office procedure - Care-for

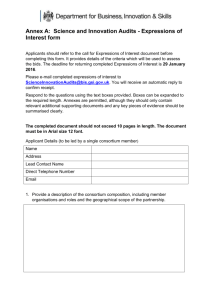

advertisement