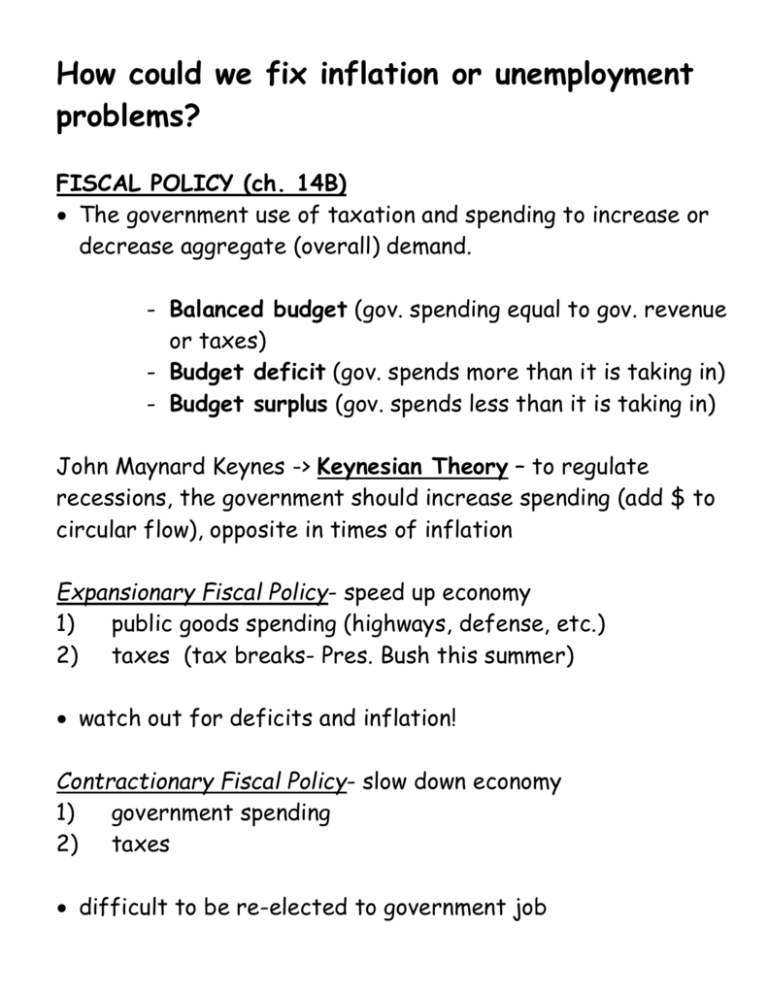

How could we fix inflation or unemployment problems

advertisement

How could we fix inflation or unemployment problems? FISCAL POLICY (ch. 14B) The government use of taxation and spending to increase or decrease aggregate (overall) demand. - Balanced budget (gov. spending equal to gov. revenue or taxes) - Budget deficit (gov. spends more than it is taking in) - Budget surplus (gov. spends less than it is taking in) John Maynard Keynes -> Keynesian Theory – to regulate recessions, the government should increase spending (add $ to circular flow), opposite in times of inflation Expansionary Fiscal Policy- speed up economy 1) public goods spending (highways, defense, etc.) 2) taxes (tax breaks- Pres. Bush this summer) watch out for deficits and inflation! Contractionary Fiscal Policy- slow down economy 1) government spending 2) taxes difficult to be re-elected to government job MONETARY POLICY (Ch.14A) Government actions (Federal Reserve) to change the money supply. - Velocity of Money- how fast $ moves through economy. Milton Friedman- Monetarist- rapid changes in the money supply causes instability. Money supply should grow about 3-5% each year to promote growth (more causes inflation, less causes recession). Expansionary Monetary Policy adds money to circulation Contractionary Monetary Policy takes money from circulation. Tools used to change $$ supply 1) Discount rate- interest loan rate for banks. * High rate -> less borrowing, less $$ in circulation * Low rate -> more borrowing, more $$ in circulation 2) Reserve Requirement- Amount of $$ banks are required to keep at the Fed. *High reserve -> less $$ in circulation * Low reserve -> more $$ in circulation. 3) Open Market Operations – sales and purchases of marketable federal securities like bonds, notes, and bills. *Sell to take $$ out of circulation *Payback to put $$ in circulation Problems -> difficult to effect people’s incomes directly, unintended effects, not good for short term. How could we fix inflation or unemployment problems? FISCAL POLICY (chapter 14B) The government use of or decrease aggregate (overall) demand. to increase - budget (gov. spending equal to gov. revenue or taxes) - Budget deficit (gov. spends than it is taking in) - Budget (gov. spends less than it is taking in) John Maynard -> regulate recessions, the government should (add $ to circular flow), opposite in times of inflation Expansionary Fiscal Policy1) 2) taxes economy watch out for deficits and inflation! 3) 4) Fiscal Policy- slow down economy government spending difficult to be – to spending MONETARY POLICY (Ch.14A) Government actions ( ) to change the money supply. - Velocity of Money- Milton Friedman- Monetarist. Money supply should grow about (more causes inflation, ). in the money supply causes each year to promote growth __ Monetary Policy adds money to circulation. Contractionary Monetary Policy circulation. Tools used to change $$ supply 1) - interest loan rate for banks. * High rate -> less borrowing, less $$ in circulation * Low rate -> 2)Reserve Requirement*High reserve -> * Low reserve -> more $$ in circulation. 3)Open Market Operations – sales and purchases of marketable federal securities like . * to take $$ out of circulation * to put $$ in circulation Problems ->