Microsoft Word Document

advertisement

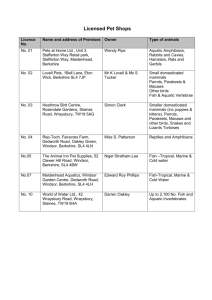

Jubak's Journal 5 investing lessons from Warren Buffett His yearly letter to Berkshire Hathaway shareholders holds good lessons for all investors -- namely, when stocks are so expensive, don't be afraid of cash. By Jim Jubak Dont pay attention to what they say. Anybody can talk about investing with discipline, avoiding unprofitable risk and buying only when the price is right. I doubt that theres an investor, amateur or professional, out there who doesnt give lip service to those principles. Pay attention, however, to what they do. You'll find countless investors who say they subscribe to these beliefs but in fact buy in violation of their investing discipline, stretching for yield and snapping up overpriced stocks. Thats why Warren Buffetts March 6 edition of his annual letter to Berkshire Hathaway (BRK.A, news, msgs) shareholders is so unusual. Not only is it full of talk about investing with discipline, but also it was written by the CEO of a company sitting on $31 billion in cash because he cant find attractive stocks and bonds to buy. (You can read Buffetts letter to shareholders here.) Its that willingness to walk the talk that makes Buffetts letter worthwhile reading for investors who dont own a share of Berkshire Hathaway. Of course, Buffetts track record at Berkshire Hathaway - an average annual increase in book value of 22% from 1965 to 2003 versus the 10.4% gain in the Standard & Poors 500 with dividends included -- adds a certain credibility to his remarks as well. (Book value, not total return, is Buffetts preferred performance measure.) So what did Buffett say and do this year that should get investors attention? What the investing landscape looks like He offers five important observations. (For what the results mean for investors in Berkshire Hathaway, please see the New developments on past columns section at the end of this article.) Theres a shortage of attractively priced stocks. At the end of 2003, cash (cash and cash equivalents, actually) levels at Berkshire Hathaways insurance operation had climbed to $31 billion from just $10 billion at the end of 2002. The huge growth in cash isnt the result of massive selling of Berkshire Hathaways core equity positions. Instead, it's the result of a lack of buying. Berkshire Hathaways biggest stock holdings* Shares Cost Market value ($ ($ millions) millions)** % Company (in ownership millions) Coca-Cola (KO, news, msgs) 200.00 8.20% $1,299 $10,150 American Express (AXP, news, msgs) 151.61 11.80% $1,470 $7,312 Gillette (G, news, msgs) 96.00 9.50% $600 $3,526 Wells Fargo (WFC, news, msgs) 56.45 3.30% $463 $3,324 Moody's (MCO, news, msgs) 24.00 16.10% $499 $1,453 1.73 1.30% $11 $1,367 PetroChina (PCCYF, news, msgs) 2.33 18.10% $488 $1,340 H&R Block (HRB, news, msgs) 14.61 8.20% $227 $809 HCA (HCA, news, msgs) 15.48 3.10% $492 $665 M&T Bank Corp. (MTB, news, msgs) 6.71 5.60% $103 $659 The Washington Post Co. (WPO, news, msgs) *Ranked by market value. **& As of Dec. 31, 2003. Source: Berkshire Hathaway 2003 annual report Buffett added some Wells Fargo shares to the Berkshire Hathaway portfolio in 2003 but made no other changes in its top six holdings. Berkshire Hathaway was unwilling to use equities to soak up a significant amount of the $44.2 billion in float generated by the insurance businesses in 2003. According to Morgan Stanley, cash grew to 33% of the companys investment portfolio (on a market value basis) by the end of last year. Thats the highest year-end cash position since 1985, when cash climbed to 41% of the investment portfolio. Bonds arent a buy either at current prices and yields. In fact, Buffetts actions say they were a sell in 2003: Berkshire Hathaway showed a pretax gain of $1.5 billion from selling U.S. government bonds during the year. The profits in governments arose from our liquidation of longterm strips (the most volatile of government securities), Buffett writes. (You and I know long-term strips as zero-coupon bonds, where the principal has been separated, or stripped, from the yield payments.) Berkshire Hathaway also realized pretax gains of $1.1 billion from selling junk bonds. In 2002, junk bonds became very cheap, and we purchased about $8 billion of these, Buffett writes. The pendulum swung quickly though, and this sector now looks decidedly unattractive to us. Yesterdays weeds are today being priced as flowers. Buffett has become even more bearish on the dollar in the last year. In 2002, for the first time in his investing career, Buffett took Berkshire Hathaway into the foreign currency market with a bet that the dollar would weaken further against a basket of five currencies that included the euro, yen and pound. Berkshire Hathaway increased that foreign currency position in 2003. By the end of the year, the company owned $12 billion in foreign currency contracts, and it owned $1 billion in eurodenominated junk bonds. Total pretax realized and unrealized gains from the inception of these foreign currency contracts in 2002 is about $1.1 billion, Morgan Stanley calculates. The pretax rate of return is about 10%, which, Morgan Stanley points out, helped offset the low yields on the companys cash position. The time to reduce risk is before the excrement hits the propeller. Since 2002, Berkshire Hathaway has been unwinding the derivatives positions it inherited in its 1998 purchase of General Re, now its reinsurance unit. When Buffett started that process, General Re had 23,218 outstanding derivative tickets that involved 884 counterparties. By the end of 2003, the derivative position was down to 7,580 tickets with 453 counterparties. Progress to date has been expensive, generating pretax losses of $173 million in 2002 and $99 million in 2003. But it could have been much worse. The General Re derivatives portfolio had been regularly marked to market prices so there werent huge discrepancies between the value of the derivatives on the books and in the market. And Berkshire Hathaway liquidated these positions in what Buffett calls a benign market. The company didnt suffer any credit defaults as it sold into a rising stock and bond market. So why take the hit now instead of hoping that this rising market would bail out the derivatives portfolio without $200 million in losses? Buffett didnt trust the accounting, and he couldnt get a handle on the risk in this portfolio. Reported profits struck us as illusionary, and we felt that the business carried sizable risks that could not effectively be measured or limited, Buffett writes. In addition, if the derivatives portfolio did get into trouble, it could potentially cause a drain on cash just when Buffett would want to be putting as much cash as possible to work in the stock and bond markets. If the derivatives business were ever to need shoring up, it would commandeer the capital and credit of Berkshire at just the time we could otherwise deploy those resources to huge advantage, Buffett reports. When stocks look fully priced, it makes sense for a long-term investor to wait. Even if that investor has to wait for a long time. In his discussion on why the company took its lumps on the General Re derivatives portfolio now, Buffett mentions his 1974 experience when a major insurance fraud forced Berkshire Hathaway to increase its cash reserves at just the wrong moment. Absent this precaution, we would have made larger purchases of stocks that were then extraordinarily cheap, Buffett writes. Its been a long time since stocks struck Buffett as cheap, if you look at Buffetts recent buying. Of his six largest holdings, Buffett last changed his position in the Washington Post Co. in 1973, Gillette in 1989, Coca-Cola in 1994, American Express in 1998 and Moodys in 2000. Only Wells Fargo among Berkshires top holdings saw action in 2003: Buffett added to his holdings. (Not that Buffett didnt make any big moves in 2003. His position in PetroChina (PTR, news, msgs), initiated last year, totaled 2.3 million shares at the end of 2003 with an estimated value of $1.3 billion. The investment cost Buffett just $488 million.) But as Buffett says, Our capital is underutilized now, but that will happen periodically. Its a painful condition to be in, but not as painful as doing something stupid. Simple rules to follow So how do you put these observations to work in your own investing life? Get your house in order. Take a hint from Buffets decision to take his lumps in the General Re derivatives portfolio. Make sure that if the financial markets do tumble, creating a buying opportunity of the kind that Buffett waits for, that you wont be too busy shoring up your personal balance sheet to take advantage of it. Make sure youre being adequately paid for risk. For example, junk bonds dont look attractive now not because theyve become so much more risky over the last 12 months. Rather, yields have fallen so far that investors, in my opinion and Buffetts, arent getting paid enough to take on the credit risk. Dont do something stupid with your cash. Sure, a 1% return on cash is depressingly low, but it still beats a 10% loss from an ill-considered purchase in the stock or bond markets. Consider plays on a weakening dollar. If the trend is strong enough to get $12 billion of Buffetts attention, it deserves a glance from you, too. For equity investors that can mean buying commodity stocks, big U.S.-based multinationals that do a major portion of sales in foreign currencies and foreign companies, such as the Spanish phone company Telefonica (TEF, news, msgs). These companies are using strong local currencies to buy control of key markets, often from U.S. companies. Remember that the long-term is more than just a month or the next quarter. Hugely profitable buying (and selling) opportunities occur regularly but not frequently. To profit from them you need to be ready for them when they appear -- and to do nothing too stupid while you wait. The last point seems a particularly important lesson now as we wait to see if the current weakness will turn into a major retreat that will take some of the froth out of stocks. Keep some powder dry. New developments on past columns Clean enough for Buffett, clean enough for me On March 4, Berkshire Hathaway (BRK.B, news, msgs) reported that book value, CEO Warren Buffetts preferred performance measure, climbed 21% in 2003, the companys best performance in five years. Float from the insurance operations -- the money that Berkshire Hathaway collects in premiums and gets to invest while waiting to pay out claims -- climbed to $44.2 billion and the cost of that capital fell to a negative 4% for the year. In other words, Berkshire Hathaway got paid to take money and invest it. Two keys for Berkshire Hathaway going forward: Industrywide insurance prices look to remain strong for at least another six months. Investment opportunities look likely to pick up in the next 12 months so that Berkshire Hathaway can invest some of its $31 billion in cash. As of March 12, Im increasing my June 2004 target price on Berkshire Hathaway to $3,350 a share from the prior $3,020. (Full disclosure: I own shares of Berkshire Hathaway B.) Editor's Note: A new Jubaks Journal is posted every Tuesday and Friday. E-mail Jim Jubak at jjmail@microsoft.com. At the time of publication, Jim Jubak owned or controlled shares in the following equities mentioned in this column: Berkshire Hathaway. He does not own short positions in any stock mentioned in this column.