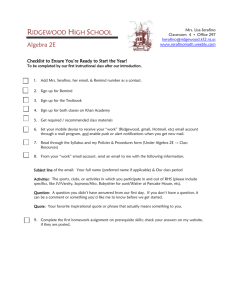

the offering - Ridgewood Capital Asset Management

advertisement