Year 11 accounting term 1 handouts

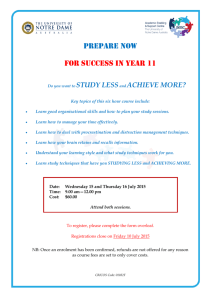

advertisement

2013 CS1 HOMEWORK SHEET 1. Determine the missing figure in each case: A B C D E Assets 39600 345000 83000 = = = = = = Liabilities 40000 + 30900 + 120000 + + Owner’s equity + 32400 95500 + 125000 200000 2. State whether the following would result in a debit or a credit to the account. a) An asset account decreases in value. b) A liability increases in value. c) Owner’s equity decreases in value. d) An asset account increases in value. e) A liability account decreases in value. f) Owner’s equity increases in value. 3. State whether the following accounts have increased or decreased in value. a) Bank – debit h) Bank – credit b) Accounts receivable – credit i) Accounts payable – credit c) Accounts payable – debit j) Furniture – credit d) Furniture – debit k) Inventories – debit e) Equipment – credit l) Accounts receivable – debit f) Owner’s equity – credit m) Loan from bank – credit g) Mortgage – debit n) Motor vehicle – debit 4. B Lake had the following assets and liabilities. Determine her investment in the business. Cash at Bank $1 000, Accounts Receivable $500, Inventories $750, Equipment $3000, Accounts Payable $250. 5. Total assets must always equal total liabilities plus total owner’s equity. Discuss this statement. 6. Compile a glossary for the following terms: Account Accounting Accounting Entity Assumption Accounting Equation Accounting Standards Accounts Payable Accounts Receivable Assets Australian Business Number Capital Chart of Accounts Cost of Goods Sold Double Entry Drawings Expenses General Journal Inventories Journal Liabilities Limited Liability Mortgage Narration Owner’s Equity Partnership Revenues Sole Trader Source Document Transaction Trial Balance Unlimited Liability Input Tax Credits Tax Invoice 7. Complete a transaction table for the following transactions of Peter Bolton’s business for May 2013. May 1 5 2 15 22 23 25 30 12. 13. Peter contributed $24000 cash to the business as capital (rec’t 001) Purchased furniture for $4200 cash (cheque no 62) Borrowed funds from XXX Finance Co $28000 Purchased vehicle from Reef City Ford $18000 cash (cheque 63) Paid $1200 to XXX Finance Co (cheque 64) Purchased furniture for $15000 (cheque no 65) Peter contributed premises to the business valued at $150000 (Memo) Bought equipment on credit from Ace Supplies for $34000 and paid a deposit of $5500 (invoice 212, cheque 66) State the transactions that give rise to the following double entry analysis. a) Cash at Bank Dr $4000 Land b) Furniture Dr 500 Acme Furniture Co c) T Ellen Dr 2000 Furniture d) Inventories Dr 100 Capital e) Cash at Bank Dr 2000 Equipment f) J Ball Dr 200 Cash at Bank g) Cash at Bank Dr 1000 Loan from Bank h) Land Dr 10000 Cash at Bank i) Cash at Bank Dr 500 S Green j) M Henry Dr 1000 Cash at Bank k) Cash at Bank Dr 400 L Allen l) Loan from Bank Dr 500 Cash at Bank m) Wages Dr 2200 Cash at Bank n) T Smith Dr 5000 Service Fees Revenue Cr Cr Cr Cr Cr Cr Cr Cr Cr Cr Cr Cr Cr Cr $4000 500 2000 100 2000 200 1000 10000 500 1000 400 500 2200 5000 Record the following entries in the General Journal of Maxwell Smart. Post to the ledger and prepare a trial balance as at 28 February 2011. Feb 3 4 7 8 12 Purchased goods from Siegfried Ltd for $2 750 including GST, tax inv 103. Received adjustment note 45 from Siegfried Ltd for $77, GST inclusive, for goods returned by us. Sold goods on credit with a cost price of $600 for $1 320 including GST, to James Watt, tax inv 67. Purchased GST free goods for cash $660, cheque 88 Sent adjustment note 37 for $44 including GST to James Watt for goods returned with a cost price of $20. These goods were originally sold on Feb 7. 15 Sold goods with a cost price of $250 for $550 GST free, cash register summary. 21 Paid Siegfried Ltd $2 673, cheque 89. 28 Paid electricity account of $132 GST inclusive, using cheque 90.