title of the proposal

advertisement

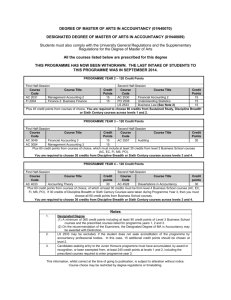

TITLE OF THE PROPOSAL: “Offering Accountancy as a New Program of the Graduate School” INTRODUCTION The UE Graduate School presently offers Master in Business Administration (MBA) with specializations in: (1) Entrepreneurship; (2) Financial Management; (3) Marketing Management; (4) Operations and Supply Chain Management; (5) Human Resource Management, and (6) Tourism and Hospitality Management. A new addition, which is the Accountancy Program, is designed to provide understanding and up to date knowledge beyond the technical confines of the accounting process by integrating strategic management approaches to address the current complexities of today’s businesses. The program will be offered in three (3) tracks: A. A research track, which emphasizes research and requires a thesis for the degree of Master of Science in Accountancy; B. A teaching track, with cognates in education-related subjects; and C. An industry track, with cognates in work-related courses. The latter two tracks lead to a degree of Master in Accountancy. All three tracks offer a choice of three majors: management accounting, audit, and taxation. The University of the East turns out a sizeable number of graduates in accountancy courses from both its Manila and Caloocan campuses. This group can be a potential market for our new offering, because only a few of the universities in Metro Manila offer a similar curriculum. In addition, there are our former students, and students from other universities within the U-belt area, who have recently passed the CPA Board Examination. There are also others who are now gainfully employed and intend to pursue an advanced degree to enhance their careers. Graduates of other related programs who find in themselves a late interest in accountancy due to job or business exposure and want to have a greater handle on their jobs or businesses can still migrate to the field by taking up this program. Further, since the University has earned a name in the field of accountancy, opening this new program would generate interest among prospective students and thus be of huge advantage to the University. RATIONALE A. The globalization of trade has resulted in the increased mobility of individuals who travel around the world in pursuit of business opportunities. Free trade agreements across countries and mutual recognition agreements of professionals in ASEAN and other regions have bolstered this phenomenon. B. Enron’s willful corporate fraud that deceived the investing public and WorldCom’s inflated cash flows – among the many accounting scandals in the past decade – stressed the need for the moral and ethical dimensions of conducting business. The response of the profession’s standard setting bodies has been to rebuild the reputation of the profession by developing more careful and complex standards that ensure high quality accountancy and audit reports worldwide. Carefully involving the participation of governments, international standard setting bodies have won not only private sector compliance but also the agreement of many governments to converge with international standards at a future time. The Philippines completely adopted international standards in 2005. The government auditing office has set a year for adopting international standards. This global phenomenon has been accompanied by new national laws and regulations that gave accreditation powers to bodies such as SEC, BIR and Central Bank which now require accountancy graduates who have passed the licensure exams to additionally comply with accreditation requirements. C. Aside from being subject to stringent accreditation requirements, accountancy professionals have been ushered into a new millennium characterized by more integrated and transparent business processes, communications, and operational procedures designed to meet the diverse and complex demands of a more educated, discriminating, and sophisticated global society. While the MBA program was and is still useful for management work, a more complex and more highly regulated environment that is attuned to new business and management trends requires an outward perspective that is at the same time more internally specialized in such areas as management accounting and internal auditing which have grown in complexity with the new standards. Further, although accountancy graduates have some academic preparation for business taxation, many of them study to be lawyers also to practice in the field of business taxation as CPA-lawyers. Taxation as a specialization has become a more lucrative profession within the field of accountancy. With 2015 as the target free flow of professional services in the ASEAN region coming soon, accountancy professionals must also raise the level of their competencies to compete. The resulting need for more skilled and knowledgeable accounting professionals, who understand the implications for a more standardized or specialized approach to the internationalization of business, has created a need for a more suitable academic preparation. To be effective however, the preparation should provide the global and broader managerial perspective as well as the necessary specialized approaches needed to manage accountancy careers in the present age. Thus, it should also provide a focus on specializations that will sharpen the graduates’ global competitiveness in their chosen fields. To further develop management skills, graduate education will enable an accountancy professional to earn the credentials necessary to manage activities within the industry and thus skip some of the years of experience they would otherwise need to gain knowledge on other but equally important aspects of the accountancy profession. A graduate degree will help students rise in the promotional ladder as well as provide a wider spectrum of career choices that includes business taxation, a field where few non-lawyer accountants excel. CONTEXT OF THE PROGRAM The Graduate School recognizes the potential and benefits of offering a program that will focus on accountancy as one of the specialized fields of graduate education. With the increasing need for higher quality of products and services, the internationalization of standards and procedures, and principled conduct of doing business as demanded by a highly complex and globalizing market, the trend calls for an increasing demand of accounting professionals who are not only skilled or technologically-savvy in their areas of expertise, but who are also competitive, peopleoriented, team-builder not only nationally but also across cultures, and abreast with local as well as global developments of the profession. Offering this program will therefore be to the advantage and benefit of those who graduated in accountancy and other fields in business and engineering. Those with a CPA license but wish to pursue further studies in specialized areas of accountancy will enhance their chances for middle-level career positions, either in government, commerce and industry, education, or for public practice. Those who graduated in accountancy will have a chance to go up the career ladder where a license is not required. Graduates of related programs who want to migrate to accountancy can still do so at the master’s level. For those with a bachelor’s degree in engineering, an intensive two- to three-week seminar in accounting as a foundation course will be developed if there is a substantial demand. This will be offered during the summer term. Because the proposed program substantially adheres to the CHED CMO 43 listings of subjects with course descriptions, its graduates will benefit from a CHED compliant program and an updated curriculum. Further, since it has adopted 3 out of the 4 specializations/majors in the CHED program, its graduates will be uniquely prepared to assume higher management as well as consultancy positions in those areas. PROGRAM SPECIFICATIONS PROGRAM DESCRIPTION As indicated earlier, we propose three (3) program tracks: a research track, a teaching track, and an industry track with a choice of three majors. A. Adopting Section 8, Article IV of CHED CMO 43, Series of 2010, the research track will be for “Master of Science in Accountancy” degree. This is a thesis program in accountancy that aims to meet the need of the profession for individuals with a broad and extensive training in research... It provides a broad-based business education, equipping students with the necessary technical knowledge in accounting, communication skills and critical thinking abilities expected by employees and required of future leaders and accounting professionals (Sec. 2, Art. I, CHED CMO 43, S 2010). B. The teaching track will be for the Master in Accountancy, a non-thesis program in accountancy designed to provide students with “high quality professional preparation for teaching at the tertiary level.” Sec. 2, Art. I, CHED CMO 43, S 2010). C. Likewise, the industry track will be for the Master in Accountancy, a non-thesis program in accountancy designed to develop in students a broader and deeper technical accounting in the specialized fields of auditing or taxation, including problem-solving skills necessary for success in professional accountancy and business. PROGRAM OBJECTIVES AND OPPORTUNITIES A. Objectives Thesis Master’s Program. The program (based on Section 6, Art III, CHED CMO 43, Series 2010) aims to: Extend the knowledge, expertise, and skill of students through the application of research to accounting problems and issues; Make a significant contribution to knowledge and/or to the understanding of one or more aspects of accountancy through the research component of the degree; Non-Thesis Master’s Program. The program (based on Section 5, Art III, CHED CMO 43, Series 2010) aims to: Build on the students’ undergraduate education to meet the emerging needs of the accounting profession; Provide advanced academic work for those with interest in any of the three specialized fields of accounting: Management Accounting, Internal Auditing and Taxation Provide the academic prerequisites for candidates who wish to take the specialty certificate examination (e.g., Certified Management Accounting (CMA), Certified Fraud Examiner (CFE), Certified Internal Auditor (CIA), or Certified Data Processing Auditor (CDPA); Build upon the critical thinking and technical skills to analyze and resolve complex accountancy issues; and Provide for depth and breadth in the accounting discipline otherwise not attainable in the undergraduate or MBA. B. Specific Professions or Careers After completion of the program, the graduates can pursue middle-level or advanced positions career/profession for public practice, or in government, commerce and industry, as well as the academic sectors. Work opportunities (Art. III, Section 7, CHED CMO 43, Series 2010) are as follows: Middle-Level Positions Public Practice - Audit Manager Tax Manager Consulting Manager Commerce and Industry Vice President – Finance / Finance Manager Comptroller Senior Information Systems Auditor Senior Fraud Examiner Senior Forensic Auditor Management Accountant Audit Manager Government State Accountant V Director III and IV Government Accountant and Auditor Financial Services Manager Senior Auditor Education Senior Faculty Chair, Accounting Department Advanced Positions Public Practice Senior Consultant Financial Advisor Commerce and Industry Chief Information Officer Chief Financial Officer Government National Treasurer VP for Finance/CFO (for GOCCs) Associate Commissioner Assistant Commissioner Education VP for Academic Affairs Associate Dean D. Competency Standards Graduates in Accountancy shall possess the following competencies (Section 5, Art. VII, CHED CMO 43, Series 2010): Strong technical and professional accounting skills beyond their undergraduate course work; Basic management, communication, and interpersonal skills; High level of theoretical knowledge and sound understanding of advanced accounting principles and techniques, including an understanding of the ethical requirements of the profession; For those enrolled in the thesis program, the graduates will also acquire advanced skills in the research methodologies in accounting. D. Curriculum Design The curriculum design is described, as adopted under Section 16, Art. VIII, CHED CMO 43, S 2010, as follows: The curriculum aims to facilitate the student’s assimilation of advanced knowledge in accounting and related aspects of business. It focuses on enhancing a student’s analytical and critical thinking skills, written and oral communication skills, and understanding of the global nature of the accounting profession. (1) The course work of thirty-six (36) units for non-thesis-Master’s program shall be based on the most current and relevant knowledge that can be applied to the professional development context of professional accountants, as evidenced by the course reference materials, course requirements, and the assessment systems. Reference materials – specialized readings in technical, ethical, and best practices standards in the specific areas of professional specialization Course learning requirements – tools should include the production of approaches, programs, and materials used in the specific areas of professional specialization; and Assessment systems – performance-based activities which require students to demonstrate advanced professional skills. (2) The course work of thirty (30) units for the thesis-Master’s program shall be research-based as evidenced by the course reference materials, course requirements, and assessment systems. Reference materials – specialized readings, especially research-based journal articles, books, or monographs Course learning requirements – development of research competencies, and Assessment systems – performance-based activities which require students to demonstrate higher order thinking skills. For selected subjects in audit or taxation, there will be team teaching. This will combine theory and practice and will require a duly accredited faculty handling the first half of the course and a duly licensed practitioner or practitioners handling the second part. Both will have a part in designing the course syllabus, but it will be the faculty that will give the final grade. For the same subjects that are open to team teaching, the Graduate School will link up with CPE-granting organizations, such as ACPAPP1, with the objective of giving CPE credits to those who are enrolled for the full course or to those who opt to listen to that portion handled by the practitioners. There is, however, an extra fee (over and above the tuition fee) for the CPE granting organization. E. Admission Requirements (1) Applicants with earned Bachelor’s Degree in accountancy, related business/finance degrees or engineering degrees and other related fields with basic accounting units from government-recognized institutions are admitted into the program, supported by a. Transcript of Records (original and photocopies) with Special Order Number indicated therein and four (4) photocopies; and b. Diploma plus four (4) photocopies; The Program (thesis and non-thesis) requires at least two-year work experience as part of the admission policy, or this may be waived; provided, that the applicant has undergone on-the-job training and industry immersion during his/her undergraduate degree. (2) Grade Point Average of 2.00 or better in the baccalaureate degree for the master’s program; An applicant whose GPA is lower than the required average but whose scores “average” in the entrance examination may be admitted on “probation” for one semester, to qualify for readmission if he/she obtains a GPA of 2.00 or better at the end of the semester. 1 Association of CPAs in Public Practice. (3) English Language Proficiency based on TOEFL/TOEIC/IELTS score or its equivalent to qualify for admission. Applicants (Filipinos, Resident and Nonresident Foreign Students) whose English proficiency falls short of the standard set by the Graduate School, shall be required to take intensive English Program prior to admission in the regular program. In the absence of TOEFL/TOEIC/IELTS, applicants for admission shall be required to enroll in the regular undergraduate English Proficiency course offered by the College of Arts & Sciences. (4) Certification of employment and study permit, if working in government or private agency; (5) Notarized medical certificate; (6) Passed the Graduate School Entrance Examination (GSEE); (7) Certification of good moral character from the Dean and a former faculty member of the school where the applicant graduated; (8) Fully accomplished application for admission; (9) Interview by a member of the Academic Committee; and (10) Four (4) recent 2”x 2” colored pictures with white background and name tag. F. Retention Policy Students should not incur a general weighted average (GWA) lower than 2.00 to earn the Master of Science or Master in Accountancy degree. PROPOSED CURRICULUM Comparative Matrix of the CHED minimum curricula requirements, Proposed Accountancy Program of the Graduate School, and other leading schools offering MS in Accountancy in Metro Manila Table 1 shows a summary of the curricula/unit requirements of 1. CHED, 2. De La Salle University, and 3. St. Scholastica’s College in Metro Manila benchmarked with the proposed accountancy curricula/units of the Graduate School (Annex A). Based on the CHED CMO, the total units offered in a graduate accountancy program is a minimum of 36 units. In contrast, the two leading schools in Metro require a minimum of 42 units, whether this is a thesis or non-thesis program. The accountancy program as proposed by the Graduate School matches the prescribed by the CHED. In so doing, those students who enroll in UE’s accountancy program may save a semester of course work because of the comparatively lower number of required units. In addition, St. Scholastica’s is reportedly increasing its tuition fee by 10% from P1,564 per unit to P1,720 per unit by the first semester, AY 2012 to 13. Table 2 presents the prescribed subjects of CHED’s MS in Accountancy programs, vis-àvis those of De La Salle’s and St. Scholastica’s programs (Annex B). 1. Detailed Curriculum of Proposed Master of Science in Accountancy (Thesis Program) The proposal substantially adopts CHED CMO 43, S 2010 prescribed curricula/subjects/course descriptions, except for subjects which are already being taught in the Graduate School and maybe considered equivalent, as indicated below. I. Admission Requirement: Bachelor’s Degree in Accountancy , Business, or Engineering II. CORE/FOUNDATION COURSES (9 Units) GMB 711 Corporate Social Responsibility and Good Governance (in lieu of Business Management and Governance of CHED)2 GMB 731 Managerial Statistics with Computer Application (in lieu of Statistics with Computer Application of CHED) Accounting Research (to be taken prior to thesis writing) III (A). MAJOR IN MANAGEMENT ACCOUNTING (15 Units) GMB 716 Economic Analysis for Managers (in lieu of Managerial Economics of CHED) GMB 721 Management Science (in lieu of Quantitative Methods of CHED) GMB 737 Corporate Finance Organizational Management Managerial Control and Costing Systems III (B). MAJOR IN INTERNAL AUDITING (15 units) Internal Auditing Theory and Practice Enterprise Risk Management Information Systems Auditing Forensic Accounting and Fraud Investigation Audit Communications III (C). MAJOR IN TAXATION (15 Units) Taxation of Business and Investment Transactions State and Local Taxation Comparative International Taxation Tax Planning and Research Special Topics in Taxation 2 Subjects with prefixed codes are subjects offered in various programs of the Graduate School. IV. COGNATES (6 Units) Government Accounting Government Auditing Advanced Financial Reporting and Analysis Seminar in Advanced Audit Topics Accounting Information Systems Research Methods in Accounting (to be developed) Statistics Applied to Accountancy Research (to be developed) Ethical Leadership and Communications GMA 711 Management Accounting V. WRITTEN COMPREHENSIVE EXAMINATION VI. THESIS (Empirical Research) (6 Units) GMB 798 Thesis Writing I GMB 799 Thesis Writing II with Research Colloquium TOTAL PER MAJOR MS COURSE (Thesis Program): 36 Units 2. Detailed Curriculum of the Proposed Master of Science in Accountancy (Non-Thesis Program) The proposal for the industry track substantially adopts CHED CMO 43, S 2010 prescribed curricula I. Admission Requirement: Bachelor’s Degree in Accountancy, Business or Engineering II. CORE/FOUNDATION COURSES (9 Units) GMB 711 Corporate Social Responsibility and Good Governance (in lieu of Business Management and Governance of CHED) GMB 731 Managerial Statistics with Computer Application (in lieu of Statistics with Computer Application of CHED) Accounting Research (to be taken before Applied Research) III (A). MAJOR IN MANAGEMENT ACCOUNTING (15 Units) GMB 716 Economic Analysis for Managers (in lieu of Managerial Economics of CHED) GMB 721 Management Science (in lieu of Quantitative Methods of CHED) GMB 737 Corporate Finance Organizational Management Managerial Control and Costing Systems III (B). MAJOR IN INTERNAL AUDITING (15 units) Internal Auditing Theory and Practice Enterprise Risk Management Information Systems Auditing Forensic Accounting and Fraud Investigation Audit Communications III (C). MAJOR IN TAXATION (15 Units) Taxation of Business and Investment Transactions National and Local Taxation Comparative International Taxation Tax Planning and Research Special Topics in Taxation IV. COGNATES/ELECTIVES (6 Units) Government Accounting Government Auditing Advanced Financial Reporting and Analysis Seminar in Advanced Audit Topics Accounting Information Systems Ethical Leadership and Communications GMA 711 Management Accounting VI. INTEGRATING COURSES (6 Units) Applied Research (in student’s major field) GMB 727 Policy Formulation and Strategic Management (Integrating course for MBA Programs of the Graduate School) V. WRITTEN COMPREHENSIVE EXAMINATION TOTAL PER MAJOR (Non-Thesis Program): 36 Units The proposal for the teaching track substantially adopts CHED CMO 43, S 2010 prescribed curricula III. Admission Requirement: Bachelor’s Degree in Accountancy, Business or Engineering IV. CORE/FOUNDATION COURSES (6 Units) GMB 711 Corporate Social Responsibility and Good Governance (in lieu of Business Management and Governance of CHED) GMB 731 Managerial Statistics with Computer Application (in lieu of Statistics with Computer Application of CHED) or Statistics Applied to Accountancy Research III (A). MAJOR IN MANAGEMENT ACCOUNTING (15 Units) GMB 716 Economic Analysis for Managers (in lieu of Managerial Economics of CHED) GMB 721 Management Science (in lieu of Quantitative Methods of CHED) GMB 737 Corporate Finance Organizational Management Managerial Control and Costing Systems III (B). MAJOR IN INTERNAL AUDITING (15 units) Internal Auditing Theory and Practice Enterprise Risk Management Information Systems Auditing Forensic Accounting and Fraud Investigation Audit Communications III (C). MAJOR IN TAXATION (15 Units) Taxation of Business and Investment Transactions National and Local Taxation Comparative International Taxation Tax Planning and Research Special Topics in Taxation IV. COGNATES/ELECTIVES (9 Units) Educ 503 Foundations of Education Educ 505 Curriculum Development ES 501 Test and Measurement GMA 711 Management Accounting Statistics Applied to Accountancy Research Research Methods in Accounting VI. INTEGRATING COURSES (6 Units) Applied Research (in student’s major field) GMB 727 Policy Formulation and Strategic Management (Integrating course for MBA Programs of the Graduate School) V. WRITTEN COMPREHENSIVE EXAMINATION TOTAL PER MAJOR (Non-Thesis Program): 36 Units COURSE DESCRIPTIONS CHED Suggested Courses The course descriptions for the specific courses in Part IV (1 and 2) of this proposal are adopted from CHED CMO 43, S 2010 for the Master of Science in Accountancy, as follows: Accounting Research. Examination of research problems and techniques in accounting. Interdisciplinary nature of accounting research is emphasized. Work in any of the specialized fields of accounting and finance used to develop current trends in accounting research. Credits: 3 units No. of Hours: (3 hours per week) 54 hours Internal Auditing Theory and Practice. Theory and practical application of modern, management-oriented internal auditing. Covers the basic theory of internal auditing and then utilization of that theory in various case-study applications. Credits: 3 units No. of Hours: (3 hours per week) 54 hours Enterprise Risk Management. Integrated approach to enterprise risk management addressing business, operations, project, safety, security and privacy risk. It covers major topics such as the top 10 risks factors that threaten a business, business drivers for risk management, risk management framework, risk management tools and methods, how to define risks for your organization, implementing a risk management program and developing a risk management culture in your organization. Credits: 3 units No. of Hours: (3 hours per week) 54 hours Information Systems Auditing. Management of information systems audit and the evaluation of IT management. Analysis and review of internal controls in contemporary computer installations and applications. Used of basic and advanced information systems audit techniques and methodologies, including audit software, integrated test facility, and concurrent auditing techniques. Technology audit reviews of the audit requirements for such technologies as LANs, EDI, and expert systems. Legal and professional requirements and computer abuse/fraud auditing. Review of future IS audit techniques, methodologies, research and social implications. Credits: 3 units No. of Hours: (3 hours per week) 54 hours Forensic Accounting and Fraud Investigation. Deceptions in financial and accounting processes. Topics include financial fraud understanding, identification, prevention and auditing, its legal proceedings and its required testimony by an expert witness, and the corresponding professional responsibilities of the auditor. Credits: 3 units No. of Hours: (3 hours per week) 54 hours Audit Communications. Application of oral and written communication skills throughout each stage of the internal audit assurance engagement process. This interactive course will encourage students to “learn by doing” in a team-building environment. It will comprise lectures, class discussion, small group assignments, and role playing. Credits: 3 units No. of Hours: (3 hours per week) 54 hours Government Accounting. The basic principles of fund accounting are covered, including the analysis of financial management systems applicable to government agencies, GOCCs and local government units. This course also introduces students to major pronouncements of the Governmental Accounting Standards Board (GASB). An introduction to the New Government Accounting System (NGAS) is also provided, including a review of Government Auditing Standards, promulgated by the Commission on Audit. Credits: 3 units No. of Hours: (3 hours per week) 54 hours Government Auditing. This course will provide students with an in-depth understanding of the concepts associated with the types of audits found in a public sector environment. An objective of this course is to enable the student to understand and have a working knowledge of the theory of the government audit process and its practical applications. It examines various government auditing standards promulgated by the Commission on Audit. Auditing standards and procedures are studied for financial and compliance audits, as well as for economy and efficiency audits. The role of performance auditing in governmental and nonprofit organizations is also covered. Case studies are used extensively. Credits: 3 units No. of Hours: (3 hours per week) 54 hours Taxation of Business and Investment Transactions. Focuses on the fundamental concepts of income taxation that apply to business and financial transactions typical of most taxpayers, such as choice of business entity; measurement of taxable income (loss) from operations; acquisitions and dispositions of property; nontaxable exchanges; cost recovery; compensation and retirement planning; and investment and personal financial plan. Credits: 3 units No. of Hours: (3 hours per week) 54 hours National and Local Taxation. This course introduces the student to the fundamentals of state and local taxation. The course is not intended to make the student technically proficient in all areas of state and local taxation, but rather, it surveys the taxes that states generally impose on its citizens, corporations, and other entities. The impact on society of current and proposed state and local taxes will be explored through the study of assigned readings and in-depth class discussions. Credit: 3 units No. of Hours: (3 hours per week) 54 hours Comparative International Taxation. The objective of the course is to broaden knowledge in the field of international taxation by introducing the student to the study of comparative foreign tax systems. The coverage is wide-ranging, touching on several countries and substantive categories of taxes as well as procedural aspects. While the income tax will be stressed, value added tax (VAT) will also be discussed. Credits: 3 units No. of Hours: (3 hours per week) 54 hours Tax Planning and Research. This course is an in-depth study of the tax-planning process and research tools that are available to both the professional business manager and tax practitioner. Credits: 3 units No. of Hours: (3 hours per week) 54 hours Special Topics in Taxation. Discussions include, but are not limited to, such topics as: transfer pricing, tax timing, and taxation of independent contractors. Credits: 3 units No. of Hours: (3 hours per week) 54 hours Advanced Financial Reporting and Analysis. Studies advanced topics in financial accounting. Emphasis is on accounting for business combinations, including purchase and pooling of interests, consolidated financial statements, cash flows, translation of foreign financial statements, and other selected issues. Credits: 3 units No. of Hours: (3 hours per week) 54 hours Seminar in Advanced Audit Topics. This course is designed to help students with previous audit-related coursework develop an in-depth understanding of the audit services market. The focus is (1) the nature and value of external audits of corporate financial statements; (2) the structure, conduct, and performance of the public accounting profession; and (3) the conceptual and practical problems external auditors face. Credits: 3 units No. of Hours: (3 hours per week) 54 hours Accounting Information Systems. The development and implementation of integrated organizational computer-based information systems has had a significant impact on the field of accounting. Accounting information systems must meet the multiple accounting needs of transaction processing, internal controls and audit, and financial statement preparation and simultaneously support the needs of decisionmakers in finance, operations, marketing, human resources, and strategic management. The Sarbanes-Oxley Act makes corporate executives explicitly responsible for establishing, evaluating and monitoring the effectiveness of internal control over financial reporting. For most organizations, the role of IT will be crucial to achieving these objectives. This course presents system and control concepts necessary for the design, implementation, control and audit of accounting information systems with an emphasis on the accounting cycle, database design requirements, information system controls, financial reporting, and management responsibilities for compliance. Credits: 3 units No. of Hours: (3 hours per week) 54 hours Ethical Leadership and Communications. The course is focused on helping students gain the knowledge and develop the skills in the areas of communication, leadership, and ethics that they will need to become a successful accounting professional. Credits: 3 units No. of Hours: (3 hours per week) 54 hours Graduate School Courses (existing) GMA 711: Management Accounting. Focuses on the problem of business decisions, making extensive use of cases. Topics include activity-based costing and management, agency theory, budgetary control systems, behavioral research in management accounting, compensation and incentive systems, efficiency and productivity measurement, decentralized performance evaluation systems, and quality control and measurement issues. The emphasis throughout is on the use of economic reasoning to solve actual business decision problems Credits: 3 units No. of Hours: (3 hours per week) 54 hours GMB 711: Corporate Social Responsibility and Good Governance. Business, financial, political and legal issues affecting systems by which corporations are directed and controlled both in industrialized and developing countries. Covers the nature of the corporation, the basic theory of the firm, the internal and external architecture of corporate governance, the role of regulatory authorities, models of corporate governance, principal-agent theory within the corporate context, as well as corporate culture, corruption, management and board compensation, concepts of social responsibility and capital market development and international cross-listing of shares. Credits: 3 units No. of Hours: (3 hours per week) 54 hours GMB 713: Managerial Statistics with Computer Application. Methods of collecting, analyzing and interpreting data for managerial decision making. Topics include data presentation, measures of central tendency, dispersion, and skewness, discrete and continuous probability distributions, sampling methods and distributions, confidence intervals ( for parameter estimates) and test of hypotheses. Credits: 3 units No. of Hours: (3 hours per week) 54 hours GMB 716: Economic Analysis for Managers. Microeconomic and macroeconomic issues from a theoretical and applied perspective. The course stresses analytical reasoning and the application of quantitative techniques and economic methodology to managerial problems. Particular emphasis is placed on the limitations, strengths, and uncertainties of macro- and microeconomic policies in view of changing institutional and regulatory environments, extensive global interactions and linkages, and increasingly volatile individual expectation. Credits: 3 units No. of Hours: (3 hours per week) 54 hours GMB 621: Management Science. Quantitative tools and principles used to model operational procedures in economic and business systems—types of variables, mathematical sets, and functional forms in constrained and unconstrained optimization. Other topics include tractability, duality, Kuhn-Tucker theory, algorithms and computation. Credits: 3 units No. of Hours: (3 hours per week) 54 hours GMB 727 : Policy Formulation and Strategic Management. This capstone course aims to integrate the concepts of strategic management, business strategy formulation and business policy. The course explores the concepts behind strategic management and strategy formulation. This includes exploring the issue of social responsibility, defining a company’s mission statement, the use of internal analysis, external analysis, and levels of strategy. The course also examines issues involved with strategy implementation. This includes structural, cultural and leadership implications. A final strategy paper is required and is defended before a panel of examiners. Credits: 3 units No. of Hours: (3 hours per week) 54 hours GMB 737: Corporate Finance. Principles of corporate finance and practical tools for financial decisions and valuation. The course focuses on two broad topics: financial policy (factors that determine a company’s need for external financing, be it debt or equity, optimal mix of debt and equity financing) and valuation (tools as a basis for selecting investment projects and valuing companies.) Credits: 3 units No. of Hours: (3 hours per week) 54 hours GMB 798: Thesis Writing I. The MBA program requires each student to demonstrate his/her mastery of a specific problem drawn from a chosen field of specialization, relevant business literature and theory, and appropriate research methods by passing the oral presentation of his/her thesis proposal. This proposal normally includes submission – to the student’s MBA Thesis Committee – of the first three chapters of his/her study (1) the research problem, (2) review of related literature and studies, and (3) research design. The thesis writing course provides students with direct advising instruction designed to help students present passing proposals. Each student’s Thesis Committee Chairperson certifies to the Dean that the formal MBA Thesis Proposal is acceptable Credits: 3 units GMB 799: Thesis Writing II with Colloquium. The course provides individual faculty mentoring to the student while they continue the process of completing their projects. The student must have an approved Thesis Proposal before enrolling in this course. The final requirement of the course is a successful oral defense of the completed research study. Prior to graduation the student’s Thesis Committee must approve the MBA Thesis without changes. Credits: 3 units Educ 503: Foundations of Education. Deals with the application of psychology to education, the determinants of behavior, how students learn, the transfer and management of leaning, emotional, physical and social factors in learning, and teacher-student relationships. Credits: 3 units No. of Hours: (3 hours per week) 54 hours Educ 505: Curriculum Development. Critical study of development in the theory and practice of curriculum making. Comprehensive consideration of newer curriculum practices, the philosophy and psychology upon which they are based, and newer methods by which they are evaluated. Credits: 3 units No. of Hours: (3 hours per week) 54 hours ES 501: Test and Measurement. Historical development of test measurement, functions and qualities of good measuring instruments, different steps in constructing teacher-made tests and improving reliability of test instruments Credits: 3 units No. of Hours: (3 hours per week) 54 hours Graduate School Courses (proposed) Research Methods in Accounting. A course designed to prepare the graduate student for thesis writing; teaches him how to make a research paper following the steps of scientific inquiry and he format for thesis; also introduces the student to the more important methods of accounting research which he can make use of in his research paper as well as in the classroom. Credits: 3 units No. of Hours: (3 hours per week) 54 hours Statistics Applied to Accountancy Research. Basic statistical techniques applied to accountancy research. Credits: 3 units No. of Hours: (3 hours per week) 54 hours