UNISA Exam Memo May/June 2010

advertisement

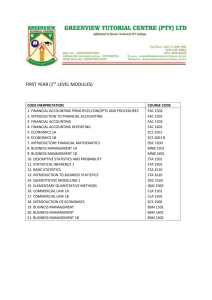

UNISA Exam Memo May/June 2010 ECS 1601 1. 2 12. 1 23. 1 34. 2 2. 4 13. 4 24. 3 35. 2 3. 2 14. 3 25. 4 36. 2 4. 2 15. 3 26. 2 37. 2 5. 4 16. 1 27. 2 38. 3 6. 4 17. 2 28. 1 39. 4 7. 3 18. 2 29. 2 40. 3 8. 2 19. 3 30. 3 9. 3 20. 1 31. 4 10. 3 21. 3 32. 2 11. 1 22. 1 33. 3 UNISA Exam Memo Oct/Nov 2010 ECS 1601 1. 4 12. 2 22. 3 33. 1 2. 1 13. 4 23. 3 34. 3 3. 3 14. 4 24. 4 35. 3 4. 1 15. 2 25. 1 36. 1 5. 3 16. 3 26. 2 37. 1 6. 2 17. No 27. 1 38. 3 28. 2 39. 3 40. 2 7. 2 correct answer! 8. 2 18. 2 29. 1 9. 3 19. 3 30. 3 10. 2 20. 2 31. 2 11. 3 21. 4 32. 4 UNISA Exam Memo May/June 2011 ECS 1601 Section A 1. Theoretical question 2. (i) Draw demand curve rel. inelastic; S shifts upwards – to the left; show greater burden on consumer (ii) A-curve swivels upwards; intercept on vertical axis unchanged; show increase in Y (iii) As shifts to the left; P and Y 3. (i) 0.7 (ii) A = 30 and Ye = 90 (iii) = 2 and Ye = 4960 4. (i) X due to stronger rand; D for fruit; D for fruit-pickers; structural unemployment (ii) Need constant prices (real GDP) to measure real growth in economy; current prices (nominal GDP) includes inflation and provides a distorted picture of economic growth. (iii) Will increase the size of the due to less money being spent abroad and more locally; also increase Y (iv) decrease in Yd; decrease in multiplier; A-curve becomes flatter; decrease in Ye (v) AD shifts to the left; Ye decreases ; Pdecreases (vi) Structural; skills development programmes to adress mismatch between skills and job requirements. Section B 1. 4 12. 1 23. 4 34. 4 2. 4 13. 2 24. 1 35. 2 3. 4 14. 4 25. 4 36. 2 4. 2 15. 2 26. 4 37. 3 5. 1 16. 1 27. 2 38. 3 6. 1 17. 2 28. 3 39. 1 7. 1 18. 3 29. 3 40. 4 8. 2 19. 3 30. 4 9. 4 20. 4 31. 1 10. 2 21. 3 32. 2 11. 1 22. 1 33. 3 UNISA Exam Memo Oct/Nov 2011 ECS 1601 Section A 1. Theoretical question 2. (i) D for money shifts to the right leaving i% unchanged; but with an increase in M (ii) D for $ will decrease – shift to the left; $ depreciates; ZAR appreciates (iii) Implement contractionary fiscal policy; decrease in G and/or increase in T; AD will decrease – shift to the left; P decreases and Y decreases. Thus: lower inflation at the cost of production / Y / employment 3. Multiplier = 2.17 Ye = 3363.5 (3364 rounded) mY = 336.4 X – Z = 63.6 4. (i) Foreign investment + income from X will increase demand for the Lilangeni (appreciates) (ii) Theoretical question (iii) Monetary transmission mechanism – explain (iv) Theoretical question Section B 1. 4 12. 2 23. 2 34. 1 2. 4 13. 3 24. 4 35. 4 3. 2 14. 3 25. 4 36. 4 4. 3 15. 3 26. 3 37. 1 5. 1 16. 4 27. 4 38. 3 6. 2 17. 4 28. 1 39. 2 7. 3 18. 4 29. 3 40. 4 8. 3 19. 3 30. 1 9. 1 20. 1 31. 4 10. 2 21. 3 32. 4 11. 2 22. 1 33. 3