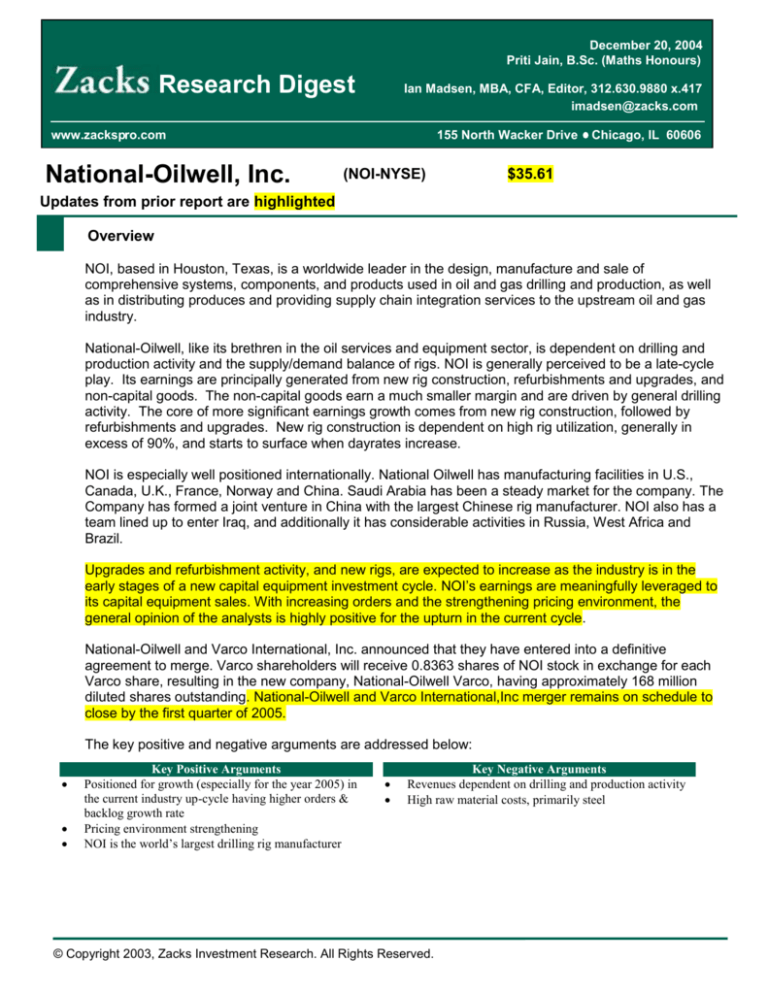

December 20, 2004

Priti Jain, B.Sc. (Maths Honours)

Research Digest

Ian Madsen, MBA, CFA, Editor, 312.630.9880 x.417

imadsen@zacks.com

www.zackspro.com

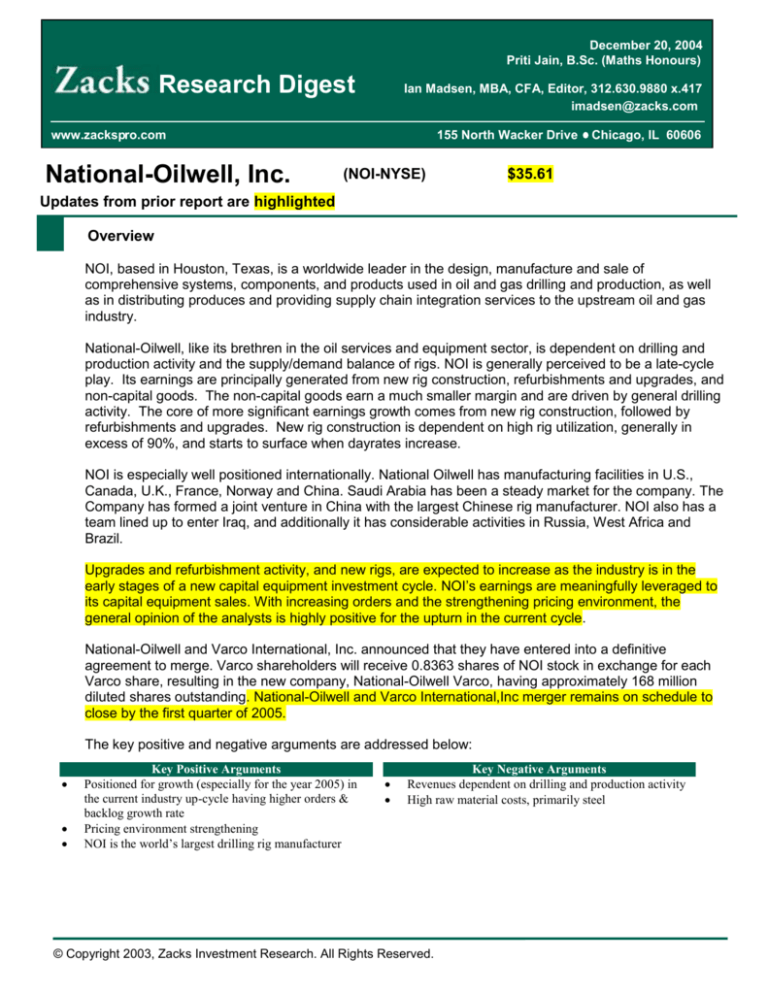

National-Oilwell, Inc.

155 North Wacker Drive

(NOI-NYSE)

Chicago, IL 60606

$35.61

Updates from prior report are highlighted

Overview

NOI, based in Houston, Texas, is a worldwide leader in the design, manufacture and sale of

comprehensive systems, components, and products used in oil and gas drilling and production, as well

as in distributing produces and providing supply chain integration services to the upstream oil and gas

industry.

National-Oilwell, like its brethren in the oil services and equipment sector, is dependent on drilling and

production activity and the supply/demand balance of rigs. NOI is generally perceived to be a late-cycle

play. Its earnings are principally generated from new rig construction, refurbishments and upgrades, and

non-capital goods. The non-capital goods earn a much smaller margin and are driven by general drilling

activity. The core of more significant earnings growth comes from new rig construction, followed by

refurbishments and upgrades. New rig construction is dependent on high rig utilization, generally in

excess of 90%, and starts to surface when dayrates increase.

NOI is especially well positioned internationally. National Oilwell has manufacturing facilities in U.S.,

Canada, U.K., France, Norway and China. Saudi Arabia has been a steady market for the company. The

Company has formed a joint venture in China with the largest Chinese rig manufacturer. NOI also has a

team lined up to enter Iraq, and additionally it has considerable activities in Russia, West Africa and

Brazil.

Upgrades and refurbishment activity, and new rigs, are expected to increase as the industry is in the

early stages of a new capital equipment investment cycle. NOI’s earnings are meaningfully leveraged to

its capital equipment sales. With increasing orders and the strengthening pricing environment, the

general opinion of the analysts is highly positive for the upturn in the current cycle.

National-Oilwell and Varco International, Inc. announced that they have entered into a definitive

agreement to merge. Varco shareholders will receive 0.8363 shares of NOI stock in exchange for each

Varco share, resulting in the new company, National-Oilwell Varco, having approximately 168 million

diluted shares outstanding. National-Oilwell and Varco International,Inc merger remains on schedule to

close by the first quarter of 2005.

The key positive and negative arguments are addressed below:

Key Positive Arguments

Positioned for growth (especially for the year 2005) in

the current industry up-cycle having higher orders &

backlog growth rate

Pricing environment strengthening

NOI is the world’s largest drilling rig manufacturer

Key Negative Arguments

Revenues dependent on drilling and production activity

High raw material costs, primarily steel

© Copyright 2003, Zacks Investment Research. All Rights Reserved.

Sales

NOI’s sales are directly related to the level of worldwide oil and gas drilling and production activities.

Third quarter generated revenues of $618 million up 16% sequentially and 24% from 3Q03. Higher sales

volumes from increased demand in both domestic and international drilling markets and better fixed cost

absorption in the company’s manufacturing plants boosted the results. The improved sequential

performance was also due in part to the absence of cost overruns and late delivery penalties that had

plagued the company in the previous quarter. Management expects the revenues in 2005 to be up by

4%-5% and anticipates that revenues from capital equipment business will be up 30% to 50% in 2005

over 2004.

The following table details NOI’s historical and projected sales by segment.

Table updated for Q3

Segment Sales ($ Millions)

Products and Technology

Distribution Services

Eliminations

Consensus Adjustments

Total

1Q04A

305

218

(27)

(0)

496

2Q04A

348

218

(33)

(0)

534

3Q04A

418

233

(33)

4Q04E

426

237

(33)

-

-

619

630

2004E

1,498

906

(125)

(13)

2,266

2005E

1,910

1,022

(131)

00-'03

24.4%

15.0%

23.1%

CAGR

03-04E

13.9%

14.4%

23.1%

04E-05E

27.5%

12.8%

4.8%

20.4%

13.0%

23.6%

-

2,801

Products and Technology (~60% of total sales)

NOI designs, manufactures and sells drilling systems and components for both land and offshore drilling

rigs as well as for complete land drilling and well servicing rigs. The products and technology division of

NOI can be further divided between capital and non-capital goods. Capital goods include complete land

and workover rig packages and offshore rig systems, and other large rig components. Non-capital goods

consist of drilling motors, downhole tools, spare parts, expendable parts and other smaller equipment.

The Products and Technology segment accounts for roughly 60% of company sales and 90% of NOI’s

operating income. Due to the importance of this segment to the bottom line, the analysts focus most of

their attention on it.

In 2003, the majority of NOI’s sales growth was driven by NOI’s acquisitions of Hydrolift, Dec. 2002, and

Mono Pumping Products, Jan. 2003. Hydrolift, acquired for $300 million, strengthened NOI’s position in

the offshore drilling market and helped it gain access to new complementary product lines, particularly

within the FPSO (floating production storage and offloading) market. Mono Pumping, acquired for $87

million, is a manufacturer of power sections for downhole drilling motors and lift pumps, transfer pumps,

grinders and screens. In 2003 revenues were up 43%, primarily due to the above mentioned acquisitions.

Third quarter generated revenues of $418 million up 7% sequentially and 31% from 3Q03. Capital

equipment manufacturing activities recorded revenues of approximately $199 million, or 48% of Product

and Technology revenues. Fifty-two percent of Product and Technology revenues, about $219 million,

were generated from non-capital equipment and system sales during the quarter, up 14% from $192

million sequentially.

Capital equipment orders were up from $185 million in 2Q04 to $333 million in the 3Q04. Backlog also

increased by 30%; as specified in the earlier quarter, the increase to a large extent was contributed due

to Kazakhstan project. The project of Kazakhstan rigs is worth approximately $150 million.The rigs will be

delivered in 2005.

Looking ahead, for the year new, international rig orders should lead to almost 10% revenue growth.

Zacks Investment Research

Page 2

www.zacks.com

National-Oilwell continues to see up to 20 rig opportunities, valued between $5 million and $10 million

each in 2005 and into 2006, with most of the international regions (Russia, China, Middle East) coming

up as promising markets. Upgraded equipment for increasingly complex drilling is required. The

accelerating backlog reflects emerging capital spending cycle.

Russia, the Middle East, Southeast Asia, the North Sea, and West Africa are among the strongest

markets. Demand for new land, platform, jack-up rigs or for mud pumps, draw-works, and top drives to

supply rig refurbishment and upgrade programs, is expected to increase (Bear Stearns).

Distribution Services (~40% of sales)

The distribution services segment provides supplies as well as repair and maintenance services through

its network of approximately 150 distribution service centers. The centers stock and sell a variety of

expendable items for oilfield applications and spare parts for NOI’s proprietary equipment.

Like the Products and Technology segment, sales are directly correlated to the general activity level of

E&P activity. Margins are just under 3% and a majority of the sales come from North America. Given the

steady increase in U.S. and Canadian rig counts, revenue and margin growth should be steady to

increasing.

In 2003 sales were up 15%, International growth and Canadian drilling accounted for most of the growth.

Increased drilling activities are expected to lift sales growth by around 12% for the 2004 year.

Third quarter revenues in the distribution business were up 7% sequentially from the previous quarter

and complemented by strong United States performance. Typically, geographical revenue contribution is

50%, 25%, and 25% for U.S, Canada, and the other internationals, respectively.

One analyst (Smith Barney) believes non-capital equipment should grow at least in line with worldwide rig

counts, but Distribution should lag due to NOI’s large exposure to North America.

Zacks Investment Research

Page 3

www.zacks.com

Margin

NOI’s historical and near term segment, operating income and operating margins is detailed below.

Tables updated for Q3

Operating Income ($ Millions)

Products and Technology

Distribution Services

Eliminations

1Q04A

23

5

(3)

Consensus Adjustments

Total

Operating Margins

Products and Technology

Distribution Services

2Q04A

35

7

(3)

0

0

26

38

3Q04A

45

8

(4)

4Q04E

49

9

(4)

(14)

(13)

36

41

2004E

153

29

(15)

(33)

2005E

277

36

(17)

00-'03

40.0%

4.0%

3.7%

CAGR

03-04E

-8.5%

101.5%

18.2%

04E-05E

80.7%

22.4%

16.3%

120.2%

-

134

295

39.6%

-21.3%

2003

1Q04A

2Q04A

3Q04A

4Q04E

2004E

2005E

12.73%

1.83%

7.71%

2.52%

10.03%

3.06%

10.80%

3.64%

11.55%

3.71%

10.23%

3.23%

14.50%

3.50%

Products and Technology (~90% of Operating Income)

The mix of capital versus non-capital equipment sold plays a significant role in the operating income of

this segment. Capital goods items generate much larger margins than non-capital goods.

Synergies from the Hydrolift acquisition were expected to generate approximately $10 million in cost

savings. Through the first half of 2003 the company had come up short and margins did not expand as

expected (Lehman). In the third and fourth quarters 2003, margins did improve to about 13.2%, versus

12.4% in the first half, versus almost 14% in 2002. A more favorable product mix was the reason for the

sequential improvement.

The margins though improved sequentially, were low on the year-over-year basis. Similar to the last

quarter the results were adversely impacted as lower-margin projects worked their way out of the

company's backlog. To the extent that future order intake comprises higher profit margin projects – which

is expected over the next 12-18 months - there should be improvement on this front.

NOI is achieving better pricing in its latest backlog additions, suggesting that margins should expand in

2005. The drilling upturn is translating into orders for new rigs and equipment, a trend that may continue

for years (Bear Stearns).

.

Distribution Services (~10% of Operating Income)

Margins have been under 3% in this segment till 1Q04. Management specified that several steps are

underway to improve profitability – including review-underperforming facilities, looking for consolidation

opportunities, cutting overheads, and streamlining some processes.

There has been a marked improvement in the sequential margins, in fact above the expectations of

Management (3.64% above the expected 3.25%).

Zacks Investment Research

Page 4

www.zacks.com

Earnings Per Share

Table updated for Q3:

EPS

Consensus

Low

Median

High

# of Estimates

Y-o-Y growth

Quarterly growth

1Q04A

$0.13

-54.3%

2Q04A

$0.25

93.0%

3Q04A

$0.32

27.5%

4Q04E

$0.36

2004E

$1.06

2005E

$2.24

$0.34

$0.36

$0.38

10

$1.04

$1.06

$1.07

11

4.0%

$2.00

$2.23

$2.50

4

111.7%

13.4%

Q3 EPS was in line with the consensus. Some analysts have raised their 2004 EPS estimates based on

increased orders while some have lowered the estimates anticipating weaker returns from Product &

Technology division.

Most of the analysts have maintained their 2005 EPS estimates. The analyst (Goldman Sachs) with the

lowest 2005 EPS estimate lowered its 2005 EPS estimate for NOI (Not Rated) to $1.70 from $1.85

despite higher revenue assumptions due to several factors – higher ’pass-through’ revenues related to

increased integrated project work, a higher mix of activity in logistics intensive foreign markets, and the

volatile raw material cost environment. The higher 2005 EPS estimates providers (Stifel- Nicolaus &

J.P.Morgan) are confident that NOI has strong capital equipment revenues ahead and incremental

increases in capital equipment revenues and margins can add significantly to EPS. Accordingly, given

that the industry is in the early stages of a new capital equipment investment cycle, there is substantial

upside earnings (Stifel Nicolaus).

Target Price/Valuation

With an average target price of $41.12, the target price ranges between $37-$45.

Generally P/E (price-earnings) multiples from 18x - 21x on 2006 earnings and 20x – 24x on 2005

earnings were the most common methodology.

Long-Term Growth

Growth is driven by the level of worldwide oil and gas drilling and production activities. Fundamentals for

an acceleration of capital equipment spending over the near term are generally positive, but this has

been anticipated for some time now and though visibility is improving, hard evidence is only beginning to

emerge. EPS growth over the next few years is significant, and the target prices are based on relatively

high P/Es based on these robust growth expectations.

Zacks Investment Research

Page 5

www.zacks.com

Individual Analyst Opinions – Analysts in yellow are updated following Q3 results

POSITIVE RATINGS

Bear Stearns – Outperform ($40): They reiterate their price target and their Outperform rating, believing

that NOI is well positioned for a wave of new investment in drilling assets. They continue to believe that

the merger is positive for NOI shareholders.

First Albany – Buy ($37): They continue to maintain that National-Oilwell is well positioned to benefit

from the strengthening oilfield services capital equipment spending cycle. The pending combination with

Varco International (VRC) will, in their view, further enhance the company's prospects. They reiterate

their Buy recommendation on National-Oilwell shares.

Goldman – Not Rated (Fair value $42): On August 12, they temporarily suspended the investment

rating and price target as the analysts are acting as an advisor in the merger involving NOI and VRC.

They are positive about the merger and are of the opinion that although short-term risks have increased

yet, long term upside has also improved.

Investology Inc – Buy ($39.10): They remain confident that the company has indeed entered a long up

cycle that should result in record revenues and profits in 2005. They reiterate their BUY recommendation

on NOI and maintain their 12-month price target of $39.1.

Raymond James – Strong Buy ($45): They remain very positive on the outlook for National-Oilwell

given the backlog growth and the improved spending by National Oil Companies and rig contractors.

They are maintaining their price target of $45 and Strong Buy rating.

Stifel Nicolaus – Market Outperform ($40): They have been confident for some time that the oilfield

industry is entering the early stages of a new capital equipment cycle. They believe National-Oilwell

management’s optimistic outlook strongly support the expectations. They reiterate their Market

Outperform rating.

J.P. Morgan – Overweight (NA): They believe a strong outlook on capital equipment orders and higher

margins, coupled with attractive relative valuation levels, support their Overweight rating.

Lehman – Overweight ($44): The analyst finds the earnings outlook of NOI as robust given the

company’s growing backlog and dominant rig newbuilding cycle. The stock’s relative valuation should

improve as orders continue to grow and they maintain their Overweight recommendation. The

combination of National Oilwell and Varco International would create a powerhouse in rig equipment and

would be the premier beneficiary of a rig construction cycle.

MSDW – Overweight ($44): They believe the NOI-VRC merger offers the potential for a dominant

position in the capital equipment segment. Both quality and quantity of the backlog is improving with new

orders implying significant earnings improvement for 2005. “Importantly, there is breadth to this cyclical

up turn with new build activity increasing across all segments including land rigs, offshore rigs, and

floating production and storage (FPSO) vessels.” They maintain their Overweight rating and 12-month

price target of $44.

RBC Cap. – Outperform ($37): They believe NOI is already ideally positioned to benefit from a multiyear equipment new build cycle and its competitive position should be enhanced following the completion

of the VRC merger, which they expect to close in early 2005. At about 18x their 2005 EPS estimate, NOI

is one of the more attractively valued stocks in their universe. They reiterate their Outperform rating with

Above Average Risk.

Zacks Investment Research

Page 6

www.zacks.com

Smith Barney – Buy-High Risk ($44): Smith Barney increased their price target by $2 to $44. Though

the margins in P&T segment are on the downside but the prices are steadily rising for new projects and

therefore they expect the P&T margins to return to the 12%-13% level in the near-term and rise in 2005.

The new company after merger would be well positioned to capitalize on rising worldwide drilling activity

and capital equipment demand.

NEUTRAL RATINGS

None

NEGATIVE RATINGS

None

Zacks Investment Research

Page 7

www.zacks.com