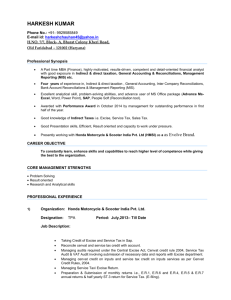

DILIP ARUN SALUNKHE MBA Finance, Indirect Taxes & SCM Ph: +

advertisement

DILIP ARUN SALUNKHE MBA Finance, Indirect Taxes & SCM Ph: + ® + 91 9689880207 Mobile: +91 8007774145 E-mail: dilip.salunkhe@gmail.com Career Objective: Seeking assignments in SCM / Excise & Export / Commercial Operations with reputed organization. Looking for an opportunity in Excise & Export or Liaison based on in-depth experience with a large organization of repute. Profile Summary: Over 11.3 years of extensive experience in handing SCM/Excise/Import & Export & administrative operations involving EXIM functions, inventory management, warehouse administration, logistics, Taxation & Audit. Successfully implementation of ISO 9001:2000.TS 16949; ISO-14001 & OHASAS-18001. On Line Working On ACES Excise & Service Tax Software Proficiency in liaising with government / regulatory authorities for keeping compliance with statutory obligation & obtaining necessary sanction / clearances. Extensive experience in handling Excise/Customs/EXIM operations & legal matters and achieving costs savings. Liaison with CHA, Freight negotiation, coordination from container booking to Delivered to Customer. Effective communication with excellent relationship management interpersonal/negotiation skills. Possess a flexible & detail oriented attitude Sound knowledge of Letter of Credit Document Knowledge of all Marketing co-ordination as well as Warehouse, Logistics, Sales & Distribution functionality in SAP (ECC 6.0) & ERP. Well aware about MIS Reports & documentation for the Certification of 5S, API 5CT, TS etc. Excellent leadership skills with presentation, communication & interpersonal skills. Core Competencies: Excise Operation: Managing the entire Excise / Customs Matters & Legal disputes pertaining to claims, refunds & other related matters. Commercial Operations: Handling the EXIM Operations for cost effective solutions & Operations. Materials Management: Planning / scheduling procurement plans, logistics, fleet management, warehouse Administration. Compliance & Documentation: Preparing requisite papers & documents for smooth functioning at the unit. Coordinating taxation, audit & keeping well prepared for the raids. Cost Reduction Initiatives: Identifying & tapping scope for streamlining systems & achieving greater efficiency while bagging higher cost savings. Registration: Getting the unit registered, handling all requisite licensing & documentation. Warehouse & Logistics: Planning for Warehousing, stock Management & transportation. Activities in SAP Maintaining Material Master, Vender Master & Customer Master. Maintaining Chapter ID, Customer Excise Detail, Vender Excise Detail & Excise rate for Material Maintaining Condition Records for Pricing & Tax Code Maintaining monthly excise exchange rate in the system Monitoring maintaining sales transaction for Sales Order, Delivery, Commercial Invoice, Tax Invoice, ARE 1 Updating & Extracting RG23AI, RG23AII & RG1 register. 98 % Cenvat and service tax Credit automation in SAP. Academic Qualification MBA (Finance) – Master in Business Administration Appears from ICFAI University. B.A (Geog.) – Bachelors of Art with 73% from Shivaji University, Kolhapur in 1997 H.S.C. – Higher Secondary School with 50 % from Pune Board Pune in 1994. S.S.C. – Secondary School Certificate with 61.33 % from Pune Board, Pune in 1992. Professional Experience Working for M/s. Fiat India Automobiles Limited As Assistant Manager Corporate Finance from April-2009 to till date Working for M/s. Rieter India Private Limited, as Sr. Officer Excise Dept from April-2007 to April-2009 From Oct,2004 to Dec, 2005 with M/s. Tata Auto comp Systems Ltd Joined as Associate Member– Stores from Feb-2006 to April-2007 Company : Fiat India Automobiles Limited Designation :Assistant Manager- Corporate Finance (April-2009- till date) Fiat India Automobiles Limited is ISO-14001, ISO/TS 16949 and 50-50 Industrial Joint Venture between Fiat Group Automobiles S. p. A., (Fiat) and Tata Motors Limited (Tata) originally incorporated on January 02, 1997. The company presently employs about 2700 employees and is located at Ranjangaon in the Pune District of Maharashtra. The definitive agreement of the Joint Venture was signed on October 19th 2007. The board of directors for this company comprises of five nominees each from Fiat and Tata. Roles and Responsibilities: Central Excise To prepare Central Excise returns and to submit in time as per central excise rules. (ER-1, ER-6 ,ER-5,ER-6& ER -7) Avail maximum cenvat credit as per central excise rule on input, capital goods & Rejected material. Responsible for all type of internal, external & Govt statutory audits. Successfully completed three govt audits. Reconciliation of statutory returns with GL accounts. Compliance of Export formalities.( To prepare ARE-1, Range Clearance , Submission Annexure19 & proof of Export ) Control over material sent for Job work and tool movements to the vendor Maintain all types of Excise , Service tax & Sales tax related Records/Documents as per statutory requirement Service Tax To Prepare Service Tax returns and filing in time as per rules. Avail maximum input services credit Reconciliation of statutory returns with GL accounts. Working of monthly liability of service tax on GTA, Consulting Eng, Tec. Test. etc & to make payment in time. Company : Rieter India Private Limited Designation : Sr. Officer Excise Dept (April-2007 to April-2009) Rieter India Private Limited is a manufacturing Textile Systems in India. Rieter is an industrial group based in Winterthur, Switzerland, and operating on a global scale. Formed in 1795, the company is a leading supplier to the textile and automotive industries. Rieter has a presence in 20 countries with some 70 manufacturing facilities and has a total worldwide workforce of approximately 15 000 employees. Rieter Textile Systems operates production plants in Western Europe, the Czech Republic, India and China. Roles and Responsibilities: Keeping Records of Modvat Copy, 4(5) a/b Challans of Vendors & Customers. Control on excise activities like PLA, Cenvat, inputs & capital goods, DSA register. Preparing of monthly ER1 (RT12) Service Tax its monthly return filling. Availment of Cenvat credits on daily basis its keeping records. Responsible to preparation of Export & Domestic invoices. Maintain targets, dates of dispatch & completed monthly task. Follow instruction of marketing dept about urgent dispatches Well versed with ISO Quality System. Warehouse Management Preparation of SOP (Standard Operating Procedure) for Material Department. Identification & Implementation of Process flow for warehouse. Preservation & Storage of Material Transportation & Courier Management. Manpower Management (Skilled Labor & Unskilled Labor) Identification of Lay-outs for new warehouse as per requirement Inventory Management Assessment of performance of the vendors based on various criterions such as quality improvement rate, timely delivery Monitoring Inventory levels, Defining maximum and minimum inventory levels and generating purchase requisitions as and when inventory reaches minimum. Conducting Inventory analysis A/B/C, X/Y/Z, lead time, vendor rating and development with regular inventory verification of stock items with review systems. Classifying inventory into obsolete, non-moving and slow moving; working towards reducing unused parts and spares through implementation of JIT (Just in Time). Company : Tata Auto comp Systems Ltd Designation: Associate Member – Stores (Feb-2006 to April-2007) TAPS is company of TACO group. Manufacturing Plastic interior & exterior components (i.e. Dashboard, Consoles, bumpers, trim parts, slide moulds, molded carpets, sound proof mats, rear parcel shelves, boot liners, head liners, door panel etc.) of passenger vehicles. Taken technical support of Sommer Allibert of France, Management & the production process is Organized with QS 9000, ISO 14001. Domestic Turnover is $40 Million & Export Turnover is $20 Million. Major Domestic Customers are TATA, GM, FIAT, FORD – India; overseas customers are FORD– Europe & MG Rover. Roles and Responsibilities: Responsible for receipt RM. Packing, BOP, Consumable, Maint, Paint, F, G. Dispatch of finished goods to Customers as per plan. Generation of Commercial Invoice & Related Document Arranging domestic’s logistic services of vehicle. Controlling of raw, packing inventory With ABC Analyses Implementing FIFO method for shelf life items. Optimum utilization of warehouse space. Responsible for house keeping of warehouses surroundings. Company : Bui. Pvt. Ltd & Union Batteries Pvt. Ltd Designation: Executive Excise & Stores (Oct-2003 to Jan-2006) The Company is in Business since last Fifteen Years. They are manufacture of storage Traction Batteries, Stationery Batteries, Monobloc Batteries, under the brand name of UNION and stands for getting continuously exports promotional awards. Company supplies in Export customer to BPS NICO Russia, Universal Batteries United Kingdom etc and in Domestic Customer Doordarshan, Sterlite, Hyundai Motors, Voltas, Heavy water Board, NCPIL and many other batteries operate forklift Manufacturers company’s annual turnover is 35 to 40 Crore, Roles and Responsibilities: Monthly Presentation for Inventory lying at Stores. Monitoring daily Receipts. Monitoring Issues as well as physical movement of material. Monitoring & maintaining All Internal & External Rejection Related activity. Implemented FIFO Systems for all stores parts to their classifications. Controlling & checking of various types of challans made for processing items, Returnable / Non Returnable, Rejected Items. Conduct physical Verification of inventory on weekly & monthly basis. And reconciling with systems stock. Keeping Record of Modvate copy, 57F4 Challans of Vendors & Customers Preparing 57F4, Subsidiary Challan, Its Reconciliation & Follow up the materials. Controlling of excise activities like PLA, Cenvat Inputs & capital goods, DSA, Register , TR-6, preparation of monthly ER1(RT12) report for excise Dept. Filing of ER-1 ER-4 & ER-6, Service Tax Return Availment of Cenvat Credit (RG-23A-II, PLA) All Legal formalities related to Import & Exports, Submission of Proof of Export, and Annexure – 46 ,Preparing procurement certificate and CT-3 Handling all Excise Concerned issues, Receipts & Issues Register, Finished goods register, Rejection register, Bond Register, TR-6 filing for PLA. CT-3 and PC reconciliation. On-line computerization for stores as per BOM Minimized the level of NC on Stores / Dispatch Dept. Developed System for material It is very useful for material handling, Material Counting, Maintain FIFO System & Reducing Space Storage area. Company : Nasan medical & Electronic. Pvt. Ltd (Jan-2000 to Sept-2003) Designation: Assistant Stores & Excise Implementation of “ERP- VB” As a Team Leader in Stores Dispatch & Excise Dept. Brought down the cases of pending GRN to nil Right sized the stores manpower from existing 48 heads to 33 heads. Strengths Achievement oriented with excellent communication, leadership, organizational & interpersonal skills, Team Player. Detail-oriented, multi taster, strong, learning and organizing. Proven strength in problem solving, coordination & analysis An individual with great initiative, adaptability & drive, perseverance & thirst for knowledge Achievements: Got “A” rating from last three years current Job. Course on Central Excise Law & Procedures by MCCIA, Pune in 2005. KAIZEN, Kanban, 5S, Supply chain Management (SCM), QS 9000, ISO 14001, Personal Snippet Date of Birth Gender Marital Status Nationality Strengths Language Proficiency Special Interest Address : : : : : : : : June, 1st 1975 Male Married Indian Adaptive, Proactive and Optimistic Proficiency in English, Hindi, Marathi Internet surfing, Traveling, Yoga, Reading A-23 Sukhwani Plaza, Akurdi Pune – 35.