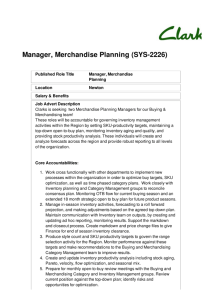

Chapter Outline

CHAPTER 6

ACCOUNTING FOR MERCHANDISING ACTIVITIES

Related Assignment Materials

Student Learning Objectives Quick Studies Exercises Problems

1.

Describe merchandising and identify and explain the important income statement and balance sheet components for a merchandising company.

6-1, 6-11

2.

Describe both perpetual and periodic inventory systems.

6-2, 6-3, 6-4

6-1, 6-8, 6-10,

6-11, 6-13, 6-14

6-8, 6-12, 6-13,

6-14

3.

Analyze and record transactions for merchandise purchases and sales using a perpetual system.

6-5, 6-6, 6-7, 6-

8, 6-9, 6-10, 6-

11 6-21, 6-22

6-2, 6-3, 6-4, 6-

5, 6-6, 6-7, 6-8,

6-9, 6-10, 6-12,

6-13, 6-14, 6-

18, 6-29

6-1A, 6-2A, 6-3A, 6-16A.

6-1B, 6-2B, 6-3B, 6-16B.

4.

Prepare adjustments for a merchandising company.

6-12 6-9

5.

Define, prepare, and use merchandising income statements.

6.

Prepare closing entries for a merchandising company.

7.

*Appendix 6A Record and compare merchandising transactions using both periodic and perpetual inventory systems.

8.

*Appendix 6B Explain and

Tax (GST).

6-11, 6-13, 6-

14, 6-20

6-15

6-16, 6-17, 6-

18, 6-19, 6-20,

6-23, 6-24

6-21, 6-22, 6record Provincial Sales Tax

(PST) and Goods and Services

23, 6-24

6-10, 6-11, 6-

13, 6-14, 6-15,

6-16, 6-17

6-4A, 6-5A, 6-7A, 6-9A.

6-4B, 6-5B, 6-7B, 6-9B.

6-15, 6-16, 6-17 6-6A, 6-8A.

6-6B, 6-8B.

6-12, 6-13, 6-

14, 6-18, 6-19,

6-20, 6-21, 66-10B, 6-11B, 6-12B, 6-13B, 6-

22, 6-23, 6-24, , 14B, 6-15B, 6-17B.

6-25, 6-26, 6-

27, 6-28, 6-30

6-10A, 6-11A, 6-12A. 6-13A, 6-

14A, 6-15A, 6-17A.

6-29, 6-30 6-16A, 6-17A.

6-16B, 6-17B.

Note: The Serial Problem, for Echo System, a computer service business, concludes in this chapter.

Learning Objectives 5 through 9 are covered in this segment of the problem. This problem can be solved manually or with an accounting software package.

Note: Analytical and Review Problems may be assigned for additional student enrichment.

Chapter Outline

Instructor’s Notes

I.

Merchandising Activities

Fundamental Accounting Principles Twelfth Canadian edition

Copyright © 2007 McGraw-Hill Ryerson Limited. All rights reserved.

6-1

Chapter Outline

Instructor’s Notes

II.

A.

Reporting Financial Performance—revenue ( net sales ) from selling merchandise minus the cost of merchandise (goods) sold to customers is called gross profit . This amount minus operating expenses determines the net income or loss for the period.

B.

Reporting Financial Position—Same as service business with exception of one additional current asset called merchandise inventory.

Merchandise Inventory

—or inventory , refers to products a company owns for the purpose of selling to customers.

The cost of this asset includes the cost incurred to buy the goods, ship them to the store, and other costs necessary to make them ready for sale.

C.

Operating Cycle—begins with the purchase of merchandise and ends with the collection of cash from the sale of merchandise.

D.

Inventory Systems—approaches to capturing the cost of goods sold and the inventory (cost of goods on hand).

1.

Perpetual inventory systems

—provide a continual record of the amount of inventory on hand. Accumulates the net cost of merchandise purchases in the inventory account. When an item is sold, its cost is subtracted from the inventory account and recorded in a Cost of Goods Sold account.

2.

Periodic inventory system

—does not require continual updating of the inventory account. The cost of new merchandise is recorded in a temporary Purchases account.

Requires updating the inventory account and determining cost of goods sold only at the end of a period .

Note: This outline, up until the last section for the appendix, relates to a Perpetual Inventory System. The terms Merchandise Inventory and

Inventory are synonymous. Inventory is used for brevity.

Accounting for Merchandise Transactions (perpetual)

A.

All costs of merchandise for resale will be debited to Merchandise

Inventory. This could include the invoice cost of merchandise and any freight charges required to be paid by purchaser as well as deducting any returns or allowances or discounts given to the purchaser.

1.

Purchase returns are merchandise received by a purchaser but returned to the supplier.

2.

A purchase allowance is a reduction in the cost of defective merchandise received by a purchaser from a supplier.

3.

A debit memorandum is a form issued by the purchaser to inform the supplier of a debit made to the supplier's account, including the reason for a return or allowance. Memorandum gets its name from the issuer.

4.

Entry (On the books of the purchaser) Debit Accounts

Copyright © 2007 McGraw-Hill Ryerson Limited. All rights reserved.

6- 2 Fundamental Accounting Principles 12th Canadian edition

Chapter Outline

Payable or Cash (if refund given) and Credit Inventory

B.

Trade discounts —Deductions from list price (catalogue price) to arrive at invoice price (actual selling price). Trade discounts are not entered into accounts.

1.

Transactions are recorded using list price minus trade discount.

2.

Entry to record purchase:

Debit Inventory, Credit Accounts Payable

C.

Purchase discounts

—Cash discounts given to purchasers for payment within a specified period of time called the discount period.

1.

Example credit terms, 2/10 n/30, offer a 2 % discount if invoice is paid within 10 days of invoice date.

2.

Entry for payment within discount period:

Debit Accounts Payable (full invoice amount), Credit Cash

(amount paid = invoice – discount), Credit Merchandise

Inventory (amount of discount).

Managing discounts—A system should be set-up to insure that all invoices are paid with in the discount period. Missing out on cash discounts can be very costly. Discounts and

Returns—discounts can only be taken on balance due on invoice after return

D.

Transportation Costs—responsibility is assigned by terms:

1.

FOB shipping point—buyer pays shipping costs. .

2.

Increases cost of merchandise when the purchaser is required to pay for transport

3.

Debit Inventory, Credit Cash or Accounts Payable (if to be paid for with merchandise later)

4.

FOB destination—seller pays shipping costs.

5.

Operating expense for seller

6.

Debit Delivery Expense (or Transportation-Out or Freight-

Out), Credit Cash.

E.

Transfer of Ownership—also defined by terms:

1.

FOB shipping point—title transfers at shipping point

2.

FOB destination—title transfers at destination.

Notice responsibility for transportation costs follows ownership.

F.

Recording Purchases Information—the net cost of purchased merchandise according to the cost principle is recorded in the inventory account. (Inventory is debited or increased for invoice and transportation costs, and credited or reduced for returns, allowances and discounts.)

III.

Accounting for Merchandise Sales

A.

Sales transactions—Recording has two parts:

Instructor’s Notes

Fundamental Accounting Principles Twelfth Canadian edition

Copyright © 2007 McGraw-Hill Ryerson Limited. All rights reserved.

6-3

Chapter Outline

Instructor’s Notes

1.

Recognize revenue—Debit Accounts Receivable (or cash), Credit Sales (both for the invoice amount)

2.

Recognize cost—Debit Cost of Goods Sold, Credit

Inventory (both for the cost of the inventory sold)

B.

Sales Discounts—cash discounts given to customers for payment within the discount period. Recorded upon collection for sale.

1.

Collection after discount period—Debit Cash, Credit

Accounts Receivable (full invoice amount).

2.

Collection within discount period—Debit Cash (invoice amount less discount), Debit Sales Discount (discount amount), Credit Accounts Payable (invoice amount).

3.

Sales Discount is a contra-revenue account—subtraction from Sales.

C.

Sales Returns and Allowances

1.

Sales returns— merchandise customers return to the seller after a sale.

2.

Sales allowances

—reductions in the selling price of merchandise sold to customers (usually for damaged merchandise that a customer is willing to keep at a reduced price).

3.

Entry: Debit Sales Returns and Allowances and a Credit

Accounts Receivable.

Additional entry if returned merchandise is salable:

Debit Inventory, Credit Cost of Goods Sold

4.

Sales Returns and Allowances is a contra-revenue account—subtraction from Sales.

5.

Net Sales = Sales – (Sales Discount + Sales Returns and

Allowances).

IV.

Additional Merchandising Issues

A.

Merchandising Cost Flow—Net purchases flows into Inventory, from there to Cost of Goods Sold on the income statement. Remaining

Inventory balance is reported on the balance sheet and becomes beginning inventory for the next period

B.

Adjusting Entries—Generally same as service business.

1.

Additional adjustment needed for any inventory loss referred to as shrinkage.

2.

Shrinkage is determined by comparing a physical count of the inventory with recorded quantities.

3.

Entry: Debit Cost of Goods Sold, Credit Inventory

C.

Worksheet for a Merchandising Company

Worksheet shown in Exhibit 6-15 eliminates the adjusted trial balance column. The process of using the worksheet is the same as for a service company. Note the additional accounts included and their sequencing.

Copyright © 2007 McGraw-Hill Ryerson Limited. All rights reserved.

6- 4 Fundamental Accounting Principles 12th Canadian edition

Chapter Outline

D.

Income Statement Formats—no specific format is required in practice. Two common formats:

Multiple-step—more detailed than just revenues minus expenses.

Show gross profit as a step towards determining net income. Two types:

Classified Multiple-step (for internal reporting)— shows details of net sales and classifies expenses into selling and general & administrative.

Multiple step (for external reporting)

—does not show details of net sales computation and expenses are not separated into selling and general & administrative.

Single-step —includes cost of goods sold as an operating expense and shows only one subtotal for total expenses, one subtraction to arrive at net income. Groups all revenues together, whether from operating or other sources. Commonly used for external reporting due to simplicity.

V.

Closing Entries —

A.

Close credit balances in temporary accounts to income summary.

B.

Close debit balances in temporary accounts to income summary.

C.

Close income summary to owner’s capital

D.

Close withdrawals to owner’s capital

VI.

Appendix 6A—Periodic and Perpetual Inventory Systems

Compared

Periodic journal entries are compared with perpetual entries for the same transactions. The list below explains periodic system, it is assumed that students have a firm grasp of perpetual system already.

A.

Records merchandise acquisitions, discounts and returns in temporary accounts (Purchases, purchase returns, purchases discounts).

Freight charges for merchandise are recorded in an account called

Transportation-In.

B.

Up-dates inventory and determines cost of goods sold only at the end or the accounting period. Using a periodic system, the total cost of all goods sold during a period is equal to the cost of merchandise on hand at the beginning of the period (beginning merchandise inventory), plus the cost of merchandise purchased during the period, less the cost of merchandise on hand at the end of the period (ending merchandise inventory).

Note: This "backing-into" cost of goods sold can be illustrated by hypothetically starting a business and buying 5 pencils. If 2 pencils remain on hand, 3 must have been sold. The next period starts with 2 pencils, etc. A periodic system does not provide data about shrinkage, spoilage, or shoplifting. These losses are hidden in the

Instructor’s Notes

Fundamental Accounting Principles Twelfth Canadian edition

Copyright © 2007 McGraw-Hill Ryerson Limited. All rights reserved.

6-5

Chapter Outline cost of goods sold figure.

C.

The inventory account can be updated as part of the adjusting or closing process.

D.

Requires closing additional temporary accounts.

Note: The "purchases" account is used to accumulate the cost of merchandise (goods bought for resale). No entry is made under a periodic system to record the disposal of merchandise when it is sold.

Note: When a purchaser takes advantage of a cash discount the contra account, Purchases Discounts, is used.

VII Appendix 6B- Sales Tax

Provincial sales tax is collected on behalf of the provincial government.

PST is later remitted to the province.

Goods and Services Tax is a federal tax of 6% on most goods and services sold in Canada. Businesses pay GST up front for purchases and collect GST from customers. The difference between the amount paid out and amount collected is then remitted to the government.

Ultimately, the consumer pays this tax. HST is used in the Maritimes only.

Instructor’s Notes

Copyright © 2007 McGraw-Hill Ryerson Limited. All rights reserved.

6- 6 Fundamental Accounting Principles 12th Canadian edition

Income Statement Relationships

1. Gross Sales- (Sales Returns/Allowances+Sales Disc.)=Net Sales

2. Net Sales-Cost of Goods Sold=Gross Profit

3. Beg Inv. + Goods Purchased-Ending Inv.=Cost of Goods Sold

4. Purchases-(Purch.Returns/Allowances+Purchases Disc)+

Transportation-In= Goods Purchased

Note: Equations 3 and 4 are used in Periodic system only.

5. Gross Profit-Operating Exp=Net Operating Income

Operating expenses could be further broken down into Selling and

General and Administrative Expenses

.

Alternate Demo Problem-Chapter Six (using periodic)

The following data was taken from ledger account balances and supplementary data for the Whisk Company.

Merchandise inventory, beginning ................................................ $20,000

Merchandise inventory, ending ..................................................... 23,000

Purchases ........................................................................................ 215,000

Purchases discount ........................................................................ 6,000

Purchases returns and allowances ............................................... 3,000

Sales ................................................................................................. 400,000

Sales discounts ...............................................................................

Sales returns and allowances ........................................................

Transportation-in .............................................................................

Required

3,200

1,800

10,000

Show the computation, in proper format, of net sales, cost of goods sold, and gross profit for the year ended December 31, 2011.

Fundamental Accounting Principles Twelfth Canadian edition

Copyright © 2007 McGraw-Hill Ryerson Limited. All rights reserved.

6-7

Solution: Alternate Demo Problem-Chapter Six

Whisk Company

Income Statement

For the Year Ended December 31, 2011

Revenue from sales:

Gross sales ..............................

Less: Sales returns and

allowances ................

Sales discounts ...........

Net sales .......................................

Cost of goods sold:

Merchandise inventory, 1/1/2004

Purchases ................................

Less: Purchases returns and

allowances

Purchases discounts ..

Net purchases ..............................

Add transportation-in ............

Cost of goods purchased .......

$ 1,800

$400,000

3,200

$3,000

$215,000

$ 20,000

5,000

$395,000

6,000 9,000

$206,000

10,000

216,000

$236,000

23,000

Goods available for sale .........

Merchandise inventory,

12/31/2004

Cost of goods sold ......................

Gross profit from sales ...............

213,000

$182,000

Copyright © 2007 McGraw-Hill Ryerson Limited. All rights reserved.

6- 8 Fundamental Accounting Principles 12th Canadian edition