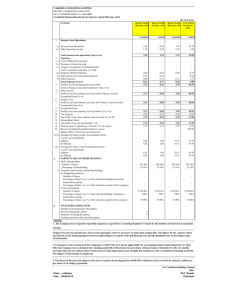

Group Profit and Loss Account

advertisement

7 November 2002 THE BIG FOOD GROUP PLC INTERIM RESULTS for the 24 weeks to 13 September 2002 Highlights Total net sales were £2,378.1 million (2001: £2,446.2 million) Operating profit before goodwill amortisation and exceptional items was £18.2 million (2001: £33.4 million) Profit before goodwill amortisation, exceptional items and tax was £6.6 million (2001: £16.7 million) Earnings per share were 1.5p (2001: 0.2p) and adjusted earnings per share were 1.6p (2001: 4.6p) Dividend 1.0p (2001: 1.0p) per share Continued strong performance of four Iceland new format trial stores with average uplift in like for like sales of 15.1% during the period Satisfactory performance at Booker with non-tobacco sales up 2.3% Commenting on the statement Chief Executive Bill Grimsey said: “I am very pleased with the performance at Booker where we have grown sales and made good progress with strategic initiatives. Meanwhile Iceland is now trading profitably, and having brought gross margin under control, the emphasis is on building sales through the important Christmas trading period and rolling out our proven new format stores.” Enquiries: The Big Food Group plc Bill Grimsey, Chief Executive Bill Hoskins, Finance Director David Sawday, Head of Group PR Tel: 020 7796 4133 on 7 November 2002 thereafter Tel: 01933 371148 Hudson Sandler Andrew Hayes/Noémie de Andia Tel: 020 7796 4133 1 7 November 2002 THE BIG FOOD GROUP PLC INTERIM STATEMENT for the 24 weeks to 13 September 2002 Introduction During the first half of the current year much progress has been made in the implementation of our strategic initiatives including the important new format trials at Iceland. The excellent performance of these stores demonstrates that we can deliver a step change in performance with this initiative. There was also a solid performance at Booker which continues to improve upon its strong position in the UK wholesale market. However, this progress was masked by the trading problems at Iceland caused by a change in promotional strategy. This was swiftly recognised and corrective action taken with the result that this business unit is now trading profitably. The re-financing, which was completed in June, gives the Company a much stronger financial platform from which to carry out its investment plans. Summary Total net sales were £2,378.1 million (2001: £2,446.2 million), the reduction due principally to Iceland’s trading performance. Operating profit before goodwill amortisation and exceptional items was £18.2 million (2001: £33.4 million), the shortfall arising from the volume and gross margin impacts at Iceland caused by the change in promotional strategy. Profit before goodwill amortisation, exceptional items and tax was £6.6 million (2001: £16.7 million) with a reduction in interest expense (before exceptional costs) of £5.1 million including the effect of the sale and leaseback. Earnings per share were 1.5p (2001: 0.2p) and adjusted earnings per share were 1.6p (2001 : 4.6p) An interim dividend of 1.0p per share is proposed (2001: 1.0p per share) Performance Review Sales Booker. The overall growth in Booker’s like for like sales of 0.8% was a satisfactory performance. The growth in the more profitable non-tobacco sales of 2.3% was particularly pleasing. This was driven by increased promotional activity, in line with our strategy to deliver better value for our customers, and the growth in alcohol, soft drinks and snacks. The decline in tobacco sales had little effect on profitability however it is an important driver of footfall so is relevant to the performance of Booker’s position as the market leader in the UK wholesale market. Woodward Foodservice. The 10.8% like for like sales growth at Woodward continued the strong upward trend. Key drivers were the growth experienced in the independent catering market in England and Wales and the development of national accounts. 2 Iceland Foods. A too aggressive move towards a value driven proposition caused a decline in like for like sales of 6.7% for the first half. A return to the more traditional promotional package was increasingly implemented from July. By contrast, in the new format stores, where there have also been changes in range, store environment and services, customers like the value based proposition. Therefore it remains part of the roll-out strategy for the new formats. The Home Shopping pick centre at Sunbury has been established and we are evaluating both the commercial progress and the cost effectiveness of this trial. Operating Profit Operating profit before goodwill amortisation and exceptional items was as follows: Booker Woodward Iceland 2002 £m 2001 £m 26.1 (1.0) (6.9) _____ 18.2 _____ 26.1 (0.7) 8.0 _____ 33.4 _____ At Booker the underlying growth in operating profit of 10% demonstrates its strength as the market leader in the Cash and Carry business. This profit growth includes the benefit of higher non-tobacco sales with the associated increase in gross margins, together with an improvement in stock shrinkage. However, additional costs of approximately £2.6 million were incurred on flood damage at the Blackburn branch and additional rents arising from the sale and leaseback in June. Losses at Woodward were at similar levels to the previous year in line with our strategic plan which is designed to take advantage of the growth in the foodservice sector. The benefit of the gross margin, arising from the increase in sales, was matched by the additional revenue costs being invested by the business unit as part of that plan. At Iceland, the operating loss of £6.9 million was in line with the expectation outlined in the trading statement of 25 July. The sales decline, noted above, was the result of a too aggressive move towards a value proposition. This required an investment in margin to generate sales and the targets for both of these elements were not met. The margin cost experienced in the first half was approximately £4.5 million. The overall impact of the reduction in sales volumes was, however, mitigated by the business unit’s ability to manage variable distribution and branch costs in line with the lower level of activity. Subsequently gross margins have been restored by the return to the traditional promotion strategy and Iceland is now trading profitably. The task now is to improve trading performance running up to Christmas. Other impacts of £1.0 million on operating profit at Iceland included the additional rents from the sale and leaseback. Strategic Initiatives In contrast to the short term profitability, the Group has made important advances in the development of its longer term outlook. At Booker, the strategic aim to grow its delivered wholesale business has been strengthened. Firstly by the start up of the Delivery Hub at Wolverhampton, a specialised delivery site providing an enhanced service and better use of our assets. Secondly the Drop Shipment programme, which involves direct delivery to customers of products like bread and milk that are needed daily. Both initiatives are 3 supported by the associated e-ordering system. Meanwhile our Premier fascia customers have increased from 705 to 818. The Woodward Foodservice business, currently focused on frozen food, aims to enhance its capability to compete for national accounts by enlarging its product offering. In September, a new distribution centre for ambient groceries was opened in Rhyl to service customers in Wales and the North West of England. At Iceland, where much of the Group’s investments are planned, developments included re-fits in the new format concepts and the opening of a new store. We have identified four formats: a freezer centre, with a minimal grocery and chilled offer; a core store, with a product mix close to that of the current standard Iceland format; a core+ store offering additional ranges, particularly in chilled and fresh foods, together with improved services; a C-store with a reduced frozen food offer, providing a full convenience store range. The first four new format stores, covering each of the concepts traded with an average uplift in like for like sales of 15.1% over the period with particularly strong results being achieved from the core and core+ formats. The trial of these formats will be extended to a further 32 stores by the end of this financial year in order to establish these propositions prior to the rollout to 100 further stores in 2003/2004. In the first half one new store opened at Leicester and a further 10 are planned to open by the end of the financial year. Interest Net interest payable was £11.8 million before exceptional costs (2001 : £16.7 million), reflecting the lower borrowings during the period including the impact of the re-financing completed in June. Exceptional Costs Operating exceptional costs were £ 3.9 million with an additional £5.2 million charged to interest. The principal components of operating exceptional costs were: £m 1.3 1.7 0.3 0.6 ___ 3.9 ___ Closure of Sovereign Integration projects Investment write down Other Sovereign was a single branch confectionery wholesale business within Booker with an operating loss of approximately £0.3 million per annum. Integration projects include financial administration and in particular the creation of a Group transaction processing centre at Deeside based on SAP technology. The £5.2 million charged to interest related to the closure of various interest rate swap contracts as noted in the 2002 annual report and accounts. Exceptional profits of £17.6 million arose from the disposal of fixed assets, principally the 31 properties which were the subject of a sale and leaseback transaction as part of the re-financing programme. 4 Cash Flow Average daily net debt, comprising actual borrowings, and estimated cash and finance leases was as follows: £m 30 March to 17 June 377 18 June to 13 September 239 On 18 June the Company received £123.5 million (net of expenses) in respect of the sale and leaseback of 31 properties. The Company generated cash of £ 123.5 million during the period, the components of which were: £m Operating profit before goodwill amortisation and exceptional costs Depreciation and amortisation 18.2 34.9 ______ 53.1 (15.6) ______ 37.5 (0.5) (27.7) 126.5 (2.3) (7.7) (2.3) ______ 123.5 (404.2) ______ (280.7) ______ Interest, tax and dividends Working capital Capital expenditure Fixed asset disposals Provisions Exceptional costs Purchase of investments Net cash flow Net debt at 30 March 2002 Net debt at 13 September 2002 Excluding the impact of exceptional items and the disposal of fixed assets, the Company generated £4.7 million of cash, in line with its own expectations. Working capital continued to be managed effectively within the overall reduction in trading activity. Both stocks and creditors increased as a result of tactical purchases. Capital expenditure at £27.7 million was lower than depreciation for the period. However, significant investments are planned for the second half particularly in respect of re-fits and new stores at Iceland. Dividend The Board have considered profitability and cash flow earned to date as well as the Company’s expectations for the remainder of the year. These indicate an improving trend, based on seasonality and the recovery of the Iceland gross margins. Accordingly, an interim dividend of 1.0p per share is proposed. The dividend is payable on 10 January 2003 to shareholders on the register at 6 December 2002. 5 Re-financing The Company completed its re-financing on 18 June providing longer term borrowing facilities. The elements were a sale and leaseback of 31 properties raising £123.5 million (net of expenses), a subordinated 10 year High Yield bond for £150 million and a bank facility for £300 million expiring 30 March 2007. This re-financing programme puts in place the necessary funding to enable the Company to execute its investment plans. The average net debt reported above indicates strong liquidity and the Company expects to meet its financial compliance obligations. The Company may from time to time choose to repurchase outstanding bonds, in open market purchases or privately negotiated transactions. Such purchases will depend on prevailing market conditions and will not exceed 10% of the bonds in issue. Pension Scheme On 1 August the Company completed its new pension arrangements for employees under which accrual of benefits under the final salary scheme ceased and with over 95% of members entering a new defined contribution scheme. Also from 1 August the Company is paying contributions of approximately £7 million per annum in respect of the actuarial deficit until the next triennial valuation in 2004. Management and Employees The Company will shortly be launching a further issue under its existing SAYE scheme in respect of approximately twelve million shares, subject to employee take-up, to all qualifying employees with service of at least one year. This reflects the Company’s aim of increasing employee share ownership still further to enable our colleagues to participate in the longer term growth prospects. During the period we have made several key appointments that will further strengthen our management team. Ted Smith, has joined as Stores Director, Iceland. He was previously Operations Director with WH Smith and held senior retail positions at Boots. Nick Canning is to join as Marketing Director, Iceland. Nick was formerly Marketing Director with News International responsible for The Sun and The News of the World. Prior to that he was Marketing Director for KP Foods, following a successful early career in marketing. Peter Fuller has joined Woodward Foodservices as Operations Director and previously held senior positions in logistics at B&Q and Asda. Outlook The successful completion of the re-financing has enabled the Group to embark on implementation of the strategic plan. Teams across the Group are engaged on initiatives designed to restore shareholder value. The main issue facing the Group today is the like for like sales performance of Iceland. Therefore the focus is on the Christmas trading period to restore sales whilst margins are maintained. Presentation to Analysts A presentation to analysts will be made today at 9.15am for 9.30am at The Smeaton Vaults, The Brewery, Chiswell Street, London, EC1. 6 Group Profit and Loss Account For the 24 weeks ended 13 September 2002 Note Turnover 2 24 weeks ended 13 September 2002 (Unaudited) £m 24 weeks ended 15 September 2001 (Unaudited) £m 52 weeks ended 29 March 2002 (Audited) £m 2,378.1 --------------- 2,446.2 --------------- 5,220.4 -------------- ------------------------------------------------------------------------------------------------------------------------------------------------Operating profit before goodwill amortisation and operating exceptional items 18.2 33.4 76.1 Goodwill amortisation (10.2) (10.2) (22.2) Operating exceptional items 3 (3.9) (5.7) (10.4) ------------------------------------------------------------------------------------------------------------------------------------------------2 4.1 17.5 43.5 Operating profit Profit on disposal of fixed assets Profit on ordinary activities before interest and taxation Interest payable (net) 4 Profit on ordinary activities before taxation Tax on profit on ordinary activities Profit for the financial period Dividends 5 Retained profit/(deficit) for the period Earnings per ordinary share - basic - adjusted - diluted 6 6 6 7 17.6 --------------- 2.8 --------------- 4.2 -------------- 21.7 20.3 47.7 (16.8) --------------4.9 (18.4) --------------1.9 (34.9) -------------12.8 --------------4.9 (1.3) --------------0.6 (3.5) -------------9.3 (3.3) --------------1.6 ========= (3.4) --------------(2.8) ========= (8.4) --------------0.9 ======== Pence Pence Pence 1.5 1.6 1.4 0.2 4.6 0.2 2.8 11.4 2.8 Group Statement of Total Recognised Gains and Losses For the 24 weeks ended 13 September 2002 24 weeks ended 13 September 2002 (Unaudited) £m 24 weeks ended 15 September 2001 (Unaudited) £m 52 weeks ended 29 March 2002 (Audited) £m 4.9 0.5 --------------5.4 ========= 0.6 --------------0.6 ========= 9.3 --------------9.3 ========= 24 weeks 24 weeks ended ended 13 September 15 September 2002 2001 (Unaudited) (Unaudited) £m £m 52 weeks ended 29 March 2002 (Audited) £m Profit for the financial period Exchange movements Total recognised gains for the period Reconciliation of Movement in Shareholders’ Funds For the 24 weeks ended 13 September 2002 Total recognised gains and losses Dividends paid and proposed New share capital allotted, including premium Net increase/(decrease) in shareholders’ funds Shareholders’ funds at the beginning of the period Shareholders’ funds at the end of the period 8 5.4 (3.3) 0.1 --------------2.2 402.5 --------------404.7 0.6 (3.4) 0.4 --------------(2.4) 400.1 --------------397.7 9.3 (8.4) 1.5 --------------2.4 400.1 --------------402.5 ========= ========= ========= Group Balance Sheet At 13 September 2002 13 September 15 September 2002 2001 (Unaudited) (Unaudited) £m £m Fixed assets Intangible assets Tangible assets Investments Current assets Stocks Debtors due within one year Short-term deposits Cash at bank and in hand Creditors due within one year Net current liabilities Total assets less current liabilities Creditors due after one year Provisions for liabilities and charges Capital and reserves Called up share capital Share premium account Merger reserve Profit and loss account Equity shareholders’ funds 9 29 March 2002 (Audited) £m 395.4 498.9 11.4 --------------905.7 --------------- 417.6 635.2 13.8 --------------1,066.6 --------------- 405.6 614.6 11.2 --------------1,031.4 --------------- 346.3 116.1 10.5 50.9 --------------523.8 366.4 135.6 15.2 74.9 --------------592.1 296.6 142.3 4.6 36.8 --------------480.3 (653.6) --------------(129.8) --------------775.9 (777.8) --------------(185.7) --------------880.9 (1,049.6) --------------(569.3) --------------462.1 (321.5) (428.0) (9.1) (49.7) --------------404.7 ======== (55.2) --------------397.7 ======== (50.5) --------------402.5 ======== 34.3 17.7 344.5 8.2 --------------404.7 ========= 34.2 16.7 344.5 2.3 --------------397.7 ========= 34.3 17.7 344.5 6.0 --------------402.5 ======== Group Cash Flow Statement For the 24 weeks ended 13 September 2002 Note Cash flow from operating activities Servicing of finance Tax refunded/(paid) Capital expenditure and financial investment Equity dividends paid 7 8 8 Cash inflow before use of liquid resources and financing Management of liquid resources: Net (outflow)/inflow from short-term deposits Financing 8 Increase in cash for the period Reconciliation of net cash flow to movement in net debt: Increase in cash for the period Cash outflow from debt and lease financing Cash outflow/(inflow) from liquid resources 24 weeks 24 weeks ended ended 13 September 15 September 2002 2001 (Unaudited) (Unaudited) £m £m 52 weeks ended 29 March 2002 (Audited) £m 47.8 (16.2) 0.4 96.4 (5.0) ---------------- 100.4 (20.7) (1.4) (4.7) ---------------- 161.8 (40.3) 8.0 (27.4) (3.4) ---------------- 123.4 73.6 98.7 (5.9) (9.9) 0.7 (112.8) ---------------4.7 ========= (38.7) ---------------25.0 ========= (81.0) ---------------18.4 ========= 4.7 112.9 5.9 ---------------123.5 25.0 39.1 9.9 ---------------74.0 18.4 82.5 (0.7) ---------------100.2 (404.2) ---------------(280.7) ========= (504.4) ---------------(430.4) ========= (504.4) ---------------(404.2) ========= 9 Movement in net debt in the period Net debt at start of period Net debt at end of period 10 Notes to the Accounts At 13 September 2002 1. Basis of preparation and accounting policies The interim accounts have been prepared on the basis of the accounting policies set out in the Group’s statutory accounts for the period ended 29 March 2002. These statements, which are unaudited, do not constitute statutory accounts within the meaning of section 240 of the Companies Act 1985. The accounts for the 52 weeks ended 29 March 2002 have been extracted from the full accounts, which have been filed with the Registrar of Companies. The Auditors’ Report on these accounts was unqualified and did not contain any statement under section 237 of the Companies Act 1985. 2. Segmental analysis 24 weeks ended 13 September 2002 £m 24 weeks ended 15 September 2001 £m 52 weeks ended 29 March 2002 £m 1,656.9 46.0 675.2 ------------2,378.1 ======= 1,677.2 41.5 727.5 ------------2,446.2 ======= 3,544.4 87.0 1,589.0 ------------5,220.4 ======= 26.1 (1.0) (6.9) ------------18.2 26.1 (0.7) 8.0 ------------33.4 54.6 (1.6) 23.1 ------------76.1 (10.2) (10.2) (22.2) a) Turnover Wholesale Foodservice Retail b) Profit before tax Wholesale Foodservice Retail Goodwill amortisation Operating exceptional items: Wholesale Foodservice Retail (2.1) (2.8) (3.8) (0.2) (1.8) (2.9) (6.4) ------------------------------------Operating profit 4.1 17.5 43.5 17.6 2.8 4.2 Profit on disposal of fixed assets (16.8) (18.4) (34.9) Interest payable (net) ------------------------------------4.9 1.9 12.8 Profit before tax ======= ======= ======= All operations are continuing and carried out in the United Kingdom and the Republic of Ireland. 11 Notes to the Accounts At 13 September 2002 (continued) 3. 24 weeks 24 weeks ended ended 13 September 15 September 2002 2001 £m £m Exceptional items before interest Integration and strategic review costs Refinancing costs Business closure Write down of investment Other 1.7 1.3 0.3 0.6 -----------3.9 (17.6) -----------(13.7) ======= Total operating exceptional items Profit on disposal of fixed assets 4. Interest payable (net) Interest receivable and similar income Interest payable: Interest on bank loans and overdrafts Loan note interest Finance charges payable under finance leases Unwinding of discount on provisions Other interest payable Exceptional costs: Bank fees related to the syndicated facility Interest rate swap closure costs 12 52 weeks ended 29 March 2002 £m 3.7 2.0 -----------5.7 (2.8) -----------2.9 ======= 7.9 2.0 1.3 (0.8) -----------10.4 (4.2) -----------6.2 ======= 24 weeks 24 weeks ended ended 13 September 15 September 2002 2001 £m £m 52 weeks ended 29 March 2002 £m (0.4) (0.1) (2.8) 7.5 3.6 0.4 0.5 --------------11.6 15.4 0.2 0.8 0.4 --------------16.7 33.2 0.2 1.4 0.6 0.6 --------------33.2 5.2 --------------16.8 ========= 1.7 --------------18.4 ========= 1.7 --------------34.9 ========= Notes to the Accounts At 13 September 2002 (continued) 5. 24 weeks 24 weeks ended ended 13 September 15 September 2002 2001 £m £m Dividends Interim dividend 1.0p per share (2001/2:1.0p) Final dividend (2001/2: 1.5p) 6. 3.3 -----------3.3 ======= 3.4 -----------3.4 ======= 52 weeks ended 29 March 2002 £m 3.4 5.0 -----------8.4 ======= Earnings per ordinary share Basic and diluted The basic and diluted earnings per share are calculated based on the following data: 24 weeks 24 weeks ended ended 13 September 15 September 2002 2001 £m £m Profit for the financial period Basic weighted average number of shares Dilutive potential ordinary shares: Employee share awards and options Diluted weighted average number of shares 52 weeks ended 29 March 2002 £m 4.9 ======== No. (m) 0.6 ======== No. (m) 9.3 ======== No. (m) 332.3 331.8 332.1 5.6 -----------337.9 ======= 1.4 -----------333.2 ======= 4.0 -----------336.1 ======= The basic weighted average excludes shares held in the employee share trust, as required by FRS14. The effect of this is to reduce the average by 10,701,000 (15 September 2001: 9,840,000, 29 March 2002: 9,874,861). Adjusted Adjusted earnings per share of 1.6p (15 September 2001: 4.6p, 29 March 2002: 11.4p) are presented in addition to the basic EPS of 1.5p (15 September 2001: 0.2p, 29 March 2002: 2.8p) required by FRS 14 since, in the opinion of the directors, this represents a clearer year on year comparison of the earnings of the Group. The adjusting items are: exclusion of goodwill amortisation 3.1p (15 September 2001: 3.1p, 29 March 2002: 6.7p); exceptional items (2.6)p (15 September 2001: 1.7p, 29 March 2002: 2.4p); and associated tax credit of (0.4)p (15 September 2001: (0.4)p, 29 March 2002: (0.5)p). 13 Notes to the Accounts At 13 September 2002 (continued) 7. Reconciliation of operating profit to operating cash flows Operating profit Operating exceptional items Operating profit before operating exceptional items Depreciation Amortisation of goodwill Amortisation of investments Exceptional costs cash flow (Increase)/decrease in stocks Decrease/(increase) in debtors Increase/(decrease) in creditors Cash flow relating to provisions Net cash inflow from operating activities 8. Analysis of cash flows Servicing of finance Interest paid Interest element of finance lease rental payments Interest rate swap closure costs Bank fees related to the syndicated facility Net cash outflow for servicing of finance Capital expenditure and financial investment Purchase of tangible fixed assets Sale of tangible fixed assets Purchase of shares for ESOP Net cash outflow for capital expenditure and financial investment Financing Issue of share capital Proceeds from new borrowings Repayment of borrowings Capital element of finance lease repayments Net cash outflow from financing 14 24 weeks ended 13 September 2002 £m 24 weeks ended 15 September 2001 £m 52 weeks ended 29 March 2002 £m 4.1 3.9 ---------------8.0 33.0 10.2 1.9 (2.5) (49.7) 25.7 23.5 (2.3) ---------------47.8 ========= 17.5 5.7 ---------------23.2 36.9 10.2 1.3 (12.9) (6.4) 3.5 48.5 (3.9) ---------------100.4 ========= 43.5 10.4 ---------------53.9 79.0 22.2 2.6 (19.5) 63.4 (10.4) (20.7) (8.7) ---------------161.8 ========= 24 weeks ended 13 September 2002 £m 24 weeks ended 15 September 2001 £m 52 weeks ended 29 March 2002 £m (10.6) (0.4) (5.2) ---------------(16.2) ========= (19.9) (0.8) ---------------(20.7) ========= (36.7) (1.4) (2.2) --------------(40.3) ======== (27.7) 126.5 (2.4) ---------------- (19.0) 14.3 ---------------- (45.8) 18.4 --------------- 96.4 ========= (4.7) ========= (27.4) ======== 0.1 260.4 (369.3) (4.0) ---------------(112.8) ========== 0.4 (32.4) (6.7) ---------------(38.7) ========== 1.5 (69.7) (12.8) --------------(81.0) ======== Notes to the Accounts At 13 September 2002 (continued) 9. At 29 March 2002 £m Analysis of net debt Cash at bank and in hand Overdrafts Debt due within 1 year Debt due after 1 year Finance leases Liquid resources - short-term deposits 15 At 13 September Cash flow 2002 £m £m 36.8 (2.0) --------------34.8 (427.0) (2.1) (14.5) --------------(408.8) 14.1 (9.4) -------------4.7 425.4 (316.5) 4.0 -------------117.6 50.9 (11.4) --------------39.5 (1.6) (318.6) (10.5) --------------(291.2) 4.6 --------------(404.2) ======== 5.9 -------------123.5 ======== 10.5 --------------(280.7) ========