International Taxation Technical Resource Panel

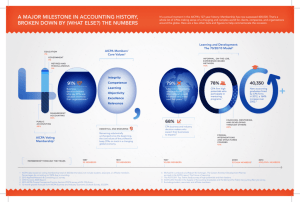

advertisement

AICPA Tax Division Comments on the 2007-2008 Guidance Priority List (Notice 2007-41) May 31, 2007 Corporations and Shareholders Taxation Technical Resource Panel (Andrew Cordonnier, Chair, (202) 521-1502, andy.cordonnier@gt.com; or George L. White, AICPA Staff Liaison, (202) 434-9268, gwhite@aicpa.org) NOTE: Comments are listed in priority order. 1. Finalization of the “No-Net-Value” regulations. 2. Guidance is needed regarding the ultimate recovery of capitalized transaction costs (e.g., bankruptcy costs, IPO costs, etc.). 3. Finalization of regulations issued under section 368(a)(1)(F), relating to a mere change in identity, form, or place of organization of one corporation. 4. Guidance is needed on the application of section 382, including— 5. The application of sections 382(l)(5) and (6) to consolidated groups; The scope of, and exceptions to, section 382(l)(1); and The application of section 382(h)(6) and/or clarification of the application of Notice 2003-65. The application of section 382(l)(3)(C) regarding relative fluctuations in value. Guidance is needed under section 355, including— Satisfaction of business expansion under section 355(b) through stock and asset acquisitions; and Finalization of regulations regarding predecessors and successors under section 355(e). 6. Guidance is needed to conform the diversification standards of section 351(e) to those of section 368(a)(2)(F). 7. Finalization of regulations issued under section 1502 regarding liquidations under section 332 into multiple members. Employee Benefits Taxation Technical Resource Panel (Sandy Wheeler, Chair, (202) 414-1856, Sandra.ormsby.wheeler@us.pwc.com; or Lisa A. Winton, AICPA Staff Liaison, (202) 434-9234, lwinton@aicpa.org) NOTE: Comments are listed in priority order. The AICPA recognizes that the IRS has an extensive list of items in the benefits area requiring guidance and we agree that those items should be addressed first. However, we also believe the following items should be addressed at a later date. 1. Guidance under section 1341 specifically focused on the tax treatment of amounts not received that were previously included in income under sections 402(b) or 409A. 2. Guidance regarding the tax treatment of bonuses paid to employee S corporation shareholders when an ESOP owns only a portion of the S corporation. 3. Guidance is needed on how to qualify for self-correction when moving from a document of one service provider to another service provider and changes were unintentionally made to the document during this process. Operational inconsistencies need to be addressed. 4. Guidance is needed on 401(k)/(m) testing for mergers and acquisitions occurring during a plan year; and clarification of the successor employer and severance of employment concepts. 5. Final regulations are needed on the section 408(q) requirement to establish a separate trust for the deemed IRA contributions. Exempt Organizations Technical Resource Panel (Mary Rauschenberg, Chair, (312) 486-9544, mrauschenberg@deloitte.com; or George White, AICPA Staff Liaison, (202) 434-9268, gwhite@aicpa.org) NOTE: Comments are listed in priority order. 1. Guidance is needed under section 512 for a simplified and uniform method of cost allocation for large organizations to use for UBIT activities. 2. Additional guidance is needed under section 512 to determine how to apply rules on UBIT, lobbying expenditures and political intervention to Internet activities of taxexempt organizations. 3. Guidance is needed to formulate established methods under voluntary compliance programs for exempt organizations to come in and correct improper positions taken with regard to IRS forms and procedures. 2 Individual Taxation Technical Resource Panel (Lorraine D. Evans, Chair, (916) 6858775, lorraine@motesevans.com; or Lisa A. Winton, AICPA Technical Manager, (202) 434-9234, lwinton@aicpa.org) NOTE: Comments are listed in priority order. 1. Guidance is needed regarding the proper handling of the exclusion of gain on sale of personal residence as part of an installment sale and as part of a like kind exchange where a personal residence is both a personal residence and concurrently has a business use, such as an office in the home, day care segments and/or held for investment such as a portion of a home or rooms held for rent. 2. Section 163(h)(4)(A) generates uncertainty about how to define a qualified residence or a second residence in the context of divorce. Does the use by the former spouse or children qualify as use by the taxpayer as a residence? Does the taxpayer responsible for the mortgage need to own the underlying property before the interest is deductible? For example, the husband may transfer ownership of the residence to the wife but remain responsible for the mortgage. Is the interest deductible? Temporary reg. section 1.163-10T(o)(1) appears to not require 100 percent ownership of the residence, but requires the taxpayer's interest in the dwelling be security for the entire mortgage. 3. Guidance is needed on how to coordinate a tuition payment and the receipt of a distribution from a Section 529 Plan. Specifically, if a taxpayer makes a tuition payment in 9/06, but receives the 529 distribution in 1/07 – assuming no other tuition payments are made – is the 2007 distribution taxable? Section 529(c)(3) does not address the question, however IRS Publication 970 states that the tuition payment and the distribution must be in the same year. 4. Guidance is needed on using deferred vacation home losses to offset gains on the sale of the vacation property under section 280A. Section 280A limits the current deductibility of expenses associated with vacation home rentals; however, excess deductions may be carried over to succeeding years. Guidance must resolve the question of whether gain from the sale of the vacation property is considered gross rental income that would allow the excess deductions to be taken in the year of the sale. 5. Guidance is needed to assist taxpayers in determining the qualifications required in order to file as a “trader” as opposed to an “investor.” No “objective” tests currently exist to determine the qualification of a taxpayer engaged in the business as a trader in securities (which provides the ability to report trading related expenses as ordinary business expenses). Instead, the determination for this qualification is dependent on existing tax court cases which are ambiguous and leave room for interpretation. 6. Guidance is needed on reverse section 1031 exchanges to include the proper treatment of expenses paid by the taxpayer in connection with operating the activity 3 while leasing the property from the accommodation titleholder. These expenses may include loan closing costs paid by the taxpayer on a loan for which the accommodation titleholder is responsible. International Taxation Technical Resource Panel (Paul Schmidt, Chair, (202) 861-1760, Pschmidt@bakerlaw.com; or Eileen R. Sherr, AICPA Technical Manager, (202) 434-9256, esherr@aicpa.org) NOTE: Under each numbered category, the first three bulleted items are the most important. 1. Guidance is needed in the following areas related to Subpart F/Deferral: Provide regulations under section 954(h) on the subpart F exception for active financial services income, especially with regard to the application of the substantial activity requirement of section 954(h)(3)(C) and the “substantially all the activities” requirement of section 954(h)(3)(A)(ii). Provide regulations under section 954(c) relating to the active rent or royalty exception. Also, consistent with the legislative history of the 2004 American Jobs Creation Act and Notice 2006-48, issue regulations providing exceptions from income inclusions under sections 956 and 367(a) for aircraft and vessel leasing that is compliant with section 954(c)(2)(A). Finalize the proposed regulations under section 959 regarding exclusions from income of previously taxed earnings. Provide guidance under section 961(c) regarding basis adjustments to the stock of a CFC held through partnerships. Finalize the proposed section 898 regulations on conforming year-ends of certain foreign corporations to the year-ends of their U.S. shareholders. Provide guidance to explain the application of section 304(b)(5). Provide more complete and definitive guidance under the PFIC regulations. In particular, (1) update the PFIC regulations to take into account the enactment of section 1297(e), which eliminates the overlap of the PFIC and Subpart F regimes under certain circumstances (including the application of section 1297(e) to a PFIC owned by a U.S. partnership that has U.S. partners), (2) provide guidance under section 1297(c) regarding the 25 percent ownership look-through rule and its interaction with the section 1297(b)(2)(C) related party income rules, and (3) provide guidance on the application of section 1297(b)(1)’s definition of passive income and in particular on the interaction of section 954(h) and (i) with section 1297(b)(2). 4 2. 3. Issue regulations pursuant to Notice 2007-13 regarding the substantial assistance rules for foreign base company services income. Provide guidance with respect to the reg. section 1.954-2(b)(4) substantial assets test relevant to qualification under the same country exception for interest and dividends, as applied to (i) stock in non-CFC foreign corporations and (ii) banks and insurance companies. Guidance is needed in the following areas related to inbound transactions: Reissue proposed section 163(j) “earnings stripping” regulations, taking into account taxpayer comments and developments since the original issuance of the proposed regulations. Provide guidance under section 267(a)(3)(B) regarding the timing of deduction for payments to CFCs and PFICs and provide exceptions for appropriate transactions. Provide guidance on the application of temp. reg. section 1.897-6T and section 1445 to nonrecognition transactions involving transfers of USRPIs to partnerships, and dispositions of interests in partnerships that directly and indirectly hold USRPIs. Provide guidance regarding new Form 8804, particularly whether a partnership that must withhold under section 1446 with respect to effectively connected taxable income allocable to foreign partners is entitled to take into account otherwise allowable deductions in the relevant taxable income computations. Following the retroactive withdrawal of reg. section 1.1441-1(b)(7)(iii) by T.D. 9323, guidance on liability of a withholding agent for interest with respect to withholding under section 1445 or section 1446, if the withholding agent does not withhold with respect to a foreign person that has no U.S. tax liability, or that has satisfied its U.S. tax liability. Guidance is needed in the following areas related to outbound transactions: Provide guidance on the treatment of gain recognition agreements (GRAs) under section 367(a) upon a section 355 distribution (including treatment of foreign transferors and foreign transferees). [Note: See AICPA comments to IRS on Notice 2005-74, Section 3.02 regarding the effect of certain exchanges on gain recognition agreements under section 367(a) submitted on February 21, 2006, available at: 5 http://tax.aicpa.org/Resources/International/Regulation+and+Administration/AI CPA+Comments+on+Notice+200574+on+the+Effect+of+Exchanges+on+Gain+Recognition+Agreements.htm] Issue regulations under section 367(a)(5). Issue further guidance on the application of new section 7874 relating to inversion transactions, including the following issues: (1) whether, in applying the ownership test to former shareholders of the acquired U.S. entity, the term “shareholder” includes indirect ownership or only direct ownership; (2) the requirement that such acquisition be pursuant to a plan or a series of related transactions; (3) the treatment of stock sold in a public offering that is related to the acquisition, including defining what constitutes a public offering; and (4) with respect to the special rule in section 7874(c)(5) for related partnerships in which all commonly controlled partnerships are aggregated, clarify (i) whether the rule applies to both domestic and foreign partnerships and (ii) for which purposes aggregation is required. Finalize the proposed regulations under section 1248 regarding dispositions of certain foreign corporations by foreign partnerships with U.S. partners; and provide guidance under section 1248 regarding dispositions by U.S. persons of foreign partnership interests where the foreign partnership owns stock in a controlled foreign corporation and the U.S. partner is a United States shareholder with respect to the controlled foreign corporation. Issue updated regulations under section 367(d), reflecting changes to the statute since their original issuance. We also suggest interim guidance be issued on the changes to section 367(d) under Section 406(a) of the American Jobs Creation Act of 2004, including the retroactive application of that provision. Issue guidance under new section 332(d) regarding its interaction with section 337. Finalize the proposed section 987 regulations relating to foreign currency translation gains and losses with respect to branch transactions (taking into account public comments with respect to the proposed regulations). [Note: See AICPA comments to IRS submitted on March 29, 2007, available at: http://tax.aicpa.org/Resources/International/Regulation+and+Administration/AI CPA+Comments+on+Foreign+Currency+Transaction+Regulations.htm] Issue guidance under section 1248(f)(2) addressing certain distributions of stock of foreign corporations to domestic corporations. 6 4. 5. Issue guidance relating to the carryover of tax attributes in section 355 transactions. The IRS has issued proposed regulations under section 367(b) addressing these issues (i.e., reg. section 1.367(b)-8). Guidance is needed regarding foreign tax credits, in particular: Issue guidance on recharacterization of overall domestic losses under section 904(g), including guidance with respect to the interaction with section 904(f) and ordering rules. The section 904(f) regulations relating to overall foreign losses should be revised to replace the outdated 1987 regulations and Notice 89-3. Repropose the proposed regulations providing guidance under section 901 on the allocation of foreign taxes in circumstances involving (i) hybrid entities and the technical taxpayer rule (issued on August 3, 2006) and (ii) noncompulsory foreign taxes paid under foreign consolidated regimes or certain structured passive investment arrangements (issued on March 29, 2007) after public comments are considered on the current proposed regulations. Issue guidance under new section 904(f)(3)(D), relating to the application of the overall foreign loss rules to certain dispositions of CFC stock, and, in particular, section 368(a)(1)(B) reorganizations, as well as relating to the provision’s interaction with section 355. Issue guidance relating to the application of the overall foreign loss rules to certain dispositions involving partnerships. Guidance is needed under section 905(c) regarding taxes paid after a liquidation, stock sale or section 338 election. More complete guidance regarding the application of reg. section 1.865-1(a)(2) and reg. section 1.865-2(a)(3) under which losses are allocated to reduce foreign source income if gain on the sale of the property (including stock) would have been taxable by a foreign country and the highest marginal rate of tax imposed on such gains in the foreign country is at least 10 percent. Guidance is needed in the following additional areas: Guidance with respect to the characterization of guarantee fees under applicable U.S. international tax principles, including sourcing for foreign tax credit purposes. Finalize the temporary and proposed regulations under section 482 governing the arm’s length value of intercompany services. 7 Clarify and relax the double reporting rules under the section 1461 regulations and the treaty-based reporting requirements under section 6114. Provide guidance regarding the implementation of the worldwide apportionment method of allocating interest expense that taxpayers may choose to elect for tax years beginning after December 31, 2008. Provide guidance regarding the treatment of domestic hybrid disregarded entities owned by foreign persons for treaty purposes, including the determination of profits attributable to a permanent establishment and application of the branch profits tax. IRS Practice and Procedures Committee (James E. Brennan, Chair, (212) 773-3209, james.brennan@ey.com; or Benson S. Goldstein, AICPA Technical Manager, (202) 4349279, bgoldstein@aicpa.org) NOTE: Comments are listed in priority order. 1. On January 11, 2005, the IRS issued temporary and proposed regulations (REG130671-04) regarding requirements for electronically filing (1) income tax returns for large corporations and (2) annual information returns for certain exempt organizations, pursuant to sections 6011, 6033, and 6037 of the Internal Revenue Code. We recommend that these regulations be finalized, and guidance issued therein to state that: To the extent a corporation, exempt organization, or other entity (otherwise subject to the e-file mandate of these temporary and proposed regulations) determines that it should amend an income tax return or annual information return already filed for a particular taxable year, such amended return should not be required to be e-filed or subject to the scope of REG-130671-04. 2. In general, Internal Revenue Code sections 6011, 6033, and 6037 provide the IRS with the authority to setup and administer a program to process electronically filed tax, information, and other returns by taxpayers. Current IRS guidance generally states that only permanent residents and citizens of the U.S. can effectively qualify for an Electronic Filing Identification Number (EFIN) or a Preparer Tax Identification Number (PTIN). (See Publication 3112, IRS e-file Application and Participation.) For purposes of maximizing the growth and utilization rate of the IRS’s electronic filing program, we recommend for Treasury to issue regulations permitting nonresident aliens and non-U.S. citizens to qualify for EFINs and PTINs under specified circumstances. 8 3. Internal Revenue Code sections 6159 and 7122 generally authorize the IRS to enter into installment agreements and offers in compromise with taxpayers who are having financial (or other) difficulties repaying tax liabilities otherwise owed to the federal government. We recommend that Treasury issue regulations or other guidance to facilitate greater utilization and acceptance by the IRS of installment agreements (including partial pay installment agreements) and offers in compromise submitted by taxpayers to address tax debts. Partnership Taxation Technical Resource Panel (Troy K. Lewis, Chair, (801) 550-2622, tlewis@sisna.com; or Marc A. Hyman, AICPA Technical Manager, (202) 434-9231, mhyman@aicpa.org.) NOTE: Comments are listed in priority order. 1. Regulations are needed with respect to section 704(c)(1)(C). Specifically, where a partner has contributed property with a built-in loss, the regulations should address the impact of the transfer or liquidation of a contributing partner’s interest on the basis of the partnership’s property with respect to any successor partner, including transfers that are subject to section 381 and other nonrecognition transfers. For example, assume that Partnership A and Partnership B merge such that Partnership A is treated as having contributed its assets to Partnership B in exchange for an interest in Partnership B and then distributed such interests in liquidation of Partnership A. If the assets of Partnership B include an asset with a built-in loss, is the loss eliminated as a result of the merger? 2. Guidance is needed on the treatment of limited liability company members under section 1402(a)(13). 3. Guidance is requested on the impact and applicability of section 409A to various nonqualified deferred compensation arrangements between partnerships and their partners. 4. Guidance is needed with respect to the application of Rev. Rul. 99-6. Specifically, the guidance should address the situations to which Rev. Rul. 99-6 applies and whether or not the liquidation of the partnership can have tax consequences. For example, where a partnership holds section 704(c) property, can the liquidation of the partnership result in the application of section 704(c)(1)(B) or section 737? In addition, where a partnership has an obligation to the person acquiring the interest in the partnership, does the hypothetical liquidation of the partnership under Rev. Rul. 99-6 result in the deemed repayment of the obligation with partnership property such that gain or loss may be recognized. 5. Guidance is needed with respect to Section 8215 of H.R. 2206, the new “family business tax simplification” election. Specifically, transition rules are needed for spouses currently filing partnership returns, the consequences under Subchapter K of making such election, and the manner in which such election is made. 9 6. Guidance on the methodology of applying section 743 for partnerships using the special aggregation rule for securities partnerships under reg. section 1.704-3(e). Guidance would be expected to include a similar aggregation rule for allocating the section 743 adjustment under section 755 and a methodology for determining when the section 743 adjustment is taken into account. 7. Guidance is needed to expand the ability of a securities partnership to aggregate gains and losses for purposes of making reverse section 704(c) allocations under reg. section 1.704-3(e)(3). 8. Guidance is requested on the treatment of partnership level section 481 adjustments. Several unresolved issues include guidance on (1) allocation of the 481 adjustment where there has been a change in ownership, (2) the impact of the 481 adjustment on a section 754 basis adjustment, and (3) the treatment of a 481 adjustment on a section 708(b)(1)(B) termination. 9. Guidance is needed to address the revaluation of partnership assets where the assets were either contributed to the partnership or previously revalued by the partnership. This guidance should include (1) how the multiple layers under section 704(c) are maintained; (2) the impact on minimum gain calculations under section 704(b); and (3) the impact on nonrecourse debt allocations under section 752. 10. Clarification is needed under section 42 regarding what items (other than impact fees) are included in the eligible low income housing credit basis, such as tap fees, offsite costs, construction loan fees and bond costs. S Corporation Taxation Technical Resource Panel (Laura Howell-Smith, Chair, (202) 220-2076, lhowellsmith@deloitte.com; or Marc A. Hyman, AICPA Technical Manager, (202) 434-9231, mhyman@aicpa.org) NOTE: Comments are listed in priority order. 1. Guidance is needed for situations in which an S corporation converts to a partnership or LLC that elects corporate taxation. This can occur in some states in a seamless transaction in which a filing with the secretary of state effectuates the conversion. In other situations it will require the creation of another entity on a temporary basis that will disappear when the transaction is complete. In either case, this should be treated as an F reorganization and the entity should still be an S corporation. Clarification is needed to state that conclusion and also to determine whether a new federal ID number is needed, and if not, what happens to an ID number that may have been applied for in the case of the temporary entity. 2. Guidance is needed regarding the deductibility under section 162(l) of health insurance premiums paid by and pursuant to a resolution adopted by the Board of Directors of the corporation on behalf of an S corporation shareholder when the 10 insurance policy under which the shareholder is covered is in the name of the shareholder rather than the corporation due to limitations under state law; insurance company policy, or cost-benefit analysis. 3. Guidance is needed as to when, for alternative minimum tax purposes, S corporations will be deemed to have corporate attributes. 4. Guidance is needed regarding the inability to utilize certain suspended passive activity losses upon redemption. Section 469(g) generally allows for the utilization of all suspended passive activity losses that have been carried forward when a taxpayer disposes in a taxable transaction of his entire interest in a passive activity. This rule does not apply, however, when the sale is to a related party described in sections 267(b) and 707(b)(1). When the related party exception applies, the loss is deferred until the party acquiring such interest in the passive activity disposes of the interest to a party that is unrelated to the initial selling taxpayer. In the case of a redemption of stock, the second disposition can never be achieved because the stock redeemed no longer exists for federal income tax purposes. It is not possible to trace the redeemed stock to a subsequent disposition. The legislative history to the provision does not appear to contemplate this situation. Although the statute treats redemptions of corporations differently than redemptions of partnership interests with regard to the ability to recognize realized losses on redemption (see section 707(b)(1) allowing for losses on redemption of partnership interests; and see section 267(b) and Revenue Ruling 57-387 for disallowance of loss on redemption of corporate stock), we believe it appropriate that all suspended losses be allowable upon a complete redemption of interests in a pass through entity. Suspended passive losses do not result from a sale or exchange of property between related parties, but rather from true economic losses. The sale transaction solely governs the timing of taking the loss into account. If such losses were not allowed upon a complete redemption in a pass through entity, true economic losses would never be recognized as the provisions of section 469(g) could never be satisfied. 5. Clarification is needed about who should sign the final return of a corporation that is the target of a section 338(h)(10) acquisition by an S corporation. 6. Clarification is needed regarding the ordering rule for adjustments to AAA when ordinary and redemption distributions are made in the same year and an ordinary distribution occurs after the redemption distribution. Under reg. section 1.13682(d)(1)(ii), AAA is adjusted first for ordinary distributions and then for redemptions. The regulations provide an example where the redemption occurs later in the year than the ordinary distribution, but does not provide an example where the redemption occurs prior to the ordinary distribution. Since the redemption distribution is based on the AAA amount as of the date of the redemption, the rule is not clear in the case of a post-redemption ordinary 11 distribution. The regulation simply says to adjust first for ordinary distributions but does not make a distinction for those ordinary distributions that are before or after a redemption. One could interpret the rule either way. Reducing the AAA balance for all ordinary distributions regardless of the timing relative to the redemption provides the best answer in most circumstances. Since a complete redemption is a sale or exchange transaction, the presence of AAA is irrelevant for purposes of determining the shareholder’s gain or loss on the redemption. Allocating more AAA to redemptions by ignoring post redemption distributions doesn’t benefit the redeemed shareholder while it leaves less AAA for the post redemption distribution to be recovered tax free by the recipient shareholders. 7. Guidance is needed on how net unrealized built-in gain (NUBIG) is allocated in a section 355 transaction involving a distributing S corporation. 8. Clarification is needed as to when transitory ownership of S corporation stock will be ignored for built-in gains tax purposes. For example, in Rev. Rul. 2004-59 under a state law formless conversion statute, the events deemed to occur include the transitory ownership of the corporation’s stock by a partnership (a disqualified shareholder). If the corporation elected S corporation status and the transitory ownership is not ignored, there might be a section 1374 built-in gains tax problem for the entity if it has appreciated assets. 9. Guidance is needed regarding the coordination of the Qsub and the consolidated return regulations with respect to the timing of Qsub elections. Under reg. section 1.1361-4(b)(3), if an S corporation does not own 100 percent of the stock of the subsidiary on the day before the Qsub election is effective, the liquidation described in reg. section 1.1361-4(a)(2) occurs immediately after the time at which the S corporation first owns 100 percent of the stock. When an S corporation acquires a subsidiary from a consolidated group, the timing of the Qsub election may not reconcile with the consolidated return regulations. Regulation section 1.150276(b)(1)(ii) states that the departing member is included in the consolidated group through the end of the day on which it leaves. A departing member, for example, might account for inventory under the LIFO method. It is not clear in this case who recognizes the LIFO recapture. The consolidated regulations have a “next day” rule that generally allocates items that occur on the day of deconsolidation to the next day if they are more properly attributable to activities occurring after the subsidiary has left the group. In the case of a Qsub election, there is no “next day” of the departing member to which items may be allocated. Accordingly, the recapture of the LIFO reserve would appear to be recognized on the selling consolidated group’s return. However, if the S corporation is deemed to acquire the stock of the member after taking into account the consolidated return rule which says the subsidiary remains a member through the day of deconsolidation, then the liquidation might happen on a separate one second return immediately after the target is deemed to leave the consolidated group under reg. section 1.1502-76(b)(1)(ii). Guidance should be issued that (1) addresses the interplay between the consolidated return and 12 the Qsub regulations regarding the timing of the deemed liquidation when a member of a consolidated group is acquired by an S corporation and a Qsub election is made for the former member and (2) specifies on which return the LIFO recapture amount is recognized. 10. Guidance is needed to confirm that an S corporation can simultaneously make both pro rata distributions according to current stock ownership and other distributions that meet the varying interest rule of reg. section 1.1361-1(l)(2)(iv) without creating a second class of stock. 11. We recommend that the guidance from PLR 200308035 be incorporated into a revenue ruling. Specifically, guidance is requested concerning whether a second class of stock is created by an S corporation’s pro rata distributions made to pay: (1) taxes in year one; (2) redemptions in year two; (3) additional taxes in year three for an amendment of its year one tax return; and (4) subsequent distributions to pay additional year one taxes. Tax Accounting Technical Resource Panel (Christine Turgeon, Chair, at (646) 4711660, christine.turgeon@us.pwc.com; or George L. White, AICPA Technical Manager, (202) 434-9268, gwhite@aicpa.org) NOTE: Comments are listed in code section order. 1. Provide guidance under sections 162 and 263(a) regarding the documentation requirements to support a deduction for success-based fees. 2. Provide a fifteen year safe harbor amortization rule under section 167 for all capitalized transaction costs. 3. Provide guidance that royalties contingent on sales may be allocated entirely to cost of goods sold under a section 263A facts and circumstances allocation method. 4. Reconsider Rev. Rul. 2005-42 regarding treatment of environmental remediation expenditures under section 263A. 5. Reconsider Rev. Rul. 70-564 to allow the carryover of LIFO layers following sections 351 and 721 transactions provided the new entity chooses to use a LIFO method. 6. Provide guidance on the terms and conditions for method changes made pursuant to section 381, including whether LIFO changes should be made on a cut-off basis. 7. Modify Rev. Proc. 2006-45 to clarify there is not a financial statement conformity requirement for controlled foreign corporations changing their accounting periods under section 442 to elect a one-month lag as permitted under section 898. 13 8. Modify accounting method procedural guidance to allow taxpayers under examination more opportunity to file method changes, to expand the method changes eligible for automatic consent, and to permit taxpayers to elect to take positive section 481(a) adjustments into account entirely in the year of change. 9. Allow taxpayers to obtain automatic consent to change the treatment of certain transactions as sales instead of as leases, or vice versa, and to implement the change with a section 481(a) adjustment and audit protection in all cases, not only in “unusual and compelling” circumstances. Such method changes could be granted with only “bare consent” where the IRS National Office does not rule as to the proper characterization of the transactions as sales or leases. 10. Provide guidance to address the application of section 453A to contingent payment installment sales. 11. Provide guidance addressing circumstances under which the all events test is satisfied with respect to incentive compensation. 12. Reconsider Rev. Ruls. 71-234 and 77-480 to allow use of the rolling average cost of inventory to the extent it approximates actual cost. 13. Provide guidance on the tax treatment of vendor allowances under section 471. 14. Provide guidance on whether a change to the Inventory Price Index Computation (IPIC) method of reg. section 1.472-8(e)(3) includes an item definition change. 15. Provide guidance to clarify the scope of the IPIC pooling rules, including whether purchased for resale items may be contained in the same pool as manufactured items and whether a LIFO election must be expanded to include all items within an IPIC pool. 16. Re-propose regulations relating to corporate estimated taxes under section 6655. Tax Practice Responsibilities Committee (Eve Elgin, Chair, (202) 533-4268, eelgin@kpmg.com; or Jean E. Trompeter, AICPA Technical Manager, (202) 434-9219, jtrompeter@aicpa.org) NOTE: Comments are not listed in any priority order. 1. Guidance is needed under Circular 230’s covered opinion standards (Section 10.35), including – Consideration of a principle-based approach within the standards to better support Circular 230’s essential role and to alleviate the unintended consequences that have occurred. 14 Consideration of substantial changes to Circular 230 written tax advice standards to remove current impediments on delivery of tax advice to clients and on the role of tax advice in the administration of the tax system. Additional written guidance on the appropriate application of the aspirational standards of Section 10.33 and the binding standards of Section 10.35 to clarify the appropriate level of due diligence in situations where either set of rules could apply. [Note: See AICPA comments on Circular 230’s covered opinion standards, submitted on March 6, 2006, available at: http://tax.aicpa.org/Resources/Professional+Standards+and+Ethics/Treasury+Depar tment+Circular+No.+230+Covered+Opinion+Standards.htm.] 2. Guidance on Circular 230’s provisions regarding general practice matters and disciplinary proceedings, discussed in proposed regulations issued on February 8, 2006, should be finalized, taking into account the AICPA comments submitted on May 9, 2006. [Note: See AICPA comments on these matters, submitted on May 9, 2006, available at: http://tax.aicpa.org/Resources/Professional+Standards+and+Ethics/Treasury+Depar tment+Circular+No.+230+/AICPA+Outlines+Concerns+About+Latest+Circulation +230+Amendments.htm] 3. Additional guidance regarding the imposition of monetary penalties under Circular 230 as amended by Section 822 of the American Jobs Creation Act of 2004 should be issued. The AICPA is currently developing comments on Notice 2007-39, dealing with this issue. Those comments will be submitted to Treasury and the IRS by the August 13, 2007 due date. 4. Guidance regarding “transactions of interest,” as discussed in proposed regulations issued under section 6011 on December 4, 2006, should be finalized, taking into account comments the AICPA submitted on March 2, 2007. [Note: See AICPA comments on these matters, submitted on March 2, 2007, available at: http://tax.aicpa.org/Resources/Tax+Advocacy+for+Members/IRS+Regulation+and+ Administration/AICPA+Comments+on+Proposed+Reportable+Transaction+Regula tions.htm] 5. Guidance should be issued regarding the penalties under sections 6707 and 6708. 15 Trust, Estate and Gift Tax Technical Resource Panel (Steven A. Thorne, Chair, (312) 486-9847, stethorne@deloitte.com; or Eileen Sherr, AICPA Technical Manager, (202) 4349256, esherr@aicpa.org) NOTE: Comments are listed in priority order as High, Medium, or Low. High Priority Items 1. Guidance is needed on the disclosure rules on listed transactions as applied to estates and trusts under sections 6011, 6111 and 6112 for tax shelters, transactions of interest, and reportable transactions. IRS Notice 2006-16, Sec. 3.02 (issued February 27, 2006) was useful in eliminating duplicate disclosures by taxpayers; however, additional guidance is still needed on the application of these provisions in the estate and gift tax area. 2. Guidance is needed regarding Circular 230 and how the requirements relate to estate planning, gift tax planning, etc., for example, what constitutes principal purpose or significant purpose transactions, and whether the statutory exclusion applies to combination strategies like installment sales to defective grantor trusts. [See also, the item under Tax Practice Responsibilities Committee.] 3. Guidance is needed under section 2053 regarding the extent to which post death events may be considered in determining the value of a taxable estate. We note that proposed regulations (REG-143316-03) were issued on April 20, 2007 and look forward to final regulations on this after public comments are considered. 4. A change in the due date of Form 3520A is requested from March 15 to April 15 for filers, to coincide with the due date for calendar year filers for related returns. If a change in the due date is not possible, then an extension or penalty relief is requested for taxpayers who file by April 15. [Note: See AICPA comments to IRS on this submitted on January 31, 2007, available at: http://tax.aicpa.org/Resources/Trust+Estate+and+Gift/Regulation+and+Administrati on/AICPA+Comments+on+Foreign+Trust+Reporting+Forms.htm] 5. A simplified procedure is needed to obtain an extension of time to elect out of the automatic allocation of the GST exemption to indirect skips and at the end of the estate tax inclusion period, similar to Rev. Proc. 2004-46. 6. Guidance is needed on the ability to split gifts under section 2513 in Crummey or similar situations, where the donee spouse has an interest in the trust and others have the ability to withdraw the contributed assets but all the transfers made to the trust during the year may be withdrawn by trust beneficiaries. Such guidance is particularly needed in the case of late filing of gift tax returns. Because of the late filing, there is no opportunity to elect out of deemed allocation 16 (i.e., each spouse’s GST exemption would be allocated to his or her portion of the transfer) (reg. section 26.32-1(b)(4)(iii), Ex. 5.). 7. The current tax reporting on Form 1040NR for foreign non-grantor trusts (and foreign grantor trusts with a US owner) is extremely difficult because the IRS form is not designed for fiduciary tax return reporting. By creation of a new Form 1041NR, which could include reporting currently on Forms 3520,3520-A tax reporting could eliminate confusion, mistakes in processing returns and enhance tax compliance filing requirements. [See AICPA Comments on Foreign Trust Reporting Issues submitted to Treasury and IRS on January 31, 2007, available at: http://tax.aicpa.org/Resources/Trust+Estate+and+Gift/Regulation+and+Administrati on/AICPA+Comments+on+Foreign+Trust+Reporting+Forms.htm.] Medium Priority Items 8. Final regulations should be issued under section 2642 regarding qualified severance. [Note: See AICPA comments on these proposed regulations (REG–145987-03) under section 2642(a)(3) submitted on February 9, 2005, available at: http://tax.aicpa.org/Resources/Trust+Estate+and+Gift/Regulation+and+Administrati on/AICPA+Asks+IRS+to+Clarify+Qualified+Severance+Regs.+for+GST+Trusts.ht m.] 9. Guidance is needed on the consequences under various estate, gift, and generation skipping transfer tax provisions of using a family-owned company as the trustee of a trust. [Note: See AICPA pre-release comments on this item, which was on last year’s IRS business plan, submitted on March 29, 2006, available at: http://tax.aicpa.org/Resources/Trust+Estate+and+Gift/Trusts/AICPA+Suggests+Par ameters+for+Private+Trust+Company+Guidance.htm.] Low Priority Items 10. Guidance is needed regarding the appropriate means and timing of GST allocations to pour over trusts from GRATs terminations. 11. Guidance is needed on how the GST applies to grandfathered domestic trusts that become foreign trusts. This issue may be analogous to a GST-grandfathered trust which migrates from one state to another; thus, similar rules and safe harbors should be considered. 12. IRS should issue guidance under section 2632(c) regarding the deemed allocation of GST exemption to certain lifetime transfers to GST trusts. In particular, clarification is requested with regard to the exceptions to the definition of a GST trust contained in section 2632(c)(3)(B)(i)-(vi) as well as the exception in the flush language of this section dealing with gift tax annual exclusions. Six types of GST trusts are defined, but there are many gray areas that we would request additional 17 guidance. Finally, until regulations are issued under section 2632(c)(3)(B)(i)(III), as required by such section, we believe this provision has no effect. 13. Guidance is needed under section 2632(c)(5)(A)(i) and examples addressing the application of the GST exemption automatic allocation rules for indirect skips in a situation in which a trust subject to an estate tax inclusion period (ETIP) terminates upon the expiration of the ETIP, at which time the trust assets are distributed to other trusts that may be GST Trusts. 14. Clarification is needed in the instructions to Form 709 with regard to Column C in Part 3 of Schedule A as to the election made under section 2632(c) (electing “ in and out” of a deemed allocation.) The instructions imply that checking the box in Column C applies only for transfers reported on the return. Confusion can result as the instructions provide that, if a prior election has been made with respect to future transfers, the box in Column C should not be checked and no explanatory statement should be filed with the applicable Form 709. 15. Revenue procedures should be issued under sections 2055 and 2052 containing sample charitable lead trust provisions. 16. Guidance is needed under section 642(c) on whether income in respect of a decedent (IRD) that is reported and used in calculating the estate’s charitable deduction on the estate tax return should be treated as “gross income” and allowed as a charitable deduction on the estate’s fiduciary income tax return when the IRD is paid to a charitable organization pursuant to the governing instrument. 17. Guidance is needed under section 645 regarding elections to include revocable trusts in an estate. Will 9100 relief be available on missed elections? 18. Guidance is requested regarding section 199 regulations as they relate to estate and gift tax. [See also, item 2 under Tax Accounting Technical Resource Panel.] 19. Guidance is needed under section 2704 regarding restrictions on the liquidation of an interest in a corporation or partnership. 20. Guidance is needed on the allocation of indirect deductions for charitable remainder trusts. 21. Guidance is needed regarding obtaining of bonds for all section 6166 cases in light of the Tax Court Roski decision. 22. Guidance is needed on the implementation and transition rules for the transfer tax changes currently expected in 2010 and 2011 unless there is legislative action. 18