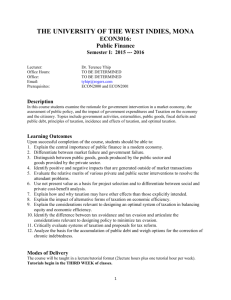

syllabus

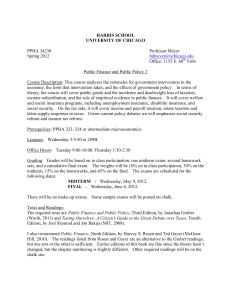

advertisement

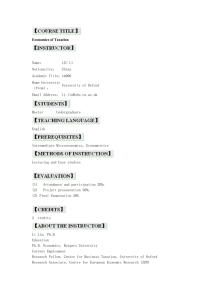

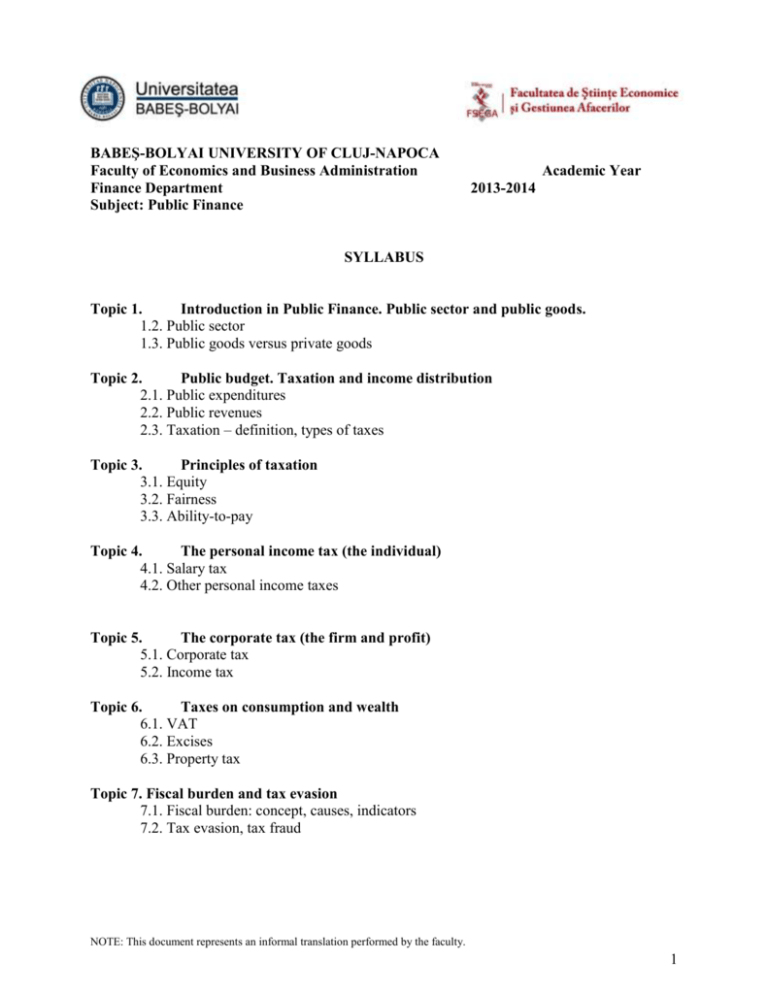

BABEŞ-BOLYAI UNIVERSITY OF CLUJ-NAPOCA Faculty of Economics and Business Administration Finance Department Subject: Public Finance Academic Year 2013-2014 SYLLABUS Topic 1. Introduction in Public Finance. Public sector and public goods. 1.2. Public sector 1.3. Public goods versus private goods Topic 2. Public budget. Taxation and income distribution 2.1. Public expenditures 2.2. Public revenues 2.3. Taxation – definition, types of taxes Topic 3. Principles of taxation 3.1. Equity 3.2. Fairness 3.3. Ability-to-pay Topic 4. The personal income tax (the individual) 4.1. Salary tax 4.2. Other personal income taxes Topic 5. The corporate tax (the firm and profit) 5.1. Corporate tax 5.2. Income tax Topic 6. Taxes on consumption and wealth 6.1. VAT 6.2. Excises 6.3. Property tax Topic 7. Fiscal burden and tax evasion 7.1. Fiscal burden: concept, causes, indicators 7.2. Tax evasion, tax fraud NOTE: This document represents an informal translation performed by the faculty. 1 References: 1. Atkinson A., Stiglitz J., Lectures on Public Economics, McGraw-Hill, 1980 2. Gruber, Jonathan, Public Finance and Public Policy. 3rd ed. Worth Publishers, 2009 3. Harvey S. Rosen and Ted Gayer, Public Finance, Eighth Edition, New York: McGrawHill/Irwin, 2007 4. Mara, E.R., Finanţele publice între competiţie și armonizare fiscală, Editura Risoprint, Cluj-Napoca, 2012 5. Richard A. and Peggy B. Musgrave, Public Finance in Theory and Practice, Fifth Edition, New York: McGraw Hill, 1989 6. Rosen, H.S. and T. Gayer, Public Finance, 9th Edition, McGraw - Hill Publishing, 2010 7. Stiglitz, Joseph, E. Economics of the Public Sector, 3rd Edition, Editura Norton & Co., New York, 2000 8. * * * Romanian Fiscal Code, 2013 Head of Department Responsible of Subject Professor Cristina CIUMAȘ Associate Professor Ramona MARA 2