk drives, which provide

long-term storage on your computer.

12. The term being resurrected to describe disk drives that dispense with spinning disks

and instead store information on flash memory is ____.

a. Solid-state Correct

b. Innards

c. Flash

d. USB

How CEO Ralph Lauren Keeps the Focus on Luxury While Selling to the Masses

By TERI AGINS

May 31, 2007; Page B1

http://online.wsj.com/article/SB118057124557519371.html

Over the past 40 years, designer Ralph Lauren has built a $4 billion fashion empire by

maintaining a bulletproof façade of luxury and snob appeal.

Through lavish fashion shows and splashy advertising spreads depicting beautiful people

in lush locales, the 67-year-old Bronx-born chairman and chief executive of Polo Ralph

Lauren Corp. has created a rarified corporate image. In the 1990s, amid a luxury boom,

Polo ads featured items such as a $9,286 mahogany highboy with tartan-patterned

drawers, and showed Mr. Lauren modeling a $3,000 suit. Lately, Polo ads showcase a

$14,000 "Ricky" alligator handbag (named for Mr. Lauren's wife).

But unlike its big luxury competitors -- LVMH Moët Hennessy Louis Vuitton SA, Gucci

Group NV and Prada Group SpA -- Polo generates significant sales from the middle and

mass markets as well. At its 145 Polo Ralph Lauren Factory Stores in the U.S.,

discounted merchandise generates sales of around $750 million, a company

spokeswoman says.

It sells its Chaps brand -- including men's dress shirts at $49.95 and linen pants at $79 -at Kohl's Corp. discount stores. And beginning next year, it will expand further into the

© Copyright 2005 Dow Jones & Company, Inc. All rights reserved.

WSJ Professor Guide: Page 11 of 21

mass market with the launch of moderately priced apparel and home furnishings at 600

J.C. Penney Co. stores under the label American Living.

Polo declined interview requests for this article.

13. Beginning next year, Polo Ralph Lauren Corp will expand further into the mass

market with the launch of moderately priced apparel and home furnishings at 600 ____

stores under the label American Living.

a. Target

b. K-Mart

c. Wal-Mart

d. JC Penney Correct

Flaws in Measuring The World's Poor May Hinder Solutions

By CARL BIALIK

June 1, 2007; Page B1

http://online.wsj.com/article/SB118064578670320492.html

"Our dream is a world free of poverty" is a slogan at the World Bank. One challenge

facing Paul Wolfowitz's replacement at the bank's helm is how to count the world's poor

so that we might know if that dream is approaching reality.

Though it was mostly overlooked amid the controversy over alleged favoritism by Mr.

Wolfowitz, the bank announced in April that 985 million people are poor world-wide, a

decline of 260 million since 1990. By that count, the United Nations' Millennium

Development Goal of halving the proportion of people living in poverty in the 25 years

ending in 2015 appears attainable.

14. "Our dream is a world free of poverty" is a slogan at the _____.

a. Global Bank

b. Wal-Mart Head Quarters

c. K-Mart Head Quarters

d. World Bank Correct

Questions from Money & Investing

A Duel at Dow Chemical

By JEFFREY BALL

May 26, 2007; Page B1

http://online.wsj.com/article/SB118013407531415231.html

MIDLAND, Mich. -- Andrew Liveris and Romeo Kreinberg once lived nine houses from

each other on a winding street in this town that for more than a century has been home to

their employer, Dow Chemical Co.

But the two executives had different visions for the company.

Mr. Liveris, who bested Mr. Kreinberg on the climb to becoming chief executive in 2004,

believes Dow should remain an integrated chemicals giant. Mr. Kreinberg, whom Mr.

Liveris tapped in 2005 to head Dow's "performance" division, argued his part of the

© Copyright 2005 Dow Jones & Company, Inc. All rights reserved.

WSJ Professor Guide: Page 12 of 21

company, which makes high-margin products like automotive adhesives, should be given

more autonomy from the low-margin part of Dow: the "basics" division, which cranks

out commodities such as caustic soda.

Last month, the hard-charging executives collided. On the night of April 11, Mr.

Kreinberg was eating a hot dog at his Asian-influenced brick house on Valley Drive

when he got a call from Mr. Liveris's secretary asking him to show up in the CEO's office

at 7 a.m. the next day, according to Mr. Kreinberg.

When he got there, Mr. Liveris and a handful of top Dow officials told him they had

discovered he secretly had been plotting with investment bankers and Omani investors to

buy out Dow. He could leave the company one of two ways, they said: Walk away or be

pushed out.

Mr. Kreinberg, 56 years old, denied the charges and refused to resign. He was fired. On

the same day, Dow also fired J. Pedro Reinhard, a Dow board member and senior

adviser. Dow says Mr. Reinhard worked with Mr. Kreinberg to arrange the unauthorized

buyout.

Now the parties are engaged in dueling lawsuits. Dow has sued Messrs. Kreinberg and

Reinhard in federal court, seeking to get back stock-related compensation from the pair.

Mr. Kreinberg's suit, filed in New York state court, and Mr. Reinhard's suit, filed in

federal district court in New York, deny any wrongdoing and seek damages.

The Securities and Exchange Commission has launched an informal inquiry, looking into

trading in Dow stock as market rumors about a possible Dow buyout were intensifying

this spring, according to a person familiar with the matter. News of the SEC inquiry, plus

disclosure of merger discussions last year between Dow and DuPont Co., was reported

Friday by the New York Times.

In an interview, Mr. Kreinberg says that though he periodically talked with investment

bankers, it was only as part of his authorized duties to execute Dow's strategy of

expanding its reach by doing deals.

Phone Records, Email?

Dow declined to make Mr. Liveris available for this article. But in an interview last

month, days after the firings, the 53-year-old CEO said he was "certain -- and I capitalize

certain" that Messrs. Kreinberg and Reinhard were orchestrating a buyout of Dow. A

person close to Dow says the company has found phone records, expense reports and

email traffic detailing the pair's effort. Dow declined to provide any evidence it might

have because the dispute has moved into court.

"The firings had absolutely nothing to do with disagreements between Liveris and

Kreinberg," says Chris Huntley, a Dow spokesman. "They were fired because they were

doing what they should not have been doing."

At the center of the firings is a February meeting between Messrs. Kreinberg and

Reinhard and bankers from J.P. Morgan Chase & Co. Mr. Kreinberg contends Mr.

Liveris twisted the substance of that meeting to justify getting rid of him because he had

been arguing the CEO's strategy wasn't bold enough.

Mr. Reinhard, through his lawyer, declined to comment for this article. But in a statement

accompanying his lawsuit, he said he "will continue to categorically deny that I have

been part of any secret effort to take over or acquire Dow Chemical."

© Copyright 2005 Dow Jones & Company, Inc. All rights reserved.

WSJ Professor Guide: Page 13 of 21

What's not in dispute is that Dow is under the gun from Wall Street. It's racing to do deals

in an effort to transform its business from commodities that are hit hard when the

chemical cycle swoons to differentiated products that command robust prices all the time.

Because of high prices for natural gas, the main ingredient for Dow's chemicals, the

company is negotiating a series of joint ventures to shift production in its basics business

to the Middle East and Asia, where gas is cheaper, and away from North America and

Europe, where gas is more expensive. The company also is pushing to beef up its

performance business, which is what prompted Dow to approach DuPont last year,

though DuPont rebuffed the overture.

doesn't mention Mr. Dimon by name, referring only to a bank CEO. It says that on April

10, the two CEOs talked again by phone, and the bank CEO named Messrs. Kreinberg

and Reinhard as the Dow officials who had been talking to J.P. Morgan. Two days later,

Dow fired the pair.

15. Messrs Kreinberg and Reinhard were fired from the ______ corporation because they

may have been orchestrating a buyout.

a. JP Morgan

b. Dow Correct

c. Dimon

d. Stanley

The Mismatch In Stock Price, Corporate Debt

By JUSTIN LAHART

May 29, 2007; Page C1

http://online.wsj.com/article/SB118040008594316704.html

The driving force behind the stock-market rally: Corporate debt is expensive, share prices

look much cheaper and private-equity firms, companies and investors are all racing to

take advantage of that mismatch.

Wall Streeters spent an inordinate amount of time last week watching to see if the

Standard & Poor's 500-stock index would join the Dow Jones Industrial Average in

record territory. It didn't: At 1515.73, the S&P is just below the record close it reached in

March 2000. Throw in dividends and it has returned about 13% since then, which isn't

enough to keep up with inflation.

Meantime, total earnings for companies in the S&P was $802 billion over the past four

quarters, S&P estimates, nearly 80% above the March 2000 mark. That gain has driven

the index's price-to-earnings ratio to 16 times earnings from 28. Historically, that's not

screamingly cheap, but isn't expensive, either.

16. Wall Streeters spent an inordinate amount of time last week watching to see if the

_________ would join the Dow Jones Industrial Average in record territory.

a. Standard & Poor's 100-stock index

b. Standard & Poor's 500-stock index Correct

c. American Exchange 100-stock index

d. American Exchange 500-stock index

© Copyright 2005 Dow Jones & Company, Inc. All rights reserved.

WSJ Professor Guide: Page 14 of 21

Short Story: Bearish Bets Lose Bullish Bias

By JUSTIN LAHART

May 30, 2007; Page C1

http://online.wsj.com/article/SB118048148598217838.html

The bearish bets piling up at the New York Stock Exchange and the Nasdaq Stock

Market may not be the bullish signs they once were.

Investors are shorting stocks -- betting prices will fall by selling borrowed shares -- like

never before. The NYSE reported that a record 11.76 billion shares, equal to 3.1% of the

total shares listed on the exchange -- were sold short in mid-May. A year earlier, 2.3% of

listed shares were sold short. Short interest on the Nasdaq Stock Market also hit a record

in May.

So-called contrarians typically see such bearishness as a reason to buy. The idea is that

when investors are down on stocks, expectations are so low that the slightest inkling of

good news can send prices higher. In contrast, when investors get too bullish, stocks get

priced for perfection, and when perfection doesn't come, stocks decline.

But with hedge funds cutting a much bigger swath in the market, today's high level of

short interest doesn't represent the bearishness that it did in the past. Many hedge funds

engage in a strategy of offsetting the purchase of shares in one company by shorting

another, betting that it will perform worse than the stock of the company that they own.

17. Investors are _____ -- betting prices will fall by selling borrowed shares -- like never

before.

a. putting stocks

b. shorting stocks Correct

c. calling stocks

d. winging stocks

Weaker GDP Masks Prospect Of Vigor Ahead

By JUSTIN LAHART

May 31, 2007; Page C1

http://online.wsj.com/article/SB118056827879219287.html21.

Good news! The economy was even weaker last quarter than originally thought.

When the Commerce Department releases an updated reading on gross domestic product

in the first quarter today, it will likely report economic growth was even more paltry than

was reported last month. Economists estimate the economy grew at an annual rate of

0.8% in the first quarter, less than the initially reported 1.3%.

When the Commerce Department first puts together its GDP report, it doesn't have

complete information on trade and inventories, so it's forced to do some guessing. In the

first quarter, it guessed wrong. It turns out the trade deficit was wider than estimated and,

more important, business inventories were lower. Revising both will cut into GDP.

But both also set the stage for a stronger second quarter.

U.S. export growth stalled in the first quarter -- an unexpected, and most likely temporary

occurrence, given the strength of overseas economies. A rebound in outbound shipping

from West Coast ports in April suggests export growth is picking up already.

© Copyright 2005 Dow Jones & Company, Inc. All rights reserved.

WSJ Professor Guide: Page 15 of 21

More important, reduced inventory levels mean companies can start ramping up

production to fill their shelves.

Demand appears to have been much weaker than most companies expected in last year's

second half, and as a result unsold goods piled up in warehouses and in stores. In the first

quarter, they throttled back on production to work those inventories down. That cut a full

percentage point out of GDP growth, UBS economists estimate. With inventories lean,

many companies now appear to be ramping up production.

They might have second thoughts if consumer spending weakens. But for now, investors

can take heart. The speed of the inventory adjustment is a testament to the economy's

resilience.

18. With inventories lean, many companies now appear to be ramping up _____.

a. sales

b. advertising

c. production Correct

d. travel plans

Japan Investor Push Begins to Pay Off

By ANDREW MORSE

June 1, 2007; Page C1

http://online.wsj.com/article/SB118065895741920827.html

TOKYO -- Activist shareholders, who have needled companies into action in the U.S.

and Europe, are getting more aggressive in Japan and in some cases are having an impact.

Yesterday, well-known camera maker Pentax Corp. bowed to pressure from shareholders

including Sparx Group Co., a Japanese fund-management company, and agreed to a

tender offer of 105 billion yen ($863 million) from optical-glass maker Hoya Corp.

Pentax had rejected an earlier merger agreement but came under intense pressure from

shareholders.

19. Activist shareholders, who have needled companies into action in the US and Europe,

are getting more aggressive in _____and in some cases are having an impact.

a. Russia

b. China

c. Japan Correct

d. North Korea

Questions from Personal Journal, Section D

What Your Golf Swing Says About Your Overall Health

By TARA PARKER-POPE

May 29, 2007; Page D1

http://online.wsj.com/article/SB118039073511916428.html

© Copyright 2005 Dow Jones & Company, Inc. All rights reserved.

WSJ Professor Guide: Page 16 of 21

How's your golf game? The answer may tell you a lot about your health.

While golfers often focus on improving their swing and lowering their scores, sportsmedicine researchers and golf-industry experts increasingly are focusing on the links

between golf and health. They are finding that everything from the quality of your swing

to the yards you get from your drive can provide telling insights into your overall fitness

and health. The good news is that a few simple steps to boost your health can also

improve your game.

You ride the golf cart. If a golf cart is essential, you probably need to improve your

fitness. A 160-pound golfer using a cart burns about three calories per minute while

golfers who walk and carry their clubs burn about six calories a minute, according to the

American Dietetic Association. After 18 holes, a cart rider will have a heart rate of about

86 beats a minute, but walking and carrying your own clubs pushes your exercising heart

rate to 120, according to Golf Digest. Exercising at the higher end of your target heart

rate range is a sign of better fitness. (Use the health tools at mayoclinic.com to calculate

your exercising heart rate range.) "Golf is a great measure of fitness for the baby boomer

generation,'' says Vijay Vad, a New York sports-medicine specialist and consultant for

the PGA Tour. "Do your legs ache at night? Do you take a cart? These are all indications

of how healthy and fit you are.''

Short drives. If your drives aren't going very far, it's often a sign of a flexibility problem

in your lower body, particularly your hip muscles. Tight hip muscles wreck your swing

and are a common cause of back pain. It can also be a sign of a sedentary lifestyle. Hours

in the car or at a desk cause hip flexor muscles to shorten and stay tight. Over time, this

loss of flexibility can hurt more than your golf game. Flexibility, particularly in your

lower body, is a key determinant in how well you age, including your risk of falling and

your ability to get around without assistance.

Accuracy problems. If the ball is consistently bending to the right or left, you may have

posture, strength and flexibility problems in your upper body. This can be a sign of

looming neck arthritis, risk for developing a stoop or back hump and shoulder problems

that can affect your range of motion and ability to live independently as you age.

Inconsistent swing. If your swing is all over the place, it may be a sign that you lack

strength in your "core" muscles. Your core includes the deep muscles in your abdomen as

well as the hips, thighs and buttocks. Core strength affects your posture, stability and risk

for injury. "If someone has an unpredictable golf game, chances are they have corestrength issues,'' says Christian Reichardt, a certified chiropractic sports physician and

owner of Golf Health, which operates two golf wellness and assessment clinics in

California. "The golf industry looks at it as if we need to fix your swing, but I look at it as

we need to fix your body.''

Your game falls apart after a bad shot. How you react to a bogey or a birdie can also

be a sign of how you manage stress every day. A golfer whose game consistently falters

after a bad shot or who stares at the ground in frustration may be someone who

internalizes stress, a risk factor for heart disease and other problems. "If you internalize

the bad shots and your performance decreases, then you may be building up the stress and

you're not able to release it,'' says Dr. Vad. "For me personally, the good shots uplift me

and the bad shots don't get to me that much.''

To improve both your health and your golf game, start with stretching exercises before,

during and after your round. Go to mayoclinic.com and search for golf stretches to see a

© Copyright 2005 Dow Jones & Company, Inc. All rights reserved.

WSJ Professor Guide: Page 17 of 21

slide show of useful exercises. The book, "Golf Rx" by Dr. Vad, includes 18 stretches

golfers can do (one for each hole) to improve flexibility and release stress. And ask your

golf pro or a sports-medicine specialist to evaluate your swing and help you determine

your problem areas.

20. Common health problems that affect your golf game include

a. lack of stress management skills

b. lack of flexibility

c. lack of strength in “core” muscles

d. all of the above Correct

New Thinking on Eye Infections and Contacts

By KEITH J. WINSTEIN and RHONDA L. RUNDLE

May 30, 2007; Page D1

http://online.wsj.com/article/SB118048287133617875.html

Recent outbreaks of serious eye infections among contact-lens users may be tied to a

reduced use of chlorine to decontaminate public water supplies in response to a federal

environmental mandate, according to a team of Chicago doctors who discovered the

latest eye problems.

Last Friday, Advanced Medical Optics Inc., a California company, recalled its Complete

MoisturePlus, a contact-lens cleaning solution, after an investigation sparked by the

Chicago team found the solution was used by almost 60% of people suffering from a rare

outbreak of infections by a microbe known as Acanthamoeba.

But the doctors, Charlotte Joslin and Elmer Tu, aren't saying the cleaning solutions

themselves were tainted during manufacture. Instead, in a research paper last August and

another soon to be published in a peer-reviewed ophthalmology journal, they link amoeba

infections and last year's outbreak of fungal infections to a 1998 decision by the U.S.

Environmental Protection Agency, which took effect between 2002 and 2004.

In an effort to reduce chemical contamination, the EPA restricted the levels of byproducts

of chlorine and other chemicals used to clean drinking water. Drs. Joslin and Tu, whose

study was federally funded, theorize that lowering the amount of cleaning chemicals may

have increased the number of amoebas in the water. That, in turn, could lead to more

infections when contact-lens users shower or swim in pools or hot tubs while wearing

lenses that can trap amoebas.

21. Recent outbreaks of serious eye infections among ______ may be tied to a reduced

use of chlorine to decontaminate public water supplies in response to a federal

environmental mandate, according to a team of Chicago doctors who discovered the

latest eye problems.

a. the elderly

b. contact-lens users Correct

c. public pool users

d. school children

© Copyright 2005 Dow Jones & Company, Inc. All rights reserved.

WSJ Professor Guide: Page 18 of 21

Working on Your Marriage -- at Work

By RACHEL EMMA SILVERMAN

May 31, 2007; Page D1

http://online.wsj.com/article/SB118057239868019405.html

People often complain they are married to their jobs. Now, some companies are helping

employees work on their marriages, on the job.

A small but growing number of companies have implemented training programs designed

to help employees strengthen their marriages or other personal relationships. Some

companies are motivated by religious values to encourage strong marriages and families.

But now, amid evidence that divorce and relationship stress can make workers less

efficient, more companies have begun offering marriage training programs with an eye to

keeping their businesses running more smoothly and profitably.

Some employers are offering their workers free marriage or relationship education

classes at corporate retreats, with spouses encouraged to attend. Others sponsor lunchand-learn sessions at which workers hear speakers on relationship skills, like more

diplomatic ways to fight with their spouses, or they provide audio programs with

relationship tips for workers to listen to while driving. At some companies, the programs

are aimed mainly at employees who are being transferred, which can create friction in a

marriage.

After an executive at Gregg Appliances Inc., an appliance and electronics retail chain

based in Indianapolis, became concerned that workers were being unproductive or

leaving the company because of marital stresses, the firm began sponsoring marriage

training classes at corporate retreats in Florida for its general managers and their spouses.

This year's session, which focused on finances, featured a version of the "Newlywed

Game," so couples could gauge how well they really knew each other's financial habits.

Ed Koplin, a principal at X-nth Inc., an engineering firm based in Orlando, Fla., wanted

to help his employees learn how to relate better to each other and to those outside of

work. One important skill: how to listen more effectively, so the other party feels more

understood. "These are life skills that will help you at work and help you at home," says

Mr. Koplin, who works at the firm's Baltimore office.

Howard Yocum, a senior electrical engineer at X-nth, says the course has helped prevent

his domestic arguments from escalating into bigger fights. "Instead of using fight-talk, I

change it into more of a discussion-type thing," Mr. Yocum says.

Marriage training sessions are part of growing trend of employers offering programs -from weight-loss regimes to childcare -- aimed at helping workers become happier, with

the additional goal of making them more industrious.

Productivity lost from marriage and relationship stress can cost employers some $6

billion annually, according to an estimate cited in a new report, "Marriage and Family

Wellness: Corporate America's Business?" sponsored by the Marriage CoMission, a

marriage strengthening advocacy group in Atlanta. Another study cited in the report

found that in the year following divorce, employees lost an average of four weeks of

work. (The report is available at http://www.marriagecomission.com/go/corporate1.)

"Unhappily married employees decrease profitability. Those in failing relationships can

hurt a company's bottom line, through higher distractions and absences, higher health-

© Copyright 2005 Dow Jones & Company, Inc. All rights reserved.

WSJ Professor Guide: Page 19 of 21

care costs and increased stress," says Matthew Turvey, a psychologist and co-author of

the report.

The programs are generally free or highly subsidized for workers. For employers, lunchand-learn sessions can cost several hundred dollars for speakers, while short courses on

relationship issues can cost about $500 to $1,500. Marriage retreats can cost companies

several hundred dollars or more per couple, depending on the venue. Many marriage

trainers are psychologists or are certified to teach marriage skills through programs often

established by psychologists or clergy members.

At annual conferences that Chick-fil-A hosts for its franchise operators, the Atlanta-based

restaurant chain has seminars on topics such as "How to Divorce-Proof Your Marriage"

and offers marriage counselors for individual sessions with couples. The company also

makes available to its corporate staffers and franchisees and their spouses Christian

marriage training sessions at a rural retreat in Georgia.

A recent attendee was Karen Rogers, a Chick-fil-A property management analyst who

has been married for 17 years. "It's important to take time away together, to focus on that

relationship," she says, adding that the session was in seminar form, not group therapy.

"They make it very safe. You're not up there spilling the dirty marital laundry out in front

of your co-workers." The session was based on television show "The Amazing Race,"

and included segments on creating marital "teams."

PRC, a sales outsourcing firm based in Plantation, Fla., recently hired marriage trainer

Sheryl Kurland to lead lunchtime sessions on successful marriages and relationships in

some offices. Ms. Kurland, an author and speaker on marriage issues, says her sessions

have no religious overtones and are also open to gay and single employees. In her

presentation, she includes four ways to handle arguments that work in most relationships.

One idea is what she calls "your department, my department." If one spouse, say, never

picks up the towels after a shower, you can nag him or her forever, or you can just decide

to pick it up yourself. "End of subject, end of stress," says Ms. Kurland.

Workplace marriage programs can be controversial. Tim Gardner, who runs the Marriage

Institute near Indianapolis, says several companies he has approached have been cool to

his offers to teach courses because they fear marriage training programs could

discriminate against single or divorced employees, or gay couples. Other companies say

they have no business intruding in workers' personal lives.

Marriage trainers say their courses aren't marriage counseling, but courses that teach real

skills, such as how to listen and communicate more effectively, and how to defuse

disagreements before they escalate into full-blown conflicts.

"We're not talking about getting everyone in a hot tub and sharing all their problems,"

says Dr. Gardner. "It's a skills-based set that benefits all sides."

One thing Dr. Gardner teaches to clients such as Gregg Appliances is that couples should

set goals in their marriage. Some ideas: set up a weekly date night or take a yearly

vacation without the kids. Or set up 10 minutes a day just to talk and catch up, without

focusing on scheduling or problem-solving or child-care logistics.

Some employees at CommScope Inc., a telecommunications-equipment maker based in

Hickory, N.C., are working with Dr. Gardner on a relationship-skills program called

"Marriage@Work." "When I first announced it to my region, people thought it was a

little too touchy-feely," says Steve Scattaregia, a regional vice president for CommScope

in Indiana. "I work for a company that has given me a lot of latitude to try stuff like this."

© Copyright 2005 Dow Jones & Company, Inc. All rights reserved.

WSJ Professor Guide: Page 20 of 21

22. Companies are offering relationship courses to help employees

a. discuss their most intimate marital problems in front of their co-workers

b. be more effective workers by reducing relationship stress

c. learn better communication skills that also be used in the workplace

d. both b and c Correct

© Copyright 2005 Dow Jones & Company, Inc. All rights reserved.

WSJ Professor Guide: Page 21 of 21