Secretaries of practice Scand Term

Secretaries of Practice

Scand Term

Statement of Account

*Summary

S/A Statement of Account

Bal. Balance

Balance due

Debit

Credit

Transaction b/f brought forward

C/f Carried forward

Discount allowed

Bills receivable

B /E Bill of Exchange

Chq. Cheque

P/N Promissory Note

Or order

Unconditional

Written order

On demand

Due date

Drawer

Drawee

Cash Receipt Rect.

Serial number

Reason of payment

Written document

N/F Not Fund

I/ F Insufficient Fund

N/S No Fund

R/D Refer To Drawer

D.D Drawer Dead

Dishonoured cheques

Personal cheque

Bearer cheque

Blank Blanc

Blank Endorsement

Due date

Date of writing

Date of Acceptance

Banker's Draft

D/d Days after date

D/s Days after sight

M/s Month after sight

Statement of Account (S/A)

- Define a statement of account?

It's a statement sent by the seller to the buyer every period showing transaction carried out and also, the balance due.

- What are the buyer sure of a statement of account?

1It makes the buyer sure of the correctness of his account with the seller.

2It is polite way to remind the buyer to settle his debit balance.

What are the debit and credit transactions show on the

S/A?

1The debit balance

2- All Invoices Each proceeded

3- Debit notes by the word

"To"

4- The Credit balance

5- Cash receipt Each preceded

6- Cheque by the word

7- Credit notes "By"

Lay-out of a statement of Account

Name of seller ,

Tel. No.:……. His address, C.R.: ……

Fax.: ……… Town. P.O.B.:…

Date: ………………

Statement of account No. : …

Stamp

Name of buyer,

His address,

Date

Town.

In Account with:

Terms of payment:…………..

Details Partial Total

Year

Month

Day 1,

Day 31,

To: Debit balance ( b/f )

(+) Debit amounts

To: Invoice No. …….

To: Debit Note No. …….

(-) Credit amounts :

By : Cash (Rect. No. …)

By : Cheque No . …..

By: Credit Note: …..

To : Debit balance ( C/F )

( only… Pounds)

E. & O.E.

***

***

***

-----------

***

***

***

-----------

******

******

------------

*******

(- )

*******

----------

*******

( Signature of seller )

Means of Payment

1- Cash Receipt ( Rect. )

_____________________

- Define a receipt

It is written document signed by the receiver ( Creditor – Seller ) and given to the payer ( Debtor – Buyer ) who pays money.

-What are the parties of the receipt ? There are two parties :

1 The receiver :

Is the seller ( Creditor ) who receivers money and signs it .

2 The payer :

Is the buyer ( Debtor ) who pays the money.

- Essential ( Important ) data of the receipt :

1- The date of writing

2- The amount ( sum ) of money in numbers ( Figures ) and in words

3- The particulars of the receiver and his signature

4- Name of the payer who pays the cash money

5- The reason for paying

6- The serial number of the receipt

" The Lay-out of the receipt "

L . E . : ------ ( in figures ) Date : ----------------

Name of the receiver,

Address,

Stamp

Received from: -------- ( Payer's name ) ---------------

The sum of : --------( Amount in words ) -----------

In settlement of : ------( Reason ) ------------------------

Signature of receiver

(-------------)

Receipt No. : -----

2- The Cheque ( Chq. )

___________________

-Define of the cheque :

It's a written order drawn by a person ( drawer ) upon a bank

( drawee ) , to pay on demand a certain sum of money to a certain person ( payee ) or to his order or to bearer.

- Parties of the cheque : There are three parties:

1- Drawer

2- Drawee

3- Payee

- Essential data of the cheque ( Main points of the cheque ) :

1- The date.

2- The amount in figures and in words.

3- the name of the drawer and his signature.

4- The name of bank and his branch.

5- The name of the payee.

6- The serial number.

" The Lay-out of a Cheque "

Sum : --- ( in figures ) Date : -------------

( Bank drawee )

Branch

Stamp

Pay to the order of : ------------ payee -----------

The sum of : only, ------------( in Words )-------

Signature of

( Drawer)

No. B/-----

3- Banker's Draft ( B/D )

_____________________

- Define a Banker's Draft :

It is a cheque drawn by a bank on another bank (may be it's branch). You can buy a B/D and send it to your creditor in his town to settle the amount due-two officials sign for the drawing bank.

- Essentials :

1- The drawing bank name and it's branch address.

2- The bank name and it's branch address on whom the cheque is drawn.

3- The payees name.

4- The sum in figures & in words.

5- The date of drawing.

6- Signatures of the two officials ( Accountant – Manager ).

7- The serial number.

" The Lay-out of a Banker's Draft "

Sum : --- ( in figures ) Date : ------------

To: Bank ( drawee )

(Branch)

Stamp

Pay to the order of : ------------( payee )---------

The sum of : only,-----------( in words )----------

P.P. Bank name ---- ( Drawer )

------- --------

Accountant Manager

No. B/-----

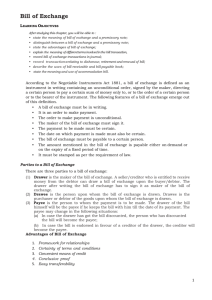

4- Bill of Exchange ( B/E )

______________________

- Define a Bill of Exchange ( B/E ) :

It 's an unconditional written order drawn by a person (drawer) an another person (drawee) ordering him to pay a certain sum of money on demand or at a fixed or future date to a certain person

(payee) or to his order.

- What are the parties of the B/E ?

There are three parties:

1- The drawer

2- The drawee

3- The payee

N.B.

: some times, the drawer and the payee may be one person.

Three Day's :

Due Date – Date of writing – Date of acceptance

- Essentials of a bill of exchange:

1- The B/E is an unconditional order " means ordering the drawee to pay the value without any condition or reserve.

2- It must be in writing.

3- It must be dated.

4- It must contain due date.

5- It must have three parties, yet, they may be two

(drawer & payee) may be one person.

6- It must contain "value received" and properly

stamped.

7- It must be accepted by the drawee and acceptance.

"The Lay-out of a bill of exchange ( B/E )"

Sum : -----( in figures ) ---- Date:---------------

Term: ---- due date -----

--------------------stamp

Pay to the order of: ------------------------- name of payee

The sum of : ---------------------------------( in words )

Value Received in : --------------------------

To: Name of drawee, Accepted

His Address, Drawee

Date

The signature of drawer

------------------

No. : ------

5- Promissory Note ( P/N )

- Define of the promissory Note :

It's an unconditional written promise , made by a person

(Maker) to pay on demand , or at a fixed or future dare a

Certain sum of money to a certain person (payee) or to his

Order.

Parties Of a promissory note : There are two parties :

1- The maker. 2- The payee.

N.B. All conditions and rules of the P/N. are the same as in the

B/E except the following :

* There are 2 parties only in the P/N.

*It needs no acceptance as the debtor promises to pay.

- Essentials of a promissory note :

It must be in writing and dated and stamped.

It must be unconditional in writing.

The maker must sign it.

It must contain value received.

It needs no acceptance.

It is endorsed in the same way as in the B/E.

"The Lay-out of a Promissory Note"

L.E. : ---(in figures) Date : -------------

Term (----------------- )

Stamp

I promise to pay to the order of : ------( Payee)------

The sum of :---------------( in words )-----------------

Value received in : ---------------------------------------

Signature of debtor

----------

( Maker )

No. : ----------

Filing and Indexing

*Summary

Filing

Arranging

Storing

Documents

Obtained

In need

Less effort Purpose Logical

Reference

Files

Folder

Alphabetical

Geographical

Numerical

Subject chronological

According to

Letters of Alphabet

Organizations

Surname

Titles

Invert

Universities

Computer filing

Clipboard

Document Holder

Paper Tray

Telephone Diary

Cutter Office machines

Letter Openers

Paper Weights

Computer Supplies

Recently

Modern Office

Calculating machine

Folding Letters

Toner

Faster

Spray

Jet nozzles

Higher

Dot matrix

Visual images

Paper Shredder

Cash register

Attached

Time recording clock

Filing:

Means arranging and classifying and storing document in a way that they can be obtained in need with less time and less effort.

Methods of Classification :

Alphabetical Classification

Numerical Classification

Alphabetical – Numerical Classification

Geographical Classification

Subject Classification

Chronological Classification

Indexing:

Is the process of determining the name and the subject under which the documents are filed; it is an important aid to filing.

- Kindly of Indexing:

Classification and Indexing

Microfilming

Computer filing

A Hard Disk File system

A flash file system

Managing files

Stationery

Letterhead

Envelops

Office Machines