the humble field

advertisement

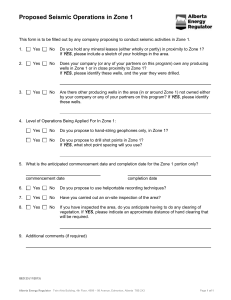

Oil and Gas Investment ! Humble Salt Dome Field Project Rework/Existing Oil & Gas Investment Investment Opportunity Black Sands Advisers - Richardson, TX MI Investments - Henderson, NV This investment opportunity offers a unique combination of existing oil production and the “rework” of existing wells with a seasoned development and management team. In many oil properties, such as the Humble Salt Dome Field, significant quantities of oil remain after conventional recovery methods have been exhausted. Black Sands Advisers (BSA) has assembled a team of experienced executives to develop and manage the reworked wells. Together the senior management has over 150 years of oil and gas experience. In addition, BSA has teamed up with MI Investments to assist in the financial structuring of the investment and investor participation. MI is offering to investors a combination of current cash flow from existing commercially viable wells that are producing income to provide our investors a 10% cash-on-cash return. and the significant upside derived from reworking existing wells on the Humble Salt Dome Field. The preferred return will run for six years at the end of the sixth year the Fund will return your initial investment. Rework of Existing Wells Although the relatively high price of oil has increased competition for the acquisition of oil properties, the United States portfolio of producing oil fields has matured over the last 20 years and provides a rich inventory of fields that are still capable of being highly productive when the proper recovery methods are employed. The Humble Salt Dome Field is arguably the most potentially prolific mature field available on the Texas/Louisiana Gulf Coast. The Humble Salt Dome field is located near Humble, Texas approximately 45 miles North of Houston, Texas. BSA and BSA’s partners acquired the North portion of the Humble Field approximately three (3) years ago and have spent millions of dollars preparing this field for enhanced production. During the past year the BSA team has reworked ten (10) existing wells on the lease. This rework program has proven that the existing wells have recharged over the years and that every well has economically viable quantities of oil that can be recovered. Of the existing ten wells, three are in full production producing over 60 barrels of oil per day yielding investors well over 20% per annum. The other seven are in various stages of production/development. Previously drilled depths of many wells are approximately 3000 feet in a zone known as the Upper Yegua. The Upper Yegua will typically produce at a rate in excess of 10 barrels of oil per day. These wells also have a zone known as the Lower Yegua; the Lower Yegua will typically produce even larger quantities of oil per day. Our projects will involve the deepening of wells into the Lower Yegua; if for any reason the Lower Yegua proves to be unproductive, we will go back up the hole Black Sands Advisers - Richardson, TX MI Investments - Henderson, NV and re-complete the Upper Yegua. We feel confident that the lower Yegua will produce higher qualities of oil based on our engineering reports and the lower Yegua’s historic production. The north side of a Salt Dome is known for having greatest oil reserves. Interestingly, the north side of the Humble Salt Dome has never been drilled due to the fact that the north side of the Dome is under the San Jacinto River. In the 1950’s there were approximately 35 wells drilled along the edge of the San Jacinto River; most of these wells had initial production of over 10,000 of oil per day. The third well in this project is located near the edge of the San Jacinto River; and thus, has the greatest upside of the three wells. Western Energy Group will re-enter this well and then drill directionally under the San Jacinto River; they expect to encounter virgin formations; and, potentially a large producing oil zone. If for any reason the trip under the river proves to be unproductive, they will go back up the hole and re-complete the Lower Yegua. LOCATON THE HUMBLE FIELD The Humble Field is located 20 minutes north of downtown Houston off of US Highway 59 and FM 1960. Below is a surface location map of drilled oil wells on the Humble Salt Dome Field. The field has produced more than 150 Million Barrels of Oil since its discovery. The Texas Company, later renamed Texaco, has been active in the field since the 1940’s and is the largest producer in the field today. Due to residential and other development, many areas of the field have not been fully utilized. Bissonet Oil Lease Black Sands Advisers - Richardson, TX MI Investments - Henderson, NV GEOLOGY The Humble Field is a predominantly deepseated pier cement salt structure, with the salt rising to within 1200 feet of the surface. The resulting salt intrusion or “dome” formation created both structure and numerous oil-bearing fault traps and isolated reservoirs along the top and flanks of the structure (see example of salt structure). The Humble field has produced more than 150,000,000 barrels of oil since 1905, with more than 70% of this production from Miocene sands on the cap rock at very shallow depths. The objective area is the “caprock transition to flank sands”. This area takes advantage of the shallow sands with potential for migrating hydrocarbons and reservoir recharging from the deeper flank sands (See video on website for more information). HISTORY HUMBLE SALT DOME FIELD, Harris County, Texas Humble Salt Dome Field was discovered in the early 1900s. Bubbles of oil were first observed seeping from ground near the San Jacinto River in 1887. Humble became an oil boomtown in the early 1900s when oil was first produced there. The first oil was produced a couple years after the famous Spindletop discovery in Beaumont, Texas. In the fall of 1902, George Hart spudded a well in the field on evidence of escaping gas in the area. His operation was halted by a blowout, an unexpected volume of gas under pressure that forced the drilling equipment out of the hole. Blowouts were encountered in several wells in the part of the field later called "the hill" and drilled in the summer of 1904 by C. E. Barrett of Houston. Despite the menace of blowouts, some success was found in the early field when Higgins Oil and Fuel Company brought in a large-volume gas well half a mile southeast of the Barrett wells in October 1904. By the end of the year Humble field Black Sands Advisers - Richardson, TX MI Investments - Henderson, NV reported two sporadically-producing oil wells that had yielded 2,000 barrels of oil. Since none of the crude had been sold, it was stored in earthen tanks for use in the field. Even though blowouts hampered field development, their threat was minimized by the invention of a blowout preventer, which was in use by 1905 when D. R. Beatty drilled the No. 2 Fee. The well came in on January 7, 1905, and gave up the first gusher production in the field with a potential of 8,500 barrels of oil per day from a depth of 1,012 feet. Other wells were sunk into the same shallow caprock, and some showed potentials of 10,000 barrels of oil per day. From 1905 through 1913 development of the field concentrated on the cap rock of the salt dome, producing at depths of 1,100 to 1,200 feet. By 1955 annual production pushed past 600,000 barrels and by 1965 the totals neared 700,000 barrels of oil. After the Humble field reached its seventieth anniversary, Humble Light field was added to it, and annual production for 1975 was 923,245 barrels of oil and 434,071,000 cubic feet of casing head gas. Several secondary recovery projects, including salt-water injection for water flood and pressure maintenance, steam injection for thermal recovery, fracture stimulation and gas injection for attic recovery, were initiated in the field. At the end of 1985 annual production declined to 453,125 barrels of oil and 268,060,000 cubic feet of casing head gas. January 1, 1994, the Humble Field, one of the four early salt dome fields (that laid the baisis for the Texas oil industry), reported cumulative production of 152M barrel of oil produced. MANAGEMENT TEAM Black Sands Advisers’ Management Team Black Sands Advisers - Richardson, TX MI Investments - Henderson, NV Black Sands is an oil and gas exploration and development company that specialize in acquiring oil and gas rework properties as well as properties that are currently oil and gas in economically viable quantities. Curtis Overstreet has been in the oil and gas industry in various capacities for over thirty years and will serve as General Manager of this project. His resume is attached. Curtis Overstreet CEO/President Mr. Overstreet has extensive background in oil and gas with an emphasis on the acquisition of producing properties and the implementation of new technologies used to improve existing production. Mr. Overstreet has gained valuable experience in the last 30 years in various aspects of oil and gas development. Other key supporting areas include: CEO of a successful regional exploration company, raised over $50 Million for various exploration companies, managed the acquisition of dozens of producing properties, CEO of a publicly traded company, financial partner of a small Exploration and Production company and leadership roles in over two dozen companies. Mr. Overstreet was Co-Founder of the largest oil and gas software company in North America (Petroware, Inc.). Mr. Overstreet served as CEO of a publicly traded company for over six years. Mr. Overstreet has a commitment to positive relationships anchored in integrity and is motivated by a desire to produce shared benefits for all parties involved. These characteristics have generated successful results and many long-term strategic business relationships. He is a 1968 graduate of West Texas State A&M University. Black Sands Advisers - Richardson, TX MI Investments - Henderson, NV Spectral Oil and Gas is an energy technologies company that uses proprietary nuclear logging tools to find overlooked hydrocarbons in old oil and gas wells. These tools use advanced spectroscopy detection to highlight hydrocarbons behind-pipe, allowing for cheaper recompletion of old wells. Steve McGuire is founder and manager of Spectral, holds the patents on several of the technologies that are used on this project and serves as Chief Scientist on the three well rework projects. Steven S. McGuire Steve McGuire has thirty years of experience in the fields of energy technologies, renewable fuels, power generation, process systems, controls and infrastructure. He has funded and managed over $200 million in projects that have integrated new technologies with the energy industry. Mr. McGuire founded Spectral Oil and Gas, an energy technologies company that uses proprietary nuclear logging tools to find overlooked hydrocarbons in old oil and gas wells. These tools used mini-trons and chemical sources matched with advanced spectroscopy detection to highlight hydrocarbons behind-pipe, allowing for cheaper recompletion of old wells. Spectral owns leases and wells in the prolific Humble Oil Field that has produced over 100 million barrels of oil before 1930 and has begun to restore production to the flank of this salt dome. Additional positions held by Mr. McGuire include Chief Executive Officer of Texogo Technologies Corp., Former CEO of SAFE Fuels (Safe Renewables Corp.), Former CEO of Biofuels Power Corp., Former Chairman and President of energy technologies companies with over 300 employees and 1,000 wells in Texas, Louisiana Gulf of Mexico and offshore. Steve also was a senior engineer for Schlumberger Offshore Services. He worked as a logging engineer and further developed training and interpretation manuals and became a noted lecturer on using new technologies to uncover overlooked oil and gas deposits. Mr. McGuire attended the University of Illinois and received his Bachelor of Science (BS) in Physics. He has written many technical papers, white papers, and business plans pertaining to the energy industry along with holding several patents. Mr. McGuire works closely with various research organizations including Southwest Research Institute, US Army Aberdeen Proving Grounds, Austrian Research Center, China Lake Naval Test Facility, USAF Research Lab, Houston Advanced Research Center and Rice University. Black Sands Advisers - Richardson, TX MI Investments - Henderson, NV Western Energy Group is an Oil and Gas exploration and production company based in Humble, Texas. Western has been in operation for over thirty years and has successfully operated in the Humble, Texas area for eight years. Paul Cothran is the founder and President of Western and will the Operator on the three well rework project. Paul Cothran Mr. Cothran has extensive background in oil and gas with an emphasis on the exploration and development of producing properties. Mr. Cothran has gained valuable experience in the last 20 years in these aspects of oil and gas development: Acquisition and development of and gas leases. Remediation of under-performing oil and gas wells, Deploying of unique technologies to enhance the production of oil and gas wells and Development of Texas Gulf oil and gas properties Other key supporting areas include: Director of Technical resources for a large offshore oil and gas company, worked with the University of Texas to run 3D seismic over state owned properties on the Texas Gulf coast, managed the acquisition of hundreds of producing properties for several of the major corporations in the oil and gas industry, and worked as an oil and gas land man. Mr. Cothran has over eight years of experience in remediating oil and gas wells in the Humble Salt Dome area. He graduated from Southwest Texas State University in 1986. ! ! ! ! Br a z o s " #$!%&' ( ) *+#' , !-, *.!! ! !!!!!!!!!! ! Brazos Land and Production is an Oil and Gas exploration and production company that specializes in the acquisition of distressed oil and gas properties. Deane Watson, Jr. is the founder and President of Brazos and is an oil and gas attorney and has operated as an oil and gas land man for over thirty years. His resume is attached. Deane Watson, Jr Mr. Watson has extensive background in oil and gas with an emphasis on the acquisition of producing properties and the implementation of new technologies used to improve existing production. Mr. Watson has gained valuable experience in the last 25 years in these aspects of oil Black Sands Advisers - Richardson, TX MI Investments - Henderson, NV and gas development: Acquisition of over 35 oil and gas leases with over 200 under-performing wells, remediation of under-performing oil and gas wells, buying large oil and gas leases and reselling them to large to mid-size companies, acquiring and funding large off shore oil and gas leases. Other key supporting areas include: Director of Business Development of a successful regional exploration company, Board of Directors of a large regional telephone company, managed the acquisition of dozens of small telephone co-ops, sold a large regional telephone company to one of the! largest utilities in Texas, Board of Directors of two publically traded companies, and leadership roles in over two dozen companies. Mr. Watson was one of the early pioneers in the Eagle Ford shale play in North America (Petroware, Inc.). ! ! company ! Br a z o s " #$!%&' ( ) *+#' , !-, *.!! He is a 1972 graduate of West Texas State A&M University and Texas Wesleyan School of Law, Admitted to the State Bar of Texas in 1994. ! !!!!!!!!!! ! J&D Petro is an oil and gas operator that specializes in aggregating oil and gas production. J&D has been aggregating and managing oil and gas producing properties for over twenty-five years. J&D provides the technical resources to ensure that the properties continue to produce at optimum rates. J&D will manage the producing properties for Black Sands Advisers. M.I. Investments is a boutique investment entity focused in the Commercial Real Estate and Oil and Gas sectors. Purpose: invest in sectors that provide long-term opportunistic returns, measurable economic demand and risk. Michael N. Mirolla Black Sands Advisers - Richardson, TX MI Investments - Henderson, NV Michael has over 25 years of hands-on commercial and residential real estate experience in the following disciplines: underwriting, workouts, loan servicing, development, project management, property and asset management, marketing, capital markets, finance and brokerage. In the last recessionary cycle (1990s) he repositioned over three (3) billion dollars of assets developing “out-ofthe-box” revenue strategies and exits. Michael has had national and global responsibilities for portfolio performance with career revenues/expenditures in the billions of dollars per annum representing: multifamily, retail, office, hotel and land. Michael has been a guest speaker at real estate functions and hired to consult on projects throughout the country. Michael earned an MBA in finance from Rutgers University Graduate School of Business where he was president of the student body. He received his BS from Seton Hall University, Stillman School of Business. He was an Adjunct Professor of real estate for the masters program at New York University School of Continuing and Professional Studies. He is a licensed real estate broker in the State of New York and Nevada; and is a certified real estate instructor in the State of New York. He is the chairman of the finance committee for a major political party in Clark County. Investment Cycle Black Sands Advisers - Richardson, TX MI Investments - Henderson, NV Investment Options Unlike many investments, oil and gas direct investing offers three investment options: Direct Cash Investment Self-Directed IRA/Pension Fund 1031 Exchange Black Sands Advisers - Richardson, TX MI Investments - Henderson, NV Each of the above referenced options require careful consideration and it is recommended that your financial advisors, including but limited to a CPA, Tax Attorney and Estate Planner provide the proper financial guidance prior to investing. Pricing History 1985 - 2013 Note: Pricing Volatility of Gas & Oil Since 1985 Project Overview BSA/MI Investments design each investment project to minimize the risk profile associated with investing in the oil and gas sector. This unique financially designed structure has the following three attributes: (1) reworked wells tend to be a more consistent investment based on patented oil reserve discovery technology and existing historic oil production logs; (2) revenue from existing proven producing wells providing each investor a minimum fixed return (investors will earn a return the first month the fund is operational); and (3) based on the price of oil and the production per well, Black Sands Advisers - Richardson, TX MI Investments - Henderson, NV the investor may earn up to 21% per annum until the end of the sixth (6) year. The investor’s capital is returned (see Exit Strategy) and the investor earns a distribution for the remainder of the project life estimated at 15+ years. Minimum First Year Return Investors will enjoy a minimum return of ten (10) percent cash-on-cash return first year earned by the purchase of existing oil reserves. The oil reserves acquired, will produce a 10% return which will be paid to the investor, 1/12th starting in the first month acquired. In addition to the fixed return to the investor, the revenue produced from the reworked wells will be distributed once they start producing. Exit Strategy - Return of Capital MI Investments has created exist strategies for our investors depending on the level of investment funded. Every investor that invests in a fund will receive their principal returned in the sixth (6) year investor will exit receiving 100% of their principal via GICP. Note: EACH INVESTOR UPON RETURN OF CAPITAL IN THE SIXTH (6) YEAR WILL CONTINUE TO RECEIVE DISTRIBUTIONS THROUGH THE LIFE OF THE INVESTMENT. Tax Advantages The following IRS tax advantages are granted to investors that fund direct oil and gas projects. Note: additional tax credits and depreciation is available that is not listed below. Oil and Gas Production Income: Depletion Allowance is 15% TAX FREE INCOME (minimum 15%) with the percentage determined annually by the IRS based on average price of crude oil and other factors. For wells that meet certain marginal production guidelines set by the IRS, percentage deductions can be as high as 25% of the gross income produced by the well. (Please see IRC Sections 611, 613, 613A(c)(6) for more information). Intangible Drilling Costs (IDC): The primary expense incurred in oil and gas partnerships is for drilling, testing, and completing the oil or gas well. These costs can be deductible for tax purposes. IDC can vary from 65% to 95% of total unit cost. Our example estimates 90%.(Please see IRC 98 – Code – Vol, Sections 263(c)(e)(2) and 59(e) and Treasury Regulations 1.612 parts 4 and 5 for more information). Black Sands Advisers - Richardson, TX MI Investments - Henderson, NV Tangible Drilling Costs (TDC): Approximately 15% - 30% of the investment constitutes “TDC’s”. This portion of your investment is depreciated over a 7 year period using the Accelerated Cost Recovery System (ACRS). Tax Advice Disclaimer: The information on this website should not be used in any actual transaction without the advice and guidance of a professional Tax Adviser who is familiar with all the relevant facts. Although the information contained here is presented in good faith and believed to be correct, it is General in nature and is not intended as tax advice. Furthermore, the information contained herein may not be applicable to or suitable for the individuals' specific circumstances or needs and may require consideration of other matters. Disclaimer This document does not constitute an offer to sell or a solicitation of an offer to purchase. This business overview has been prepared by Black Sands Advisers and MI Investments (“the Parties”) solely for information purposes and is not to be used as a basis to form an investment decision. The business overview is neither an offering document nor are any guarantees expressed or implied by the Parties regarding the success of the venture described in this business overview. The information contained in this business overview does not purport to be all inclusive or to contain all of the information that a prospective investor may require. This business overview includes certain statements, estimates, projections and assumptions that reflect management’s subjective views regarding the anticipated future performance. Such statements, estimates and projections reflect various assumptions concerning projected results, which may or may not prove to be correct, and there can be no assurance that any projected results will be achieved. Contact Information: MI Investments Michael N. Mirolla Managing Member D: 702.608.7020 Black Sands Advisers - Richardson, TX MI Investments - Henderson, NV