Appendix of Forms

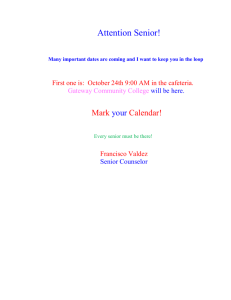

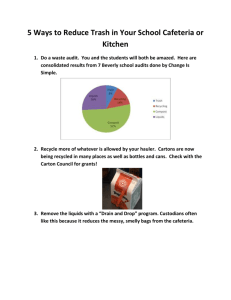

advertisement