9-19-09 Crashes are sudden, Mass realizations of Reality

advertisement

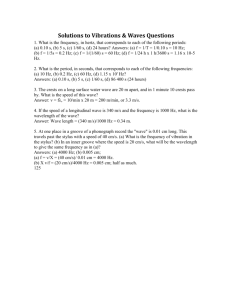

September 19, 2009 Crashes are sudden mass realizations of reality Earnings expectations have never diverged as much from economic reality The only inflation is occurring in stocks The market is not just pricing in the end of recession, but two years of recovery as well. Baltic Dry Goods index indicates the downturn will intensify Technically, wave 5 down still lies ahead Why a Crash now? The higher they climb the harder they fall; technical evidence End to gold hedging means a top for gold, leaving it highly vulnerable. The Fed's Market Manipulation is a highly destructive lie, akin to Nazi era propaganda Duration of the Bear Market is likely 15 more years. The Market always alternates, so expect the opposite of the last time. A Crash vs. slow decline; Bonds get killed vs. government bonds appreciate the most Earnings expectations have never diverged as much from economic reality The only inflation is occurring in stocks Stephanie Pomboy, who puts out a highly regarded macroeconomics newsletter, is convinced that after a quarter century of overindulgence, deflation and credit contraction will continue for some time. Yet investors are discounting an environment where retail sales revert to 3%-style annual gains. To achieve such gains, retail sales, which are declining at a rate of $331 billion annually, would have to rise by $470 billion, meaning an $800 billion swing. That's betting on a miracle! Meanwhile consumer spending which is declining at an annual rate of $165 billion would have to reverse into a $779 billion increase, nearly a trillion dollar swing. Her conclusion: because surplus liquidity has nowhere else to go, the only inflation is occurring in stocks. Earnings expectations, she quips, “have never been so far afield of economic reality”. The market is not just pricing in the end of recession, but two years of recovery as well. According to economist David Rosenberg, “the market is not just pricing in the end of recession, but two years of recovery as well.” Expectations of 4% real GDP growth and a 40% earnings growth next year are just unrealistic. With deflation and excess capacity, the only way that corporate profits rebounded recently, was through massive cost-cutting. This cost-cutting feeds directly into lower wages or fewer man hours worked, which tie into the consumer's inability or unwillingness to spend. The de-leveraging process, which invariably accompanies a boom gone bust, will take years to bring the country's outstanding debt in line with its debt-servicing capacity. De-leveraging will mean much lower GDP-growth rates. Baltic Dry Goods index indicates the downturn will intensify The Baltic Dry index (of shipping activity) which began rising just before the March low, has made an about face, and has been slipping for 3 months, which indicates the downturn will intensify. Technically speaking, wave 5 down still lies ahead The transitional b wave rose to the Fibonacci 61.8% retracement of the entire drop from wave 2. Wave 4 was a complex a-b-c. Notice also that the RSI (relative strength) is back to the level of the alltime high reached on October 2007. Next we drop into wave 5 for a minimum of ~Dow 5100, and likely 2700. A Diag II at the beginning of a Bear Market or correction indicates a long, drawn-out move, as we have just seen in this wave 4. This structure, as well as the greater Bear Market pattern is our unique contribution to the Wave Principle.* Why a crash now? The higher they climb the harder they fall; technical evidence You can no more change the direction of the Market, than you can turn the tide. Both involve forces far greater than even the Fed can manage. Market Manipulation has taken the equity market to an extreme overvaluation relative to economic reality. A Crash is the sudden realization by the masses of just such a disparity. We have completed the wave 4 correction of a 5-wave downwards C, meaning this leg down has not yet bottomed. Because of manipulation, we have climbed too far, too fast, and higher than market forces would have taken us. A 200-day moving average which is 20% below the S&P gives you an idea of how much we’re out of sync with reality. Like any falling object, when you increase the distance to the ground, its speed becomes geometrically magnified as acceleration is squared. Since there is no “ground” to stop the Market, the higher speed & acceleration, mean it will overshoot the rational pessimistic sentiment and under-valuations to an extreme. In effect, the Fed has been setting the stage for a CRASH. Unlike the plunge which occurred last year over four months, a Crash occurs in a matter of days, and strikes fear of survival in the hearts of investors. The 1964-1977 cycle Bear Market below is an example of the market’s fractal nature of the Diag II complex A-B-C. Here we see that the final leg of the larger Diag II, wave e, contained a second, smaller Diag II near the top. Wave e marked that Bear Market's longest move and its trough. The gap in wave e was a Crash, and although not clear from the chart, it continued dropping once the chart resumed nearing the trough, before bouncing and coming down one last time. This time around, we're in Supercycle degree, and can expect a plunge approximately ten times the magnitude, that’s why the area of Dow 2700 is the more likely trough, although ~5100 may be the first stop. Bear Market’s Duration We can roughly estimate the duration of this bear market by the previous cycle bear. Assuming they are roughly proportional it has taken us 9 years, as opposed to 5 years to reach the identical spot in the cycle Bear shown above. Since the entire Bear lasted 13 years, we can cross multiply we get 23.4 years total, or roughly 15 years to go to 2024. 5/9 years to date = 13/x total years x = 23.4 ~2024 ~15 more years Hedging gold loses its glitter Last week Barrick Gold was one of the last miners to announce unwinding the rest of its hedge book. Essentially Barrick is buying back the gold sold for future delivery, to guarantee minimum revenues in the event of a drop in price. The extended positioning of gold producers, wanting exposure to gold's rising price, sets gold up for a major fall. Oddly enough, this is precisely when a hedge book would be the smartest thing to do. The Mexican Government discovered this with their Oil hedge last year, which yielded $8 billion. Let's face it, gold is a store of purchasing power in times of inflation, and has little value when in deflationary mode. Although gold typically moves contra the Dollar, and the dollar has a bit further to fall. (see chart) Once the dollar bottoms, it will surge in a V pattern and gold simultaneously plummet. It will be at least 3 years before the opposite extremes are reached, and all the while gold will be plunging to the likely trough near $200 an ounce – that will be the time to buy gold, and take off hedges, not now! “Sell when others are euphoric; buy when there's blood in the streets” uttered two centuries ago it’s still wise counsel. Not just Market Manipulation – Goebels-style propaganda Have you noticed that paint-the tape closings are timed precisely to magnify questionable news, such as the Fed's release of the 17% profits on the bail-out loans to banks, while appearing to shrug off anything unfavorable, such as consumer credit shrinking at the fastest rate ever? It's not just market manipulation, but Goebels-style, Nazi era propaganda - “if you tell a lie often enough, people will believe it”. The Fed's manipulation is nothing more than a big lie, and a highly destructive one at that. (See last week's installment for details) * A complex A-B-C correction, where wave A is a Diagonal II, (Diag II) has not been catalogued as a corrective pattern in any of Prechter's books, nor anywhere else. From Elliott Wave International's (EWI) viewpoint, Diag IIs are so rare, that they have failed to identify a single one. Obviously for that very reason Prechter's and Hochberg's counts are consistently mediocre, when they're not blatantly wrong. As you see in our charts, Diag IIs are virtually ubiquitous and provide crucial information which allows us to determine the most attractive asset classes for strategic allocation, and spot the beginning of long, profitable moves. Once these moves have played out, Diag IIs indicate the minimum swift retracements as well. Below is their weekly count for the Dow – all wrong! The 3 waves between (4) and (5) are much clearer in the candle charts, see the top chart above. Wave 4 just completed is a likely roadmap to the Bear Market Essentially, the structure a complex A-B-C, where wave A(a) sub-divides into a five-part Diag II. Below is a close-up of the Diag II on the hourly charts. Here is a close-up of the Wave a Diag II in the Dow. From a technical standpoint we have just witnessed an example the Market as a fractal. Essentially in a fractal, the whole is repeated in its parts Thus Wave 4 (from 3 to 4) just completed provides a roadmap of the entire Bear Market. If we flip the Dow weekly chart vertically, then 3 is at the top and we are on the way down to c of the Diag II. The blue arrow pointing to the top of the wick indicates where we are within the greater Bear Market. Of course wave B may not be as pronounced, or even a new high, and wave A will likely plunge much lower than shown, but the next high, wave d should be similar to the proportions above in the Dow and Russell 2000. This week’s charts: In this Dow chart we can see a series of Diag IIs, which are not normally part of a correction in the “a” wave, indicative of manipulation. However all that’s left is a day or two of wave b transition at the upper right corner. Diag IIs always retrace to at least where they began, here the lowest one is at ~72.5 which is the minimum drop for the dollar. However once that’s over the larger Diag II is compounded by the smaller to indicate a move much, much higher likely lasting 2-3 years. By not recognizing these Diag IIs and the smaller Diag II Prechter’s group missed the boat on the dollar, calling the rally too soon. The long bond chart shows the identical pattern as stocks, going into wave 5 down…so this time bonds will NOT be a safe harbor. “The Market always alternates, so expect the opposite of the last time” last time government bonds were big winners in the flight to safety, this time bonds will get killed, just like stocks! This is crucial when overweighting bonds has become the latest portfolio strategy. Best regards, Eduardo Mirahyes Exceptional Bear