california state university, fullerton school of business administration

advertisement

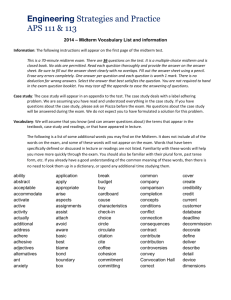

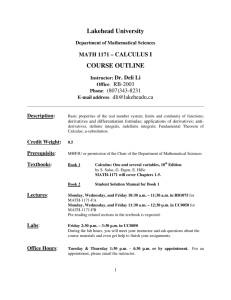

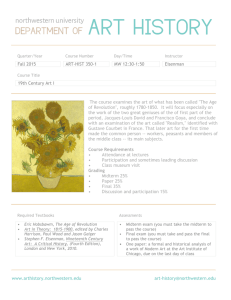

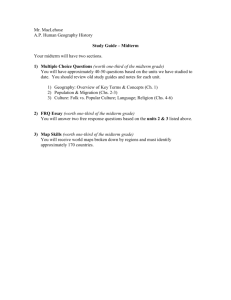

CALIFORNIA STATE UNIVERSITY FULLERTON MIHAYLO COLLEGE OF BUSINESS AND ECONOMICS DEPARTMENT OF FINANCE Commercial Bank & Financial Institutions Management (Finance 425) ( (Spring 2013) Instructor: Classroom: Class Time: Office: Office Hours: Office Phone: Email: Bruce Xiao SGMH - 1117 7:00-9:45 pm, Tuesdays SGMH-5243 4:00 - 6:00 pm, Tu/Th or by appointment (657) 278-8597 bxiao@fullerton.edu Textbook: Bank Management, Koch, Timothy W. & Macdonald, Scott S. Seventh Edition, 2010, by South-Western Course Objectives: The course is designed to: a) Introduce the fundamental aspects of bank management; b) Provide overview financial concepts applicable to bank management; c) Understand decision making and problem solving in bank management. Prerequisite: Finance 320 or permission of the instructor Course Policy: 1) Grading: Midterm I Midterm II Group Project Final Exam Total Note: 20% 20% 20% 40% 100% 20 points 20 points 20 points 40 points 100 points a) Plus/Minus grading will be used. b) Scores will be curved. 3) Exams: There are two midterm exams plus final exam. Midterm I: 30 questions (27 multiple-choice and 3 essay questions) Midterm II: 30 questions (27 multiple-choice and 3 essay questions) Final Exam: 45 Questions (40 multiple-choice questions 5 essay questions) 4) Group Project: Maximum group number for each group is 3. Power point is required for the presentation. A hard-copy written report needs to be submitted by the due day. a) Bank performance analysis and strategic advising b) Written report c) Oral presentation 1 (12 points) (4 points) (4 points) 5) Graduate Student: According to the requirement of Finance Department, there will be additional work required for graduate students since this class is offered to both undergraduate and graduate students. As a graduate student, you need to make a 5- minute presentation with use of power point. The topic that you will present should be related to what has been covered in the class. First, you need to present the author or instructor’s opinion about a subject. After that, you will make reasonable argument why you do not agree with the instructor or author. You need to present a topic right after the instructor covers that topic in the class. Your presentation will affect your grade. Withdrawal policy: It confirms with the withdrawal policy of CSUF. Assessment Statement: The main purpose of the degree program at the Mihaylo College of Business & Economics (College) at Cal State Fullerton is to provide you with the knowledge and skills that prepare you for a successful career in business. In order to assist us in achieving this goal, we will use a number of assessment tools to track your progress throughout the College curriculum. Please expect to participate in College assessment activities in several of your courses while at CSU, Fullerton. As you do so, you will assist us in identifying our program’s strengths and weaknesses as well as areas for potential improvement. In other words, you are making an important investment in the value of your degree. Academic Dishonesty: It confirms with the official policy of CSUF. The Department of Finance requires that students engaging in academic dishonesty receive a grade of F. In addition, Department policy requires that all individuals engaging in academic dishonest be reported to the Vice President, Student Affairs. Academic dishonesty takes place whenever a student attempts to take credit for work that is not his/hers own or violates test-taking rules. Examples of academic dishonesty during test taking include looking at other students' work, passing answers among students or using unauthorized notes. When students sitting next to each other have identical answers, especially the dame mistakes, this may indicate academic dishonesty. Examples of academic dishonesty on out-of-class projects include submitting the work of others or quoting directly from published material without footnoting the source. If you have any questions about the proper use of outside sources, please consult with your professor. 2 Course Schedule (tentative): Date Topic Chapter Introduction Banking and Financial Services Industry 1 Government Policies and Regulation 2 Analyzing Bank Performance 3 Managing Non-interest Income and Non-interest Expense 4 Managing Interest Rate Risk: GAP and Earning Sensitivity 7 Managing Interest Rate Risk: D-GAP & Market Value of Equity 8 Midterm I (Chapter 1, 2, 3, 7, 8) Funding the Bank 10 Review of Midterm I Managing Liquidity 11 The Effective Use of Capital 12 Midterm II (Chapter 10, 11, 12) Review of Midterm II Overview of Credit Policy and Loan Characteristics 13 Evaluating Commercial Loan Requests and Managing Credit Risk 14 Evaluating Consumer Loans 15 Customer Profitability Analysis and Loan Pricing 13, 14, 15 Problem Loans and Loan losses 13, 14, 15 Guest Speaker (John Grauten, President of First Bank California) Off-balance Sheet Activities Group project paper due Group Presentation Final Exam (Chapter13, 14, 15) Tuesday, May 21, 7:30-9:20 pm 3