Austria - European Association of Tax Law Professors

advertisement

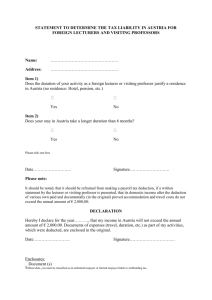

Austrian Report On Avoidance of multiple inheritance taxation within Europe 1. Austrian Tax Law 1. 1. Overview In Austria two types of taxes are levied on the transfer of goods or rights without consideration. The transfer of assets on the death of natural persons is subject to an inheritance tax (Erbschaftssteuer, ErbStG 1955, federal law gazette 1955/141, latest amendment by federal law gazette I 2000/42) which is sticking closely to the ability-to-pay-principle and only taxes the amount of property received by the single beneficiary. Therefore the Austrian inheritance tax does not have the character of an estate tax. The transfer on death may be conducted by means of inheritance, deeds and wills, statutory shares in transfer on death as well as by contracts concluded by the transferor. Lifetime gifts are subject to a gift tax (Schenkungssteuer, ErbStG 1955, federal law gazette 1955/141, latest amendment by federal law gazette I 2000/42) which is from a technical point of view mostly identical to the inheritance tax. Real estate situated in Austria is additionally subject to an minimum inheritance or gift tax (Grunderwerbsteueräquivalent oder Mindesterbschaftssteuer) which is based on the assessed value of the real estate (widely deviating from the fair market value) and has to be paid even if the basis of the inheritance tax should be negative or the acquisition was exempt from tax. Life time gifts of real estate situated in Austria are also subject to real estate acquisition tax (Grunderwerbsteuer, GrEStG 1987, federal law gazette 1987/309, latest amendment by federal law gazette I 1999/106) as far as the donation is qualified (e. g. assumption of mortgages). The taxable value of the burden on the donation is the basis of the real estate acquisition tax. Therefore the donation of domestic real estate is subject to three kinds of taxes: the gift tax, the minimum gift tax (which is levied separately from the gift tax) and the real estate acquisition tax. The transfer of deomestic real estate by means of death only triggers inheritance tax and minimum inheritance tax, but not real estate acquisition tax. 1. 2. Criteria for tax liability 2 Minimum inheritance/gift tax and capital acquisition tax are only levied on the transfer of domestic real estate. The link for taxation is the situs of property. The criteria employed for inheritance and gift tax liability are residence (Wohnsitz), habitual place of abode (gewöhnlicher Aufenthalt), and in cases, where an Austrian citizen having unlimited liability to inheritance or gift tax has moved to another country and therefore eliminated unlimited tax liability in Austria, the nationality (Staatsbürgerschaft). The concept of “domicile” which is common in common-law-countries is not known in Austria. A definition of residence and habitual place of abode may be found in section 26 of the Austrian Federal Fiscal Code (Bundesabgabenordnung). An individual is deemed to reside at the place where he maintains an house or apartment (not necessarily legal ownership, power of disposal is essential) under circumstances which indicate that he will retain and use it not merely temporarily (e. g. for only one project in Austria), but permanently for himself (e. g. for holiday purposes). An individual is considered to habitually stay in Austria, if his stay is not merely of temporary nature. Stays lasting longer than 6 months in Austria constitute unlimited tax liability in any case. The inheritance and gift tax refer to the residence, the habitual place of abode, and the nationality of the donor/deceased as well as to the donee/heir. To avoid unlimited tax liability of the donation or the inheritance the donor/deceased as well as the donee/heir have to transfer their residences to another country. According to sec 6 par 1 of the Austrian Inheritance Tax Act (AITA) the nationality of the donor/donee and the deceased/heir may constitute unlimited tax liability in Austria, if the parties involved have relinquished their residence within two years from the implementation of the donation or the moment of death of the deceased (taxation of tax exiles). If either the donor/deceased or the donee/heir have got a residence or the habitual place of abode in Austria, the world-wide property of the donor or deceased is subject to the Austrian inheritance or gift tax. If the deceased or donor is a resident of Austria, the total assets transferred are taxed in Austria irrespective of the residence or habitual place of abode of the beneficiary. If the heir or donee is a resident of Austria, total assets transferred to him are subject to Austrian tax liability irrespective of the residence or habitual place of abode of the donor/deceased. If neither the donor/deceased nor the donee/heir have got a residence or the habitual place of abode in Austria and nationality of the parties involved does not infect the transfer with unlimited tax liability, only parts of the domestic property of the donor or deceased are subject 3 to the Austrian inheritance or gift tax. In case of limited liablity to Austrian inheritance or gift tax only immovable property located in Austria assets of an agricultural, forestry, or business enterprise (sole trader, partnerships, i. e. transparent entities) located in Austria rights to such enterprises (e. g. usufruct) rights whose transfer must be recorded in registers kept in Austria According to a ruling of the Austrian Administrative Court in 1975 interests in nontransparent entities whose registered office or place of management are situated in Austria (e. g. public and private limited companies) are not subject to limited tax liability although the transfer of ownership of these shareholdings has to be recorded in the Register of Companies (Firmenbuch). 1. 3. Tax Avoidance Tax exiles who are Austrian citizens are subject to unlimited tax liability for a period of two years after abolishing residence and habitual place of abode in Austria (taxation on the basis of nationality). According to section 11 of AITA enrichments transferred by the same person to another are grossed up within a period of ten years from the latest enrichment. Therefore it is not possible to split one large donation into smaller portions to make multiple use of the personal allowances. 1. 4. Valuation and exclusions Goods and rights subject to Austrian inheritance and gift tax are valued according to the Austrian Valuation Act (Bewertungsgesetz 1955, BGBl I 1999/28). Domestic real estate is valued at its assessed value which is far away from fair market value, whereas foreign immovable property is appraised at market value. From the 1st of January, 2001, the Austrian legislator intends to raise the taxable basis of domestic real estate by multiplying the assessed value by 4 three so that the difference in value between domestic and foreign real estate is not so big any more. Business property owned by transparent entities (e. g. sole trader, partnership) is valued at its going-concern value (typically costs of replacement without reconsidering profit expectations). Interests in companies are valued at stock exchange quotations (listed companies), actual sales prices (in case of disposal within one year from date of valuation), or a valuation method called “Wiener Verfahren” (= Viennese valuation method) which derives the market value of the interest from the average of net asset value and the profit expectations. Usufructs ans similar rights are valued at net present value. Goods not mentioned expressivly have to be appraised at market value. Tax free transfers are Household and personal effects Reversion to parents of property given as a gift to children Donations for the maintenance and education of the beneficiary Presents commonly given on special occasions (birthday, wedding and so on) Lifetime gifts from spouse to spouse to secure an equal share in the acquisition of a dwelling of 150 square metres maximum in size Several types of privately held investments the yield of which is subject to the Austrian withholding tax on investment income of 25% (“final taxation” = Endbesteuerung) exemption from inheritance tax, not from gift tax! Distributions from Austrian Private Law foundations Deposits with Austrian banks or Austrian branches of foreign banks are exempt from gift tax, if the donation takes place before June 30th, 2002 1. 5. Rates and tax-free base amounts Tax rates applicable depend on the one hand on the amount received, on the other hand on the relationship between donor/deceased and the recipient under family law. Tax rates are progressive and range from 2% to 60%. Five categories are recognized: in the first category (with the lowest tax rates (from 2% to 15%)) only the spouse and the children are found, whereas in the fifth category only recipients without family-law relationship between donor/deceased and recipient are found (tax rates vom 14% to 60%). 5 Category 1: spouse, children, stepchildren, adopted children (not: foster children) Category 2: descendants of children mentioned in category 1 Category 3: parents, grandparents and more remote ancestor, stepparents, brothers and sisters as well as hal-brothers and half-sisters Category 4: sons- and daughters-in-law, parents-in-law, nephews and nieces Category 5: all other transferees (also: cohabitees and divorcees, because there is no family-law relationship (any more)) From the 1st of January, 2000, two types of allowances are granted. Personal allowances are granted to each recipient subject to tax. The deduction varies according to the category of the recipient (1 and 2: ATS 30.000, 3 and 4: ATS 6.000, 5: ATS 1.500). Gifts between spouses are exempt from tax up to the total value of ATS 100.000, so that the maximum deduction between spouses amounts to ATS 130.000. Object-oriented allowances up to ATS 5.000.000 are granted on the transfer of business property of sole traders and of qualified interests in partnerships and companies. The objectoriented allowance is not dependent on family-law relationships between donor/deceased and recipient and in the case of partnerships and companies granted only if the donor/deceased has held an interest of at least 25% (minimum shareholding) and transferred an interest of at least 25% (minimum transfer). The recipient has to conduct business at least for five years after the transfer, otherwise the tax allowance is subsequently taxed. The deduction is restricted to domestic enterprises (registered office or place of management in Austria), which might be in conflict with Community Law. If the same property or conglomeration of property is subjected several times to inheritance and/or gift taxation within short time intervals, considerable loss of substance might occur (section 17 of AITA). If the transferees of all transfers within five years prior to acquisition are included in the tax categories 1 or 2, the inheritance or gift tax shall be reduced by 50%. If the previous acquisistion occurred within the time period between year 5 and year 10 prior to acquisition, the inheritance or gift tax is reduced by 25%. 2. Double taxation relief 2. 1. Unilateral relief 6 In Austria, two provisions are known by which international multiple taxation of inheritances and gifts may be avoided, namely section 6 par 3 of AITA and section 48 of the Austrian Federal Fiscal Act (AFFA). Basically the liability to pay inheritance or gift tax abroad does neither influence the tax liability nor the amount of tax payable. To the extent that the liability to pay foreign taxes which are – seen from the typical characteristics – similar to the Austrian inheritance or gift tax refers to real property or business property aborad, debts owed to the donor or the deceased by non-residents or to rights which only can be transferred by registration in a foreign register, it may be deducted from the Austrian tax base. This, of course, does not result in an avoidance of double or multiple inheritance and gift taxation, but in a mere mitigation of double taxation. In case of reciprocity the Federal Ministry of Finance may at its own discretion credit foreign inheritance on the goods and rights mentioned above against the Austrian inheritance or gift tax. A precondition of unilateral relief according to section 6 par 3 of AITA is effective international double taxation. Section 48 of Austrian Federal Fiscal Act is a rule pertaining to any kind of double taxation. The avoidance of effective, virtual, and economic double taxation is within the scope of this rule. The unilateral relief is granted by the Federal Ministry of Finance at its own discretion. In case of effective double taxation by inheritances or gift taxes the Federal Ministry of Finance grants unilateral relief if in the case of existence of a double taxation treaty Austria would have lost its right to tax the respective good or right. In relation to other countries which do not levy inheritance or gift tax the Austrian Federal Ministry of Finance may grant unilateral relief to safeguard reciprocity. According to a recent ruling of the Austrian Administrative Court the principle of reciprocity is not an automatism but is restricted to cases in which Austria has a reasonable economic interest in avoidance of double taxation. On the other hand, the Austrian Administrative Court ruled on March 30th, 2000, that the Federal Ministry of Finance had to grant unilateral relief, if Austria would have lost its right to tax in the case of application of the OECD-model double-taxation convention. Furthermore, the Federal Ministry of Finance usually does not grant unilateral relief, if Austria is not the state of residence of the taxpayer, because in the opinion of the Ministry it is the duty of the state of residence (and not the state of source) to avoid double or multiple taxation. 2. 2. Tax Treaties 7 Austria has concluded tax treaties with the following countries: Czech Republic (March 1st, 2000) France (October 8th, 1959) Germany (October 4th, 1954) Hungary (February 25th, 1975) Liechtenstein (December 7th, 1955) Sweden (November 21st, 1962) Switzerland (January 30th, 1974) United States (June 21st, 1982) Only the treaties with the United States, France, and the Czech Republic relate to inheritance and gift tax, whereas all other treaties include inheritance tax only. All these treaties are modelled after the OECD Model Estate Tax Conventions of 1966 and 1983. According to the allocation rules of the immovable property shall be taxed in the state where it is situated, movable property belonging to an enterprise shall be taxed in the state in which the permanent establishment is situated to which the assets and liabilites are attributable. The right to tax all other property of the deceased or donor remains with the state of residence of the deceased or donor. 2. 3. Method to avoid double taxation Austria always avoids double taxation by means of the exemption method whereas some of the treaty partners (especially United States and France) make us of the tax credit method. 3. EC Law Although neither of the Austrian Supreme Courts has already ruled a breach of Community Law in inheritance and gift tax cases, the judges have indicated that the Austrian Inheritance Tax Act is within the scope of Community Law and especially the four fundamental freedoms, which is in contrast to a ruling of the Fiscal Court of Duesseldorf of July 3rd, 1996. 8 According to the prevailing opinion in the scientific literature the following provisions of the Austrian Inheritance Tax Act are deemed to be in conflict with Community Law: Limited tax liability of citizens of the European Union (on the back of Schumackercase) Extended taxation on the basis of Austrian nationality (on the back of Asscher-case) Discriminatory valuation of foreign immovable property (fair market value instead of assessed value for domestic immovable property) Allowances for taxpayers only limited liable to AIT (on the back of Schumacker-Case) Discrimination of foreign charitable bodies (no tax exemption and application of full tax rate, whereas domestic charitable bodies are either free of inheritance or gift tax or are subject to a tax rate of only 2,5%; on the back of Royal-Bank-of-Scotland-case) Reciprocity for crediting of foreign taxes within the European Union (on the back of Avoir-fiscal-case) Exemption of several types of privately held investments from inheritance tax the yield of which is subject to the Austrian withholding tax on investment income of 25% (“final taxation” = Endbesteuerung) the debtor has to be a domestic bank or a domestic enterprise (case pending before the European Court of Justice, registered under C-516/99) (on the back of Verkooijen-case) Exemption from gift tax of deposits with Austrian banks or Austrian branches of foreign banks (on the back of Verkooijen-case) Allowance for transfer of business property is restricted to permanent establishments situated in Austria and to partnerships or companies whose residence or place of management are situated in Austria (on the back of Baars-case) Furthermore, according to the prevailing opinion Austria is held liable for not eliminating double inheritance and gift taxation by concluding bilateral or multilateral treaties with all other member states of the European Union as it is presribed by article 293 of the Treaty (exarticle 220). In contrast to the ruling of the German Tax Court of Dusseldorf form the 3rd of July, 1996, the Austrian scientific community is of the opinion that Inheritance and Gift Taxes are within the scope of the Community law as far as fundamental freedoms of the European Union might restricted. The Tax Court ruled that inheriting goods and rights was no economic acitivity and therefore not within the scope of Community Law. Especially Lang M. (Europarechtliche 9 Aspekte der Besteuerung von Erbschaften, in: Birk (Hrsg), Steuern auf Erbschaft und Vermögen, DStJG 22, Köln 1999, 255ff) pointed out that the relevant question is not whether the act of inheriting or donating is an economic activity or not, but if the act of inheriting or donating cross-border is restricted by national laws. The restriction of the cross-bordertransaction might be an infringement of one or more of the fundamental freedoms. At least, the free movement of capital may be endangered, if under identical circumstances the crossborder-inheritance or donation is taxed more heavily than a purely national inheritance or donation. Since the inheritance tax is deemed to be a direct tax, many of the rulings of the European Court of Justice concerning income taxation (also a direct tax) may be applied similarily to inheritance and gift tax matters. According to a most recent ruling of the European Court of Justice (April 13th, 2000, C251/98, Baars) the freedom of establishment is not restricted to income or corporation tax, but also to any other kind of tax possibly discriminating or restricting the establishment of enterprises abroad. The refusal of Dutch Net Wealth Tax Law to grant an allowance for majority interests in foreign companies, but permitting this allowance for majority interests in domestic companies constitutes a breach of the freedom of establishment. Section 15 a of the Austrian Inheritance Tax Act (as well as section 13 a of the German Inheritance Tax Act) provides an allowance of ATS 5.000.000 for the donation or inheritance of domestic establishments, interests in domestic partnerships of at least 25% (but only so far as the assets are attributable to an Austrian permanent establishment), as well as interests in domestic companies of at least 25%. The inheritance or donation of interests in companies which have been founded in a member state of the European Union and the place of management of which is situated abroad is not favoured by this allowance, even if all the assets owned by the foreign company are attributable to permanent establishments in Austria. By the ruling in the case Baars in my opinion the European Court of Justice has clearly stated that any type of tax restricting fundamental freedoms is running counter to Community Law and therefore has to be disregarded. Not only taxes on earnings do infringe the Community Law, but also taxes on net wealth and other non-income values. Therefore in our opinion most of the provisions listed in the Austrian Report are at least possibly, some of them obviously in conflict with the Community Law. 4. Case 10 4. 1. Country A The concept of “domicile” is not known in Austria. Especially the concept of “domicile of origin” is not applicable in Austria, whereas the concept of “domicile of choice” seems to be in line with the principle of “residence”. A residence within the meaning of section 26 of the Austrian Federal Fiscal Act would constitute unlimited liability to inheritance or gift tax in Austria. 4. 2. Country B According to section 6 par 2 of AITA Austrian citizens who have abolished residence and habitual place of abode in Austria within two years from the date of death or the implementation of a donation are treated as being resident in Austria. Tax exiles shall be prevented from moving to another country before transferring assets by means of inheritance or donation. If the Austrian citizen moves to a member state of the European Union, the taxation on the basis of nationality is deemed to be in conflict with Community Law (Asscher-case) as well as in conflict with Austrian Constitutional Law, because citizens of other states do not fall within the scope of the tax-exile-provision (discrimination á rebours). 4. 3. Country C If the deceased/donor or the heir/donee have got a residence or the habitual place of abode in Austria, the transaction is subject to unlimited liability (taxation of property whereever it is situated). 4. 4. Country D If neither the deceased/donor nor the heir/donee have got a residence or the habitual place of abode in Austria, the transaction is subject to limited liability (taxation of parts of the domestic property only). The following goods are subject to limited tax liability in Austria: 11 immovable property located in Austria assets of an agricultural, forestry, or business enterprise (sole trader, partnerships, i. e. transparent entities) located in Austria rights to such enterprises (e. g. usufruct) rights whose transfer must be recorded in registers kept in Austria Interests in Austrian companies are not subject to limited tax liability. 4. 5. Country E According to section 26 par 2 of the Austrian Federal Fiscal Act the deceased obviously does not have a residence and/or a habitual place of abode in Austria and therefore is subject to limited tax liability only. Furthermore, the Federal Ministry of Finance is legally entitled (section 26 par 2 last sentence of the Austrian Federal Fiscal Act) to not apply the rules on residence and habitual place of abode if the taxpayer has not been staying in Austria for more than a year and neither has conducted business nor been employed in Austria during this period of time.